StellarX Decentralized Crypto Platform Review

StellarX is a cryptocurrency trading platform operated by Ultra Stellar LLC which acquired the platform from Coinsquare. Ultra Stellar also operates the LOBSTR Stellar wallet which is available as web, Android and iOS apps. LOBSTR users are able to send and request payments, purchase crypto, and trade Stellar assets on the Stellar marketplace. The entity also controls StellarTerm which is an open-source client that can be used to access the marketplace.

It is described as one of the first trading apps with full-features for Stellar’s marketplace. It showcases a wide selection of assets that include crypto, fiat tethers, commodities, bonds, and more. StellarX is essentially a third-party client that is built on top of Stellar’s open marketplace and it’s a trademark of the Stellar Development Foundation that is operated by an independent commercial entity that is apparently unaffiliated with the Stellar Development Foundation.

It’s important to note that unlike exchanges such as Coinbase Pro or Poloniex, StellarX doesn’t hold user’s assets or secret keys, and it doesn’t maintain order books or have its own trading system. StellarX is effectively a browser that provides users with access to the open marketplace that is maintained independently by the Stellar network. Users on StellarX can settle trades in seconds and the platform can act as a bridge between the fiat and digital currency ecosystems since it enables people to swap assets. What’s the real value proposition is that Stellar network fees are so low making trading on StellarX is totally free.

To most users, StellarX can feel much like a decentralised exchange (DEX) since users can trade from their own wallets and all their actions are settled on-chain. However, it is essentially a graphical user interface for the publicly-accessible Stellar trading environment. StellarX is not available in some jurisdictions such as Cuba, Iran, North Korea, Sudan, Syria, Crimea region of Russia.

Fees

Using StellarX is free for users and the Stellar network charges a flat per-transaction fee as an anti-spam measure. However, the fee is so low (0.00001 XLM) that StellarX refunds it out-of-pocket for every trade made through the interface. They bundle network fee refunds into a single payment and these are issued on a weekly basis.

What assets can be found on StellarX?

Users access any asset on the Stellar network since StellarX is a transparent client for Stellar. Users can find tethers for off-chain assets such as Euros, Philippine Pesos, Bitcoin, Ethereum, and Carbon Credits. As one of the first decentralized crypto platforms with global fiat gateways, StellarX allows users to trade for example Bitcoin for Euros or Chinese Yuan. Users can also find Stellar’s network token Lumen and Stellar-native coins such as Mobius.

Assets on the marketplace are listed alphabetically by default based on either the name of the asset or the asset it is tethered to e.g. BTC or ETH. Users have the ability to sort tokens by any of the information that they can view on each token’s respective line including token issuer, ticker symbol and issuer public key, price, volume, etc. If multiple issuers have tokens that are tethered to the same asset there will be a [+] symbol next to the asset. By clicking on this, a user can view all the issuers of tokens that are anchored to that asset. For a user to see the token’s details, they can simply click on the token and view information such as price charts, recent trades.

Listing tokens on StellarX

Since StellarX is an open client, if a user issues a token on Stellar, it’s theoretically available on StellarX. Nonetheless, issuers are encouraged to follow Stellar’s issuance guidelines strictly in order to have more exposure on StellarX. Issuers can optimize their token’s chances of getting more exposure by completing their token’s account information including the issuer, point of contact, and currency documentation, per SEP0001. If an issuer is an off-chain custodian, they should support SEP0006. In general, the more information provided about the issuer and the actual token and more importantly the more functionality an issuer supports, the more important that particular token will most likely be to the ecosystem.

StellarX aims to provide quality projects with the access to users who can then buy, sell, store, and use crypto their assets. StellarX has stringent measures in place to ensure projects go through in-depth legal, security, technical and economic review frameworks.

As a peer-to-peer cryptocurrency marketplace, StellarX is focused on offering customers access to vetted issuers and anchors which means that they are curated to an extent. This is supposed to be for the purposes of enhancing customer protections from pump and dump or ponzi schemes, or other types of frauds.

How to use StellarX

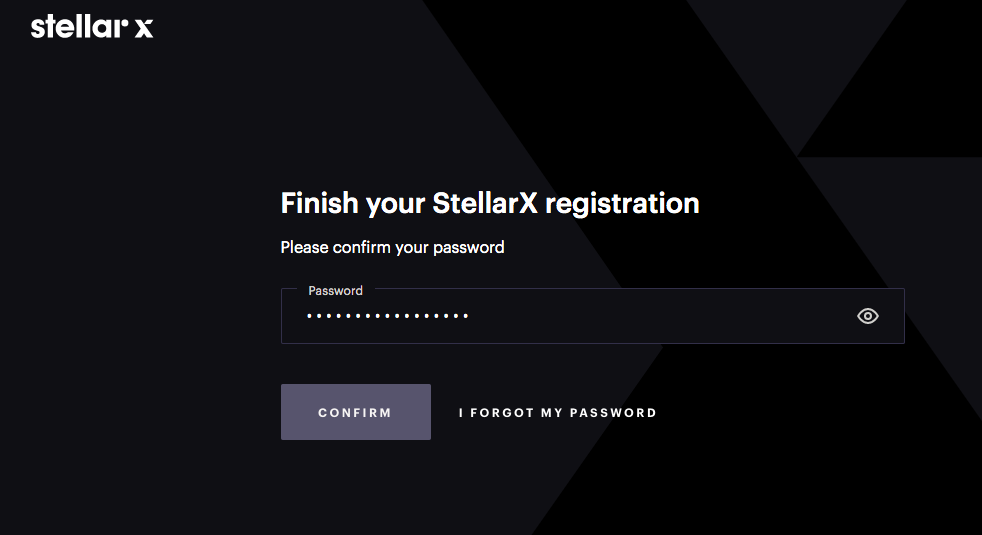

To register, a user is asked to enter their email address and accept the terms of service. The user is then asked to choose a password.

Once a user has chosen a password, a confirmation email will be sent to them. The user can then click the link sent to their email in order to verify their new account. Following that, a user will be provided with a 15-word recovery phrase. This phrase can be used to

Unlock or recover an account should the user lose access to it for any reason. Users should ensure their recovery phrase is stored in a secure place.

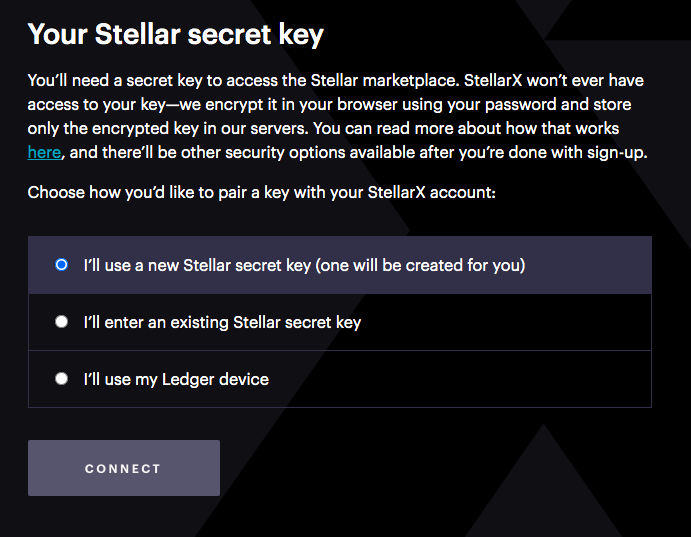

From here, the user can now choose to connect an existing Stellar wallet or Ledger to their StellarX account or create a new wallet that will be associated with their new StellarX account. If a user has never used the Stellar network before, they are able to create a new wallet address.

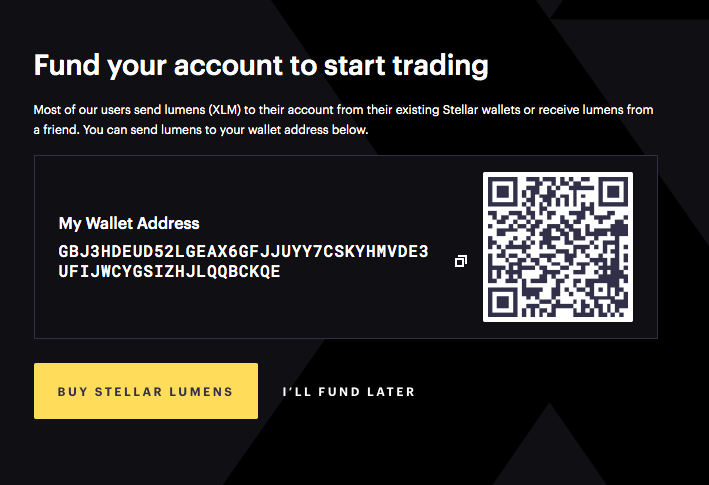

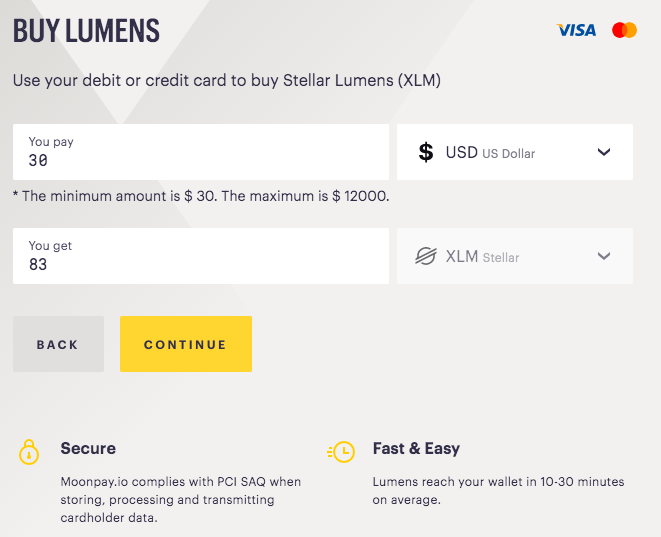

If they have an existing Stellar wallet address or ledger, they will simply have to input the Secret Key which typically begins with an S in order to add it to their StellarX account and their account will be set up. Before the account is set as active, the user needs to fund the account with some Lumens (XLM). Users can deposit digital assets such as Bitcoin or Ethereum from external networks and can also deposit US dollar, Mexican peso and other fiat currencies from their bank accounts. Alternatively they can also purchase Stellar Lumens (XLM) with any major debit or credit card.

Once a user funds their account they can start trading.

Aquarius

Ultra Stellar, which is the team behind StellarX, has introduced incentives on the Stellar network by introducing such as Aquarius which is a new liquidity management layer for Stellar. Aquarius introduces rewards for Stellar DEX market makers and automated market maker liquidity providers and powers DeFi projects.

Aquarius is powered by AQUA token which is the currency for rewards and on-chain voting. By trading on the community-selected market pairs, liquidity providers and traders can earn AQUA.

Conclusion

StellarX is a multi-use platform that helps users manage their Stellar wallets. It offers different functions to help users navigate the StellarX marketplace including receiving deposits from another Stellar wallet, withdrawing funds to another Stellar wallet, depositing or withdrawing funds via an anchor, trading on the StellarX marketplace, managing multiple Stellar wallets/hardware ledgers from a StellarX account, enabling multi-factor authentication, viewing the private or secret key for any Stellar wallets, closing any unused trustlines.

Image credits: https://www.stellarx.com/