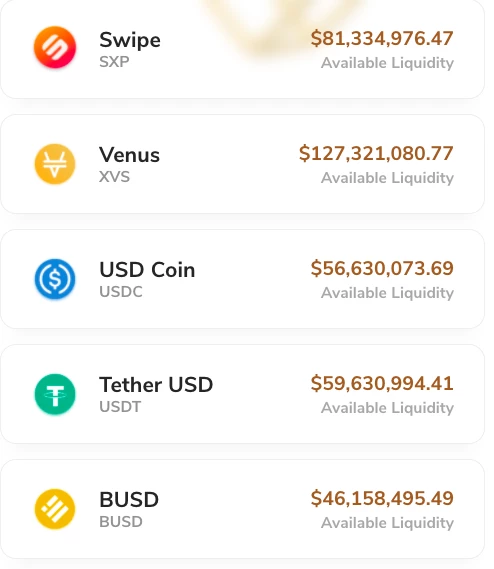

Venus is described as decentralised marketplace for lenders and borrowers. It is additionally also recognised as a money market & synthetic stablecoin protocol. According to the Whitepaper, Venus is aimed at enabling the decentralised stablecoin, VAI, which is built on the Binance Smart Chain and backed by a basket of stablecoins and crypto assets.

Source: https://venus.io/

Venus is essentially an algorithmic-based money market system which is designed to provide users with a holistic decentralised finance-based lending and credit system utilising the Binance Smart Chain for fast, low-cost transactions and to gain access to a deep network of wrapped tokens and liquidity.

Users of Venus are able to utilise their crypto assets by simply supplying collateral to the network that may be borrowed by pledging over-collateralised digital currencies. This is supposed to facilitate a secure lending environment where a lender would receive a compounded interest rate annually (APY) paid per block, while the borrower would pay interest on the crypto assets that are borrowed.

The interest rates are set by the protocol in a curve yield, where the rates are automated on the basis of the demand in a particular market, for instance Bitcoin. The notable competitive advantage that Venus has over other money market protocols is that Venus enables the use of collateral supplied to the market, for borrowing other assets as well as for minting synthetic stablecoins with over-collateralised positions that protect the protocol. A basket of cryptocurrencies backs the synthetic stablecoins and not fiat currencies. You can trade XVS on exchanges such as Binance, Bitrue, CoinW.

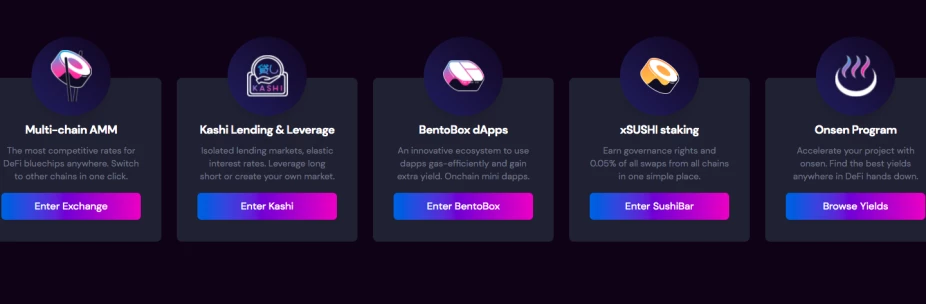

The Sushi ecosystem consists of the popular SushiSwap automated market maker. The exchange is designed to allow token holders to trade up to 100 ERC-20 tokens. It uses a similar model to other decentralised exchanges like Uniswap, where users are not required to provide identity verification in order to use the swap exchange. All a user is required to have is a Web 3.0 wallet and Ether to pay fees for the swap. Exchange commissions per trade on SushiSwap is about 0.3% when a user joins a liquidity pool. About 90% of the fee is disbursed as profits to liquidity providers. Other small transaction fees may be applicable when a user approves a new token’s pool.

Source: https://sushi.com/

The ecosystem also includes liquidity pools. SushiSwap typically offers bonuses to investors who are able to provide capital to boost the liquidity pool that they participate in and an ERC-20 token is given to them as reward for the liquidity they provide. Like many other decentralized protocols, SushiSwap consists of a range of liquidity pools.

Another component is the farms and users don’t need to be liquidity providers to earn rewards. SushiBar allows users to maximize yield by staking SUSHI tokens for xSUSHI. About 0.05% of the fees from swaps made on the exchange are distributed as SUSHI in proportion to a user’s share of the SushiBar. When a user has their SUSHI tokens staked into the SushiBar, they receive xSUSHI in return which they can use for voting rights and they also have a fully composable token which is able to interact with other protocols. A user’s xSUSHI will continue to compound and when the user decides to unstake they will receive the SUSHI tokens that they originally deposited and the tokens earned from fees. You can trade SUSHI on exchanges Binance, Coinbase, and KuCoin.

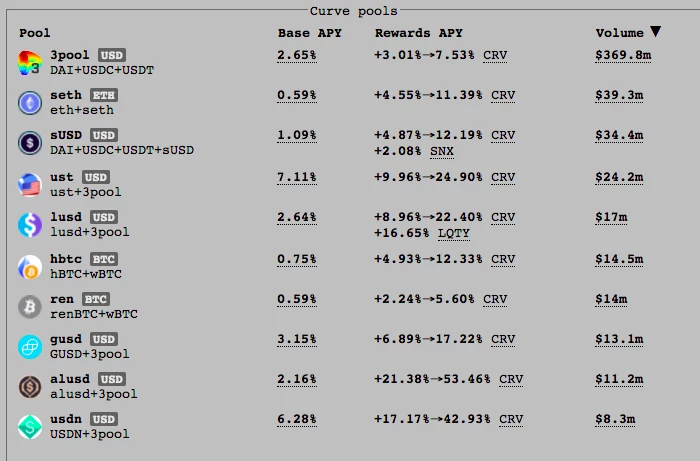

Curve is another automated market maker and essentially a non-custodial exchange focused on enabling users and other decentralised protocols to exchange stablecoins such as DAI to USDC through it with low fees and low slippage. What makes Curve unique is that unlike other exchanges that match a buyer and a seller, it uses liquidity pools such as Uniswap. For this to be possible, Curve requires liquidity and as such it rewards tokens to those liquidity providers.

Source: https://curve.fi/

On centralised exchanges, a tug of war between buyers and sellers generally determines the price of an asset. On a decentralised exchange such as Curve, the ratio between two assets in a given pool is what determines the price. Essentially, a DEX like Curve Finance is made up of a series of pools, where each pool contains 2 types of crypto assets. Let’s demonstrate:

Let’s say there’s a pool containing 10 ETH and 1000 USDC. Each ETH is worth $100 (1000 divided by 10). Now let’s say some entity decides to purchase 1 ETH from the pool for $100. This would imply that the price of ETH would then be $111 for the next person who comes in to buy. This structure incentives traders to go to a different exchange and purchase ETH for the actual market price previously established as $100 and in turn sell it for a profit on a DEX by adding 1 ETH to the pool. This is meant to restore the ratio between the assets and bring the price of ETH back to what it should be i.e. $100. The more crypto assets made available in a pool, the less the price volatility when someone decides to purchase or sell a crypto asset that is in the pool.

In order to maintain decent sized pools and keep prices within a favourable range, Curve and other DEXs typically incentivise users by making it possible for them to deposit crypto assets into such pools. Curve offers interest rate rewards to users who deposit funds into the pools from trading fees made on the platform. The more popular the pool, the higher the interest rates provided to those users lending their assets. Lenders are also able to withdraw their crypto assets along with the interest earned without any penalties and they can do so freely at any time.

Curve predominantly deals with stablecoins and ‘lends’ its pools to DeFi lending platforms like Compound Finance. This also means that users who deposit their stablecoins into a pool on Curve and if that pool is being ‘lent’ to Compound they will earn interest from Compound, as well as the trading fees on the Curve Finance platform. This can provide participants with attractively high interest rates on deposited funds depending on the market conditions. You can trade $CRV tokens on exchanges such as Binance, Coinbase, KuCoin, OKX, Bittrex, Huobi, and Bybit.