SynFutures – Decentralized Derivatives Market

What is SynFutures?

SynFutures is a decentralized web3 infrastructure for derivatives that allows for robust crypto risk management capabilities to hedge portfolio risks in any asset, anywhere, anytime. The proven resilient sAMM model protects liquidity providers (LPs) even in volatile market conditions.

To compare SynFutures with other derivative marketplaces, it’s helpful to examine it from two perspectives: SynFutures versus centralized derivative exchanges and SynFutures versus other decentralized derivative exchanges.

In comparison to publicly accessible centralized derivative exchanges, which use order books with bid-ask orders filled by financial institutions due to the sophisticated algorithms required, SynFutures uses a synthetic Automated Market Maker (sAMM) to provide liquidity. This allows anyone to become an LP and earn fees while democratizing market making, which is usually reserved for a select few on centralized exchanges. SynFutures is also permissionless, meaning its services are entirely open for public use, in contrast to centralized exchanges that are closed to certain users.

Regarding other decentralized derivative exchanges, SynFutures is designed to be natively permissionless, while other derivative DEXs that claim to be permissionless are often permissioned by their DAOs to list new asset pairs. SynFutures has minimized exogenous and asset-pair-specific configurations, allowing any user to list arbitrary asset pairs and even the market itself to form endogenous pricing and behaviors. This design philosophy has enabled SynFutures to offer a broad range of assets, including Bitcoin, Ethereum, long-tail assets, and even some NFTs.

Key features of SynFutures include the ability to list any asset within 30 seconds, a single-token LP that allows for liquidity provision with one click, and robust risk management and safety backed by a team with experience in TradFi financial engineering and DeFi protocol safety. SynFutures has undergone external code audits to ensure its reliability and security.

SynFutures is described as a next-generation derivatives exchange that is focussing on creating an open and trustless derivatives market through making it possible for users to trade on anything with a price feed. SynFutures is looking to cultivate a free market and maximize the variety of tradable assets, thereby lowering the barrier to entry in the derivatives market and helping to create a more equitable digital assets exchange market.

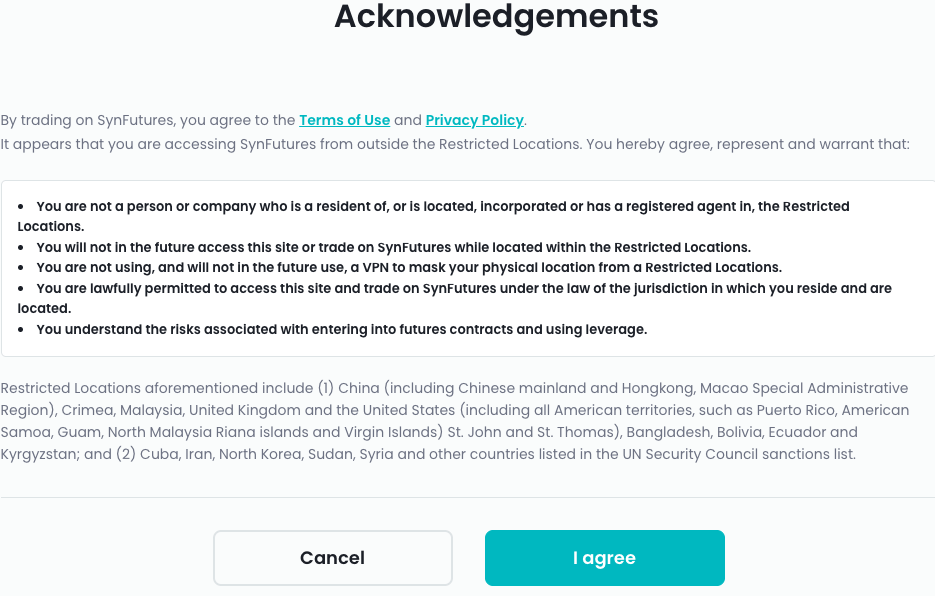

Currently, SynFutures is in the beta version which makes it possible for users to access the DApp via beta.synfutures.com. This can be done through a Web3 wallet such as MetaMask, for example. [Update: SynFutures has since launched its V2 product]. You can check out the terms before using the platform.

The platform offers an all-in trading fee that is lowered by 4bps in beta following changes that set the reserve fee at 1bp. The platform also offers transparent data.

SynFutures is said to have been inspired by Uniswap. However, instead of focusing on the decentralized spot exchange market, SynFutures is designed as a decentralized synthetic asset derivatives trading platform. Its first version comes with a futures trading market. Just as users of Uniswap are able to create new spot trading pairs, SynFutures@v1 makes it possible for any liquidity provider to essentially create digital asset futures trading pairs that have arbitrary assets and arbitrary expiration dates.

Understanding SynFutures’ Synthetic Automated Market Maker Model

By adopting a Synthetic Automated Market Maker model (sAMM), SynFutures’ asset pricing follows a constant product formula. As far as liquidity provision is concerned, only a single asset (quote asset) of the trading pairs is required to be supplied, and the other asset (base asset) is then automatically synthesized by the contract. This makes it possible to support cross-chain and real-world assets such as gold and foreign currencies and not simply Ethereum native assets.

The sAMM can be viewed as a market participant that has its own margin account that is similar to other users. Nonetheless it is always prepared to make prices based on the constant product formula and its current position. Aside from trading, the sAMM contract provides users with interfaces to add and remove liquidity to the sAMM liquidity pool. Additionally, the sAMM contract also acts as the gateway for users to deposit margin to and withdraw margin from their account.

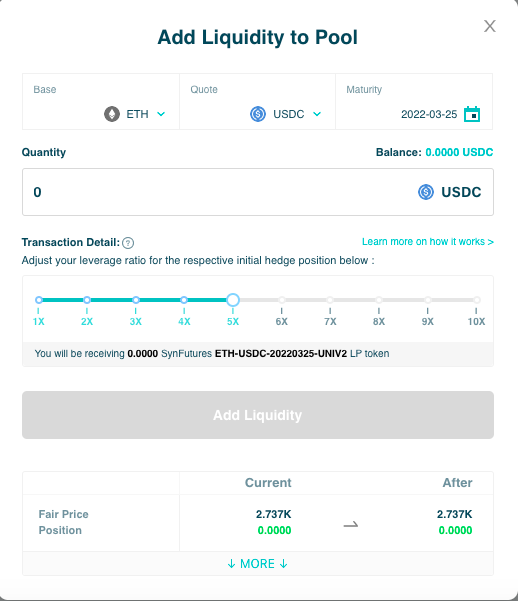

Liquidity on SynFutures

In order for a user to add liquidity to the sAMM, they have to interact with the smart contract and transfer the margin token, or the QUOTE asset to the sAMM. This could be wBTC, ETH, MATIC, etc.

The sAMM creates a long position in the futures contract internally utilizing half of the added margin token. This effectively synthesizes the BASE asset of a trading pair, and keeps the remaining half as available margin. Contemporaneously, the sAMM then allocates a short position of the same size as the newly created long position to the same user. This means that the user owns a share of the total long position and the available margin of the liquidity pool in the sAMMAs as a liquidity provider. The share of the long position of the sAMM plus the position in their own account equals the total risk position of a liquidity provider. Ultimately, this means that adding liquidity to the sAMM does not change the total risk of the liquidity provider since the newly created long and short positions generally offset each other.

The important thing to note, however, is that the liquidity provider needs to ensure sufficient margin in their margin account in order to meet the margin requirement after adding liquidity to the sAMM. In order to remove liquidity from the sAMM, they’d be a reduction of the long position and allocation of the reduced long position to the user requesting to remove liquidity thereby facilitating the return of the margin token to the user. In the same light, removing liquidity from the sAMM doesn’t change the total risk of the liquidity provider.

Liquidation on SynFutures

An account is liquidated if the margin balance of an account becomes lower than its maintenance margin requirement. SynFutures provides two approaches for liquidation. The first is a conventional DeFi approach whereby the liquidator takes over the position of the liquidated account. Consequently, they have to provide the required initial margin at current mark price. The liquidator also receives the balance of the maintenance margin of the liquidated account as reward when a successful liquidation event occurs.

SynFutures employs this system due to the fact that the approach barely has any impact on the market since the only change to the system as a whole would be the extra margin that is provided by the liquidator. It’s important to be aware that a liquidator willing to provide that type of margin and take on the risk of holding such a position may not always be available. This makes full liquidation attractive when such a liquidator is present.

Liquidations are normally handled by executing trades in the market to partially reverse the position of an account falling below its maintenance margin requirement when it comes to the traditional financial market and centralized exchanges. SynFutures functions based on the concept of an Automated Liquidator (ALQ) who plays the role of passively performing liquidator duties by only providing liquidity and earning trading fees. With the AMM, accounts that need to be liquidated can be forced to trade with the ALQ. More precisely, the respective AMM partially reduces positions to meet margin requirements.

SynFutures’ Ecosystem Partners

SynFutures has some ecosystem partners that include: Fantom, BingX, Mars Ecosystem, BENQI, Pangolin, Aavegotchi, Quickswap, Keystone, Aurora, Project Galaxy etc.

SynFutures is currently available to users from most countries except China, Malaysia, United Kingdom, United States, and countries listed in the UN Security Council sanctions list.

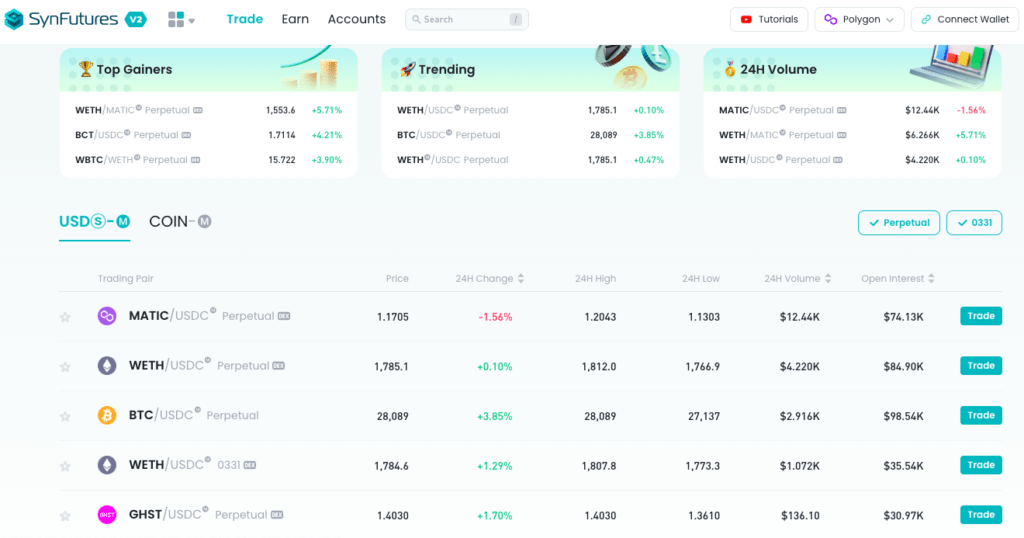

How to Trade on SynFutures v2 [2023 Update]

To get started visit the SynFutures platform.

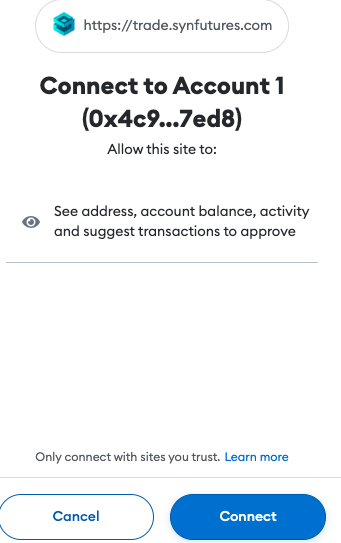

From there you can connect your wallet.

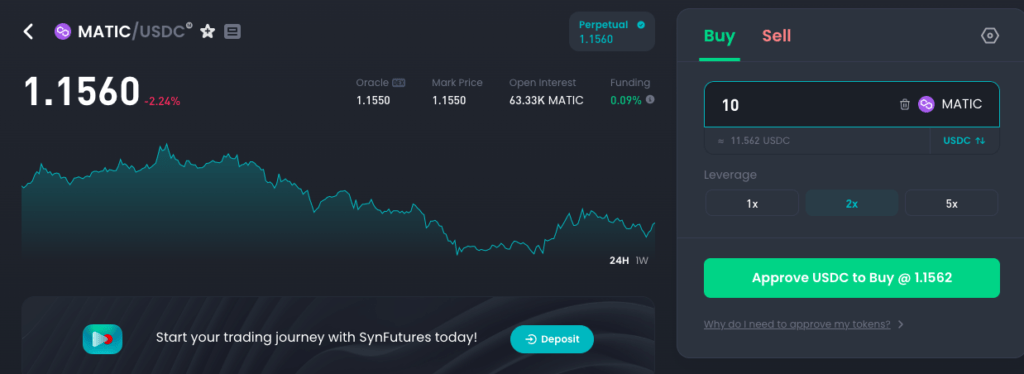

Once your wallet is connected, you can proceed to trade on the platform.

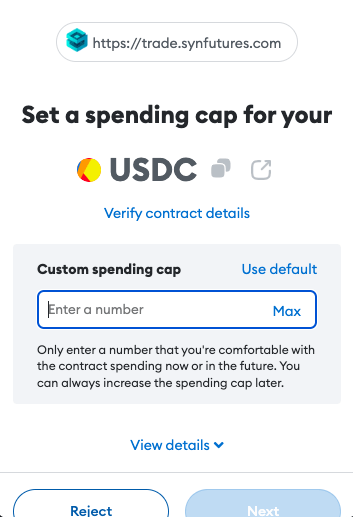

What’s great about SynFutures is that you can set your own spending cap to ensure that you’re not risking more than you can afford to lose.

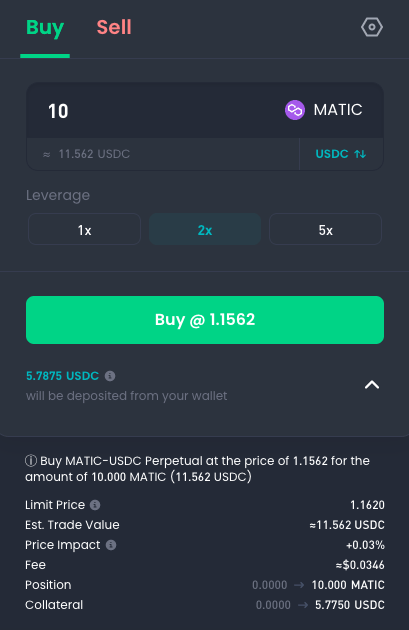

In this example, we were buying a MATIC/USD perpetuals contract.

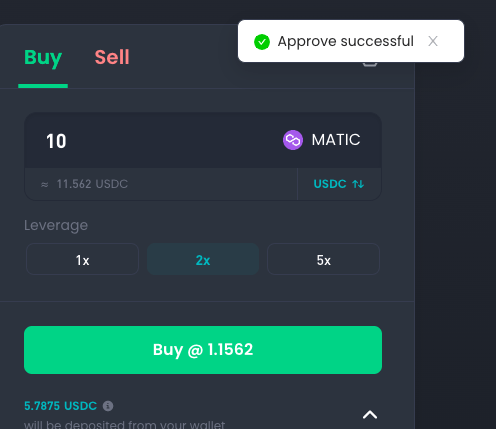

First we had to approve for our wallet to interact with the smart contracts on SynFutures.

You can choose the amount of leverage you want to use.

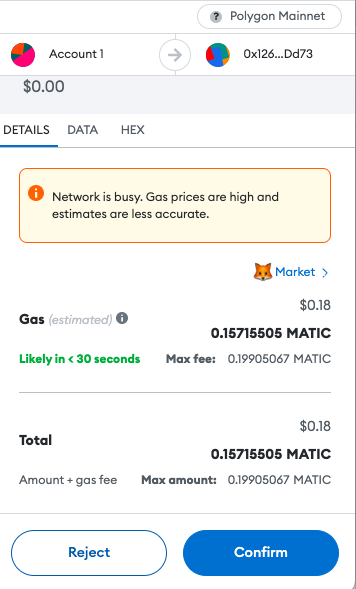

Once that’s sorted you can pay the gas fee.

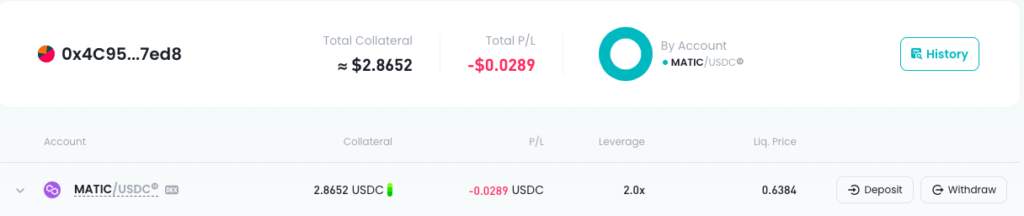

Once you’ve successfully played your trade, you can go to the Accounts tab to monitor your trades.

Once you’ve done at least one trade on the platform, SynFutures also offers you the opportunity to earn passive referral income when people you recommend to the platform trade. You can simply go to the dashboard and click ‘Tell-A-Friend”.

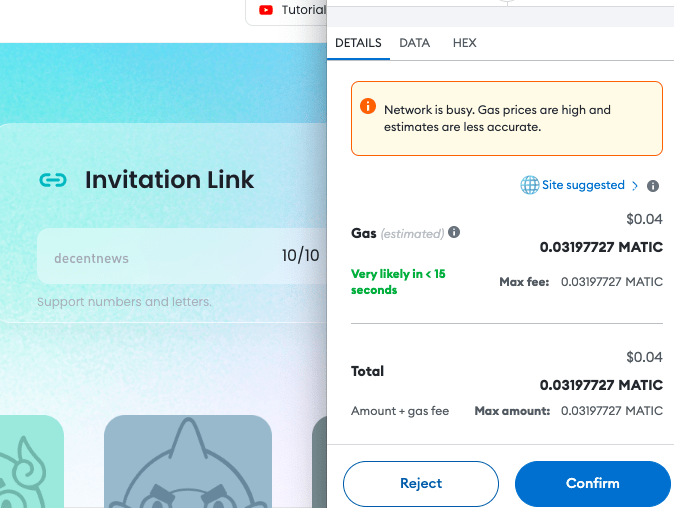

There – you’ll be about to create an invitation link.

Once completed and you have your referral link, you can simply share with friends so that they can enjoy some awesome offer!

For more about SynFutures, check out their official resources.