Top 7 RWA Projects to Watch: Hidden Gems

The Real-World Asset (RWA) tokenization space is rapidly evolving, bridging the gap between traditional finance and blockchain technology by transforming tangible assets into digital tokens. From real estate to private credit and luxury goods, innovative projects are unlocking new opportunities for investors worldwide.

1. Securitize

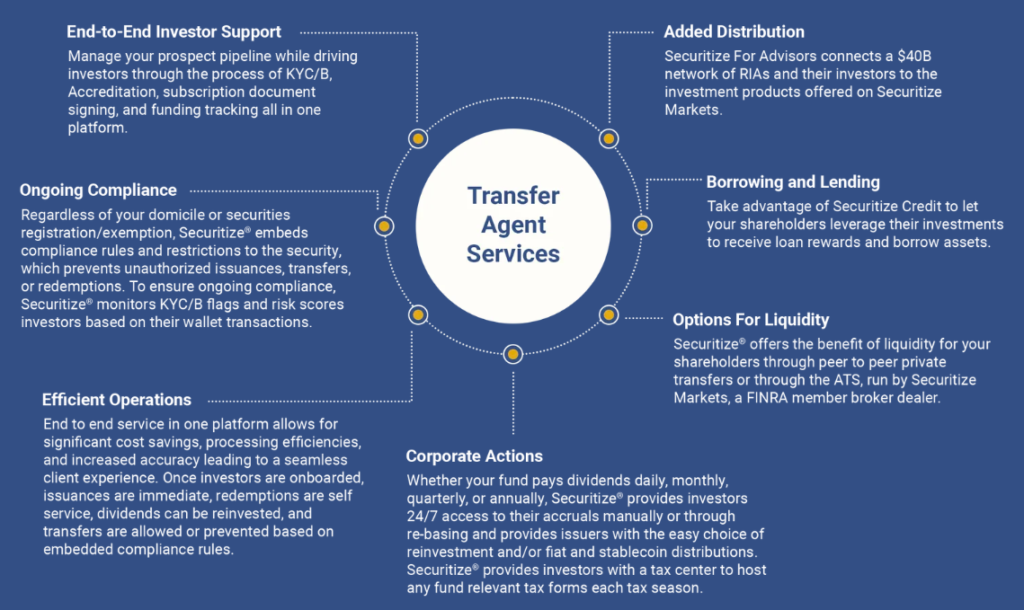

Securitize has emerged as a comprehensive platform for managing digital securities, providing end-to-end solutions for issuing, managing, and trading tokenized assets. With a strong emphasis on regulatory compliance, Securitize has quickly positioned itself as a leader in the RWA market.

It offers a suite of services, including investor communication tools, issuance platforms, and transfer agent services. Notably, Securitize’s collaboration with BlackRock, the world’s largest asset manager, to tokenize up to $10 trillion worth of assets underscores its significant role in bringing traditional finance into the blockchain realm. By offering a legally compliant framework for tokenization, Securitize enables greater institutional participation, making it an ideal substitute for projects like Polymesh that focus on regulatory compliance and securities.

2. Untangled Finance

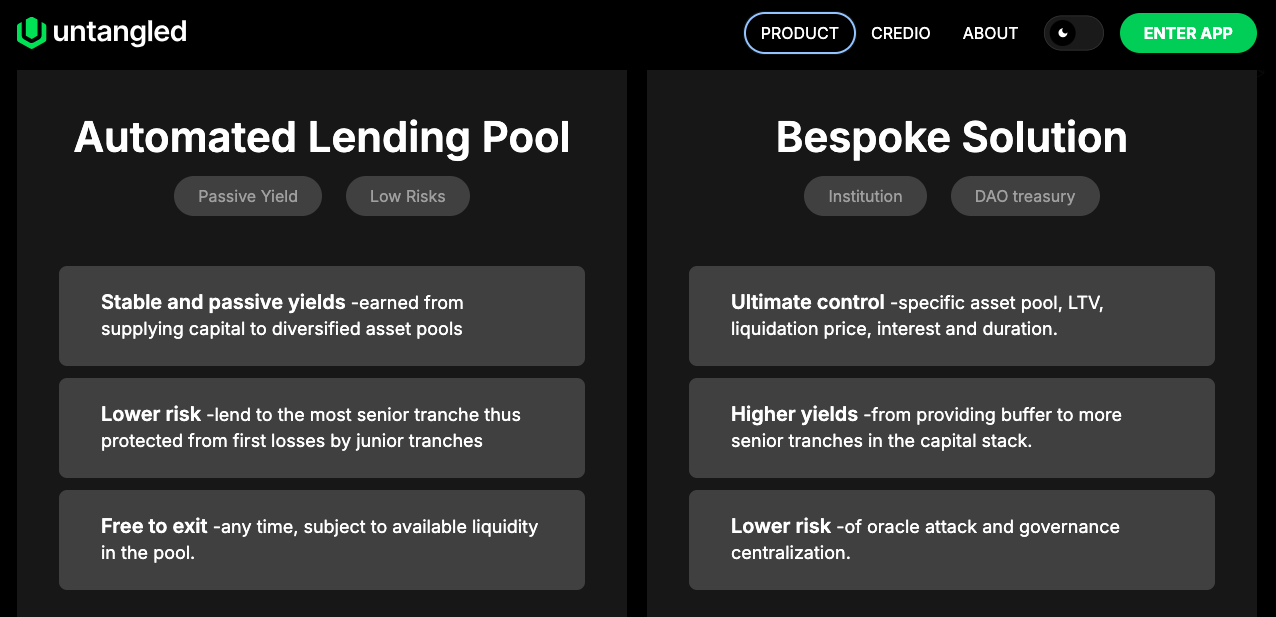

Untangled Finance focuses on bringing private credit assets onto the blockchain, making them more liquid and accessible to a wider range of investors. Launched on the Celo network, Untangled Finance recently raised $13.5 million in funding to accelerate its mission of bridging the gap between traditional finance and decentralized finance (DeFi).

By enabling the tokenization and trading of real-world credit assets such as bonds, loans, and private debt instruments, Untangled Finance is helping to democratize access to credit markets. This platform could be a powerful substitute for projects like TrueFi, given its similar focus on credit markets, but with an emphasis on tokenizing private credit rather than unsecured crypto loans.

3. Swarm Markets (SMT)

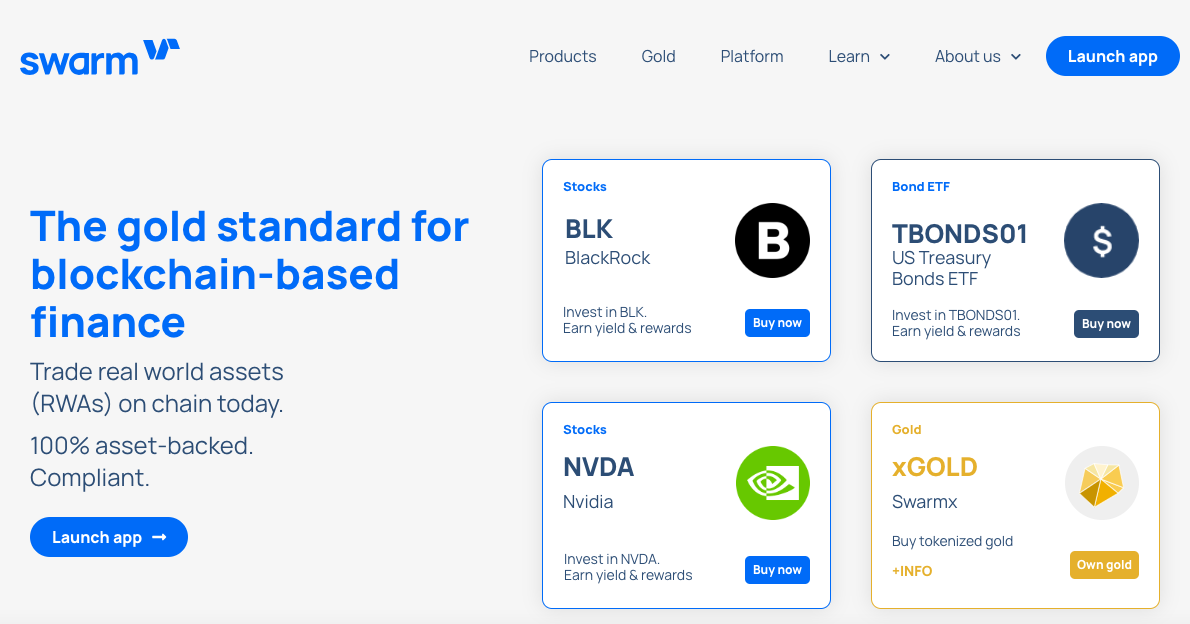

Swarm Markets is a decentralized platform specializing in the tokenization of a broad range of real-world assets, including securities, commodities, and cryptocurrencies. Emphasizing regulatory compliance, Swarm Markets aims to create a bridge between traditional finance (TradFi) and DeFi by offering a secure, compliant environment for trading tokenized assets.

Its collaboration with Mattereum to securitize more real-world assets on-chain positions Swarm Markets as a key player in the tokenization space, offering a robust alternative to projects like Maker that aim to integrate traditional assets into DeFi ecosystems. $SMT can be traded on Gate.io, MEXC, and others.

Its collaboration with Mattereum to securitize more real-world assets on-chain positions Swarm Markets as a key player in the tokenization space, offering a robust alternative to projects like Maker that aim to integrate traditional assets into DeFi ecosystems. $SMT can be traded on Gate.io, MEXC, and others.

4. Lofty AI

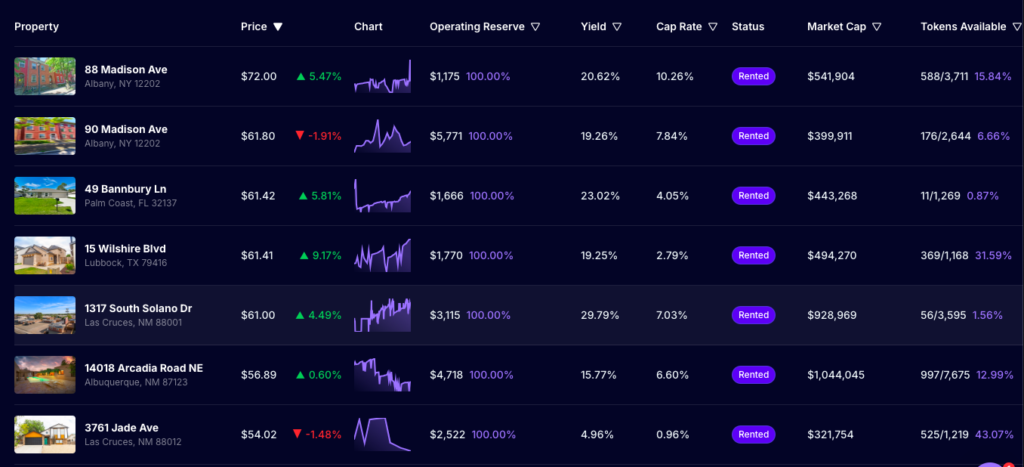

Lofty AI offers a fresh approach to real estate tokenization by leveraging the Algorand blockchain to fractionalize property ownership. The platform allows users from around the world to invest in American real estate markets without the usual geographic and legal restrictions. By breaking down properties into smaller, bite-sized tokens, Lofty AI makes it possible for anyone to own a share of real estate, providing liquidity and accessibility to one of the most traditionally illiquid markets.

This project could serve as a substitute for Ondo Finance by providing a different model of real estate tokenization, focused on individual properties rather than mortgage-backed securities.

5. Chromia (CHR)

Chromia is a blockchain platform designed to solve scalability issues in decentralized applications (dApps), particularly in the context of RWA tokenization. Chromia utilizes a unique sidechain architecture that allows developers to create blockchain applications with greater flexibility and scalability.

The platform’s focus on real-world applications, such as land registries, public records, and supply chain management, makes it a powerful tool for tokenizing physical assets in a transparent, secure, and efficient manner. As such, Chromia could substitute for platforms like Algorand by offering a more scalable solution for tokenizing diverse real-world assets across multiple industries. $CHR can be traded on Binance and Bybit.

6. Clearpool (CPOOL)

Clearpool is a decentralized capital markets ecosystem that allows institutional borrowers to design unique, single-borrower liquidity pools. It provides a novel approach to DeFi lending by offering greater flexibility and customization for large-scale borrowers, positioning itself as a leader in the RWA lending space.

Clearpool also enables staking and provides a bridge for safely transferring tokens between networks, making it an attractive alternative to TrueFi. Clearpool’s focus on creating bespoke liquidity solutions for institutional investors makes it a dynamic option in the evolving landscape of RWA tokenization. $CPOOL can be traded on Bybit, Gate.io.

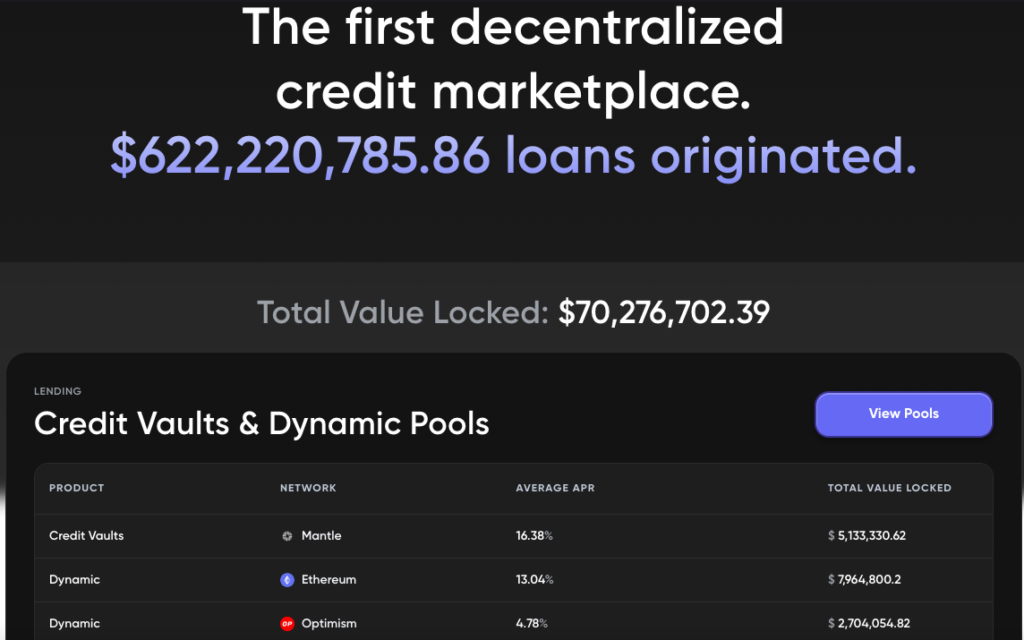

7. Creditcoin (CTC)

Creditcoin offers a decentralized credit network that connects borrowers and lenders, enabling the tokenization and trading of credit assets like loans, bonds, and debt instruments. The platform focuses on creating a decentralized marketplace for credit assets, providing a transparent and efficient environment for trading these assets. $CTC can be trade on Bybit, OKX or Gate.io.

By leveraging blockchain technology, Creditcoin helps enhance liquidity and accessibility in the credit markets, positioning itself as a suitable alternative to Mantra, particularly for investors looking to diversify their exposure to credit-based RWAs.

These projects represent a variety of approaches to RWA tokenization, from real estate and credit assets to digital securities and decentralized lending. Each offers unique advantages and could serve as valuable substitutes for the more well-known projects, providing fresh perspectives and innovative solutions in the rapidly evolving world of RWA tokens.

For more on RWAs, read Tokenized Trillions – The Digitization of Real Word Assets Using Blockchain Technology.