NFTX – Create, Mint & Trade NFT-backed Tokens

What is NFTX?

NFTX is a protocol for NFT index funds on Ethereum, owned and managed by the community. The NFTX index funds are ERC20 tokens that derive their value from NFT collectibles. The ultimate governance of the protocol is under the purview of NFTX token holders.

The NFTX project was initiated in January 2021 by developer Alex Gausman, with the aim of facilitating the creation of NFT index funds – ERC-20 tokens that are backed by NFT collectibles. The project originated from the necessity to diminish the complexity of NFT investing and to tackle the issues of illiquidity and lack of transparency in the domain.

By offering an avenue for the NFT ecosystem to leverage DeFi’s recent innovations concerning liquidity, NFTX enhances the liquidity of NFT assets. NFTX index funds provide diversified NFT exposure to novice investors. As a side benefit, they enhance transparency as they aid in the price discovery of the underlying NFT category.

NFTX aspires to evolve as the principal issuer of bundled NFT funds, which could encompass Digital land, in-game items, digital art, and digital collectibles, among others. NFTX also plans to present comprehensive metrics about the NFT space, akin to CoinMarketCap or DefiPulse but for the NFT domain.

The NFTX DAO has the ultimate ownership and governance of NFTX. The NFTX smart contract employs an upgradeable proxy, which is controlled by the NFTX Dao. NFTX token holders possess the authority to modify the NFTX smart contract if they reach a consensus.

What Makes NFTX Unique?

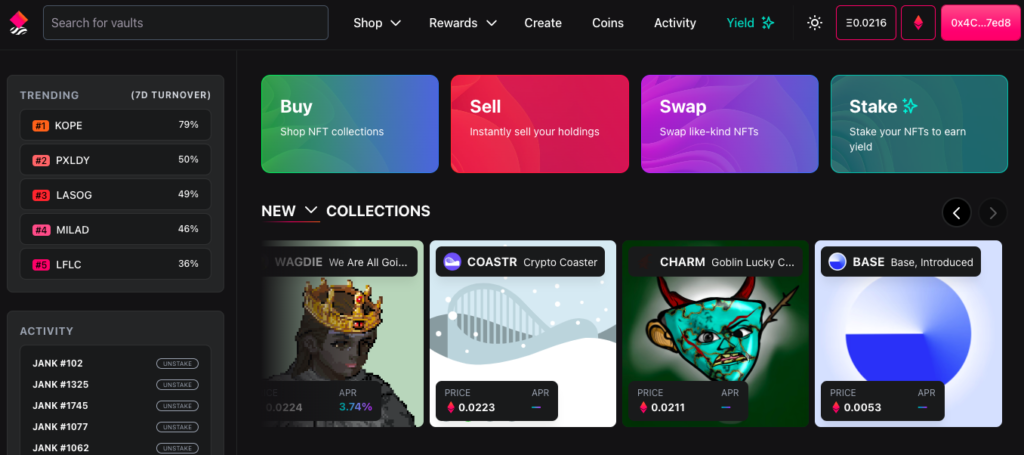

NFTX functions as a platform designed to establish fluid markets for non-fungible tokens (NFTs), which are often difficult to liquidate. It enables users to deposit their NFTs into an NFTX vault, from which a fungible ERC20 token, known as a vToken, can be minted. This token essentially serves as a claim ticket to a random asset within the vault and can further be utilized to reclaim a specific NFT from the vault.

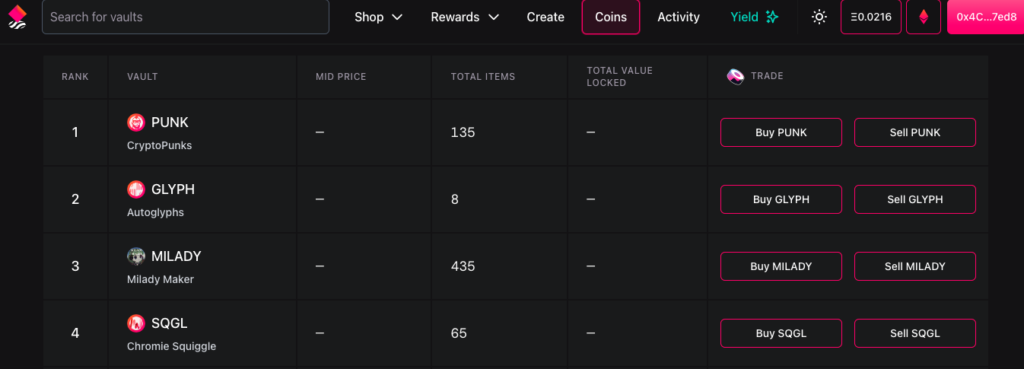

NFTX offers a unique service of creating fungible and combinable ERC20 tokens, dubbed vault tokens, which are underpinned by NFT collectibles. By using NFTX, it becomes feasible to generate and exchange tokens that reflect your preferred collectibles, like CryptoPunks, CryptoKitties, or Avastars, directly through an exchange platform.

The central goal of NFTX is to establish itself as the leading issuer of NFT vault tokens, empowering anyone to engage in trading and investing in NFT markets, even without specialized knowledge or skills required for investing in individual assets. In achieving this, NFTX aims to operate as an NFT asset magnet.

The contracts of NFTX are completely permissionless and operate on-chain. The NFTX.org interface, which is developed and maintained by the NFTX DAO, plans to be open-sourced at the earliest opportunity, allowing anyone to operate it locally as required.

NFTX is the product of a decentralized autonomous organization (DAO) composed of community members, contributors, and central members, all united in their goal of building the primary liquidity hub for NFTs. Being an open organization, NFTX encourages anyone from any location to join and contribute their expertise or additional resources, with the common objective of fostering the success of NFTX.

Why Use NFTX?

- The ability for LPs to stake their freshly minted vTokens and earn yield rewards

- Enhanced distribution and price identification for NFT initiatives

- Quickly turning any NFT into cash by minting it as an ERC20 and trading it through Sushiswap

- Amplified liquidity for NFT investors and traders

How does NFTX work?

Creation of Vaults

Any Ethereum-based NFT asset can be leveraged by anyone to create vaults. Post the creation of a vault, users have the option to deposit acceptable NFTs into the vault and subsequently mint a fungible token, supported by NFTs and known as a “vToken”.

Production of vTokens

The depositing of NFTs into a pre-existing vault (or one personally created) can be done by anyone, with the objective of minting a fungible vToken. This vToken represents a 1:1 claim on a random NFT stored within the vault.

Establishment of Base Prices

Upon pooling their newly minted vTokens in Automated Market Makers (AMMs) such as Sushiswap, users can facilitate a liquid market for others to conduct trades. As liquidity and trading volume are solidified, the NFT-supported vToken undergoes price discovery, leading to the identification of a “floor price”.

The term “floor price” refers to the minimum price for a specific NFT. Users create a floor price by minting and trading vTokens in markets where they perceive their NFT to hold inflated value.

Eligibilities

While the Mask vault permits the deposit of any Hashmask, other vaults employ an eligibility list that only allows the deposit of specific NFT sub-categories. As an illustration, the Kitty Gen 0 vault accepts only Kitties with Generation 0 metadata. Other Kitties are not eligible for deposit in this vault.

Who Stands to Gain from NFTX?

Art Aficionados

NFTs, in their rudimentary form, do not generate yield. However, they can venture into the realm of decentralized finance when employed for minting vTokens. In essence, art aficionados can leverage NFTX to extract increased value from their NFTs:

- Accrue protocol charges

- Gain trading fees as a provider of liquidity

- Engage in farming with stablecoins using vTokens as loan security

Content Producers

Content producers can enjoy perpetual protocol fees and extend their distribution scope and fairness by initiating on the NFTX protocol:

- Receive protocol fees

- Distribute NFTs via an AMM in the shape of vTokens

- Forge instantly liquid markets for novel content

Investors

Typically, NFTs are highly illiquid and challenging to appraise. NFTX simplifies speculation and investment in the NFT market:

- Access the most fluid NFT markets

- Monitor the pricing of specific NFT categories

NFTX Fees

NFTX V1 does not implement any fees.

NFTX V2 enables vault creators to levy fees based on minting and redeeming NFTs in and out of vaults. Three fee options exist in V2 and are set to the ensuing default settings for all DAO and fresh vault creations:

- Minting Fee of 5%

- Random Redemption Fee of 0%

- Targeted Redemption Fee of 5%

These fees are circulated as rewards to the liquidity providers for the vault.

Liquidity providers to vaults can sidestep minting fees by employing a zap to automatically include liquidity.

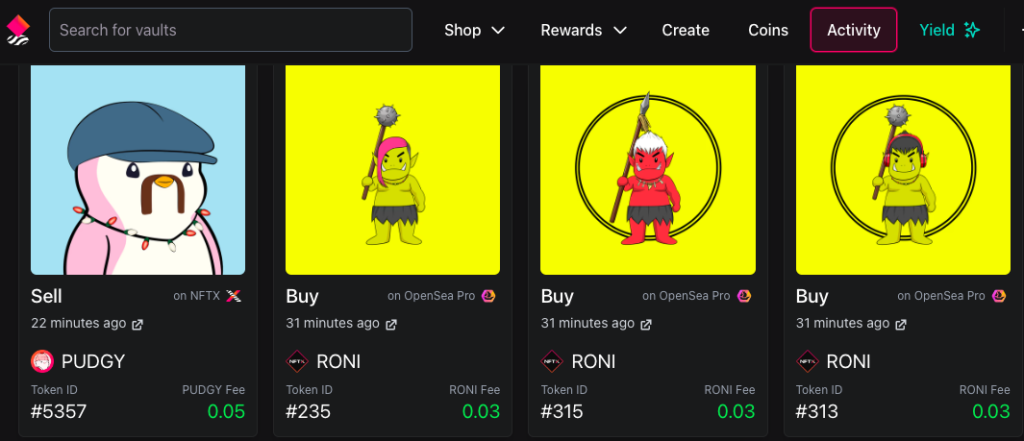

NFTX Rewards

To incentivize increased vault liquidity, all fees generated from Buys and Sells (Minting and Redeeming) are allocated to anyone staking their SLP against that vault. These rewards are distributed on a block-by-block basis, and are paid in the vault tokens used for staking.

$NFTX Token

The $NFTX token serves as a governance token that can be employed to vote on proposals and influence the organization’s course. A total of 650000 $NFTX tokens will ever be in existence.

- 65K $NFTX tokens are assigned to the founder of NFTX, Alex Gausman. These tokens are subjected to a 5-year linear vesting schedule, without a cliff. Rewards on this vesting schedule are unlocked per block and added to the circulating supply until fully distributed.

- 390K NFTX tokens were circulated during the initial community raise, which occurred from December 2020 to early January 2021. These tokens were rewarded to early community members via open bounties at varied rates of ETH, along with multiple NFTs.

- 65K NFTX tokens were initially provided as liquidity by the NFTX DAO on an AMM.

- 130K NFTX tokens are retained in the NFTX DAO Treasury and are used for additional market-making activities on vaults, such as the CryptoPunks vault.

Minting

The latest NFTX v2 unveils a fresh minting interface that empowers you to seamlessly generate a liquid ERC20 token from your NFT!

By placing your NFT into an NFTX vault, you generate an ERC-20 token (vToken) which constitutes a 1:1 claim on a random NFT within the vault.

As opposed to a non-fungible token (NFT), an ERC-20 token is fungible (all tokens are identical), enabling it to be:

- Instantaneously sold on an AMM (such as Sushiswap)

- Pooled into an AMM to garner trading fees

- Used for staking

- Employed as security to secure stablecoin loans

vTokens can be utilized to reclaim a random vault NFT whenever desired.

Redeeming

NFTX v2 provides an easy avenue to reclaim your minted ERC20 Vault Tokens (vTokens) for either a random or specific NFT within the vault.

Redeeming facilitates users to assume ownership of an inherent NFT from within a vault. This implies that a user can navigate to an AMM like Sushiswap, buy a solitary vToken such as PUNK, and use that token to stake a claim on a random CryptoPunk from the PUNK Vault.

For an added fee, typically 5% (1.05 vTokens), users have the option to select a particular NFT from the vault.

Staking

Staking allows you to earn fees from the vault, as currently 100% of protocol fees are distributed to stakers. Liquidity providers receive an 80% share of the fees, while inventory providers get 20%.

Stakers also acquire an ERC20 “xToken” like xPUNKWETH, which represents a claim on the underlying staked SLP, or xPUNK, which represents a claim on the staked inventory. We anticipate other projects to develop applications for these xTokens.

How do you stake on NFTX?

To stake on NFTX, you’ll need an NFT from that collection. Let’s consider the Space Poggers collection as an example.

There are two mechanisms to stake and earn fees:

- Liquidity staking

- Inventory staking

Keep in mind, in both scenarios, your NFT is placed inside the vault where anyone can purchase or exchange it back out. There’s no guarantee you’ll receive the exact same NFT back, so refrain from staking any rare NFTs or ones you’re sentimentally attached to.

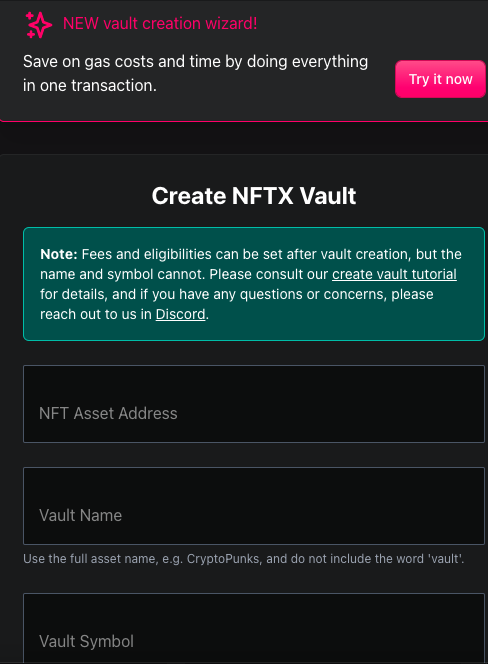

Vault Creation

NFTX v2 presents a new vault establishment interface that simplifies the process of creating a public vault for any NFT or a distinct subset of NFT IDs.

Vault establishment is the core of the NFTX protocol, allowing users and content creators to start generating fungible ERC20 tokens for any NFT.

By developing NFT-backed ERC20 tokens, users can establish liquid markets for NFTs that would otherwise be illiquid, while also earning fees and rewards from providing liquidity.