Poloniex is a cryptocurrency exchange offering a wide variety of digital assets. The exchange platform offers a trading environment and provides advanced charts and data analysis tools. Founded in 2014 by Tristan D’Agosta a programmer and music composer who established the Polonius Sheet Music company in 2010, the Poloniex exchange gained popularity around 2016 when it became one of the first exchanges to list Ethereum. D’Agosta sold the exchange to Circle in a deal reportedly valued at $400 million at the time of execution.

Circle integrated its payment services and institutional trading with Poloniex’s retail trade platform. Essentially, Poloniex became a division of the social payment service, offering trading of over 100 crypto pairs available for spot trading and offering features such as margin trading, lending, and staking.

Poloniex was originally based in the United States before relocating to the Seychelles, home to other cryptocurrency exchanges such as BitMEX, Prime XBT, and even Binance according to some reports. In November 2019, the exchange was spun out of Circle, and as part of the spinout, it shut down access to US-based users in Dec 2019. The current Poloniex exchange is now owned by the entity Polo Digital Assets, Ltd., which is backed by an Asian investment agency. Justin Sun’s Tron, a blockchain-based decentralized platform, is an investor in Poloniex. Tron was part of the group that invested $100 million in the exchange ahead of its 2019 spin-out from Circle.

The cryptocurrency exchange still remains one of the top ranked digital asset trading platforms today.

Strengths

- The exchange offers users the opportunity to manage their digital asset balances and trades on the go as Poloniex allows users to trade on the web, Android, iOS, Websocket, and HTTP APIs.

- On the exchange users are able to buy, sell, and trade cryptos such as Bitcoin (BTC), Ethereum (ETH), TRON (TRX), Tether (USDT), and many of the popular altcoins in the market including Chainlink (LINK), Polkadot(DOT), and 0x protocol (ZRX), just to name a few.

- Poloniex has a strong focus on decentralised finance (DeFi) projects and its one of the exchanges with the most DeFi project listings.

- Users have the ability to make deposits and withdraw from their crypto wallets, monitor account balances and orders, view real-time ticker updates across all markets, and choose their favorite cryptocurrencies and create price alerts for them.

- The exchange charts allow users to see the prices over all time, use TradingView, and toggle between candlestick and line charts.

- Poloniex offers staking services so you users can let their crypto work for them. If a user holds TRON (TRX) or Cosmos (ATOM) they can receive regular rewards with Poloniex’s simplified staking.

- Users can trade 25+ margin trading pairs, buy Bitcoin with their credit and debit card from within their crypto wallet, and lend their BTC, ETH, USDT, and other crypto assets to earn interest directly in their exchange accounts.

- Despite Poloniex being a global exchange with only a few geographic restrictions, access to the Poloniex platform is still prohibited in some jurisdictions which means residents and citizens of countries with stricter stances on digital asset trading such as Cuba, Iran, North Korea, Sudan, Syria, USA, etc are not able to use or access Poloniex’s platform and services.

- Poloniex offers two account verification levels. Level 1 is obtained by default once you sign up. This allows for unlimited spot trading, deposits, with a US$20k daily withdrawal limit, and all other Poloniex services. You won’t be able to access Poloniex margin trading and IEO LaunchBase. Level 2 gives you the user access to all Poloniex features and you can make withdrawals of up to US$750k per day.

Weaknesses

- Poloniex does not support deposits in fiat currencies. Users can buy digital currencies via Simplex and then proceed to deposit the coins in their exchange accounts.

- Poloniex was hacked in 2014, losing over 12% of its customers’ Bitcoin holdings at the time. Poloniex claims 100% of the customers who experienced a financial loss have been reimbursed. Poloniex has had no publicly known security breaches ever since. The exchange has gone to great lengths to try and strengthen security including implementing security measures such as protection against DoS attacks, cryptographic signatures-based DNS cache protection, strong security against web attacks like robot infiltration, storing user funds in cold wallets, requiring users to use 2FA, email confirmations and IP lockouts, just to name a few.

- In January 2018, Poloniex users reportedly experienced issues related to customer account balances on the exchange platform.

- Customer service is reportedly slow to respond to customer queries.

Fees

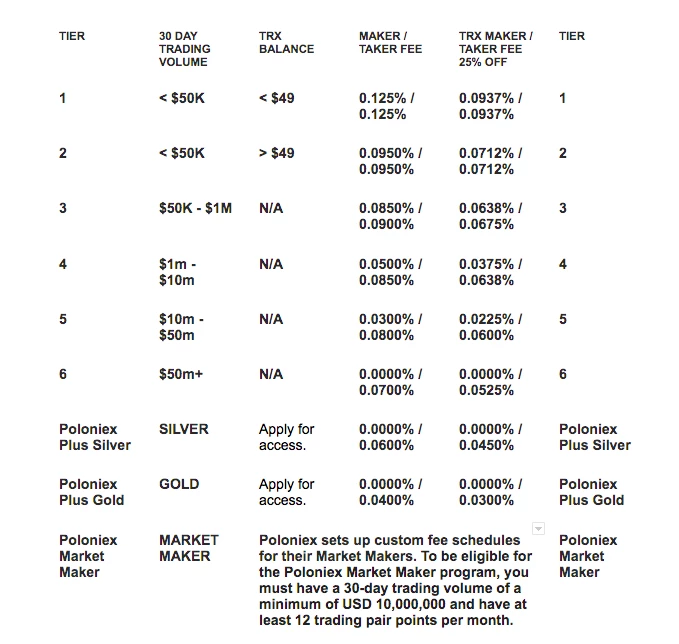

Source: Poloniex

On Poloniex, users are charged trading fees on a per-trade basis. As a trader’s rolling 30 day trade volume increases to the next fee tier, their maker/taker fee rate will decrease. Every 24 hours, your 30 day trading volume and current TRX balance will be calculated and the fee tier will be dynamically updated according to the structure above. On Poloniex, users can also view their trading tier status to see which fee tier is applied to their account.

Margin Interest Fees

Margin traders pay interest to their lender based on the amount they loan. The interest rate is specified in the loan offer and is charged once your margin position has been closed.

Margin trades are also subject to the trading fees outlined above.

Lending Fees

15% of the interest earned by a lending customer will be collected by Poloniex as a lending fee.

Deposit and Withdrawal Transaction Fees

Poloniex does not charge fees for depositing crypto into your Poloniex account. When you withdraw assets from your wallet, there is a fixed fee per asset to cover the cost of broadcasting a transaction to the network. Users are also able to transfer funds between Poloniex accounts for free with Off-Chain Transfers.