Top 5 DeFi Altcoins to Watch in 2025

As we look toward 2025, several DeFi altcoins are emerging as strong contenders for explosive growth and utility within the blockchain ecosystem. Below is an in-depth analysis of the top five DeFi altcoins to watch in 2025, complete with insights into their tokenomics and unique value propositions.

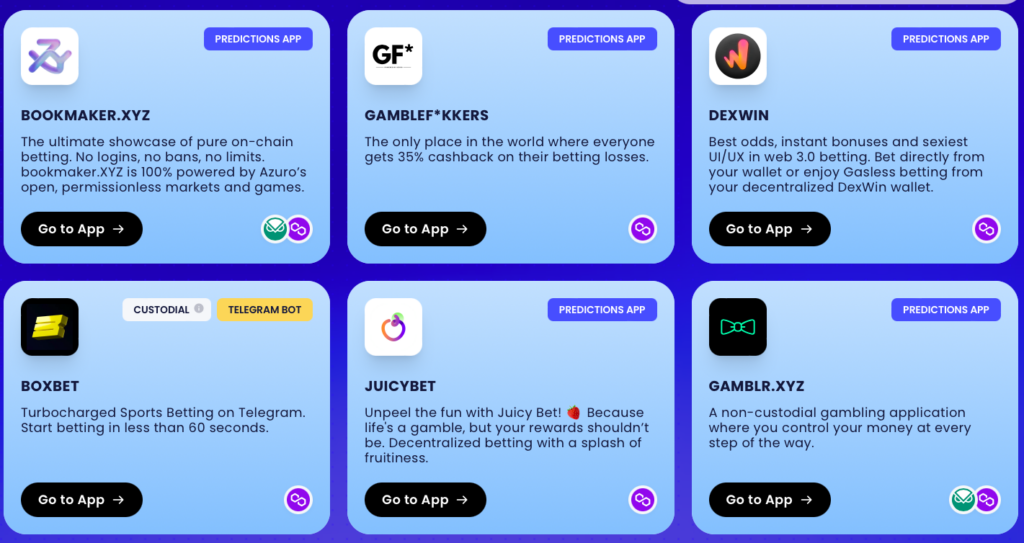

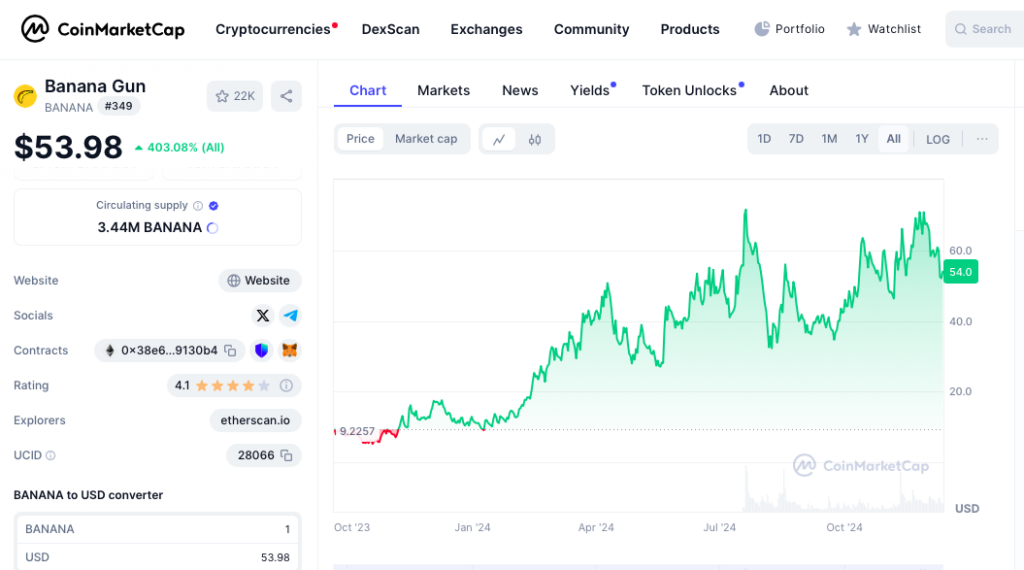

1. Azuro Protocol ($AZUR)

Ticker: AZUR

Token Standard: ERC-20

DEX: Uniswap V3 (Pair: AZUR/ETH)

Azuro Protocol is transforming the decentralized betting industry by creating a composable and fair ecosystem. The project focuses on building a robust infrastructure for prediction markets and betting dApps.

Tokenomics:

- Total Supply: 1 billion AZUR

- Initial Circulating Supply: 152 million

- Ecosystem Incentives: 37.5% of the total supply, distributed through initiatives like Azuro Waves and DEX liquidity incentives.

- DAO Treasury: Supports liquidity and ecosystem growth with a 6-month lock-up followed by linear vesting over 30 months.

Why Watch:

Azuro’s focus on transparency and portability within the betting ecosystem positions it as a leader in its niche. The protocol’s governance via a DAO ensures community-driven development, a critical factor in DeFi sustainability. You can trade $AZUR on MEXC and Gate.io.

2. Handle.Fi ($FOREX)

Ticker: FOREX

Token Standard: ERC-20

DEX: Balancer

Handle.Fi is revolutionizing stablecoin finance by introducing a decentralized protocol for forex trading and stablecoin issuance. $FOREX is at the center of this ecosystem, incentivizing liquidity and governance participation.

Tokenomics:

- Total Supply: 420 million FOREX

- Governance Utility: Users lock FOREX in Balancer pools to receive veFOREX, enabling governance participation and boosted rewards.

- Protocol Rewards: 41.1% allocated for vault collateral stakers, fxToken liquidity providers, and governance stakers.

Why Watch:

Handle.Fi combines innovative tokenomics with practical use cases for stablecoin enthusiasts. Its efficient reward mechanisms and governance incentives make it a strong contender in DeFi forex solutions.

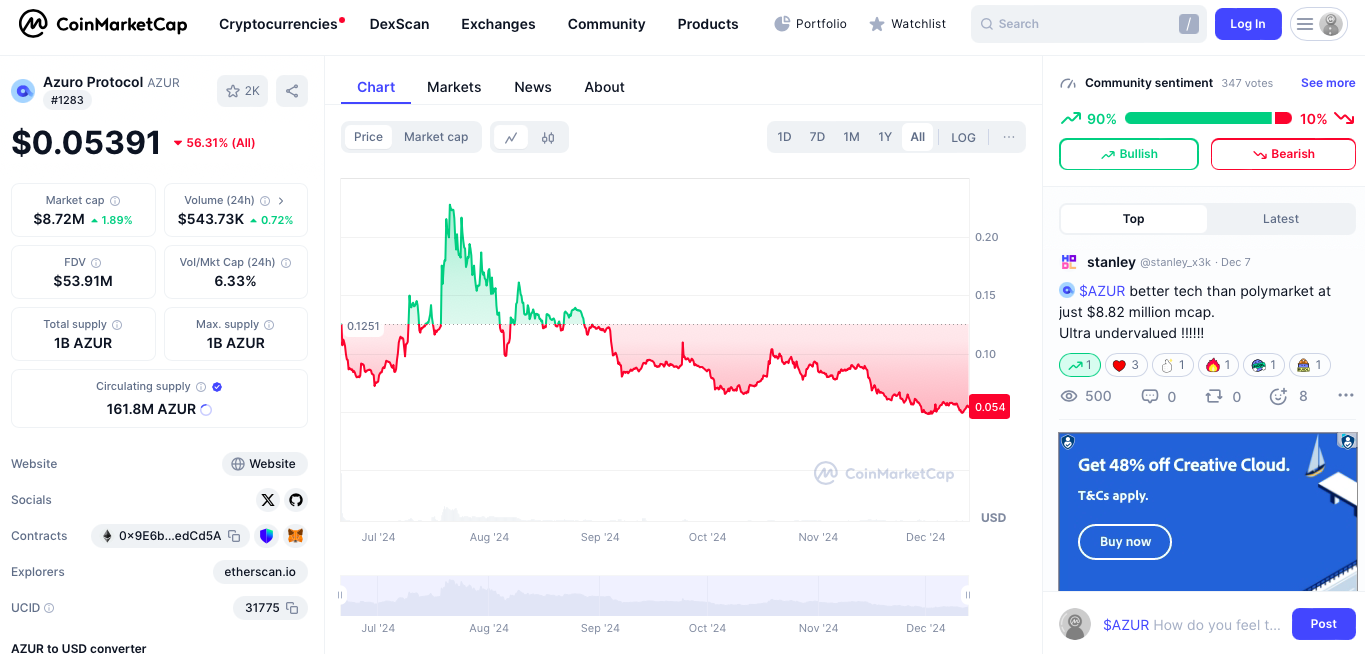

3. Railgun ($RAIL)

Ticker: RAIL

Token Standard: ERC-20

DEX: Uniswap | SushiSwap

Railgun provides on-chain privacy for DeFi users, enabling private trading and lending on platforms like Uniswap and Aave. Its focus on user anonymity has garnered widespread attention.

Tokenomics:

- Maximum Supply: 100 million RAIL on Ethereum

- Circulating Supply: Determined by active stakers and governance participants.

- Rewards: Active governors receive portions of treasury funds distributed every two weeks, along with staking incentives.

Why Watch:

As privacy becomes a more pressing concern in the DeFi space, Railgun’s privacy-enhancing technology and governance model stand out as critical components for long-term success.

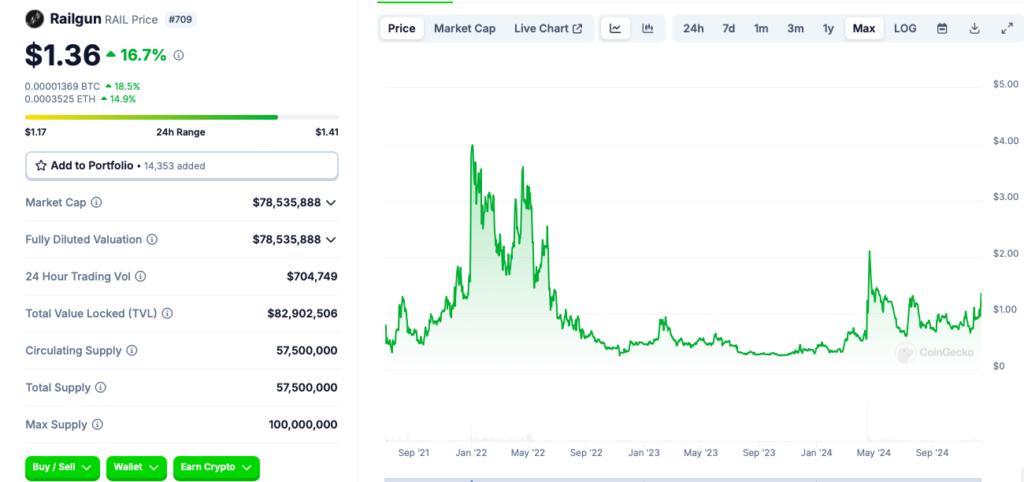

4. BananaGun ($BANANA)

Ticker: BANANA

Token Standard: ERC-20

DEX: Uniswap

BananaGun is redefining the DeFi ecosystem with its revenue-sharing tokenomics and trading bot integration. The project is designed to create a sustainable feedback loop between bot users and token holders.

Tokenomics:

- Circulating Supply: 3.2 million BANANA

- Treasury Allocation: 45% locked for emissions and operations, released linearly over 24 months.

- Rewards: Token holders earn bot revenue share (40%) and receive bonuses through bot trading activity.

Why Watch:

BananaGun’s innovative approach to combining DeFi with automated trading mechanisms makes it a standout in its category. The no-inflation reward structure ensures sustainability for long-term growth.

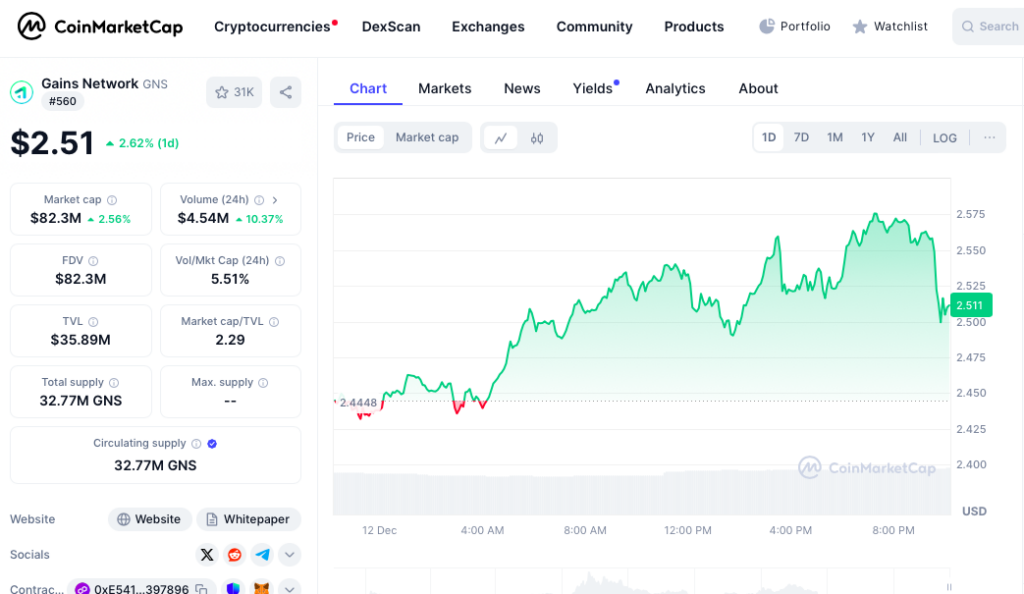

5. Gains Network ($GNS)

Ticker: GNS

Token Standard: ERC-20

DEX: Uniswap | Polygon

Gains Network powers gTrade, a decentralized leveraged trading platform. With features like high liquidity efficiency and oracle-based pricing, it offers a seamless trading experience.

Tokenomics:

- Supply Cap: 100 million GNS

- Deflationary Mechanism: Over 10% of the supply has been burnt through organic deflation.

- Ecosystem Utility: Supports liquidity for gToken vaults and incentivizes governance participation.

Why Watch:

Gains Network’s ability to deliver high-performance trading with decentralized liquidity solutions positions it as a leader in the DeFi trading niche. Its innovative use of oracles and vaults ensures efficiency and scalability.

Where to Buy These Altcoins

To trade these altcoins securely and seamlessly, consider using reputable decentralized exchanges (DEXs) like gTrade, Uniswap or Balancer. For centralized options, platforms like Binance, OKX, or MEXC are great starting points.