Top 10 Liquid Restaking Protocols to Watch in 2025

Liquid restaking is quickly gaining traction in the decentralized finance (DeFi) world as it allows users to maximize their staking rewards by reinvesting their liquid staking tokens (LSTs) into various yield-generating strategies. With numerous innovative protocols emerging, 2024 is shaping up to be a pivotal year for liquid restaking. Here are the top 10 liquid restaking protocols to keep an eye on in 2024.

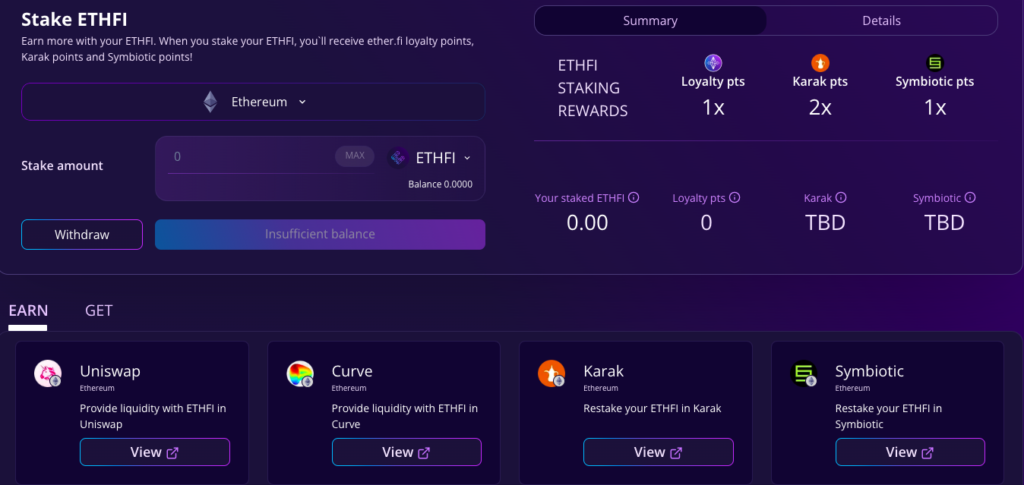

1. Ether.fi

TVL: $6.5 billion

Ether.fi stands out as one of the largest and most prominent liquid restaking protocols in the DeFi ecosystem. It allows Ethereum stakers to receive eETH, a liquid restaking token that can be used across DeFi platforms while continuing to earn staking rewards. Through its integration with EigenLayer, Ether.fi gives users the ability to restake their ETH, securing additional services such as oracles, Layer 2 rollups, and more, all while maximizing their staking rewards.

Ether.fi’s dual strategy of offering staking rewards and additional yield opportunities has made it a cornerstone protocol for those looking to optimize their staking portfolios in 2024.

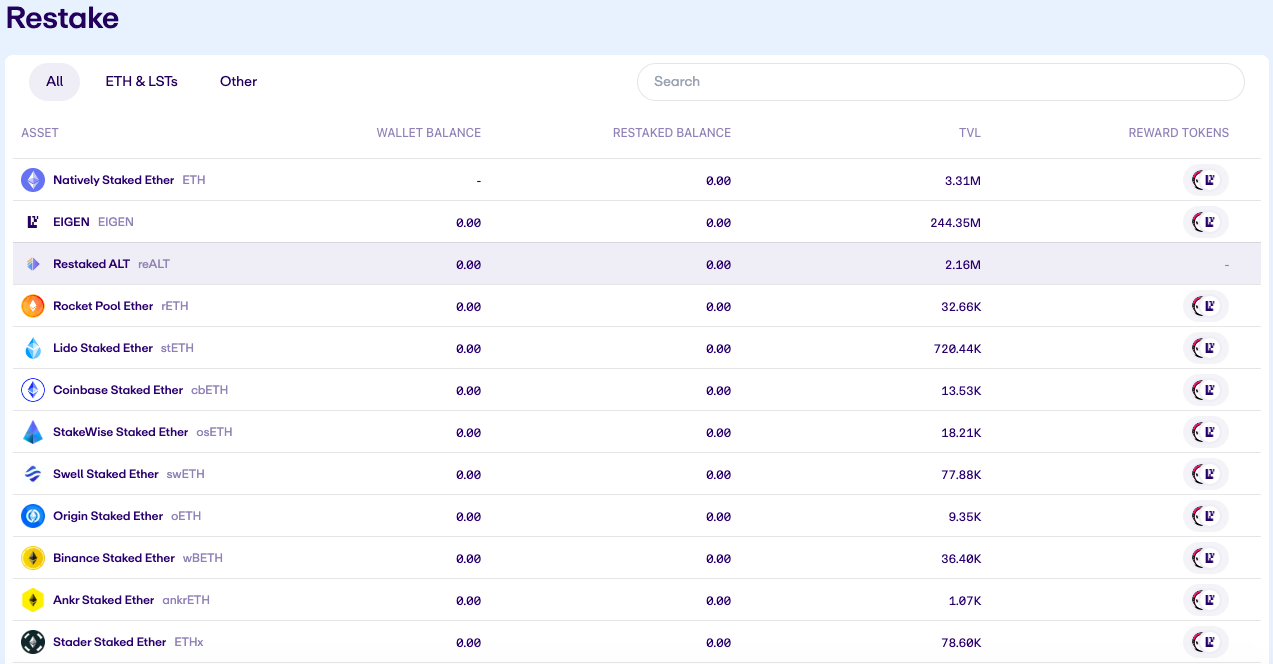

2. EigenLayer

TVL: $1.5 billion

EigenLayer is revolutionizing cryptoeconomic security by enabling Ethereum stakers to restake their ETH or liquid staking tokens (LSTs) to provide security for decentralized applications built on the network. EigenLayer allows stakers to simultaneously earn rewards across multiple protocols, providing pooled security for a wide range of services. This reduces capital costs for stakers and fosters innovation by enabling decentralized services to tap into Ethereum’s security without building their own networks.

As one of the foundational liquid restaking protocols, EigenLayer has become integral to the DeFi ecosystem, allowing users to securely stake while participating in various applications, all with increased capital efficiency.

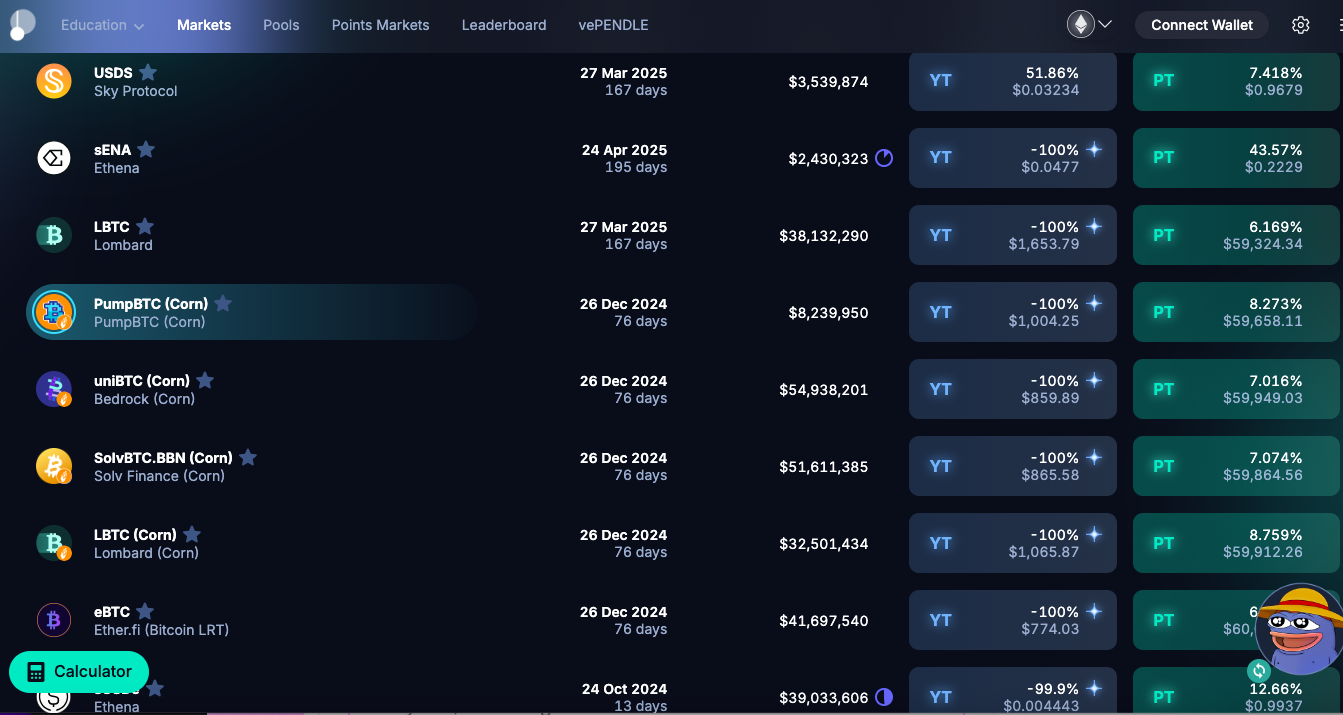

3. Pendle

TVL: $700 million

Pendle is a permissionless yield-trading protocol that allows users to tokenize their yield-bearing assets into Principal Tokens (PT) and Yield Tokens (YT), enabling greater control over yield management strategies. Through Pendle AMM, users can trade these tokens and speculate on future yields, enhancing their returns in both bullish and bearish markets.

Pendle also supports liquid restaking by enabling users to restake liquid staking tokens like stETH in order to capture additional yield while maintaining the liquidity of their assets. Pendle’s innovative approach to yield tokenization and its integration with liquid restaking protocols like EigenLayer has made it a top choice for DeFi users seeking advanced yield strategies in 2024.

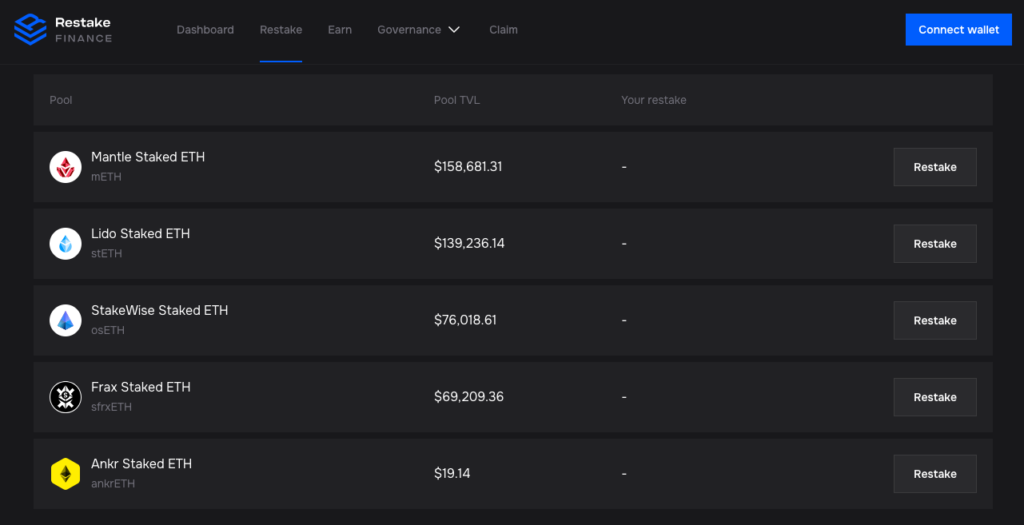

4. Restake Finance

TVL: $1 billion

Restake Finance is a modular liquid staking protocol specifically designed for the EigenLayer ecosystem. It allows users to restake their LSTs into Actively Validated Services (AVSs) while continuing to earn staking rewards. With its unique rehypothecation mechanism, Restake Finance enables users to optimize yield by restaking tokens like stETH, generating additional rewards through rstETH.

The platform’s governance token, RSTK, empowers users to participate in decision-making and share in protocol earnings. Restake Finance’s focus on maximizing capital efficiency and rehypothecation has positioned it as a leader in the liquid staking space for those looking to earn rewards through EigenLayer.

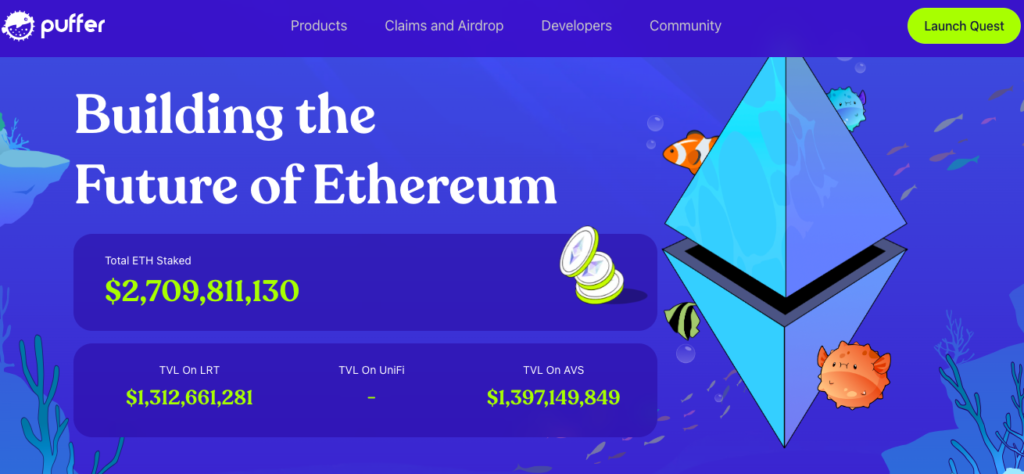

5. Puffer Finance

TVL: $1.7 billion

Puffer Finance offers a unique approach to liquid restaking by minimizing slashing risks and introducing validator tickets, which ensure rewards regardless of validator performance. By depositing ETH, users can mint pufETH, which not only captures staking rewards but also earns additional restaking yields through EigenLayer.

Puffer Finance has quickly gained popularity due to its emphasis on security and user-friendly staking processes. Its innovative validator tickets make it an attractive option for those looking to minimize risks while maximizing rewards in the restaking ecosystem.

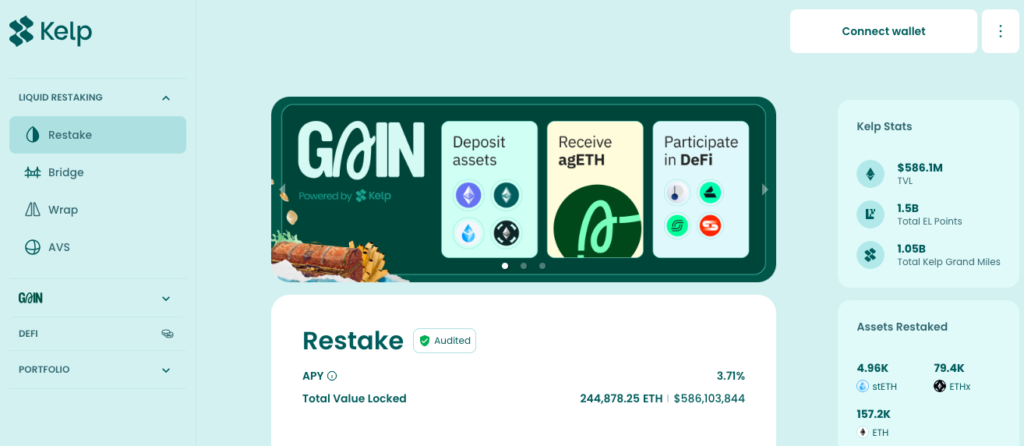

6. Kelp DAO

TVL: $1 billion

Kelp DAO is an emerging liquid restaking protocol built on EigenLayer, focusing on providing users with a simplified process to restake ETH and other assets such as stETH, ETHx, and sfrxETH. Users receive rsETH in return, which represents their restaked assets and earns rewards from Ethereum staking and EigenLayer services.

With strong community backing and a growing user base, Kelp DAO’s intuitive platform and zero-fee deposit policy have made it one of the fastest-growing liquid restaking protocols. It offers a seamless experience for users looking to restake assets and earn higher yields in DeFi.

7. Inception

TVL: $850 million

Inception is a liquid restaking protocol built on the Ethereum mainnet that takes a unique approach by offering Isolated Liquid Restaking Tokens (iLRTs). These tokens allow users to engage in DeFi activities without pooling risks, mitigating the complexities often associated with restaking.

Inception’s vault system interacts with EigenLayer, offering strategic restaking options for assets like stETH and rETH. The protocol’s focus on reducing risks and increasing transparency has attracted a wide range of users, making it a notable player in the liquid restaking space in 2024.

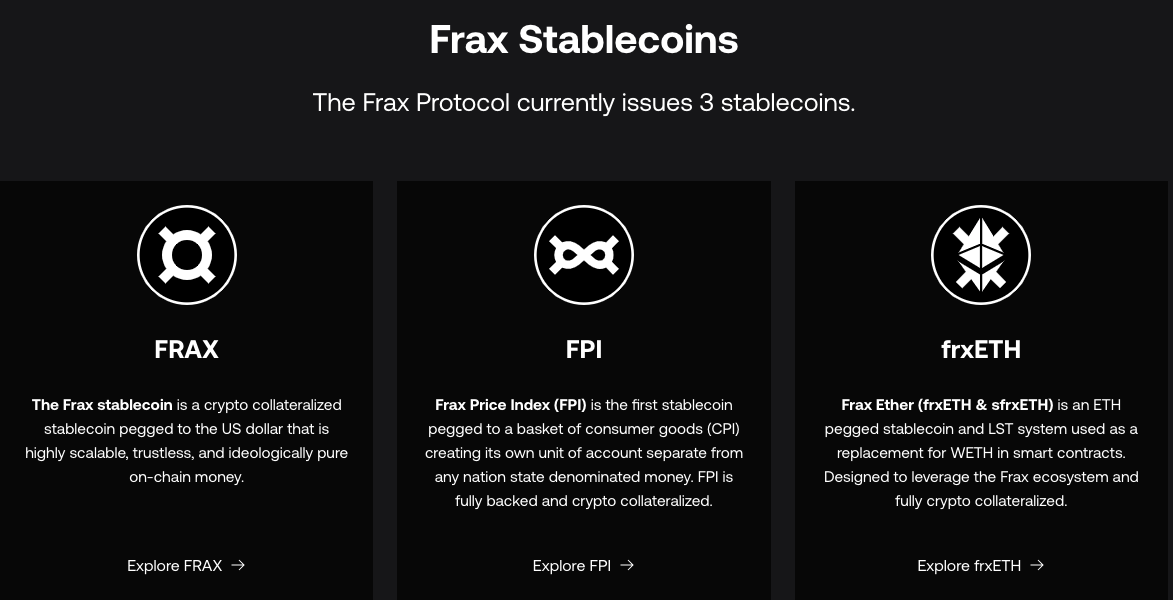

8. Frax Ether (Frax Finance)

TVL: $2 billion

Frax Finance, known for its algorithmic stablecoin system, has expanded into the liquid staking and restaking space with Frax Ether. Users can stake ETH and receive frxETH, a liquid staking token that can be used across DeFi protocols while continuing to earn staking rewards. Frax Ether integrates with restaking platforms, enabling users to maximize their yield by participating in multiple DeFi services.

Frax Ether’s strong foundation in the stablecoin market and its seamless integration with the Ethereum ecosystem make it a top choice for users looking to optimize staking returns through liquid restaking.

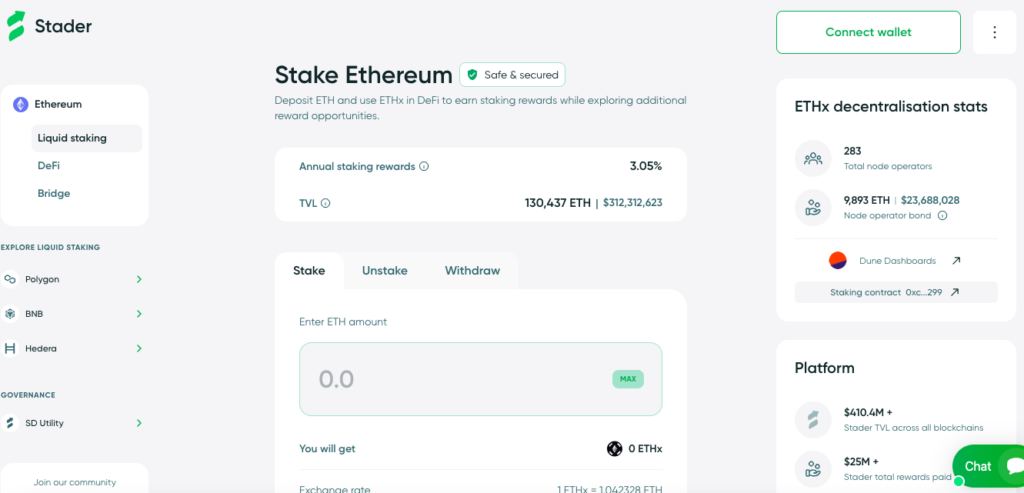

9. Stader Labs

TVL: $2.5 billion

Stader Labs has established itself as a multi-chain liquid staking protocol that enables users to stake assets across networks like Ethereum, Binance Smart Chain, and Solana. In 2024, Stader introduced rsETH, allowing users to restake their liquid staking tokens into EigenLayer and other services to earn additional rewards.

Stader Labs’ multi-chain support and easy-to-use interface make it an excellent choice for DeFi users looking to diversify their staking strategies and maximize returns across different ecosystems.

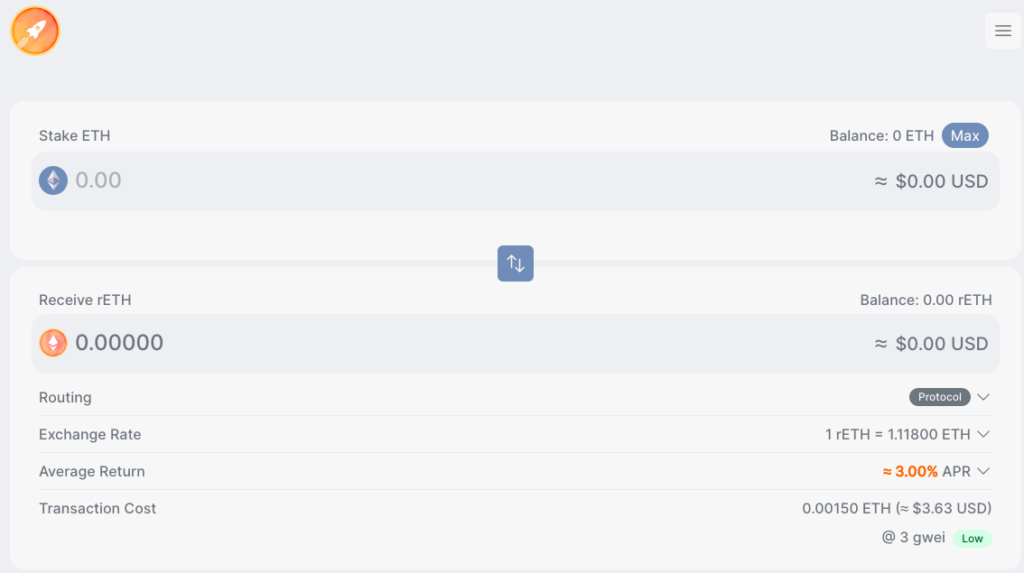

10. Rocket Pool

TVL: $2 billion

As one of the most trusted liquid staking platforms on Ethereum, Rocket Pool has expanded into the restaking market by offering users the ability to restake their rETH through EigenLayer and other services. Rocket Pool’s decentralized node operator network provides stakers with a secure and decentralized way to participate in Ethereum staking, with a lower threshold than traditional staking.

With a focus on decentralization and security, Rocket Pool’s move into restaking offers users the opportunity to earn even greater rewards without compromising on the core values of Ethereum’s ecosystem.

Conclusion

The liquid restaking ecosystem is rapidly expanding in 2024, offering users a diverse range of opportunities to enhance their staking rewards. Protocols like Ether.fi, EigenLayer, Pendle, and Restake Finance are leading the charge, while new entrants like Inception, Kelp DAO, and Puffer Finance provide innovative features to help users optimize their yield strategies. Whether you’re looking for advanced yield management, multi-chain support, or secure and decentralized staking options, these protocols offer some of the best ways to capitalize on liquid restaking in the evolving DeFi space.