Pangolin – Decentralized Exchange on Avalanche Review

What is Pangolin?

Launched in 2021, Pangolin is a decentralized exchange on the Avalanche Network. Utilizing a similar automated market maker model to that of Uniswap, Pangolin managed to facilitate over $10 billion dollars in trading volume within the first year of launching. PNG is a community distributed native governance token of the ecosystem, usable for trading tokens on Avalanche and Ethereum.

Benefits of Using Pangolin

- Pangolin offers fast and cheap trades. Pangolin users are able to swap assets while enjoying sub-second transaction finality and transaction fees as low as a few cents.

- The project’s development is community-driven.

- All PNG tokens are distributed directly to the community to promote fair and open token distribution.

Features on the Pangolin Platform

Users can swap tokens with the automated market maker (AMM) exchange. All a user needs to do is launch the app to access the swap feature.

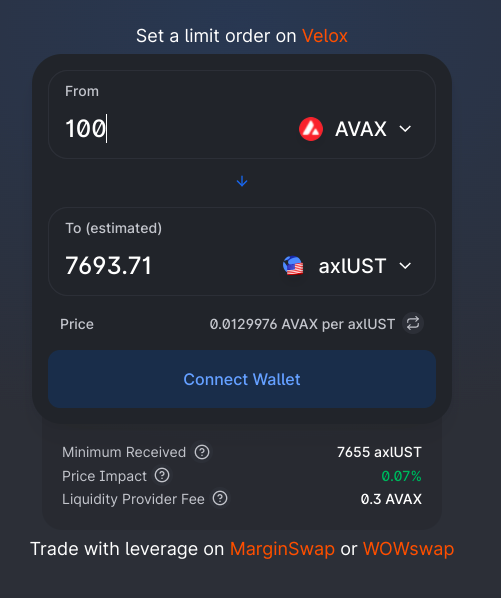

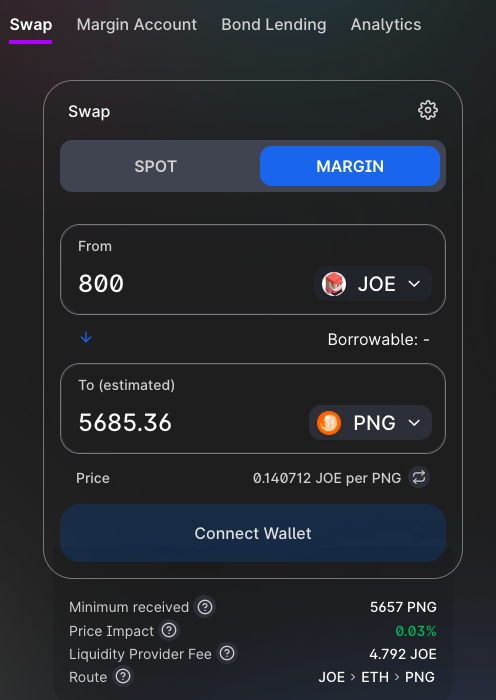

Users can execute limit orders and also trade with leverage on MarginSwap or WOWswap.

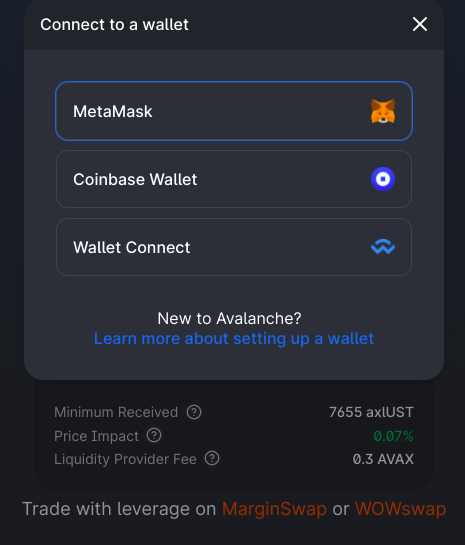

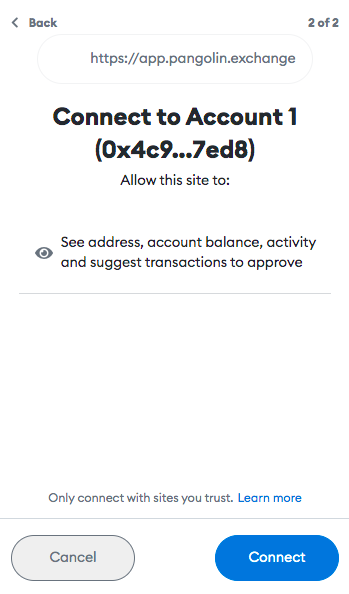

In order to get started on Pangolin a user needs to connect a Web3 wallet such as MetaMask.

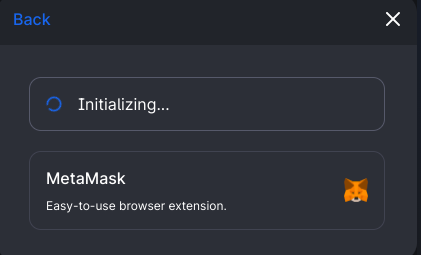

Wait to connect to your web3 wallet.

Log into your wallet.

Connect to your default wallet if you already have MetaMask set up or set up a new wallet.

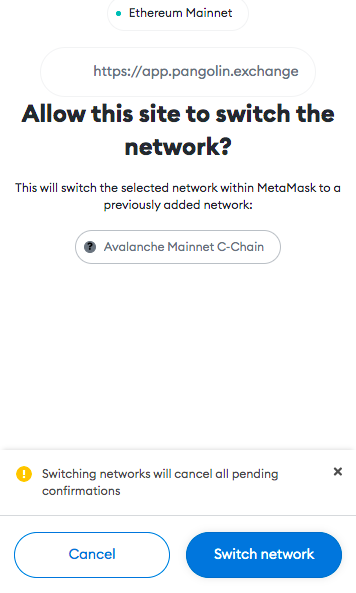

Choose which blockchain network you’d like to transact on. In this case, we switched from the Ethereum network to Avalanche.

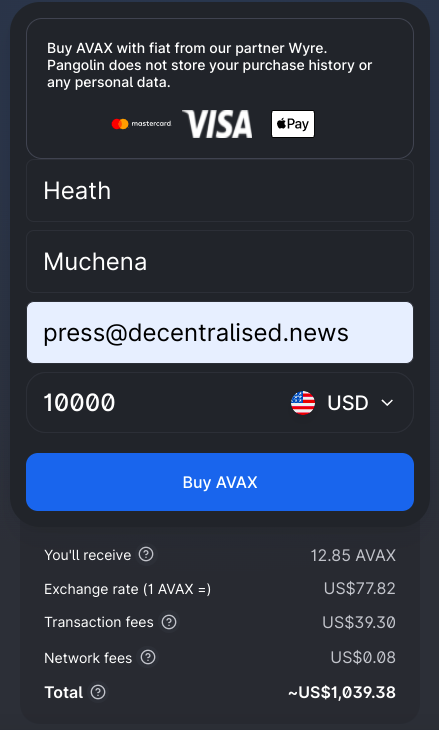

Once your wallet is connected, you’ll be able to process your swaps or buy AVAX which is the native ecosystem token of the Avalanche network. You can purchase AVAX tokens with fiat via Pangolin’s fiat gateway provider Wyre. You can use a Visa, Mastercard and even Apple Pay.

Pangolin has other ecosystem partners helping them deliver offerings to users effectively. Some of their partners include Coin98, Beefy Finance, TrustSwap and many others.

Users of Pangolin can exchange a number of different tokens on the exchange. As a user, you can also track your portfolio and token watchlist.

Liquidity Pools on Pangolin

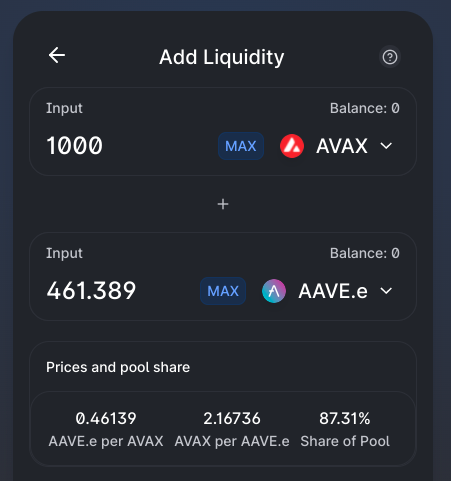

Users of Pangolin are able to add or remove liquidity on existing pools or create entirely new liquidity pools. If you’re a PNG token holder, you can add liquidity and receive PGL tokens which are effectively seen as a representation of ownership of the pool.

Once liquidity is added, a user is able to use the PGL tokens to earn PNG. By adding liquidity, a user can earn 0.25% of all trades on the pair that they choose, proportional to their share of the pool. Fees are added to the pool and these fees in fact accrue in real time and can be claimed by withdrawing liquidity. Read a more comprehensive guide on managing liquidity on Pangolin here.

Farming & Liquidity Mining on Pangolin

On Pangolin, users can deposit their Pangolin Liquidity Provider PGL tokens in order for them to receive PNG which is the Pangolin protocol governance token. Pangolin allows users to stake LP tokens into super farms and earn PNG along with other incentive tokens.

It is important for users to understand that there is a difference between yield farming which focuses on gaining the highest yield possible in DeFi and liquidity mining which focuses more on providing liquidity to a DeFi protocol. Staking on the other hand focuses on helping to secure a blockchain network.

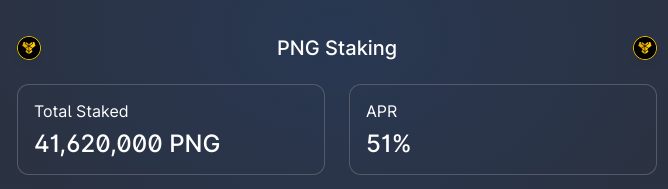

Staking on Pangolin

Users of Pangolin can also stake their PNG tokens in order to earn more tokens. Currently PNG tokens are available for trading on exchanges such as Gateio & MEXC.

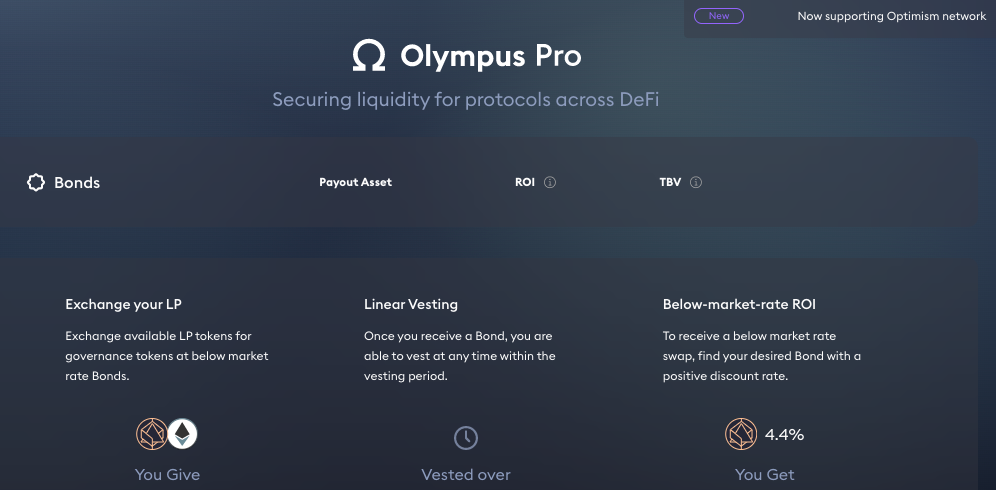

Users can also access bonding via Olympus Pro’s marketplace. Bonding is essentially a mechanism that allows a user to sell assets to a protocol in exchange for its native token. Read more about bonds here. PNG is the native token of Pangolin’s ecosystem and it has different use cases including for participating in ecosystem governance.