Top 5 Cosmos Ecosystem Crypto Coins

1) Terra (LUNA)

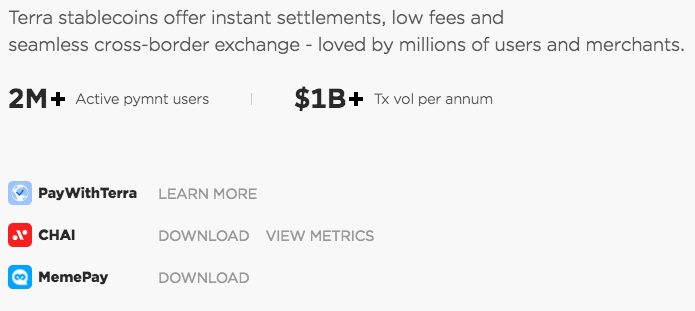

A blockchain protocol that runs on a Proof of Stake (PoS) blockchain and which utilises fiat-pegged stablecoins in order to manifest a price-stable payment system that is truly global, Terra brings together price stability while providing the censorship-resistance features similar to decentralised digital currencies such as Bitcoin. Terra in fact offers faster and more affordable settlements. The stablecoins on Terra are pegged to the International Monetary Fund’s Special Drawing Rights basket of currencies, the US dollar, the South Korean Won, and the Mongolian tugrik.

LUNA is the native token of the Terra blockchain and its use case covers the stabilization of prices of the protocol’s stablecoins. Holders of LUNA tokens are also able to vote on governance proposals.

A decentralized financial payment network, Terra is meant to reconstruct the conventional payment stack on the blockchain by utilizing a basket of fiat-pegged stablecoins that are algorithmically stabilized by the LUNA reserve currency in order to facilitate open financial infrastructure development and programmable payments. LUNA tokens can be traded on exchanges such as KuCoin and Huobi.

2) Cosmos (ATOM)

Cosmos was launched back in 2014, when a core contributor the network ‘Tendermint’ was founded. The whitepaper was released in 2016 and the token sale was launched in 2017. ATOM tokens help secure the Cosmos Hub which is the blockchain for the project.

Cosmos is interoperable with other applications and cryptocurrencies and it consists of many independent, parallel blockchains, called zones, that are each powered by classical Byzantine fault-tolerant (BFT) consensus protocols like Tendermint. The Cosmos network’s architecture is a more general application of the Bitcoin sidechains concept that instead of using Proof-of-Work, it uses classic BFT and Proof-of-Stake algorithms.

Cosmos Hub is a multi-asset distributed ledger whose native token is ATOM. There are 3 main use cases for ATOM tokens, mainly:

- Spam prevention mechanism

- Staking benefits

- Voting rights on proposals

Similar to Ethereum’s concept of ‘gas’, ATOMS can also be used for paying fees and these fees may be proportional to the amount of computation required by the transaction.

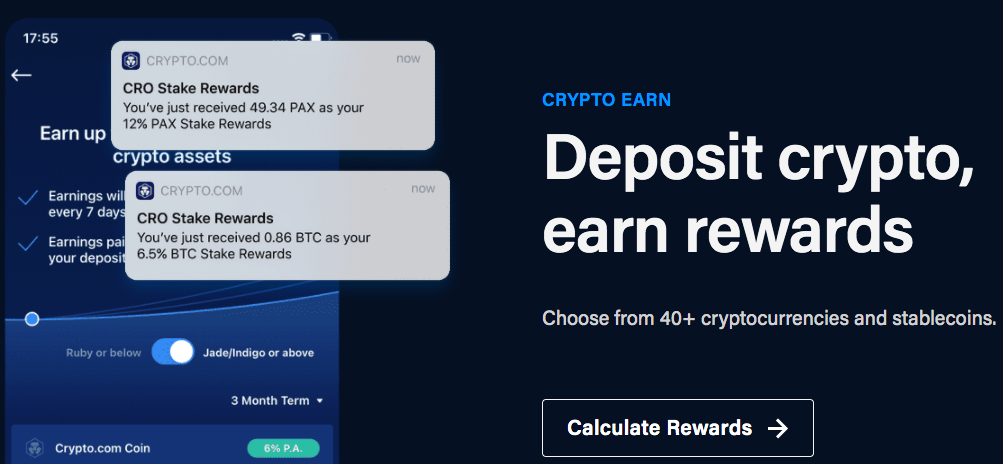

3) Crypto.com

Dubbed an all-in-one digital currency marketplace for users, Crypto.com offers products and services that include its crypto exchange offering, debit cards and a wallet service for digital asset custody, a brokerage service, and even lending and borrowing products that are mostly associated with decentralised finance.

The token which powers the Crypto.com platform is the CRO coin which has three main use cases and they are:

- CRO is used for reduced trading fees on the Crypto.com exchange

- CRO can be used for paying for products and services within the Crypto.com ecosystem and potentially beyond

- CRO holders receive higher yields on lending products

- CRO card holders also receive some benefits and rewards

- CRO holders act as validators to earn for transaction processing by simply staking their digital assets on the Crypto.com Chain.

CRO coins can be traded on exchanges such as FTX, Bittrex, OKEx, Huobi, and KuCoin.

Built on top of the Ethereum blockchain, CRO coin is an ERC-20 token standard.

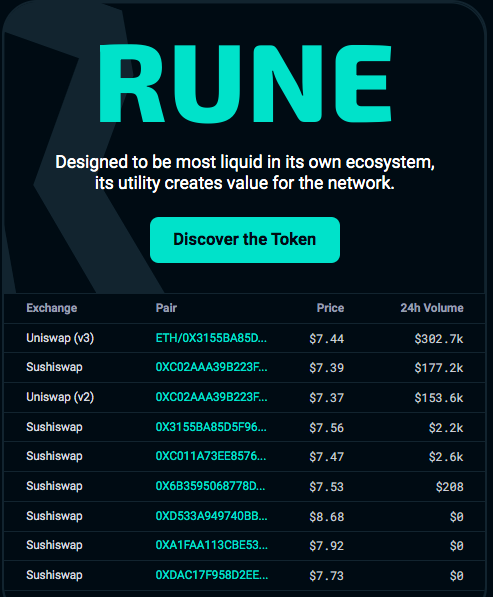

4) THORChain (RUNE)

Initially launched following an IEO on the Binance DEX, the chain-agnostic, decentralized liquidity network, THORChain is an interoperable blockchain that makes cross-chain atomic token swaps possible and is made possible in a non-custodial manner reducing counterparty risks. For instance, without registration or KYC traders on ThorChain have the ability to seamlessly move from Polkadot to Bitcoin or Ethereum etc.

THORChain is built on Tendermint and uses proof-of-stake consensus. Network validators need to bond RUNE, which is THORChain’s native token. THORChain does not peg or wrap assets, it in fact enables users to swap tokens across various Layer 1 blockchains. ThorChain works on Cosmos, Polkadot, Solana, and even Monero. Funds like Multicoin Capital have disclosed investing in RUNE.

RUNE tokens have utility in several ways including:

- In liquidity pools

- Nodes bonding RUNE as collateral

- As a settlement asset thereby providing liquidity

- For security and governance

- Incentives

RUNE tokens are currently available on multiple blockchains, including Binance Chain (as a BEP-2 token) and Ethereum (as an ERC-20 token). RUNE tokens can be purchased or traded on HitBTC, Binance, FTX and many others.

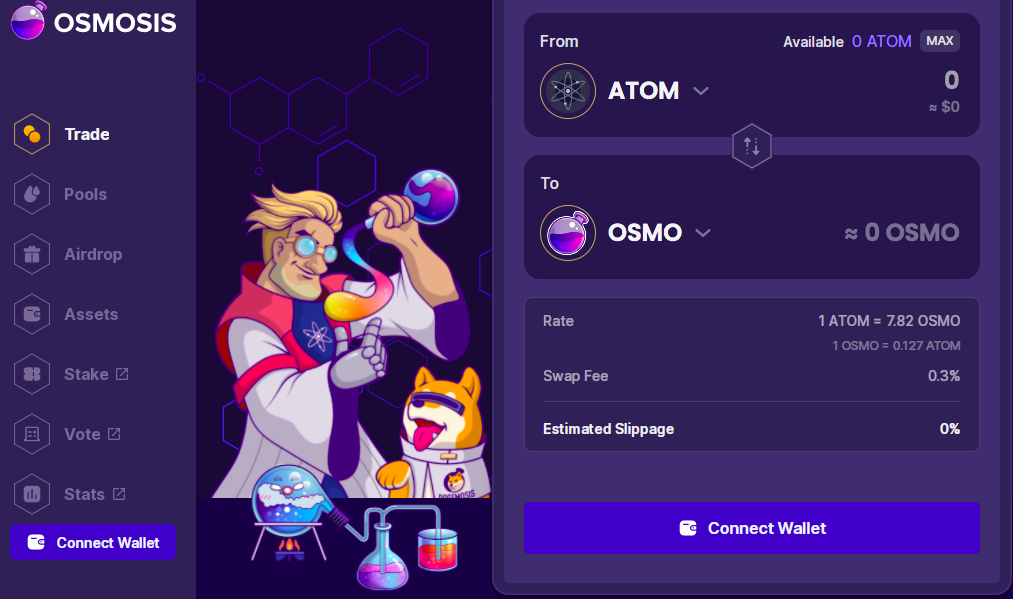

5) Osmosis (OSMO)

OSMO is the governance token ticker for Osmosis Hub’s main digital currency. Osmosis is an automated market maker protocol that is built for liquidity providers.

OSMO’s token distribution serves a dual purpose of acting as a protocol-level liquidity mining incentive, and as a way to reward liquidity providers to the system. It means that participants get an ownership stake in the protocol which they even then go on to use to help steer the project development in the right direction.