A French-registered money transfer service, Tempo Mobile Money Transfer facilitates money transfers from 20 countries to more than 50 countries globally, including digital currency remittances to almost a dozen African countries. Users can send money from countries such as Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary. Countries users can send money to include Kenya, Malaysia, Mexico, Morocco, Nepal, Nicaragua, Nigeria, Pakistan, Paraguay, Peru, Senegal, South Africa, South Korea, Tanzania, Thailand, Togo, Uganda, and Vietnam.

Tempo is regulated by The Central Bank of France and licensed by the French Regulator (Prudential Control Authority and Resolution) ACPR. A member of the International Association of Money Transfer Networks, Tempo has a European Payment Service license which means that all its activities are governed by French and European regulations and licensed by Banque de France.

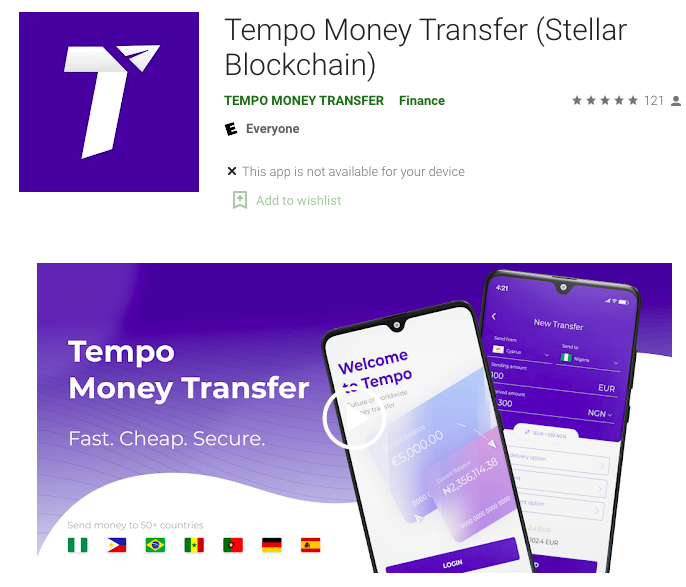

Tempo is powered by the Stellar blockchain so for instance, Tempo is integrated via stellar with Coins.ph which makes it possible for users to send funds to anyone in the Philippines by simply using a name and mobile phone number of the person they wish to send funds to. A Coins.ph account is created for the recipient automatically for the recipient when they receive notification on their mobile as the funds are credited. The recipient then only has to initiate a bank transfer or even make a request to have the funds delivered to their location or arrange to pick up the funds at any payout location in the Philippines. Recently, it was also announced that Arf and Tempo introduced a new payment corridor via the Stellar network from Europe to the Philippines.

To use Tempo, simply download the app, complete KYC, select the destination where you are sending funds and how much, confirm the payment and delivery methods, add the recipient’s details and you’re ready to go!

Overview

- With Tempo, users can send money to more than 50 countries from pretty much anywhere using a card, bank deposit, or cash pickup.

- Tempo utilizes the Stellar blockchain to make transfer faster and more secure.

- By visiting Tempo locations, or through the Stellar e-wallet or online, users are able to send global remittances from Europe to more than 35 countries globally. Users can also get funds from more than 100,000 payout locations.

- Tempo offers several payment and delivery methods giving users flexibility e.g. people can receive funds in their bank accounts, bank cards, or cash. People can also send money using Visa, Mastercard or Sepa transfer.

- No hidden commissions, cheaper transfer fees and competitive FX exchange rates to users’ local currencies.

- Decent customer service, online chat, and support available in 12 languages.

- Faster transaction times (minutes) and fairly reasonable transfer times (between 1 to 48 hours).

- Tempo prioritises security and claims to keep customer’s funds separate in a segregated account to ensure that they will not be compromised.

- Good presence in underserved locations.

- Payout options are limited in certain countries and only direct bank deposits are available in some cases.

- Transfer fees tend to be more expensive for transferring smaller amounts or less than EUR 500.

- There is a send limit of EUR 5,000 a month; EUR 9,000 every 90 days, and EUR 20,000 a year.

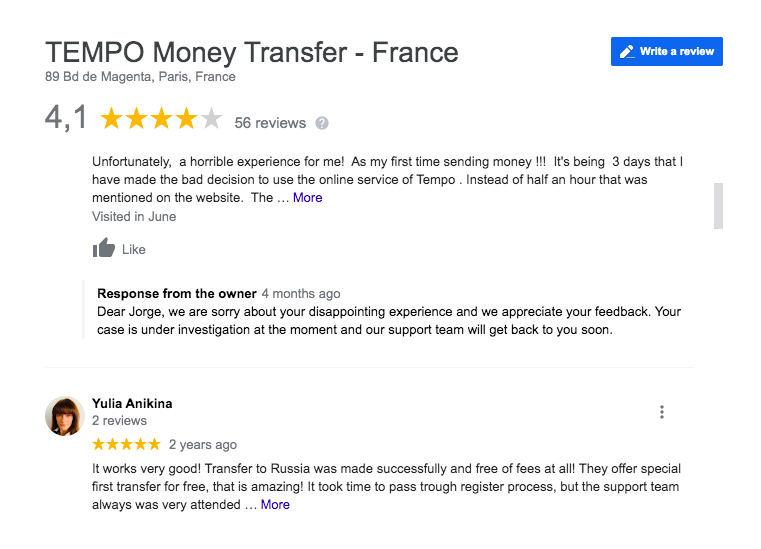

Reviews

Transfer Fees

Fees depend on where a user will transfer the money to and how the recipient will receive the funds. There is a fixed fee each time a user initiates a transfer. Examples of fees:

- EUR 5,000 – fee estimate 30-150 EUR

- EUR 1,000 – fee estimate 15-40 EUR

- EUR 500 – fee estimate 20 EUR

- EUR 100 – fee estimate 4-10 EUR

- Funding a transfer with a credit card may incur surcharges

A user’s bank account will be directly debited with the amount of the e-transfer including Tempo France’s fees for e-transfers that are funded via a credit card or debit card.

Exchange Rates

According to Tempo, users are able to save approximately 0.25% to 4% of the sum that they are transferring as compared to regular banks.