The Ultimate Guide to Stablecoins

Stablecoins are digital assets designed to maintain a stable value relative to a specific currency or commodity. They are often used as a store of value, a medium of exchange, and a means of transferring value between different cryptocurrency exchanges.

The first stablecoin, Tether (USDT), was launched in 2014 and has since become one of the most widely used stablecoins in the crypto industry. Other popular stablecoins include USDC, DAI, and BUSD.

According to CoinMarketCap, the total market capitalization of stablecoins has grown significantly over the past decade, from less than $1 billion in 2013 to over $140 billion as of March 2023. This growth can be attributed to the increasing adoption of stablecoins by traders, investors, and institutions in the crypto industry, as well as the rising demand for stable assets in volatile markets.

It’s worth noting that stablecoin growth has not been consistent over the past decade, with periods of rapid growth followed by periods of consolidation and market correction. However, the overall trend has been one of steady growth, and stablecoins are now an important and established part of the cryptocurrency ecosystem.

Different Types of Stablecoins

The most common types of stablecoins are fiat-backed stablecoins, commodity-backed stablecoins, and algorithmic stablecoins.

Fiat-backed stablecoins are the most common type of stablecoin, with Tether (USDT) and USD Coin (USDC) being the most widely used. These stablecoins are backed by fiat currencies, such as the US dollar, and are typically issued by a centralized entity. Fiat-backed stablecoins are used for various purposes, including payment transactions, remittances, and trading.

Commodity-backed stablecoins are less common, with PAX Gold (PAXG) and DigixDAO (DGD) being the most widely used. These stablecoins are backed by a commodity, such as gold or silver, and are typically issued by a centralized entity.

Algorithmic stablecoins are a newer type of stablecoin and are less common than fiat-backed and commodity-backed stablecoins. These stablecoins rely on an algorithm to maintain a stable value and are typically decentralized. Algorithmic stablecoins are used for various purposes, including trading and investment.

Difference Between Stablecoins and Cryptocurrencies

The main difference between a stablecoin and cryptocurrency is that a stablecoin is designed to maintain a stable value relative to an underlying asset, such as a fiat currency or a commodity, while a cryptocurrency is not backed by any underlying asset and is subject to market volatility.

Cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH), are designed to be a medium of exchange and a store of value, but their value is highly volatile and subject to market fluctuations. Stablecoins, on the other hand, are designed to be a more stable and predictable means of payment and investment.

Can you mine stablecoins?

No, stablecoins cannot be mined in the same way that some cryptocurrencies, such as Bitcoin or Ethereum, can be mined. This is because stablecoins are typically not based on a proof-of-work consensus mechanism, which is required for mining. Instead, stablecoins are usually issued and backed by a centralized entity, such as a bank or a company, which controls the issuance and management of the stablecoin. However, there are some exceptions, such as the algorithmic stablecoin Basis Cash (BAC), which can be mined through liquidity provision.

Growth and Use Cases of Stablecoins

The stablecoin market has grown significantly in recent years, with the total market capitalization of stablecoins surpassing $100 billion as of March 2023. Stablecoins are used for various purposes globally, including:

- Payments: Stablecoins are used for payment transactions, including cross-border payments, remittances, and micropayments.

- Trading and Investment: Stablecoins are used as a trading pair for cryptocurrencies, allowing traders to hedge against cryptocurrency volatility. Some stablecoins also provide yield-earning opportunities for investors.

- Decentralized Finance (DeFi): Stablecoins are a crucial component of the DeFi ecosystem, allowing users to collateralize loans, earn yield through liquidity provision, and participate in decentralized exchanges.

The usage and uptake of stablecoins has grown significantly over the past few years. According to a report by CoinMetrics, the total market capitalization of stablecoins has increased from $2.4 billion in January 2019 to over $115 billion as of March 2023. This growth is driven by several factors, including increased demand for stable value cryptocurrencies, improvements in the stability and transparency of stablecoin issuers, and the growing popularity of decentralized finance (DeFi) platforms.

Stablecoins have seen particularly high usage in the cryptocurrency industry, where they provide a stable store of value and facilitate fast and efficient transactions. For example, according to data from Glassnode, the stablecoin supply on centralized exchanges increased by over 400% in 2021, reaching a peak of over $20 billion in November.

Source: https://studio.glassnode.com/dashboards/mrkt-stablecoin-supplies

In addition to their use in the cryptocurrency industry, stablecoins are increasingly being used in traditional finance and commerce. For example, some stablecoin issuers have partnered with payment processors to enable stablecoin payments at merchants and retailers. Additionally, some stablecoins are being used for cross-border remittances, where they provide a cheaper and faster alternative to traditional remittance methods.

Stablecoins have also seen significant adoption in the DeFi space, where they are used as collateral for loans and as a means of transferring value between different decentralized applications. According to data from DeFi Pulse, the total value locked in stablecoin-based DeFi protocols reached over $30 billion in March 2023, up from just $1.5 billion in January 2021.

Overall, stablecoins are seeing growing adoption and usage globally, driven by their ability to provide a stable store of value and facilitate fast and efficient transactions across a wide range of industries and applications. However, as with any new technology, there are also risks and challenges associated with stablecoins, particularly around regulatory compliance, security, and the potential for market manipulation.

Are stablecoins FDIC insured?

FDIC (Federal Deposit Insurance Corporation) insurance is a type of protection that is provided to depositors in US banks in the event of bank failure. FDIC insurance covers up to $250,000 per depositor, per insured bank.

Stablecoins, like other cryptocurrencies, are not insured by the FDIC. This is because they are not considered bank deposits and do not fall under the FDIC’s jurisdiction. Stablecoins are often backed by reserves of fiat currencies or other assets held by a centralized issuer, which may provide some level of protection against loss of value or default risk, but this is not the same as FDIC insurance.

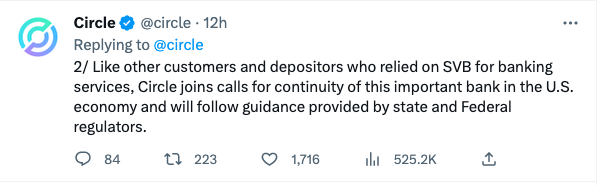

It’s important to note that not all stablecoins are created equal, and their level of risk can vary depending on the type of stablecoin and the underlying collateral. For example, stablecoins that are backed by US dollars held in bank accounts may be considered less risky than those that are backed by cryptocurrencies or other assets with more volatile prices. This is not always the case, as seen with the recent depeg of USDC due to its exposure to Silicon Valley Bank.

It’s important to do your own research and due diligence before investing in any type of stablecoin.

Advantages vs. Disadvantages of Stablecoins

Advantages of Stablecoins:

- Price stability: Stablecoins are designed to maintain a stable value against a pegged asset, such as the US dollar or gold. This can provide a stable store of value and help reduce volatility in the cryptocurrency market.

- Fast transactions: Stablecoins can be used to facilitate fast and efficient transactions, without the delays and fees associated with traditional banking and payment systems.

- Accessibility: Stablecoins can be used by anyone with an internet connection, regardless of geographical location or access to traditional financial services.

- Privacy: Some stablecoins can have privacy features designed to provide greater anonymity and privacy than traditional payment methods.

- Programmability: Some stablecoins are built on blockchain platforms, which allows them to be used in smart contracts and other decentralized applications.

Disadvantages of Stablecoins:

- Centralization: Many stablecoins are backed by a centralized issuer, which can create a single point of failure and increase counterparty risk.

- Regulatory uncertainty: Stablecoins are a relatively new technology and are not yet subject to clear and consistent regulatory frameworks in many jurisdictions. This can create uncertainty for issuers and users.

- Risks of scale: Stablecoins, like any system that becomes large and widely adopted, can create systemic risks and concentration of economic power. If a stablecoin issuer were to fail or become insolvent, it could have significant ripple effects on the wider cryptocurrency ecosystem.

- Volatility of underlying assets: Some stablecoins are backed by cryptocurrencies or other volatile assets, which can create risk of price fluctuations and loss of value.

Other risks:

As stablecoins become more widely adopted and their market capitalization grows, they can create systemic risks and concentration of economic power. If a stablecoin issuer were to fail or become insolvent, it could have significant ripple effects on the wider cryptocurrency ecosystem. This could include a loss of confidence in stablecoins and a reduction in demand for other cryptocurrencies, which could lead to a broader market downturn.

In addition, stablecoins backed by a single issuer can create a concentration of economic power. If one issuer were to become dominant, it could create a situation where they have significant control over the supply and demand of the stablecoin, which could create issues around market manipulation and anti-competitive behavior. To mitigate these risks, it is important for stablecoin issuers to maintain transparency around their reserves and collateralization, and for regulators to establish clear and consistent frameworks for stablecoin issuance and management.

Popular Stablecoins & Their Value Propositions

The stablecoin market has grown rapidly over the past few years, with a wide range of players offering different types of stablecoins. Some of the most prominent stablecoins and their stabilization mechanisms include:

Tether (USDT): Tether is the largest stablecoin by market capitalization, and is backed 1:1 by the US dollar. Tether uses a centralized model, with its reserves held in banks and reported monthly. However, Tether has faced controversy over its transparency and its ability to maintain its peg during times of market stress.

The mechanics of USDT issuance involve the following steps:

- Tether Limited receives deposits of US dollars from users in exchange for USDT.

- Tether Limited mints new USDT tokens and sends them to the user’s wallet.

- Tether Limited holds the deposited US dollars as reserves to back the issued USDT tokens.

- Users can redeem their USDT for US dollars at any time by sending them back to Tether Limited, who will then return the equivalent amount of US dollars from their reserves.

USD Coin (USDC): USDC is a stablecoin issued by Circle and Coinbase, and is backed 1:1 by the US dollar. USDC uses a transparent model, with its reserves held in segregated bank accounts and audited monthly. USDC has gained popularity due to its transparency and regulatory compliance.

The mechanics of USDC issuance involve the following steps:

- Users deposit US dollars with a regulated financial institution that has partnered with Circle.

- Circle mints new USDC tokens and sends them to the user’s wallet.

- Circle holds the deposited US dollars as reserves to back the issued USDC tokens.

- Users can redeem their USDC for US dollars at any time by sending them back to the partnering financial institution, who will then return the equivalent amount of US dollars from their reserves.

Dai (DAI): DAI is a decentralized stablecoin issued by MakerDAO, and is backed by overcollateralized crypto assets such as ETH. DAI uses a unique stabilization mechanism, where the MakerDAO ecosystem adjusts interest rates and liquidation mechanisms to maintain the stablecoin’s peg. DAI’s decentralized nature and lack of reliance on traditional assets has led to its popularity among cryptocurrency enthusiasts.

The mechanics of DAI issuance involve the following steps:

- A user deposits Ether or other supported cryptocurrencies into a smart contract called a Collateralized Debt Position (CDP).

- The user then generates new DAI tokens from the CDP, which are sent to their wallet.

- The value of the collateral in the CDP is monitored by the MakerDAO protocol to ensure that it remains sufficient to back the issued DAI tokens.

- Users can repay their DAI debt at any time by sending DAI back to the CDP, and in return, they receive the equivalent amount of collateral that was deposited initially.

TrueUSD (TUSD): TrueUSD is a stablecoin backed 1:1 by the US dollar and is issued by TrustToken. TrueUSD uses a transparent model, with its reserves held in escrow accounts and verified by third-party accounting firms. TrueUSD has gained popularity due to its transparency and strong regulatory compliance.

Binance USD (BUSD): BUSD is a stablecoin issued by Binance and is backed 1:1 by the US dollar. BUSD uses a centralized model, with its reserves held in banks and reported monthly. BUSD has gained popularity due to its association with Binance, one of the largest cryptocurrency exchanges.

Paxos Standard (PAX): PAX is a stablecoin issued by Paxos and is backed 1:1 by the US dollar. PAX uses a transparent model, with its reserves held in segregated bank accounts and audited monthly. PAX has gained popularity due to its transparency and strong regulatory compliance.

Overall, the mechanics of stablecoin issuance can be quite different depending on the type of stablecoin, but they all involve some form of depositing collateral or reserves and minting new tokens that are pegged to a specific value.

The value propositions of these stablecoins vary, with some emphasizing transparency and regulatory compliance, while others focus on decentralization and lack of reliance on traditional assets. However, all stablecoins aim to provide a stable store of value and facilitate fast and efficient transactions.

In terms of stabilization mechanisms, stablecoins can use a variety of methods to maintain their pegs. Some use centralized models, where reserves are held in traditional bank accounts and reported periodically. Others, such as DAI, use decentralized mechanisms, where interest rates and liquidation mechanisms are adjusted dynamically to maintain the stablecoin’s peg. Ultimately, the effectiveness of these mechanisms depends on the stability and reliability of the underlying assets and the issuer’s ability to manage risk.

What factors or market conditions can lead to stablecoins depegging?

Stablecoins are designed to maintain a stable value relative to a specific currency or commodity, typically through the use of various mechanisms such as collateralization, algorithmic adjustments, or centralized reserves. However, there are certain factors or market conditions that can lead to stablecoins depegging or deviating from their intended value. Here are a few examples:

- Market volatility: Stablecoins can come under pressure during periods of high market volatility or uncertainty, which can lead to increased demand or selling pressure, thereby impacting their peg. For instance, during the market crash in March 2020, some stablecoins such as DAI and USDC experienced a temporary depegging due to the liquidity crunch in the market.

- Lack of liquidity: Stablecoins rely on sufficient market liquidity to maintain their peg, and any shortage of liquidity can lead to price distortions. If demand for a stablecoin exceeds its available supply, its price may rise above its peg, and if supply exceeds demand, the price may drop below its peg.

- Collateral risks: Some stablecoins are backed by collateral, which can include cryptocurrencies or fiat currencies. If the value of the collateral falls below a certain threshold, the stablecoin issuer may be forced to liquidate the collateral to maintain the peg, which can lead to a depegging.

- Regulatory risks: Stablecoins may face regulatory risks and uncertainty, which can impact their adoption and lead to a depegging. For instance, if a stablecoin is deemed to be a security by regulators, it may face restrictions or even be forced to shut down, which can impact its price and stability.

- Governance risks: Stablecoins that rely on a centralized authority or governance model may face governance risks, such as mismanagement or fraud, which can impact their peg and stability.

Stablecoins & Impact on Banking

The growth potential of stablecoins is significant, as they offer a number of benefits over traditional banking systems. Some potential growth areas and impacts on banking include:

- Cross-border payments: Stablecoins can be used for fast and low-cost cross-border payments, without the need for intermediaries such as banks or payment processors. This can be particularly useful for remittances and international trade, which are often costly and time-consuming using traditional banking systems.

- Decentralized finance (DeFi): Stablecoins can be used as a stable and reliable form of collateral in decentralized finance applications, such as lending and borrowing platforms, decentralized exchanges, and synthetic assets. This can open up new opportunities for financial inclusion and innovation, by enabling anyone with an internet connection to participate in financial markets.

- Central bank digital currencies (CBDCs): Some countries are exploring the use of digital currencies issued by central banks, which could function as a type of stablecoin. CBDCs could have significant implications for the banking system, as they would provide an alternative to traditional bank deposits and payment systems.

However, stablecoins also present risks and challenges to the banking system. For example, stablecoins could potentially be used for money laundering, terrorist financing, or other illegal activities, which could pose regulatory and legal challenges. Additionally, the growth of stablecoins could potentially impact the composition of bank reserves, as users may choose to hold stablecoins instead of traditional bank deposits.

Overall, the growth potential of stablecoins is significant, but their impact on the banking system will depend on how they are adopted and regulated in the coming years. As with any new technology, there are both opportunities and risks associated with stablecoins, and it will be important for policymakers, regulators, and industry stakeholders to work together to ensure a safe and sustainable ecosystem for stablecoins.

Stablecoins have the potential to impact credit intermediation, composition of reserves, and security holdings framework in a number of ways.

- Credit intermediation: Stablecoins can provide an alternative source of funding for borrowers and investors, without the need for traditional credit intermediaries such as banks. This can enable more efficient and accessible credit markets, especially in emerging economies and for small and medium-sized enterprises (SMEs).

- Composition of reserves: As stablecoins become more widely adopted, they could potentially impact the composition of bank reserves. If users choose to hold stablecoins instead of traditional bank deposits, this could reduce the amount of deposits held by banks, potentially leading to a decrease in the money multiplier effect and a reduction in lending capacity.

- Security holdings framework: Stablecoins are typically backed by a reserve of fiat currency or other assets, which must be held in a secure manner to ensure that the stablecoin remains fully collateralized. This could impact the security holdings framework of financial institutions, as they may need to hold additional reserves of fiat currency or other assets to support stablecoin issuance.

Overall, the impact of stablecoins on credit intermediation, composition of reserves, and security holdings framework will depend on how they are adopted and regulated in the coming years. Policymakers, regulators, and industry stakeholders will need to work together to ensure that stablecoins are used in a safe and sustainable manner, and that they do not pose undue risks to financial stability or consumer protection.