On The Radar: Top DeFi Airdrops 2023

Decentralized Finance (DeFi) continues to revolutionize the financial landscape, offering innovative solutions for wealth management and investment opportunities. In 2023, several cutting-edge projects are making waves in the DeFi space, providing secure and high-yield strategies to investors. In this article, we will explore three notable DeFi platforms – Teahouse Finance, Summer.fi, and DEX Finance – each with its unique offerings and features.

Teahouse Finance: Decentralized & Flexible Asset Management

Teahouse Finance stands as a beacon of decentralized and flexible asset management in the DeFi realm. Powered by state-of-the-art tools and foolproof smart contracts, Teahouse Finance’s primary mission is to provide a secure and adaptable platform for wealth management.

Source: https://vault.teahouse.finance/

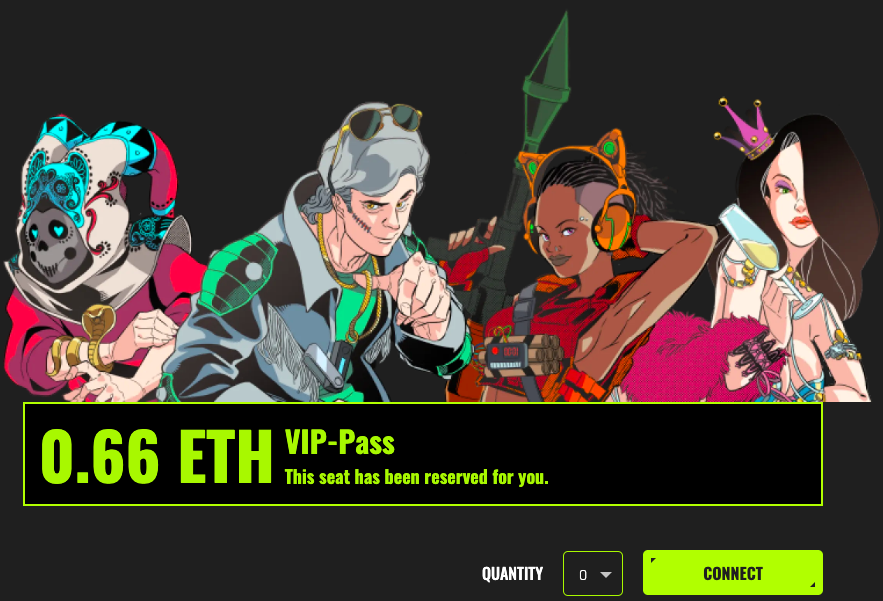

The platform’s standout feature is its HighTable NFTs, exclusive passes that grant access to Teahouse strategy vaults. Within these vaults, holders can select from a range of low, medium, and high-risk strategies based on their risk tolerance. Notably, many of these high-yield vaults offer a one-week entry/exit cycle, making them attractive options for both individual and institutional investors seeking to navigate the volatile market.

Source: https://ht.teahouse.finance/VIP-pass/public/mint/teahousehightable

One key aspect of Teahouse’s approach is that strategies are executed offline for privacy and efficiency, while all funds are securely stored and managed transparently on-chain. Categorized into Low, Medium, and High-Risk categories based on their backtested Maximum Drawdown, Teahouse’s strategies are carefully curated to suit various investor preferences.

Teahouse Finance aims to address the needs of investors who seek a secure place to park their funds for earnings. Recognizing the risks and uncertainties prevalent in the Web3 space, from vulnerable smart contracts to failed projects and scams, Teahouse provides a reliable solution for those who lack the time or expertise to manage their own funds. By offering an asset management platform and partnering with in-house and external strategy providers, Teahouse matches investors with flexible and high-yield strategies, fortified by secure, audited smart contract vaults and cutting-edge tools.

Summer.fi: Multipurpose DeFi Platform for Automation

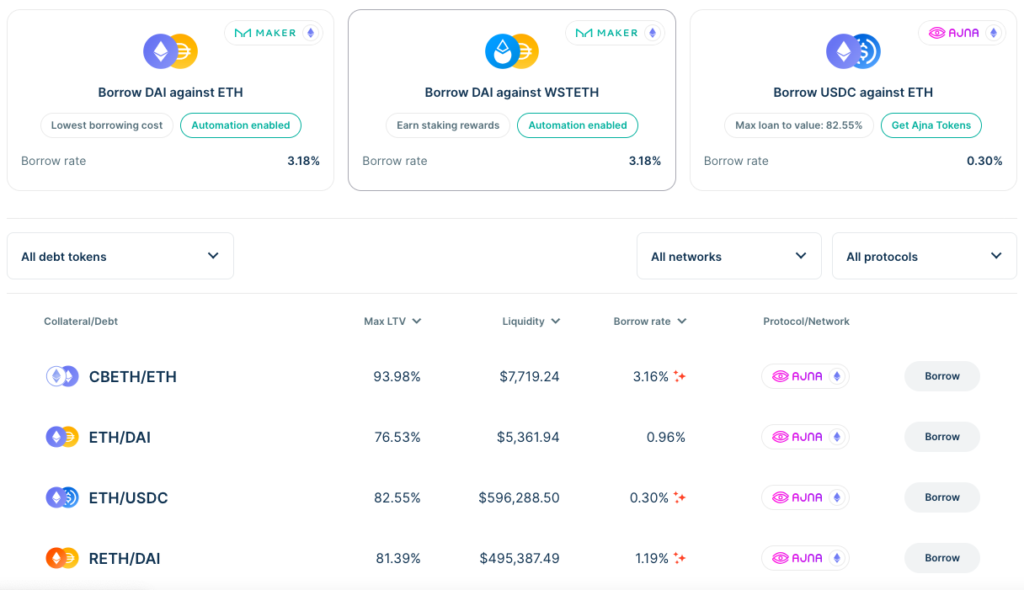

Summer.fi, formerly known as Oasis.app and born as one of MakerDAO’s early projects, has evolved into a standalone entity following Maker’s full decentralization. This multipurpose DeFi platform offers users various automation features for Borrowing, Multiplying, and Earning, accompanied by stop-loss protection, auto-buy, auto-sell, and constant multiple features.

Source: https://summer.fi/borrow

With Summer.fi, users can access a curated experience designed for optimal user experience. The platform clearly displays users’ positions, returns, and risk levels, ensuring they have all relevant information at their fingertips. Summer’s code is open-source, inviting community members to pressure test and audit the core technology, enhancing transparency and trust in the platform.

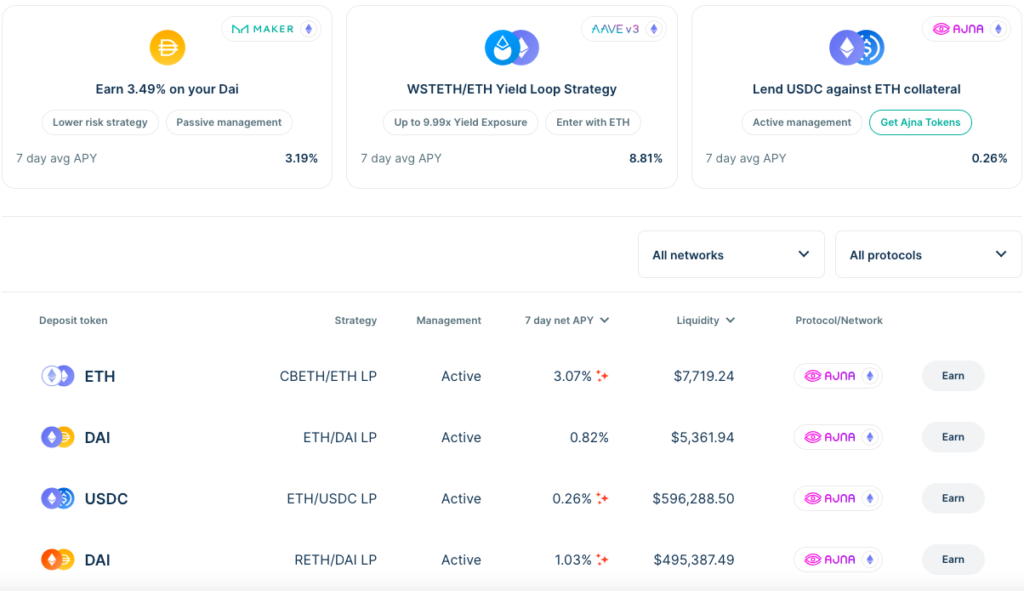

Source: https://summer.fi/earn

Summer.fi introduces Summer Earn, a feature catering to stETH/ETH and wstETH/ETH pairs. Users can benefit from a fee of 0.07% of the amount swapped to close or adjust their positions, along with variable annual fees depending on the Vault type.

The platform’s Stop-Loss protection enables users to set up transaction triggers to prevent liquidation, providing peace of mind during volatile market conditions. Auto-Buy and Auto-Sell features, similar in structure to Stop-Loss protection, allow users to automate their Vault’s multiple factor based on price triggers, maximizing potential gains.

DEX Finance: DAO-driven High-Yield Ecosystem

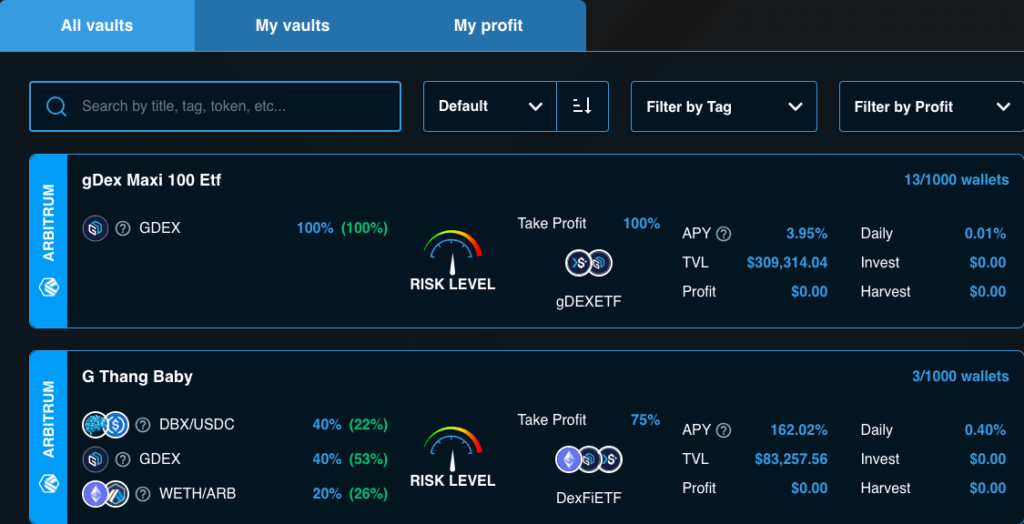

As a decentralized autonomous organization (DAO), DEX Finance is dedicated to providing the highest yields in the DeFi market. The platform offers a comprehensive ecosystem of financial products, including dexVAULTS, dexETF, Dex Money Market, and dexIRA.

Source: https://app.dexfinance.com/

dexVAULTS stands out as a user-friendly solution for simplifying advanced trading strategies used by experienced investors. Users can deposit funds into a strategy and rely on DeFi‘s sophisticated yield aggregator to handle auto-balancing and profit-taking on their behalf.

On the other hand, dexETF enables efficient trading by auto-balancing funds on every mint or burn. By leveraging the ETF, users can benefit from exposure to a wide range of cryptocurrencies while mitigating the downside risk of holding a single token. The auto-balancing feature works to force appreciation, maximizing the value of assets held within the ETF.

Key Takeaways

As DeFi continues to evolve and expand, these three platforms – Teahouse Finance, Summer.fi, and DEX Finance – have emerged as prominent players in the space, offering unique and innovative solutions for asset management, yield generation, and risk mitigation. As the DeFi landscape progresses, keeping an eye on these top DeFi airdrops of 2023 may prove to be a rewarding endeavor for investors seeking secure and high-yield opportunities in the decentralized finance realm.