Top 10 Solana Must-Have Tokens in 2024

Solana has rapidly risen as a powerhouse in the blockchain space, distinguished by its lightning-fast transactions and minimal fees. The blockchain’s unique architecture enables it to process thousands of transactions per second, making it an attractive platform for developers and users alike. As Solana’s ecosystem continues to grow, decentralized finance projects on the network are gaining significant traction. These projects are not only driving innovation but also offering new opportunities for investors. Below, we dive into some of the top DeFi coins within the Solana ecosystem that are worth watching.

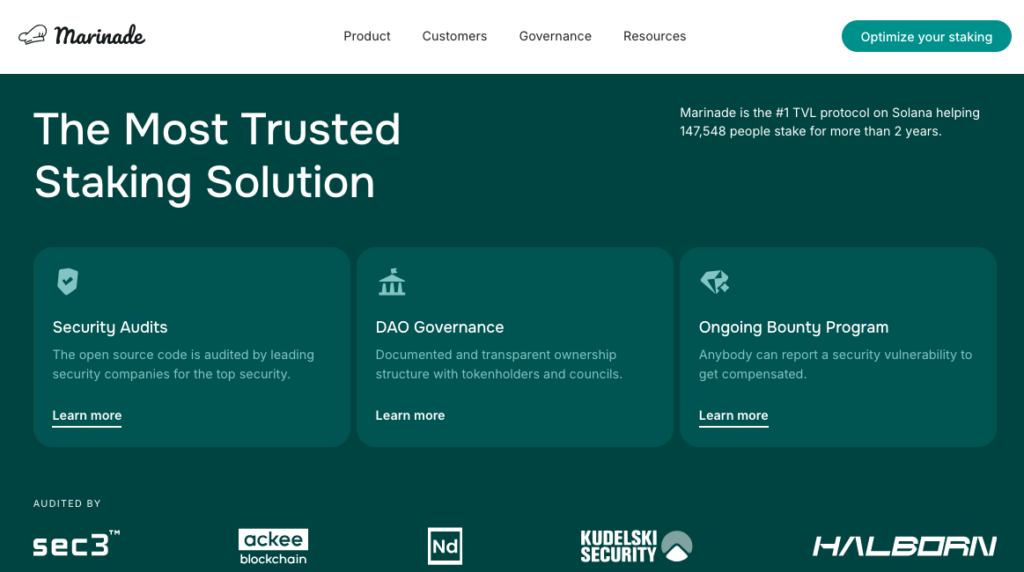

1. Marinade (MNDE)

Marinade Finance is at the forefront of liquid staking on Solana. It allows users to stake SOL and receive mSOL, a liquid representation of staked SOL that can be used across various DeFi platforms. This approach improves capital efficiency by letting users earn staking rewards while maintaining liquidity for other DeFi activities. Marinade is unique in its governance model, where MNDE token holders can vote on protocol upgrades and changes, ensuring that the community has a voice in the project’s future. As Solana grows, Marinade’s role in enhancing staking flexibility could see its native token MNDE rise in value, making it a strong candidate for investors looking to gain exposure to Solana’s DeFi market. $MNDE tokens can be traded on Gate.io and KuCoin.

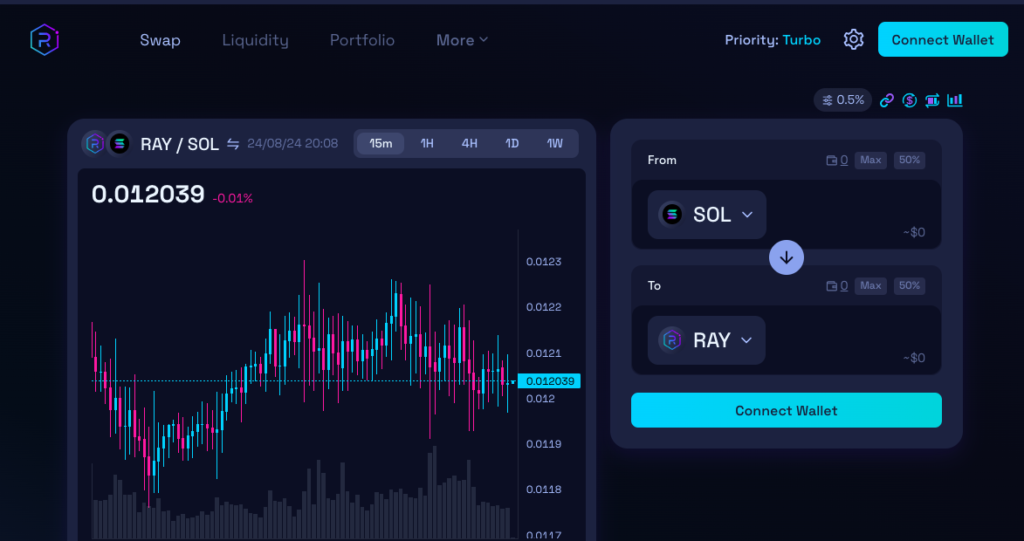

2. Raydium (RAY)

Raydium is a cornerstone of the Solana DeFi ecosystem, functioning as a decentralized exchange (DEX) and automated market maker (AMM). Raydium’s integration with Serum, another major Solana project, allows it to offer deep liquidity and fast transactions at low costs. The RAY token serves multiple purposes, including governance, staking, and providing liquidity incentives. Raydium’s seamless experience and robust infrastructure make it an essential component of the Solana ecosystem, particularly as it continues to attract more liquidity providers and traders. $RAY tokens can be traded on Binance.

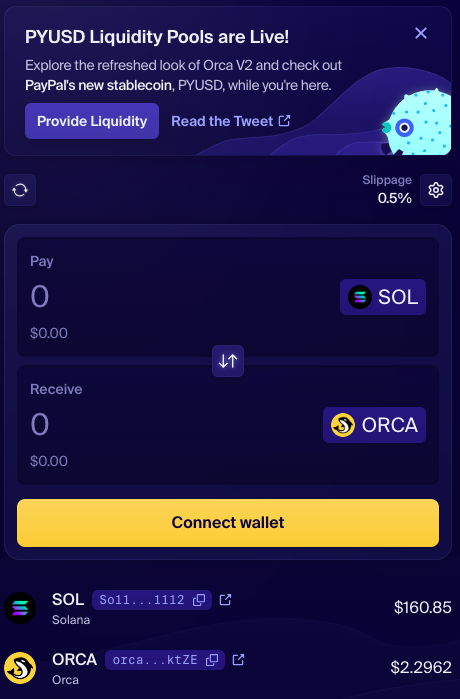

3. Orca (ORCA)

Orca stands out for its user-friendly interface, making decentralized trading on Solana accessible to both beginners and experienced traders. As a DEX, Orca emphasizes simplicity without compromising on performance. Its native token, ORCA, is used for governance, liquidity mining, and trading fee discounts. Orca’s focus on usability, combined with its efficient liquidity pools, positions it as a key player in onboarding new users to the Solana DeFi space. The platform’s ability to offer competitive yields and low slippage swaps makes it a valuable tool for maximizing returns on Solana. $ORCA cn be traded on Coinbase, Kucoin and Gate.io.

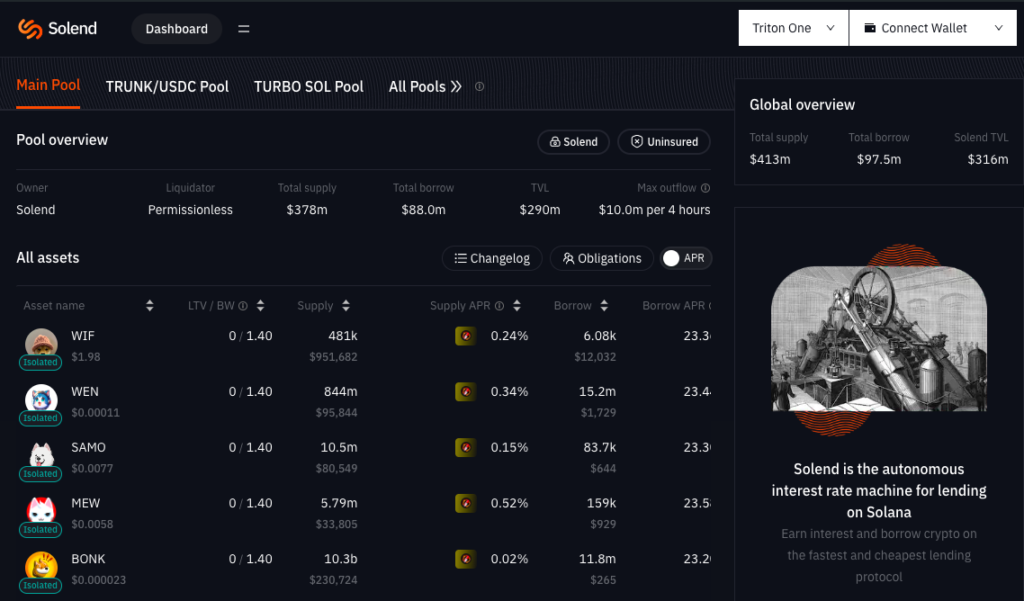

4. Solend (SLND)

Solend is Solana’s leading decentralized lending and borrowing protocol. It allows users to deposit assets to earn interest or borrow against their collateral. Solend’s SLND token plays a crucial role in governance, giving holders the power to vote on key decisions. Additionally, Solend’s integration with Marinade Finance enhances its appeal by allowing users to leverage their mSOL tokens for lending and borrowing, thereby increasing capital efficiency. With its focus on low fees and fast transactions, Solend is poised to attract a growing user base as DeFi adoption on Solana accelerates. You can trade $SLND on Gate.io.

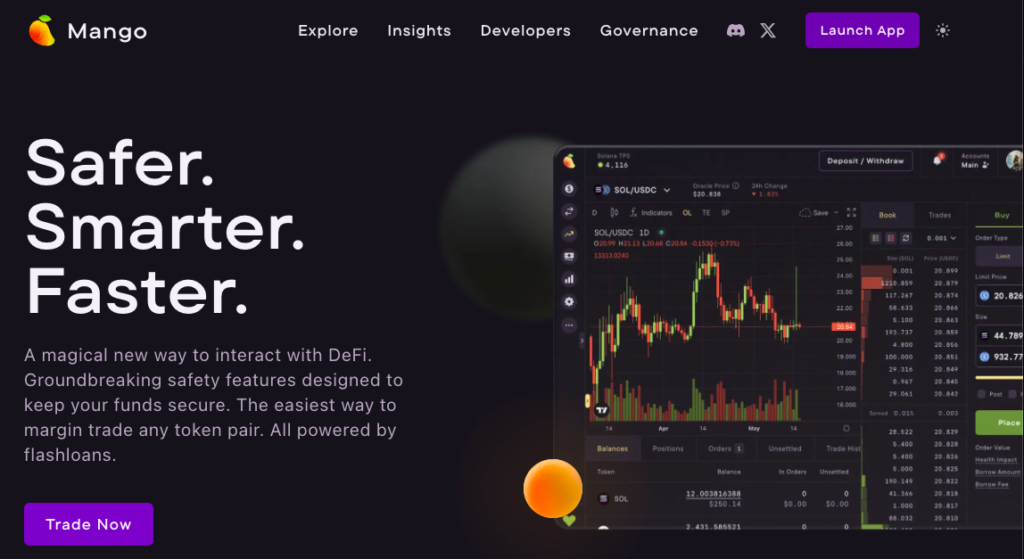

5. Mango Markets (MNGO)

Mango Markets is a decentralized trading platform on Solana offering advanced trading features, including cross-margin trading, perpetual futures, and lending. The MNGO token is integral to the platform, offering governance rights and liquidity incentives. Mango Markets differentiates itself by blending the best of centralized finance (CeFi) and DeFi, providing a hybrid trading experience that caters to both market makers and takers. As DeFi continues to mature, Mango’s comprehensive suite of trading tools positions it as a go-to platform for sophisticated traders on Solana. $MNGO tokens can be traded on Gate.io and Kraken.

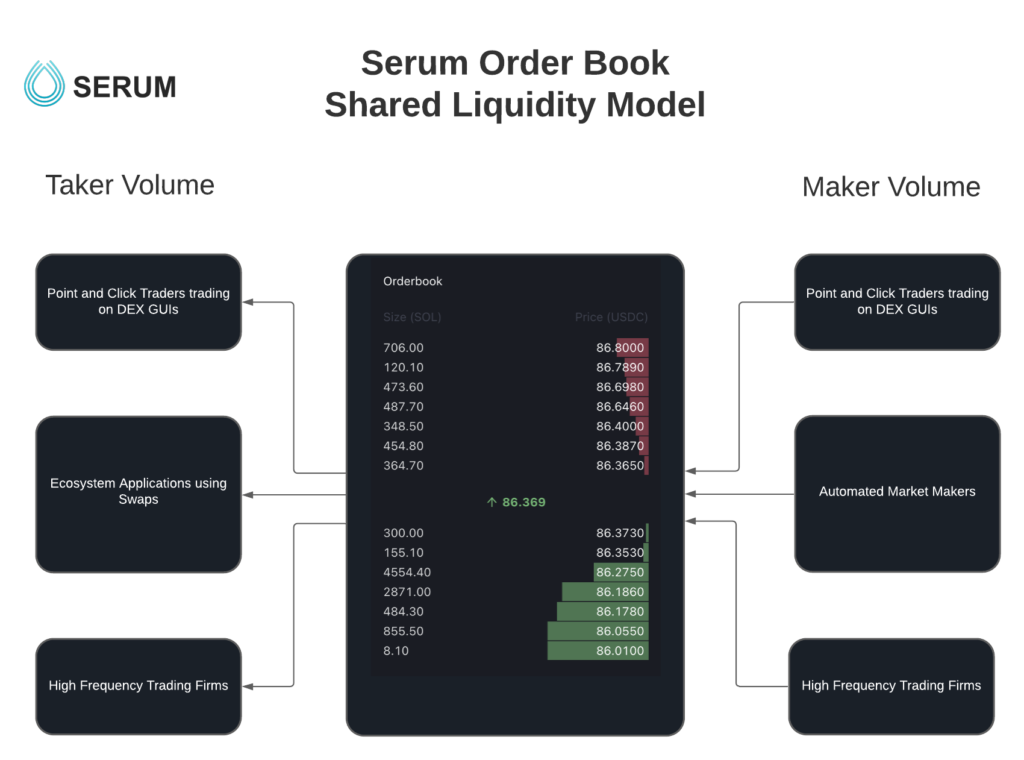

6. Serum (SRM)

Serum is a decentralized exchange and liquidity infrastructure platform that utilizes Solana’s high-speed network to provide a seamless trading experience. Unlike many DEXs, Serum uses an on-chain order book model, which allows for more precise price discovery and efficient trading. The SRM token offers reduced trading fees, staking rewards, and governance rights, making it an essential asset for active traders within the Solana ecosystem. Serum’s ability to facilitate cross-chain trading and its role as a foundational layer for other Solana-based applications make it a cornerstone of the DeFi landscape. You can trade $SRM on Bybit, Gate.io and Kraken.

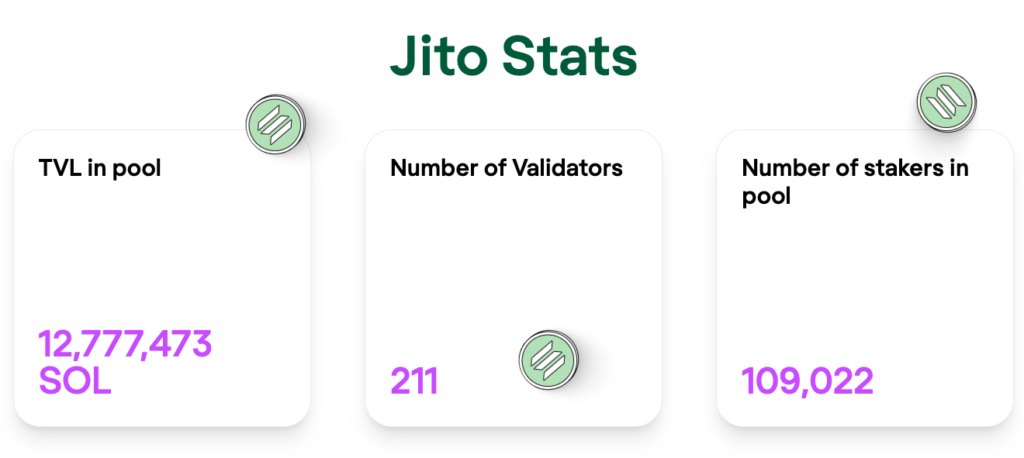

7. Jito (JITO)

Jito is a Solana-based protocol focused on maximizing validator rewards while minimizing the risks associated with Maximum Extractable Value (MEV) exploitation. Jito’s innovative approach to trading ensures that transactions are executed with minimal slippage, making it an attractive option for traders seeking to optimize their returns. The JITO token is used to incentivize participants and support the network’s security. As MEV becomes a more prominent issue in DeFi, Jito’s solutions could become increasingly valuable, particularly for high-frequency traders. You can trade $JITO on Binance, Bybit and OKX.

8. Drift Protocol (DRIFT)

Drift Protocol is a decentralized derivatives trading platform on Solana that offers perpetual swaps with high leverage. Drift’s dynamic AMM model adjusts the trading pool based on market conditions, minimizing price slippage and enhancing the trading experience. The DRIFT token plays a vital role in the platform, providing fee reductions, governance rights, and staking opportunities. Drift’s focus on advanced trading instruments and its ability to cater to professional traders make it a standout project in Solana’s DeFi ecosystem. You can trade $DRIFT on Bybit, Gate.io and MEXC.

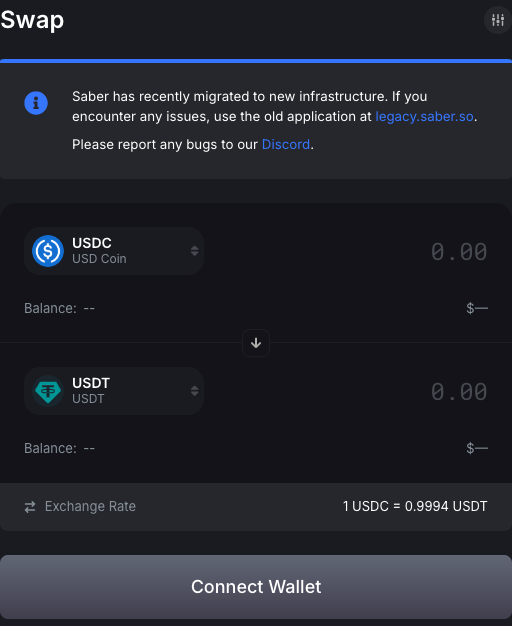

9. Saber (SBR)

Saber is an AMM protocol specializing in stablecoin and wrapped asset swaps on Solana. By focusing on low-volatility assets, Saber provides a stable and reliable platform for users looking to minimize risk while earning passive income through liquidity provision. The SBR token offers governance rights and incentivizes users to participate in the platform. As the demand for stablecoins continues to grow in DeFi, Saber’s role in maintaining liquidity and stability within the ecosystem will likely expand, making SBR a potentially valuable asset. You can trade $SBR on Gate.io and MEXC.

10. Tulip Protocol (TULIP)

Tulip Protocol is Solana’s first yield aggregation platform, designed to optimize yield farming strategies and maximize returns for users. Tulip’s automated strategies leverage Solana’s high-speed network to execute transactions quickly and efficiently, ensuring that users can capitalize on the best opportunities in the market. The TULIP token provides governance rights and other rewards, making it an essential part of the protocol’s ecosystem. As yield farming remains a popular DeFi activity, Tulip’s innovative approach to optimizing returns positions it as a leader in the space. You can trade $TULIP on Gate.io and Jupiter Exchange.

Conclusion

Solana’s DeFi ecosystem is rich with opportunities, driven by projects that are pushing the boundaries of what’s possible in decentralized finance. From liquid staking to advanced derivatives trading, these top DeFi coins represent the future of finance on Solana.

As the blockchain continues to evolve, these projects are well-positioned to benefit from increased adoption and growing institutional interest. For investors looking to tap into the potential of DeFi on Solana, these coins offer a compelling starting point.