How to Cross-chain Bridge Using Stargate Finance

What is Stargate?

Stargate stands as a community-led entity tasked with developing the fully composable native asset bridge and the inaugural dApp utilizing LayerZero technology.

The ambition of Stargate is to streamline the process of transferring liquidity across chains into a straightforward, singular transaction.

Benefits of Using Stargate

Within the realm of DeFi, Stargate enables users to conduct cross-chain native asset exchanges in a singular transaction. For instance, it allows for the conversion of USDC on Ethereum to USDT on BNB.

Stargate‘s architecture allows various applications to integrate native cross-chain transaction capabilities at the application layer. For example:

- A DEX might leverage Stargate to facilitate cross-chain swaps in one transaction (e.g., exchanging AVAX for ETH seamlessly within the DEX’s interface).

- A yield aggregator might use Stargate for cross-chain deployment of assets to tap into new APY prospects.

These types of cross-chain exchanges are made possible through Stargate’s community-supported unified liquidity pools.

Stargate’s Unique Proposition

Stargate distinguishes itself as the first bridge to effectively address the bridging trilemma, offering a solution where traditional bridges have to compromise:

- Instant Guaranteed Finality: Both users and applications are assured that once a transaction is executed on the source chain, it will be recognized on the destination chain.

- Native Assets: Offers the facility for users and applications to engage in swaps using native assets rather than wrapped assets, avoiding the need for additional exchanges and associated costs.

- Unified Liquidity: By providing a singular liquidity pool accessible across multiple chains, Stargate enhances liquidity depth for users and applications, bolstering confidence in the bridge’s efficiency.

How to Bridge Assets Cross-chain Using Stargate

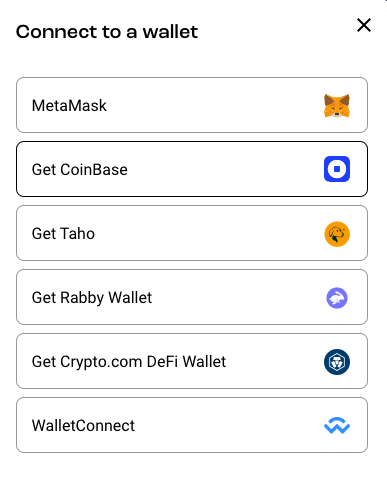

First, connect your web3 wallet.

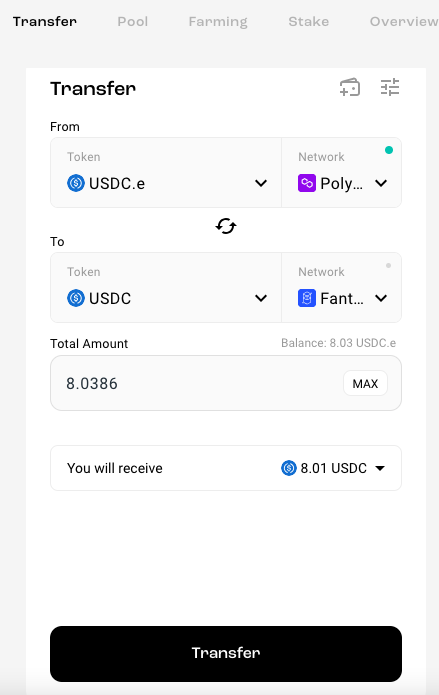

For this demonstration, we’ll be doing a cross-transfer of USDC on Polygon to Fantom.

For this demonstration, we’ll be doing a cross-transfer of USDC on Polygon to Fantom.

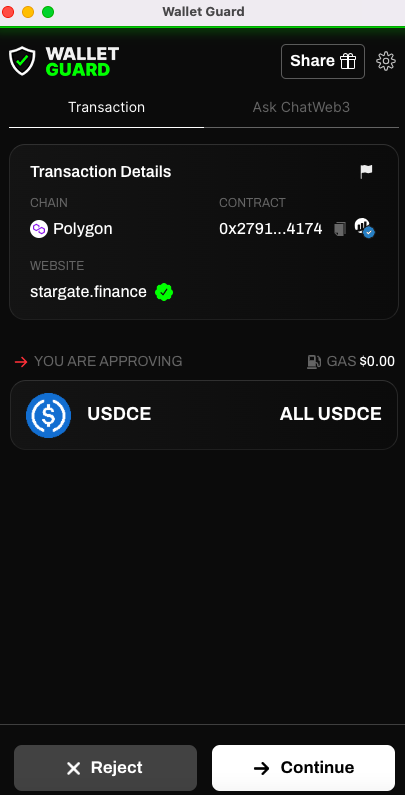

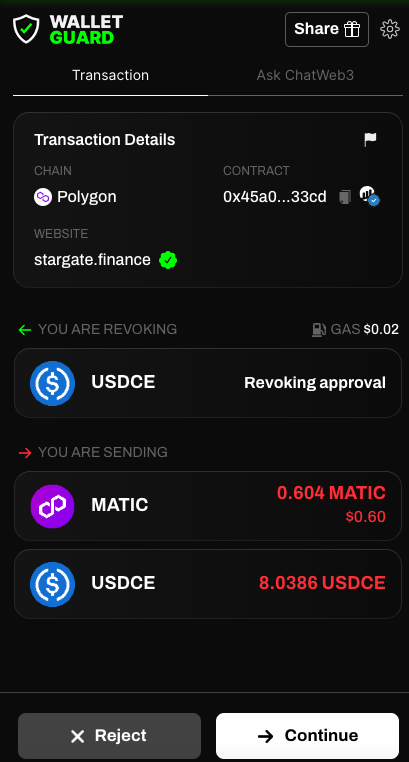

If using MetaMask wallet, you may be prompted to confirm actions via Wallet Guard for extra security.

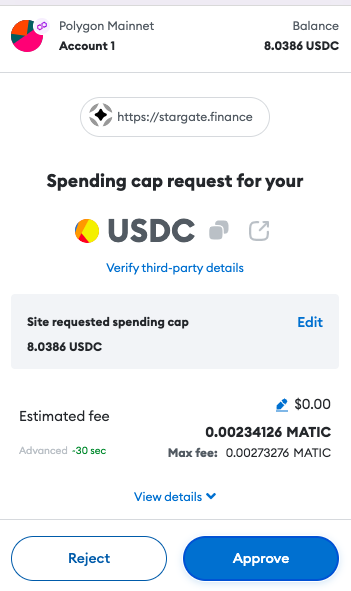

Set your spending cap.

Pay the associated fee.

Confirm the action.

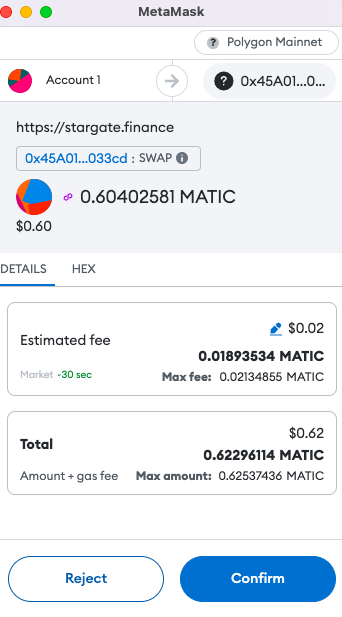

Pay the gas fee.

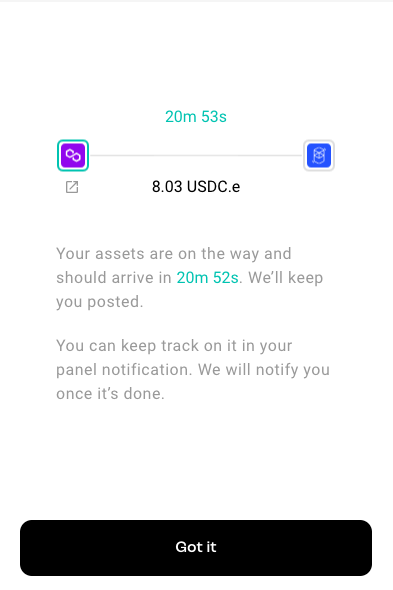

Your transaction is then initiated.

You can see the status of your transfer.

The Governance Structure of Stargate

The governance of Stargate rests solely in the hands of those holding Stargate tokens, who exert their influence through a system of voting escrow.

The Stargate DAO

Central to Stargate’s decentralization and self-governance, the DAO oversees all matters related to the network and its incentives. This includes decisions on protocol evolution, integrations, economic strategies, and how to allocate emissions to providers of stablecoin liquidity.

The Mechanism of Voting Power

Adopting a time-weighted voting approach, Stargate ensures that holders of its tokens who commit for longer durations wield more significant influence over the protocol’s governance.

The governance voting power within Stargate is quantified through veSTG, a non-transferable metric obtained by staking Stargate tokens under a lock-up agreement. The amount of veSTG diminishes linearly with the approach of the staked tokens’ release date.

Considerations for Launch Auction and Stakeholders

Both the launch auction participants and the team and investors of Stargate receive veSTG, adjusted to the average duration of their token lockup, aligning these balances with the voting escrow system’s expectations.

Tokens from the launch auction are earmarked with veSTG reflecting a 15-month lockup period, whereas team and investor tokens correspond to a 24-month lockup period.

The Role of Multisig

Occasionally, governance decisions necessitate modifications to Stargate’s protocol or treasury, actions facilitated through a multisig process. This multisig process involves a trusted collective within the community, mandated to execute decisions as directed by the token holders’ governance activities.

The Stargate Foundation

Tasked with nurturing the protocol’s advancement and long-term viability, the Foundation champions community-driven projects, partnerships within the DeFi and crypto space, promotional activities, and the day-to-day upkeep of the Stargate protocol.

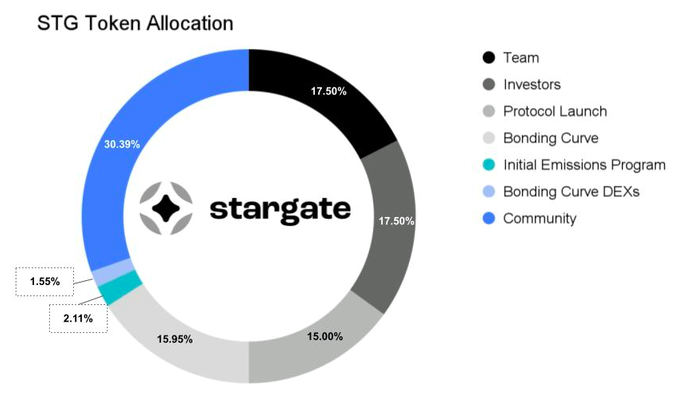

Allocation of STG Tokens

At inception, 1 billion STG tokens were created, establishing the total, unchanging supply. The allocation over the initial three years is designated as follows:

- 17.50% to Stargate’s main contributors, with a one-year complete lockup followed by a two-year gradual release.

- 17.50% to investors, under the same conditions as above.

- 65.00% for the Stargate community, aimed at realizing the protocol’s mission to streamline cross-chain liquidity transfers into a fluid, singular action.

This community portion is further divided:

- 15.00% for protocol initiation.

- 10.00% to those purchasing at the STG launch auction.

- 5.00% towards a STG-USDC pool on Curve.fi.

- 15.95% for Bonding Curve post-launch incentives.

- 2.11% for initial emission programs.

Additionally, up to 1.55% is allocated across DEXs on various platforms with the rest reserved for future community endeavors and protocol sustainability.

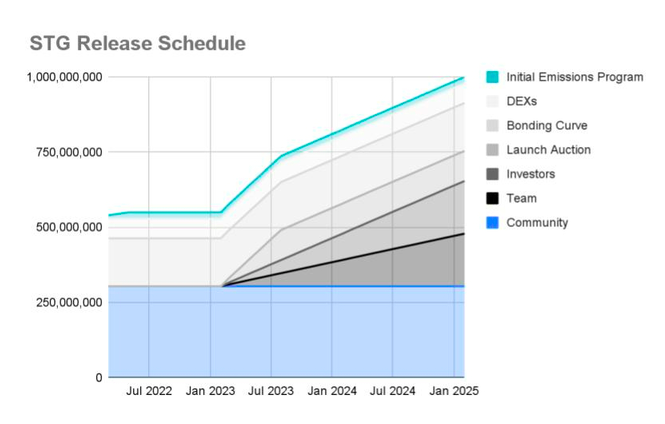

Token Lockup Details

The release of STG allocations is timed across different schedules:

- For launch initiatives and Bonding Curve & DEX Liquidity, tokens are available immediately upon acquisition.

- Launch Auction tokens are subject to a one-year total lockup, followed by a six-month linear release.

- Team and Investor allocations are locked for one year, then released linearly over the following two years.