Top 10 Real-World Asset (RWA) Cryptos

In 2024, the intersection of traditional finance and blockchain technology is being revolutionized by Real-World Asset (RWA) tokens. These tokens are digital representations of tangible assets like real estate, commodities, and financial instruments, securely stored on a blockchain. The tokenization of these assets brings the liquidity and accessibility of cryptocurrency markets to traditionally illiquid markets, bridging the gap between the physical and digital worlds. Here, we explore the top 10 RWA crypto projects making waves this year.

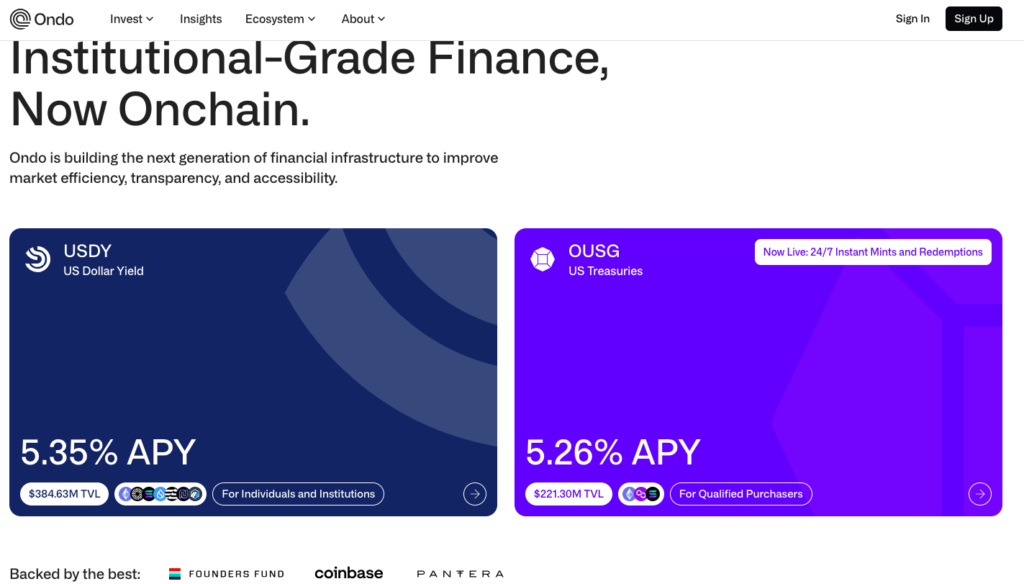

1. Ondo Finance (ONDO)

Ondo Finance stands out by offering tokenized versions of high-grade investment products such as mortgage-backed securities. By democratizing access to these traditionally exclusive assets, Ondo Finance allows everyday investors to gain exposure to a range of financial instruments. This model also provides steady income through interest payments on these tokenized assets, attracting a diverse range of investors. With a 380% increase in value over the past year, ONDO is proving to be one of the top-performing RWA tokens in the market.

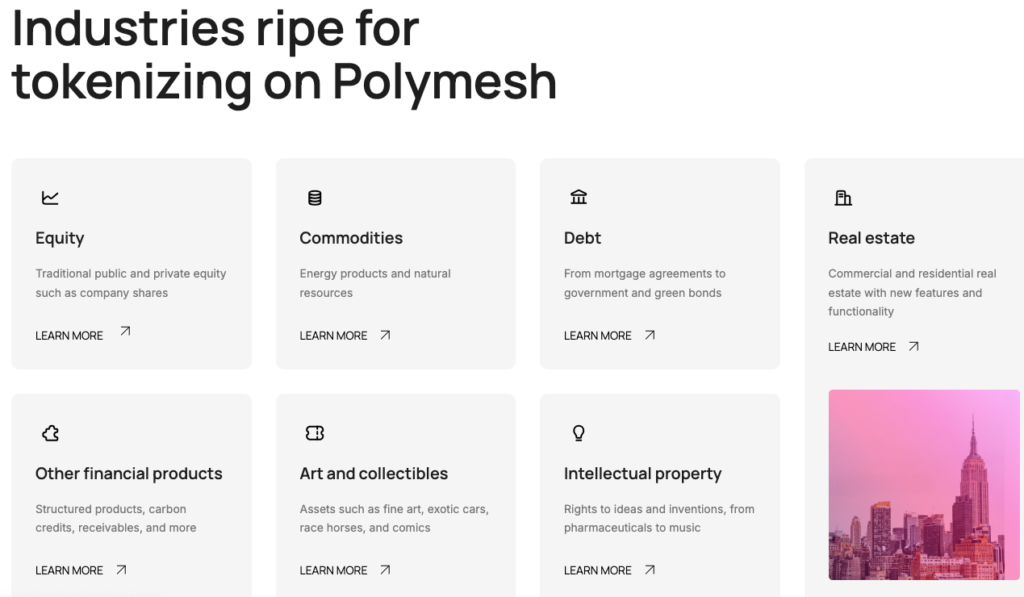

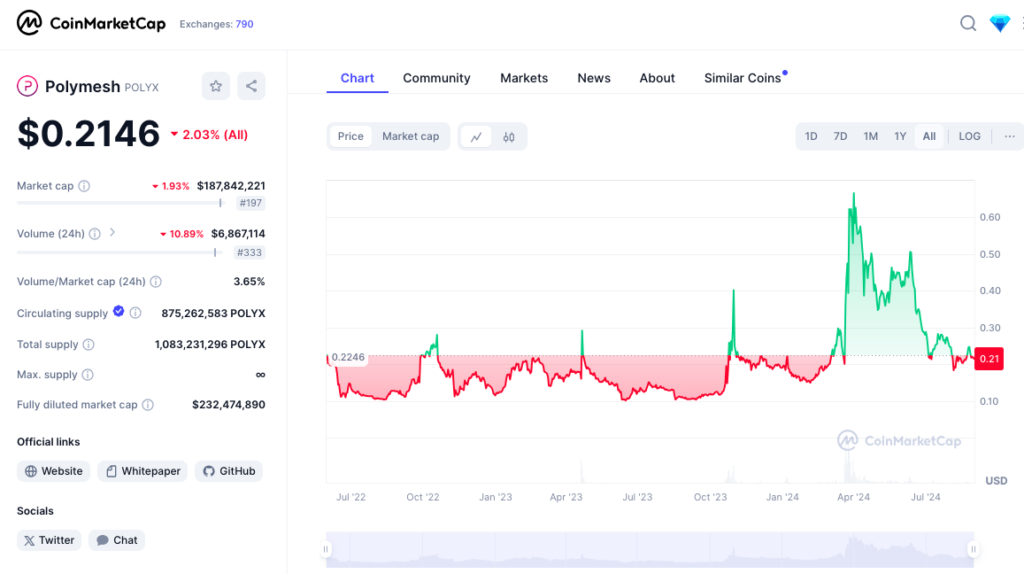

2. Polymesh (POLYX)

Polymesh is designed for the tokenization of regulated assets like stocks, bonds, and exchange-traded funds (ETFs). Focusing specifically on the financial industry, Polymesh addresses compliance, security, and regulatory requirements, making it a significant player in the RWA sector. POLYX, its native token, has seen a 165% increase in value over the past year, underlining its growing adoption and potential in bringing regulated financial assets onto the blockchain.

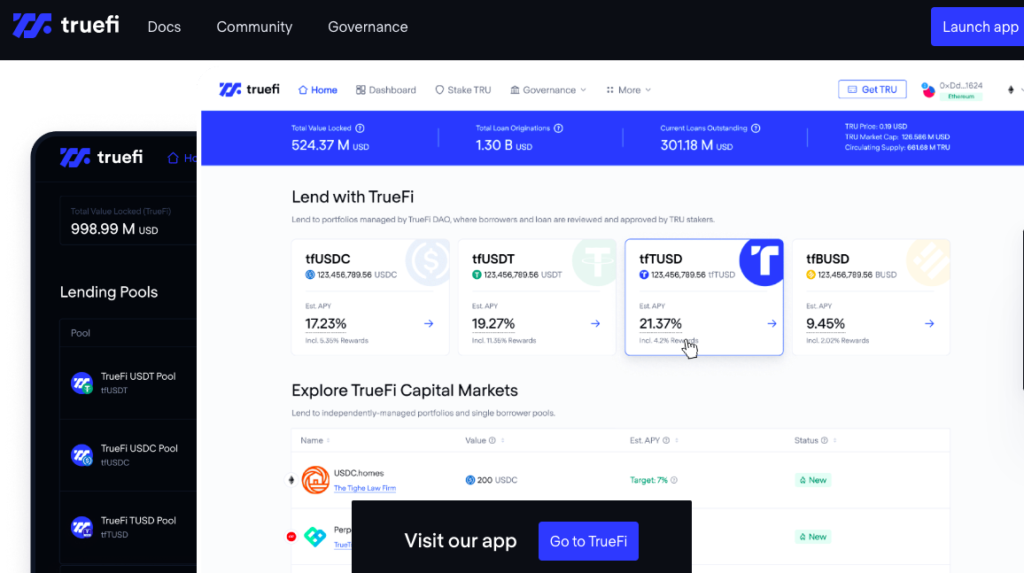

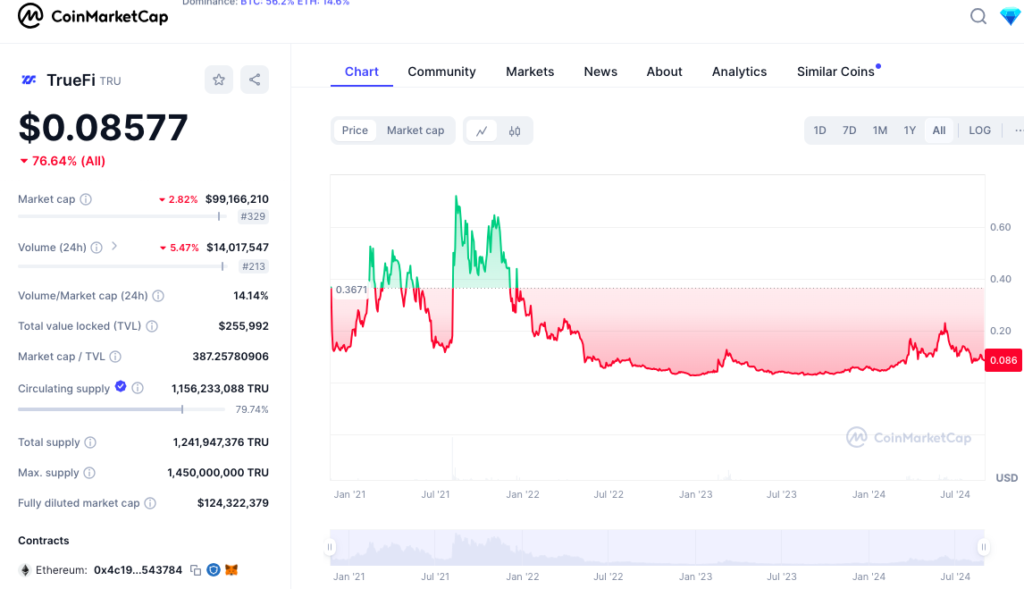

3. TrueFi (TRU)

TrueFi is a DeFi platform offering unsecured loans, making it unique in a market where collateral is typically a requirement. By broadening access to crypto loans, TrueFi opens the door for a wider range of borrowers. Its native token, TRU, has grown by 145% over the past year, indicating both its potential and the risks inherent in its innovative approach to DeFi lending.

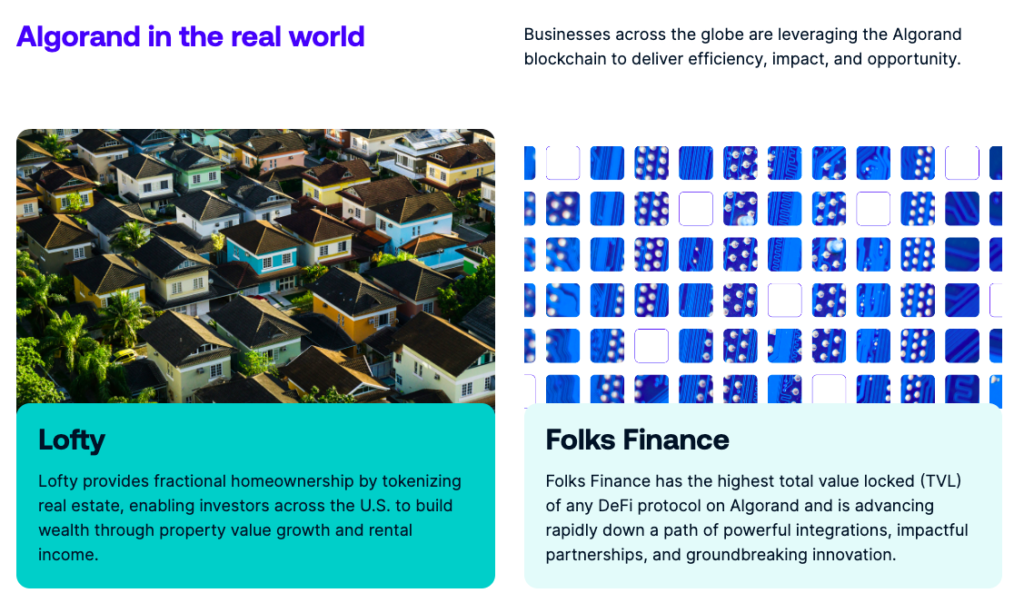

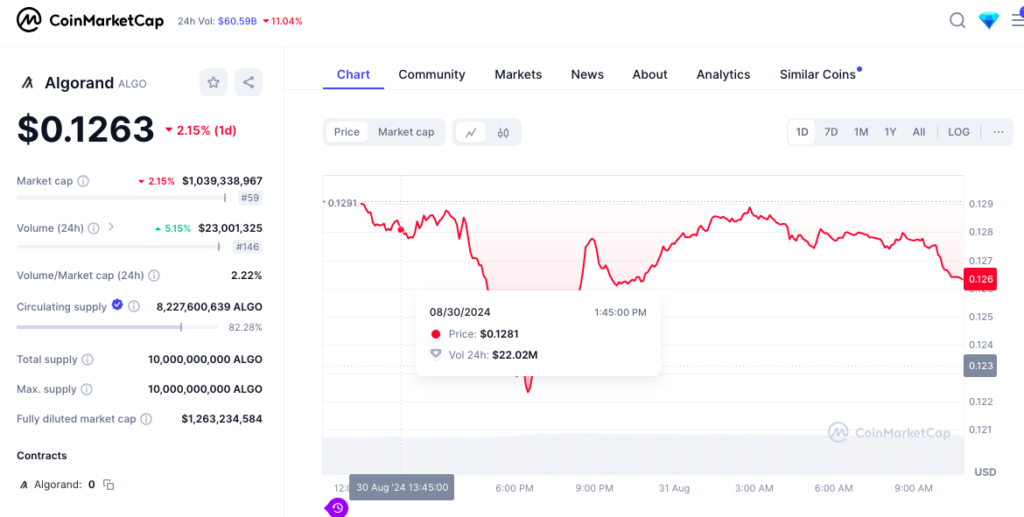

4. Algorand (ALGO)

Algorand supports the tokenization of a diverse range of real-world assets, from fine art to real estate. Its user-friendly platform appeals to creators and artists looking to tokenize their work. Algorand’s broad applicability across various industries, combined with its 15% value growth in the past year, positions it as a versatile player in the RWA space.

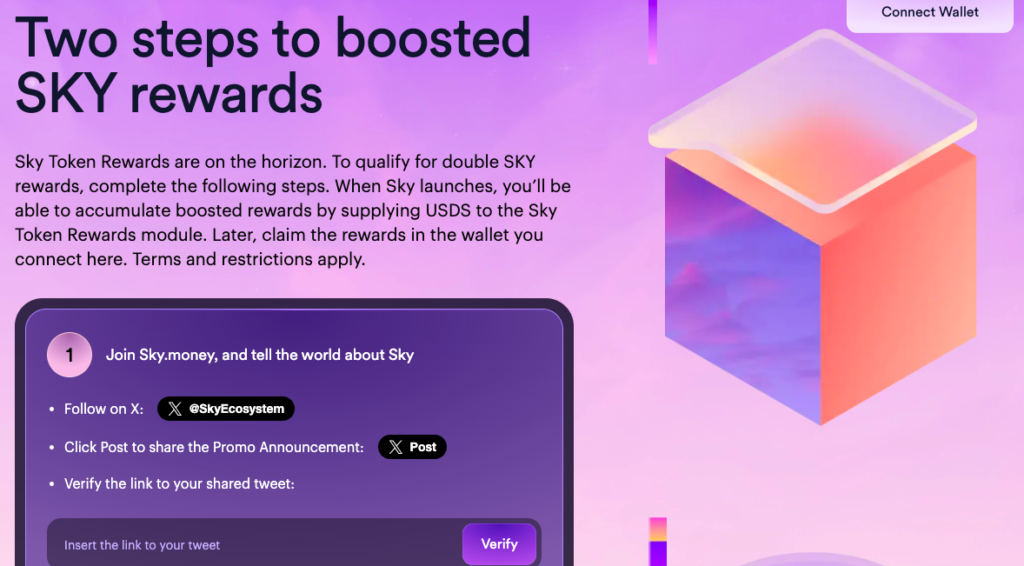

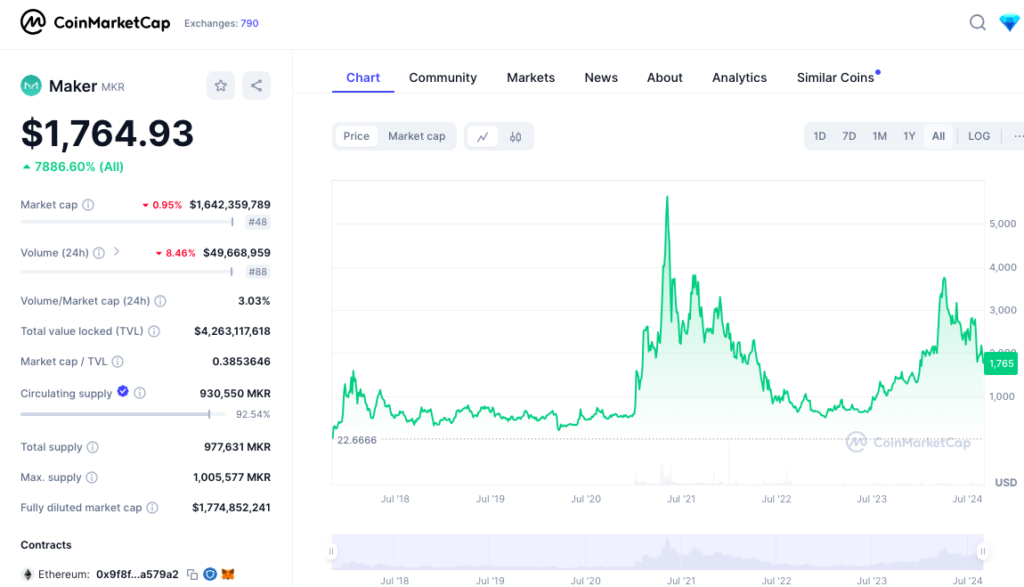

5. Maker (MKR) – SKY.MONEY

Known for its stablecoin, DAI, Maker (now Sky.Money) has expanded into the RWA sector by offering collateralized real estate loans. This model integrates traditional assets into the DeFi ecosystem, providing liquidity for property owners through DAI issuance. Maker’s market cap of approximately $1.79 billion and its significant increase in value highlight its role as a pioneering project in RWA tokenization.

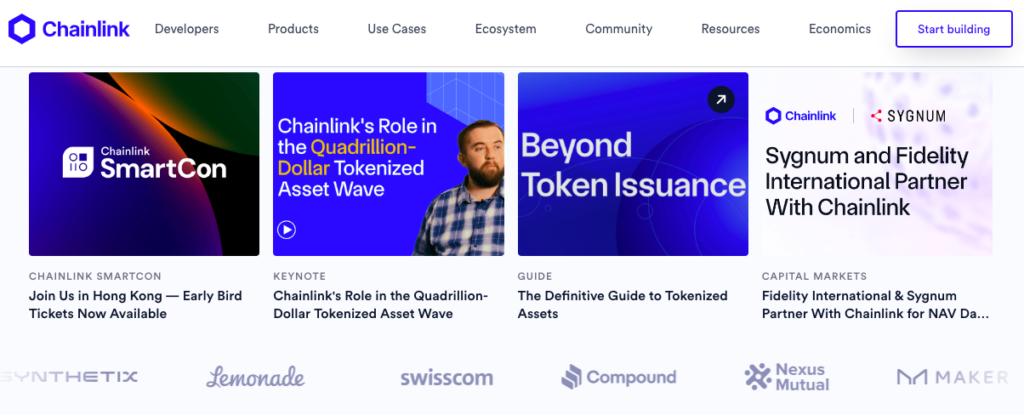

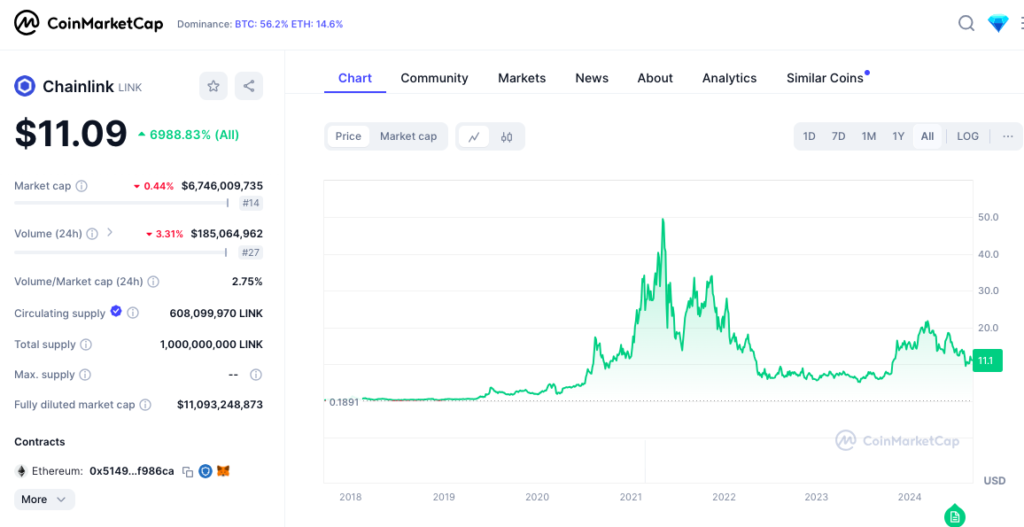

6. Chainlink (LINK)

Chainlink plays a crucial role in the RWA market by acting as a decentralized oracle network that provides real-world data to smart contracts on the blockchain. This ensures the accuracy and reliability of data feeds for asset-backed tokens, thereby enhancing their trustworthiness. As more assets are tokenized, the demand for reliable oracles like Chainlink is expected to grow, further solidifying its position in the ecosystem.

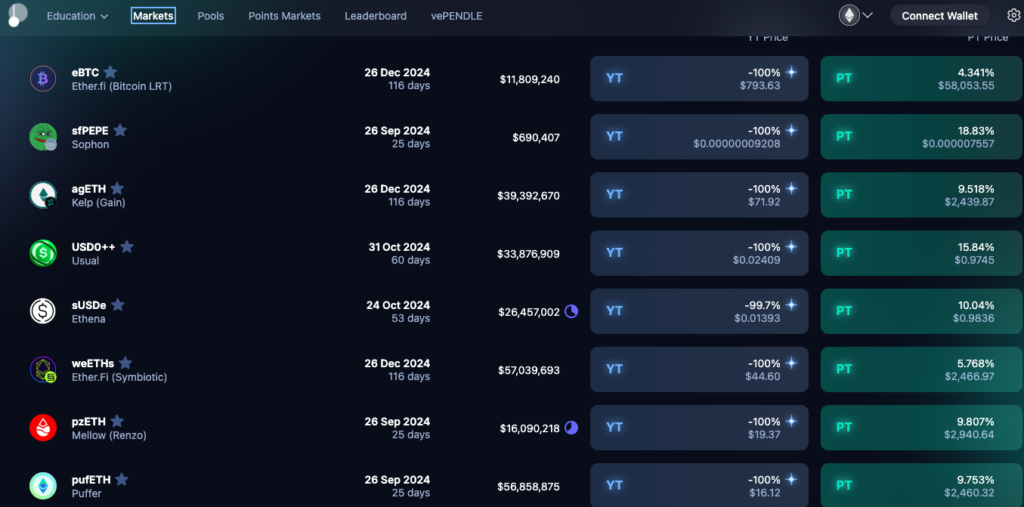

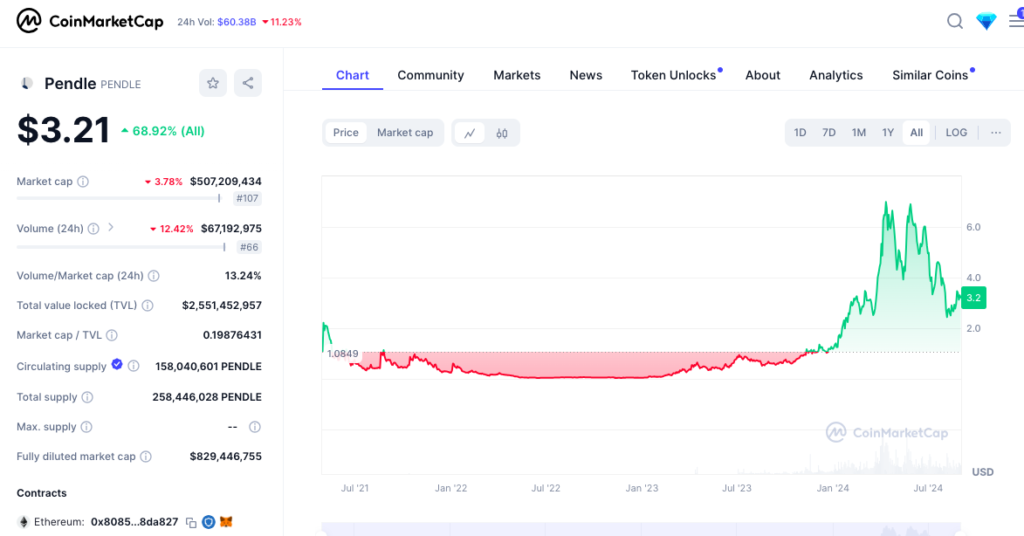

7. Pendle (PENDLE)

Pendle Finance introduces a novel concept of tokenizing future yield streams, allowing users to trade them as tradable assets. This approach unlocks liquidity for future earnings, providing new investment opportunities in the DeFi ecosystem. Pendle’s integration of RWA into its model positions it as an innovative platform for both retail and institutional investors looking to maximize returns and diversify portfolios.

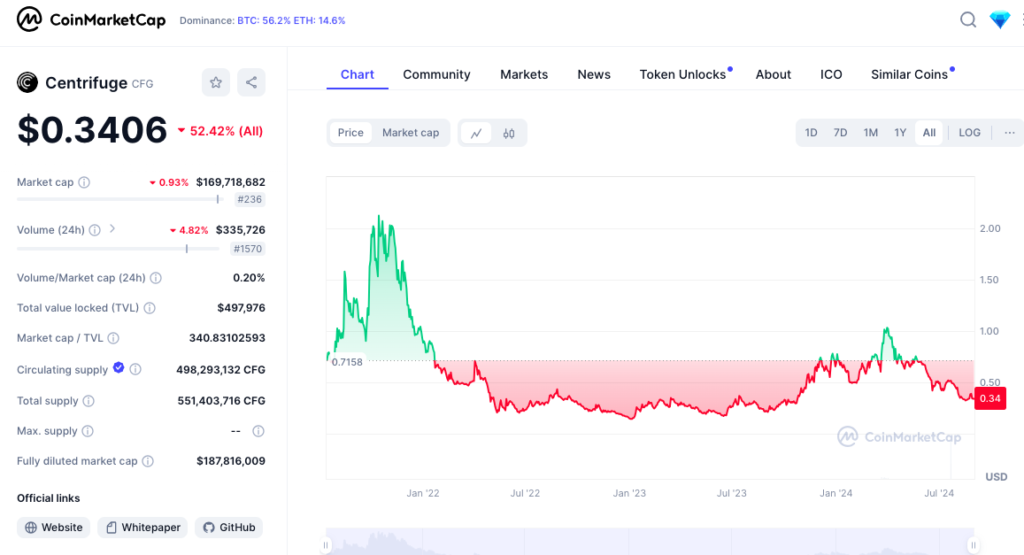

8. Centrifuge (CFG)

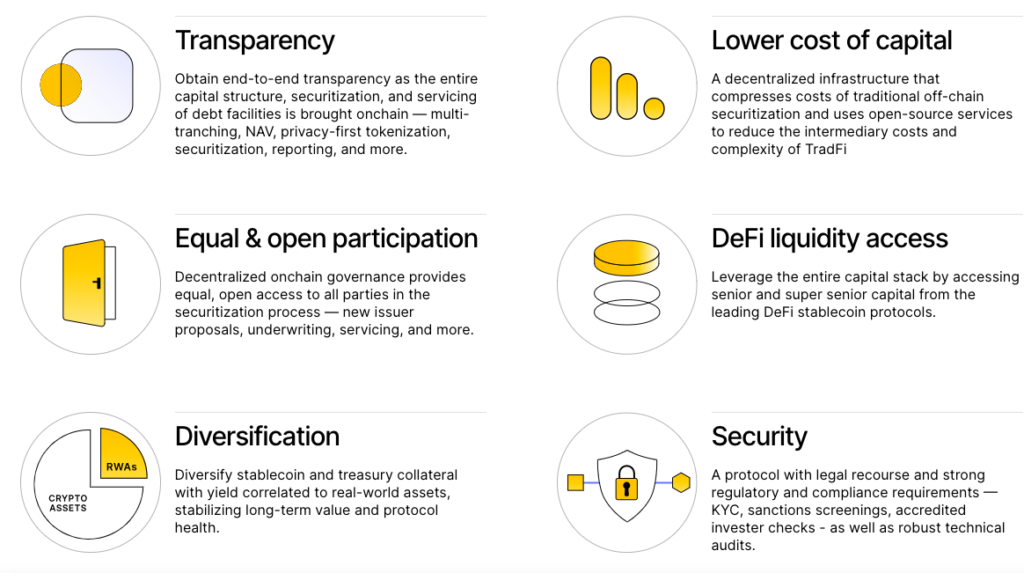

Centrifuge focuses on the tokenization of real estate assets, aiming to provide liquidity for financing commercial properties and housing. Its Tinlake protocol allows investors to provide liquidity against tokenized assets and farm yield in return, eliminating the need for traditional intermediaries like banks. This approach not only democratizes the real estate market but also reduces barriers to entry, making it a leading player in RWA tokenization.

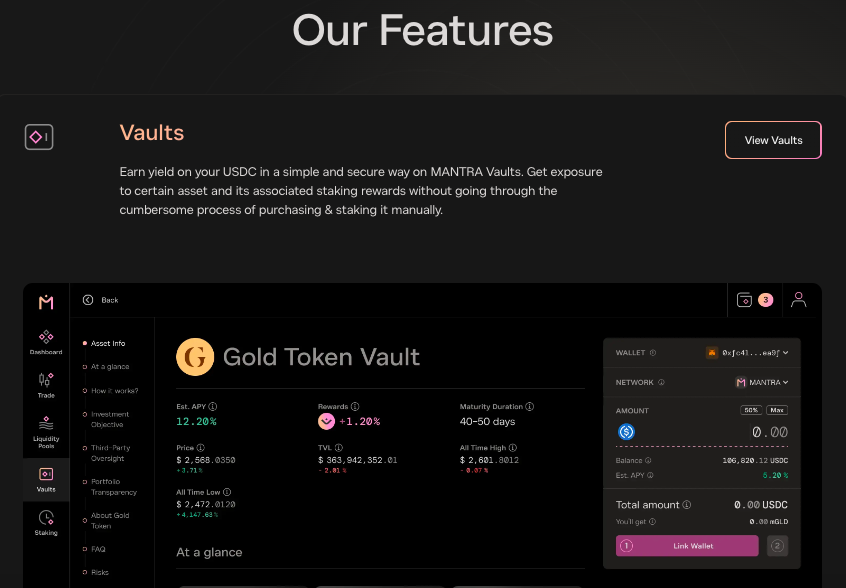

9. Mantra (OM)

Mantra leverages the Polkadot blockchain to tokenize a variety of assets, including real estate, art, and commodities, allowing users to access these markets through fractionalized tokens. The platform’s decentralized governance model ensures that community members have a say in its development, making it a dynamic and responsive participant in the RWA market. Mantra’s focus on financial inclusivity and accessibility positions it as a promising project for 2024.

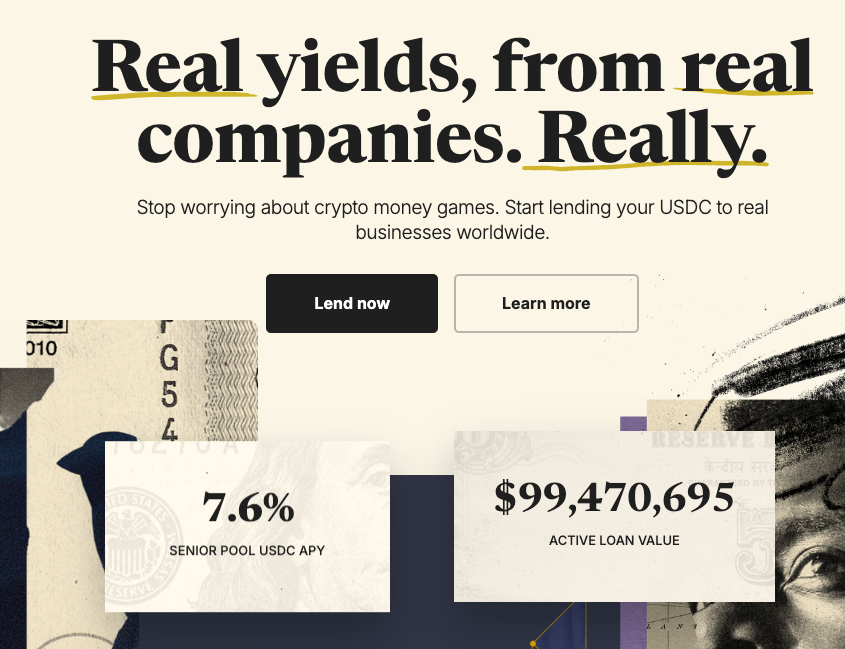

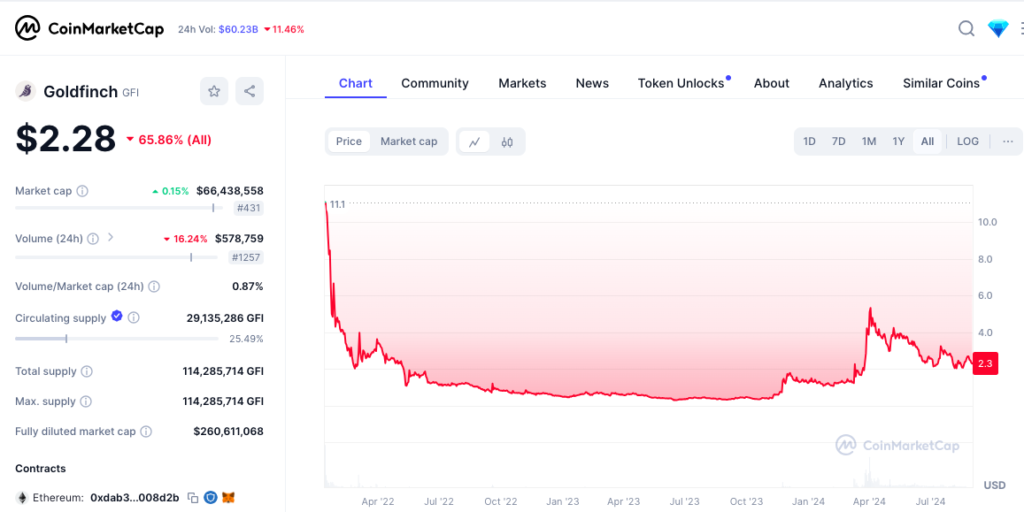

10. Goldfinch (GFI)

Goldfinch is a decentralized credit protocol that provides crypto-backed loans to real businesses, particularly in developing countries. This model fosters economic growth and financial inclusion by providing access to capital where it is most needed. Goldfinch‘s unique approach has earned it a place among the top RWA crypto projects, with significant growth potential as it expands its footprint in emerging markets.

Why RWA Tokens Matter

The tokenization of real-world assets is more than a technological innovation; it represents a fundamental shift in how value is managed, traded, and perceived. RWA tokens enable the fractional ownership of high-value assets, democratizing access to investment opportunities and enhancing liquidity for traditionally illiquid markets. By integrating blockchain technology with real-world assets, these tokens also provide unparalleled transparency and security, reducing risks associated with fraud and lack of trust.

The Future of RWA Tokens

The RWA sector is poised for significant growth as more assets become tokenized, regulatory frameworks evolve, and blockchain technology matures. The projects listed here are at the forefront of this transformation, each contributing unique solutions to bridge the gap between the physical and digital economies. As RWA tokens continue to gain traction, they offer investors a unique opportunity to diversify portfolios, gain exposure to new asset classes, and participate in the next wave of blockchain adoption.

By keeping a close eye on these top RWA projects, investors can position themselves to capitalize on the transformative potential of tokenized real-world assets. As we move further into 2024, the rise of RWA tokens will likely play a pivotal role in shaping the future of finance, offering new avenues for growth, innovation, and financial inclusion.