Top 5 Fantom Ecosystem Tokens

Fantom (FTM)

Fantom is based on directed acyclic graphs (DAG) which are composed of vertices and edges and unlike a blockchain, there are no blocks and transactions are generally recorded as vertices on top of one another. Nodes submit the transactions to the DAG similarly to blockchains that complete a Proof-of-Work task in order to submit a transaction. In Fantom’s case, validator nodes form a trustless Proof-of-Stake network.

In the same way that blocks on a blockchain contain references to previous blocks, every new transaction on a DAG references previous transactions in order to be accepted onto the network.

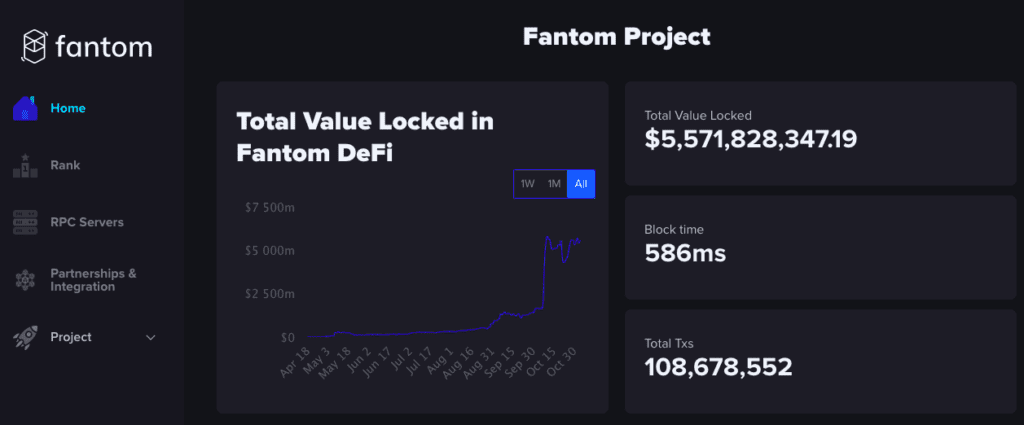

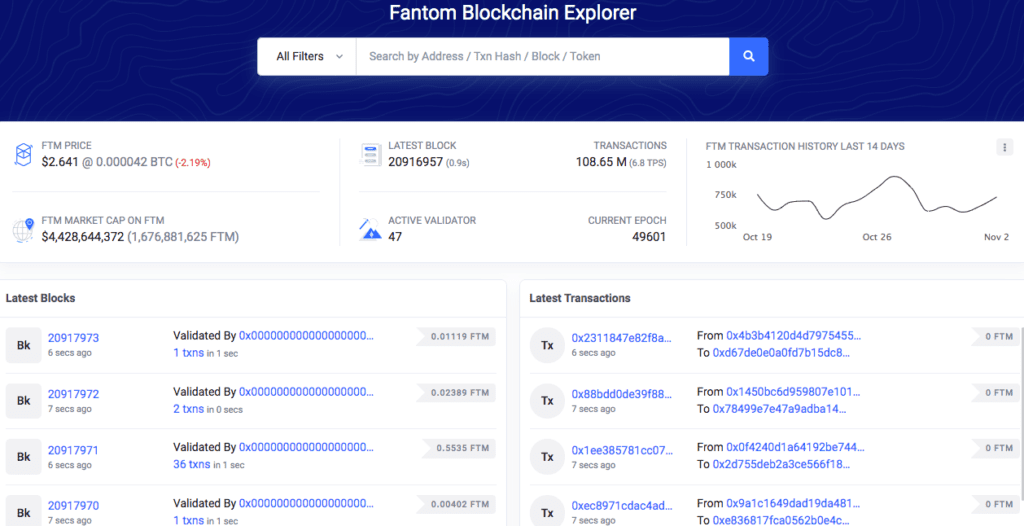

Fantom is effectively a DAG based Smart Contract platform that aims to solve problems of scalability that plague other existing public distributed ledger technologies. Fantom maintains consensus by adopting a new protocol known as the Lachesis Protocol which is integrated into the Fantom Opera Chain to enable applications to be built on the chain. Fantom has a long-term vision of providing compatibility and creating an ecosystem that makes real-time transactions and low-cost data sharing possible. Fantom has its own block explorer which was created by the Etherscan team and is called FTMScan.

As a high-throughput, fast, open-source smart contract platform for decentralised applications and other digital assets, Fantom’s aBFT consensus protocol is meant to be reliable and deliver speed and security. There are already more than 80 DApps deployed on Fantom and even Ethereum DApps can be deployed and run on Fantom since Fantom is Ethereum Virtual Machine (EVM) compatible. Fantom has a 370m FTM Incentive Program to incentivise developers to continue to build on Fantom.

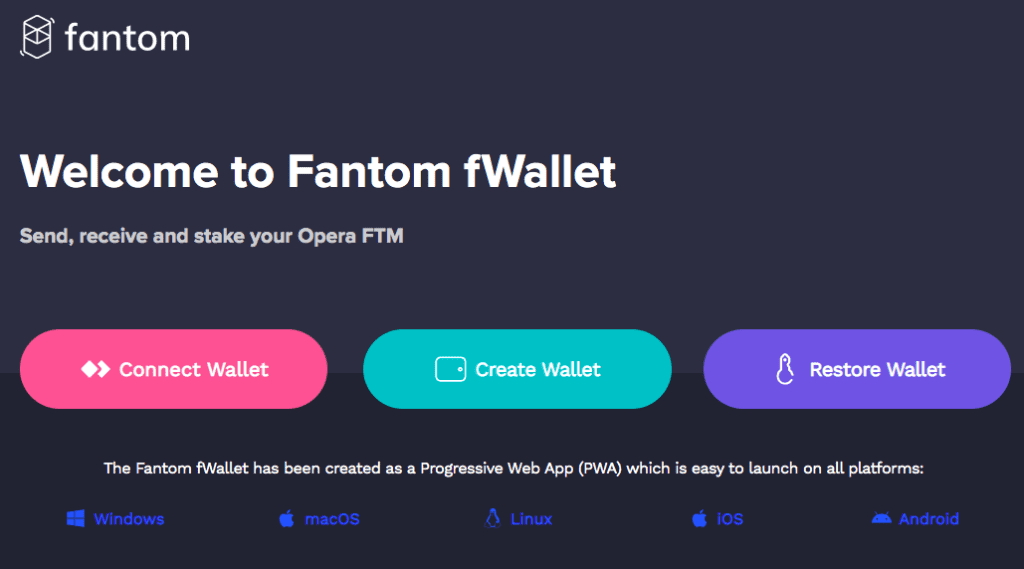

On Fantom, thousands of transactions can be processed in a matter of seconds and cost as little as fractions of cents. FTM is Fantom’s in-house PoS token which enables user rewards, fee collection and staking activities. Users can use the Fantom fWallet to send, receive, and stake their Opera FTM on desktop, mobile and hardware wallets.

FTM tokens can be traded on exchanges such as OKEx, KuCoin, FTX, and Binance.

Popsicle Finance (ICE)

A multichain yield optimization platform for Liquidity Providers, Popsicle.Finance has the vision to become a fully decentralized platform that is managed by its users or holders holders of the ICE governance token which is used to vote on key operational aspects of the protocol including proposals for protocol updates, pool inclusions, and fee management.

ICE tokens can be traded on exchanges such as Bitfinex and PancakeSwap, among others.

SpookySwap (BOO)

SpookySwap (BOO) is the governance token for the SpookySwap automated market-making decentralized exchange on the Fantom Opera network for leveraging diversified funds across ecosystems. SpookySwap offers a user-centric service with diverse farms, a built-in bridge, and built-in limit orders. It offers a staking, a swap service, supports liquidity pools and yield farming and even has its own generative NFTs called Magicats.

Stakers of BOO receive xBOO tokens as receipt representing their share of the pool. The pool automatically compounds and by using a portion of all trade fees to buy back BOO, it means that the xBOO to BOO ratio is supposed to grow over time. As a liquidity provider, you will earn fees according to your share in the pool, and your xBOO receipt will be required as proof when claiming the rewards.

SpookySwap (BOO) can be traded on CEX, SpookySwap, Hotbit, ZT, etc. SpookySwap claims to maintain the lowest swap fee of 0.2% (0.22% for limit orders). SpokySwap supports Coinbase wallet has been fully audited by Certik and has made a bridge for Fantom crossing to and from Ethereum, Binance Smart Chain, Polygon, Avalanche, and Arbitrum.

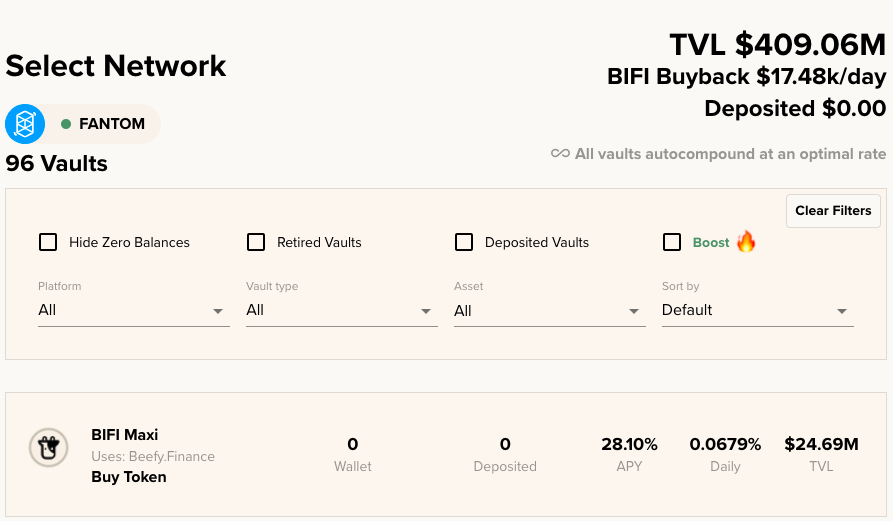

Beefy Finance (BIFI)

Beefy Finance is a decentralised multichain yield optimiser which automatically maximizes user rewards from different liquidity pools, automated market makers and yield farming opportunities in DeFi through a set of investment strategies that are enforced and secured by smart contracts.

Beefy Finance offers vaults wherein crypto tokens are stored and depending on the investment strategy that is associated with a specific vault, the optimiser will automatically increase a user’s deposited token amount by compounding arbitrary yield farm reward tokens back into the initially deposited asset. A user’s funds are never locked in any vault on Beefy Finance and the user can always withdraw their funds anytime.

Dividend-eligible revenue shares in Beefy Finance come in the form of BIFI tokens which are the native governance tokens through which holders earn profits that are generated by Beefy Finance and have the ability to vote on proposals. BIFI tokens are available on exchanges such as 1inch Exchange. Beefy.Finance supports wallets such as MetaMask, TrustWallet, and WalletConnect.

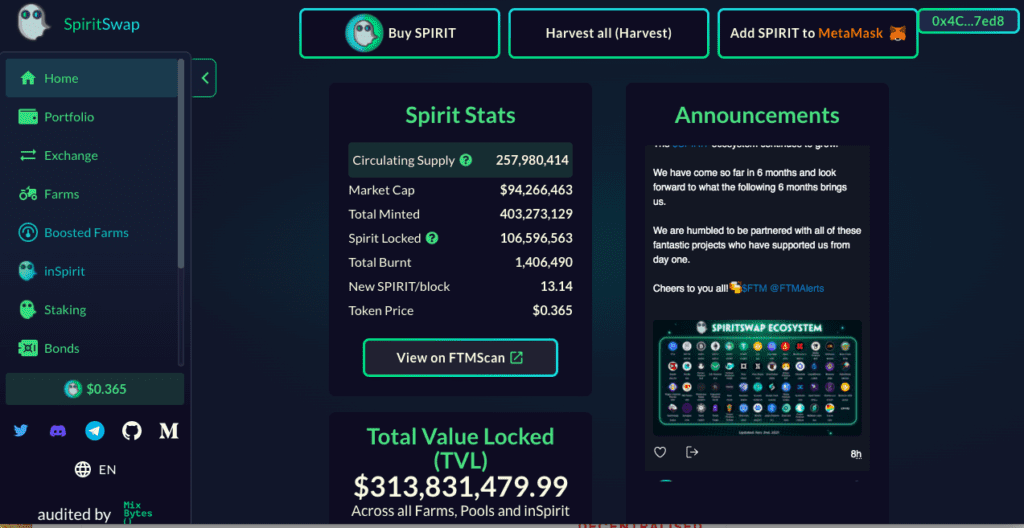

SpiritSwap (SPIRIT)

SpiritSwap is a native decentralized exchange for the Fantom blockchain which enables trading, staking and yield farming. The SpiritSwap DEX makes it easy for users to swap tokens on Fantom via automated liquidity pools. Its design is akin to Uniswap in that each swap on SpiritSwap incurs a fee and that fee gets distributed to liquidity providers who essentially deposit equal values of two tokens and in return, receive SpiritSwap Liquidity Pool tokens (SPIRIT-LP) which represent a proportional share of the given liquidity pool. By introducing revenue sharing through the automated market maker model, the SpiritSwap protocol effectively adds incentives for Fantom network participants.

Liquidity providers can claim their underlying tokens anytime but they receive a 0.25% fee (which is directly added back to the liquidity pool) for every swap that is made in their pair if they keep providing liquidity. Any user of SpiritSwap can create a liquidity pool and set their prices with any two tokens of their choice as long as those tokens are available on Fantom. SPIRIT tokens can be traded on SpiritSwap, Gate.io, ZT, etc.