Top 5 Platforms for Staking Solana

As the decentralized finance space continues to grow, Solana has emerged as a key player, offering fast and cost-effective transactions. For investors looking to earn passive income, staking Solana (SOL) has become an attractive option. With numerous platforms available, choosing the right one is crucial for maximizing returns and ensuring security. This article provides an in-depth look at the top five platforms for staking Solana, focusing on their unique features, rewards, and security measures.

1. Kraken: A Secure and Accessible Staking Platform

Kraken is one of the most trusted names in the cryptocurrency world, offering a secure and user-friendly platform for staking Solana. Established in 2013, Kraken serves over 10 million users in 190+ countries, making it a go-to option for both beginners and experienced traders. The platform offers an annual percentage yield (APY) of 3-5% on Solana staking, with payouts occurring 1-2 times per week. Kraken is known for its robust security features and has no lock-up periods, allowing users to stake and unstake their assets at their convenience. This flexibility, combined with a reliable track record, makes Kraken a top choice for staking SOL.

2. Solflare: A Comprehensive Non-Custodial Wallet for Solana Staking

Solflare is a popular non-custodial wallet designed specifically for interacting with the Solana blockchain. It provides a seamless staking experience directly through its mobile, web, or browser extension platforms. Solflare supports staking SOL with an effective return rate of 7.25% APY, making it a competitive option for those looking to maximize their returns. The platform’s security and ease of use are highlighted by its significant user base, with over 73.95 million staked accounts and more than $14 billion in value staked. Solflare’s integration of Solana NFTs and other blockchain features further enhances its appeal as a versatile tool in the Solana ecosystem.

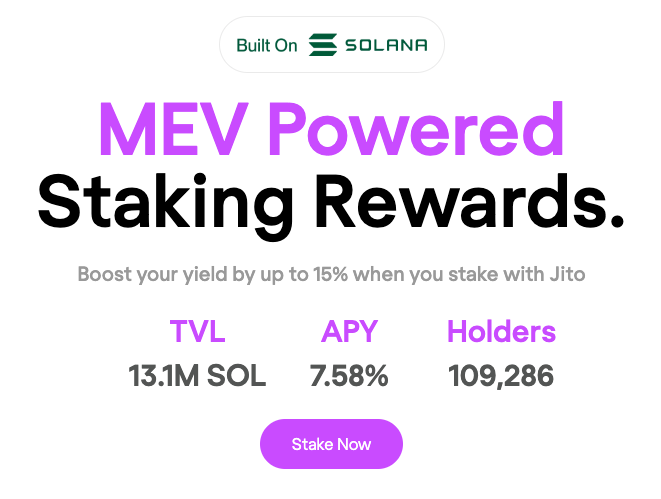

3. Jito: Maximizing Returns with MEV-Enabled Validators

Jito stands out as a liquid staking platform for Solana, offering users the ability to maximize their staking rewards through MEV (Maximal Extractable Value) enabled validators. This approach ensures that users can achieve higher returns, with Jito providing an effective staking return of 7.34% APY. The platform’s focus on security is evident through its use of advanced encryption and multi-layered security measures, safeguarding user assets. Jito’s liquid staking model also provides flexibility, allowing users to stake their SOL and receive JitoSOL, which can be traded or used within the Solana ecosystem, enhancing liquidity and potential returns.

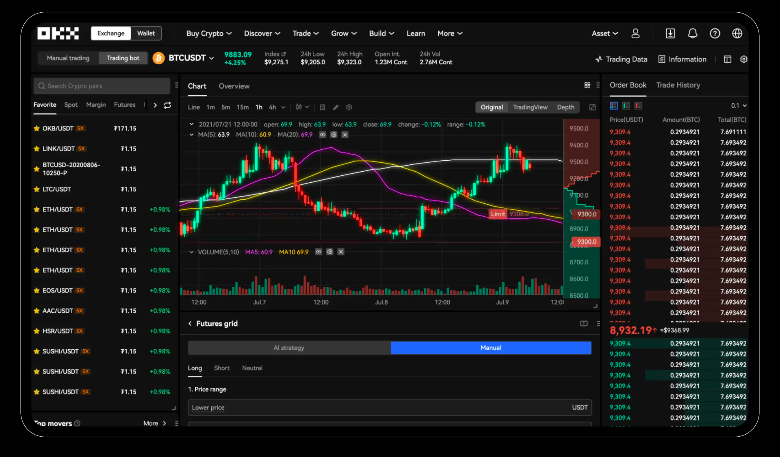

4. OKX: A Comprehensive Exchange with Hassle-Free Staking

OKX is a well-established cryptocurrency exchange that offers a straightforward and efficient platform for staking Solana. With an annual percentage return (APR) of 6.82% and an effective return rate of up to 8.32%, OKX provides one of the highest potential rewards among staking platforms. The platform supports a wide range of trading options, including spot, futures, and margin trading, which makes it a versatile choice for users who are looking to engage in more than just staking. OKX’s staking rewards are distributed at the end of each period, ensuring that users can quickly reinvest or withdraw their earnings without unnecessary delays.

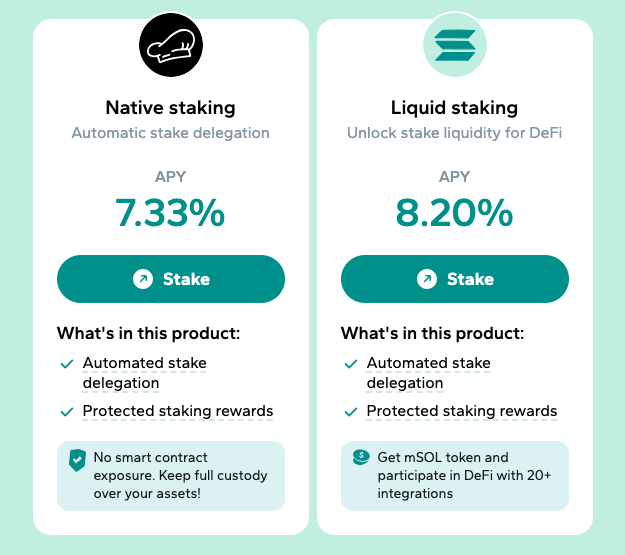

5. Marinade Finance: Leading the Way in Automated Liquid Staking

Marinade Finance is a pioneer in the field of automated liquid staking on Solana. It allows users to choose between classic and liquid staking, pooling funds among over 100 high-performing validators. With a total value locked (TVL) of $1.5 billion and an effective staking return of 7% APY, Marinade offers a robust platform for maximizing staking rewards while promoting decentralization. The platform’s liquid staking feature, where users receive mSOL (Marinade SOL), provides additional flexibility as these tokens can be used across the Solana ecosystem, further enhancing potential returns.

Conclusion

Selecting the right platform for staking Solana is essential for maximizing returns while ensuring the security of your assets. Kraken offers accessibility and reliability, Solflare provides a secure and user-friendly interface, Jito leverages advanced validator strategies, OKX combines high returns with trading versatility, and Marinade Finance leads in automated liquid staking. Each of these platforms brings unique strengths to the table, allowing investors to choose the one that best aligns with their staking goals and risk tolerance.

By carefully considering these options and staying informed about the latest developments in the DeFi space, investors can make strategic decisions that enhance their staking experience and potential rewards.