The Great Dollar Exodus: How China Is Quietly Undermining U.S. Financial Hegemony

The United States is treating its currency like a weapon. But China is treating it like ammunition.

The United States has long benefitted from an unprecedented financial privilege: the U.S. dollar’s status as the world’s reserve currency. That privilege, however, is unraveling – subtly, structurally, and with potentially seismic consequences.

The center of this slow-motion shift is China, whose response to decades of dollar dependency and geopolitical hostility is nothing short of a stealth financial revolution.

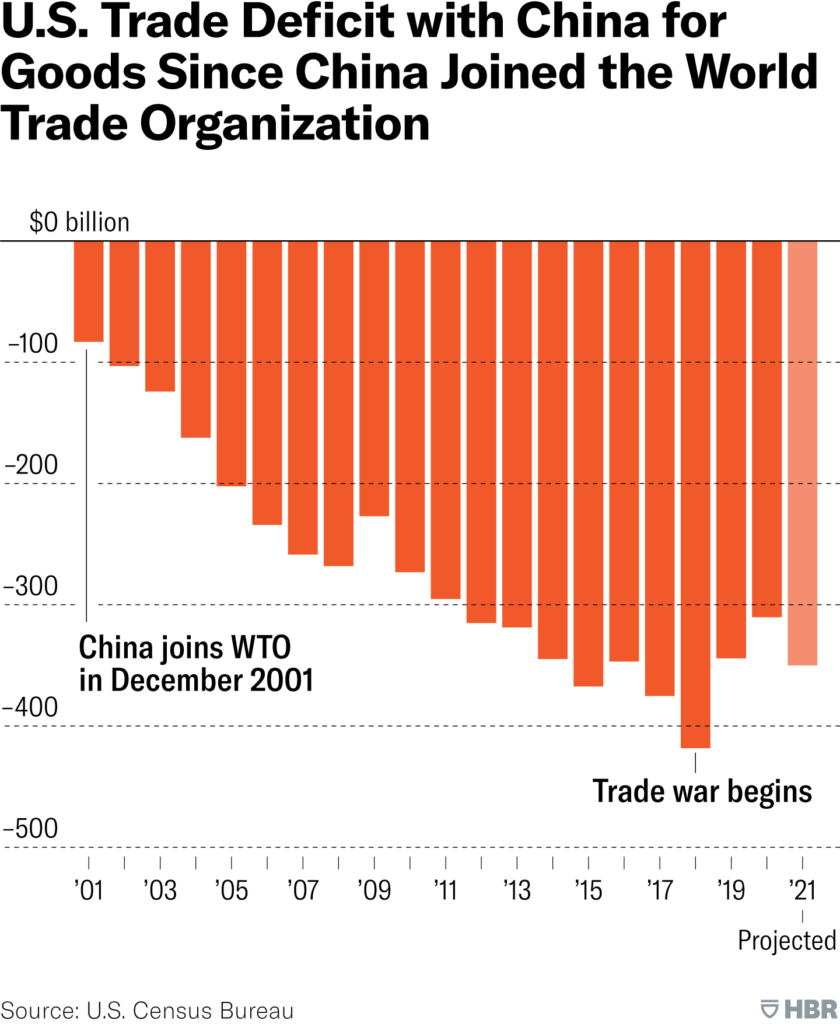

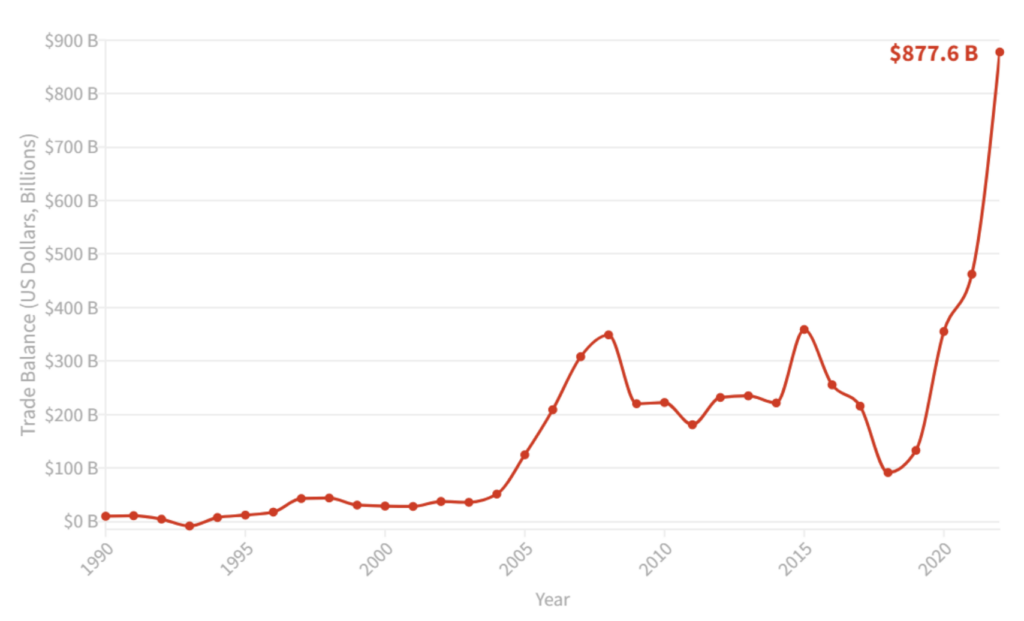

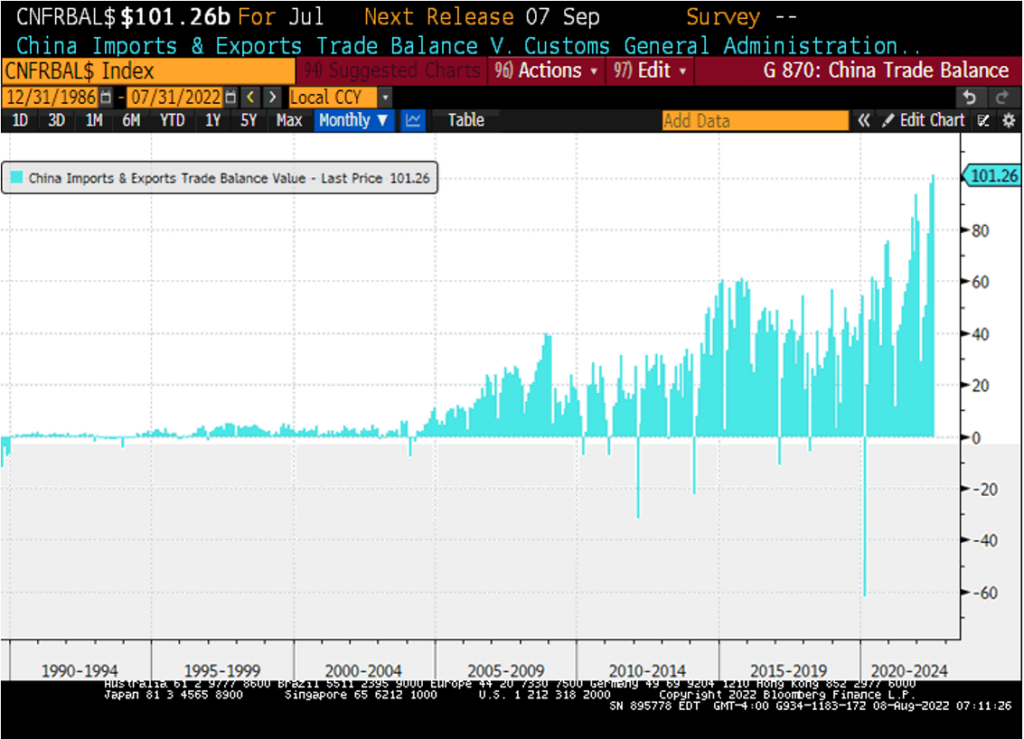

In 2022, China posted a record trade surplus of $857 billion, with $576 billion coming from the U.S. alone. That’s more than $1.5 billion per day in net income, a torrent of dollars flowing eastward into China’s reserves.

In the past, this flood of capital would have been recycled back into the U.S. economy via Treasury bond purchases, real estate acquisitions, or stock investments – a mutually reinforcing loop in the American-centric global financial order.

But now, the loop is breaking.

China’s Financial Counteroffensive

Rather than reinvesting those dollars in the U.S., China is dumping Treasuries. In Q1 2024 alone, Beijing sold $53.3 billion in Treasury and agency bonds – in the open market, at a loss. This wasn’t passive portfolio rebalancing; it was an emergency maneuver. China didn’t even wait for the bonds to mature.

This is not about de-dollarization in the traditional sense. China isn’t rejecting the dollar – it’s repatriating it. But it’s not bringing it home to hoard in central bank vaults. Instead, it’s extracting these dollars from the Western banking system and rerouting them through non-Western financial infrastructure – Chinese banks, new bilateral trading systems, RMB-based swap lines, and commodity-backed arrangements.

The underlying logic is clear: if dollars are going to be used, they’ll be used on China’s terms.

Weaponizing the Dollar Backfires

The weaponization of the dollar reached its zenith with the seizure of Russia’s reserves in 2022. That action sent shockwaves across the non-Western world. China, Saudi Arabia, the UAE, and others realized that their sovereign assets could be frozen on a whim, should they fall afoul of Washington.

In response, Beijing is rapidly shifting to a financial sovereignty model. It’s building a parallel global financial system that insulates itself – and its partners – from Western sanctions or coercion.

-

It is settling trade with South America and Africa increasingly in local currencies or yuan.

-

It is conducting bilateral trade with Russia and the Middle East using a mix of gold, digital yuan, and bartered commodities.

-

It has even embraced crypto indirectly by allowing Bitcoin financial infrastructure to flourish in Hong Kong.

This is not a speculative hedge – it’s a sovereign realignment.

Draining the Dollar’s Power at the Core

The U.S. financial system depends on foreign demand for its assets. Foreigners hold $61 trillion in American financial assets, while only owing around $18 trillion in dollar-denominated debt. This imbalance means that foreign states and investors – not American voters – hold the economic Sword of Damocles over U.S. markets.

Whenever the global economy contracts and dollar shortages emerge, foreign holders rush to liquidate U.S. assets. The Federal Reserve then scrambles to backstop markets by injecting liquidity or opening swap lines – measures that, ironically, reinforce the dollar’s privilege but expose its fragility.

But what happens if the world stops coming back?

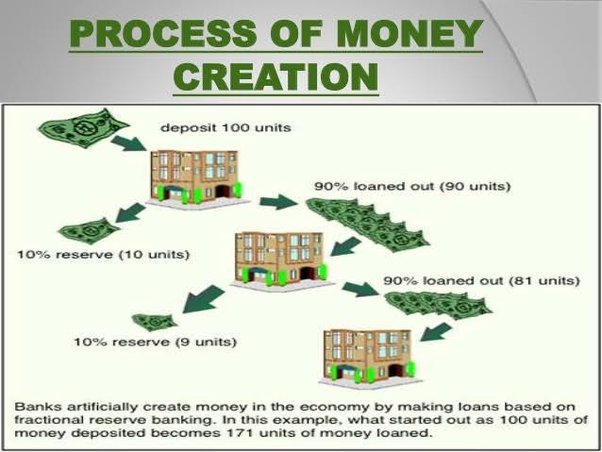

China isn’t just selling bonds – it’s withdrawing from the game itself. Each dollar removed from U.S. banks is a dollar that no longer multiplies into credit via fractional reserve lending. This is a slow bleed of monetary power from Wall Street to Beijing.

The Dollar’s Delicate Dance with Deficits

The U.S. trade deficit and dollar dominance are two sides of the same coin. America runs massive trade deficits to provide the world with dollars, which in turn ensures the dollar remains central to global finance. This dynamic, however, hollows out the U.S. manufacturing base, driving economic resentment, especially in the Midwest and industrial heartland.

For decades, each new trade bogeyman – Japan, Germany, Mexico, now China – has been scapegoated. But the real enemy isn’t China. It’s the financial architecture that demands the U.S. run deficits to keep the system alive.

Now, China is calling the bluff.

If countries like China, Russia, and Saudi Arabia no longer wish to hold U.S. financial assets, and begin trading dollars outside the Western banking system, then the U.S. may finally have to confront the core contradiction of its global dominance: You can be the empire or the factory – but not both.

A Fracturing Future

This is not the collapse of the dollar – it is the fragmentation of its monopoly. The rise of parallel systems – yuan clearinghouses, gold-settled trade, and even decentralized crypto rails – heralds a future where the dollar is one reserve currency among several, not the only game in town.

For the United States, this represents a moment of reckoning. Will it adapt to a multi-polar monetary order with humility and strategy? Or will it double down on coercion, tariffs, and isolation?

Meanwhile, China isn’t waiting for the answer. It’s already building the next financial world – with bricks made from your dollars.

Don’t Hate the Player, Hate the Game

The U.S. built the post-war financial order. Now, its greatest beneficiaries are quietly exiting the casino, cashing in their chips, and building a new house across the street. The dollar remains powerful – but it is no longer untouchable. The silent exodus has begun. And it’s picking up speed.