Top Decentralized Exchanges to Watch in 2025

In 2025, the competition among DEXs has intensified, with platforms introducing innovative features such as decentralized order books, multi-currency trading, AI-powered market-making, and liquidity aggregation.

Here’s a list of the top decentralized exchanges in 2025 that are redefining the way crypto traders engage with DeFi.

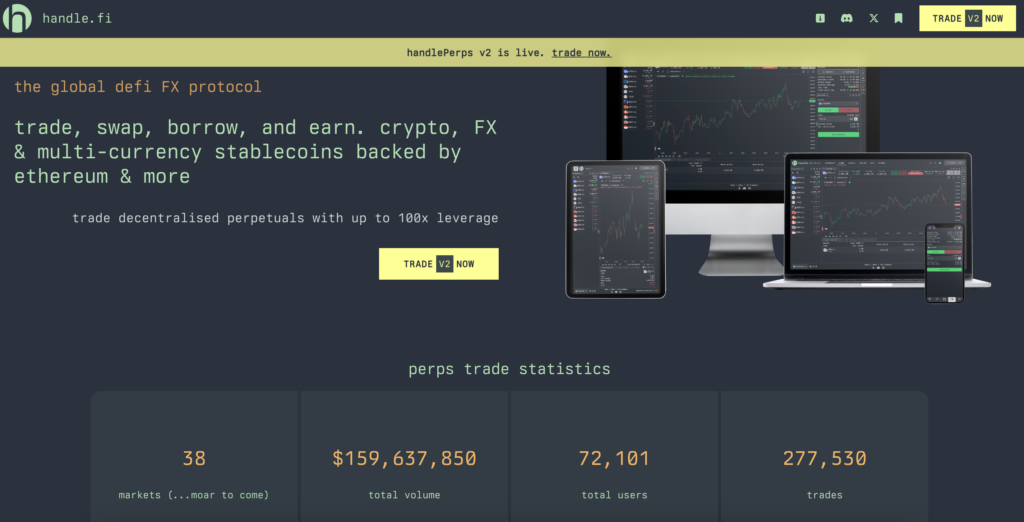

1️⃣ Handle.fi: The Ultimate Multi-Currency DeFi Trading Protocol

🔹 Best For: Forex (FX) and stablecoin trading in DeFi

Handle.fi is revolutionizing the DeFi FX market with its multi-currency stablecoin protocol, allowing users to trade, borrow, and earn from fxTokens, which are stablecoins pegged to various national currencies.

Key Features:

- Multi-Collateral Vaults: Borrow and leverage in your local currency, reducing foreign exchange risks.

- Capital Efficiency: Minimized liquidation probabilities and partial vault liquidations ensure optimal asset utilization.

- 1:1 Redemption: Helps maintain the stability and peg value of fxTokens.

- Global FX Market Integration: With over $7.5 trillion traded daily in the traditional forex market, Handle.fi bridges the gap between DeFi and FX.

🛠 Supported fxTokens: fxUSD, fxEUR, fxGBP, fxJPY, fxAUD, fxCNY, and more.

Why Handle.fi?

📈 Handle.fi is one of the few DEXs that provides FX trading capabilities, making it an attractive platform for global traders looking to settle and hedge in their local currencies.

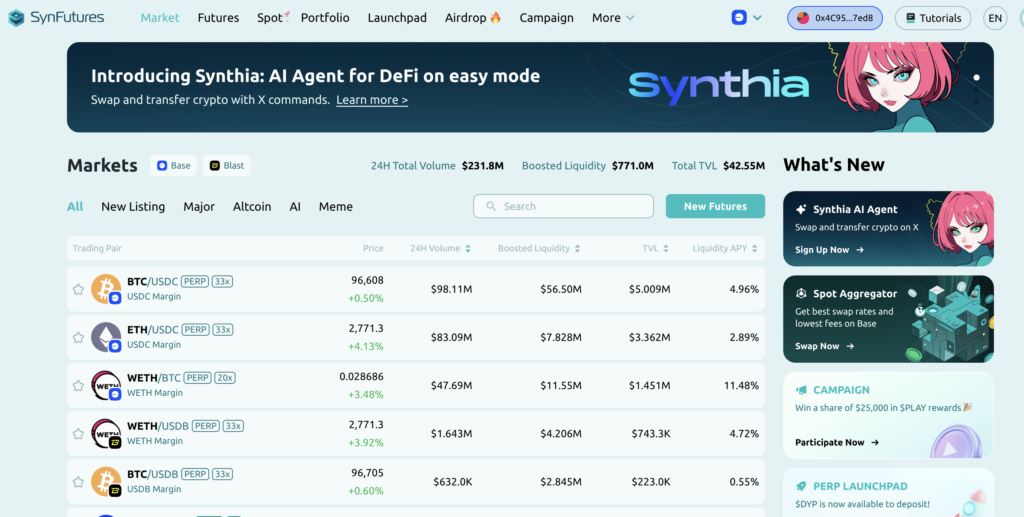

2️⃣ SynFutures (Oyster AMM): The Next-Gen Derivatives DEX

🔹 Best For: Perpetual futures and leveraged trading with concentrated liquidity

SynFutures has developed the Oyster AMM, an upgraded version of its successful sAMM model, enabling single-token concentrated liquidity for derivatives trading.

Key Features:

- Permissionless On-Chain Order Book: Combines AMM and an order book for higher capital efficiency.

- Single-Token Liquidity Model: Liquidity providers (LPs) only need to supply one token instead of a pair.

- Stabilization Mechanisms: Includes penalty fees for price manipulation and a mark price mechanism to reduce volatility.

🚀 With $75 billion+ in cumulative trading volume and 200K+ all-time traders, SynFutures is setting a new standard for decentralized derivatives trading.

Why SynFutures?

⚡ The first hybrid DEX that integrates an order book with concentrated liquidity AMM, ensuring efficient execution even for niche assets like meme coins and Liquid Restaking Tokens (LRTs).

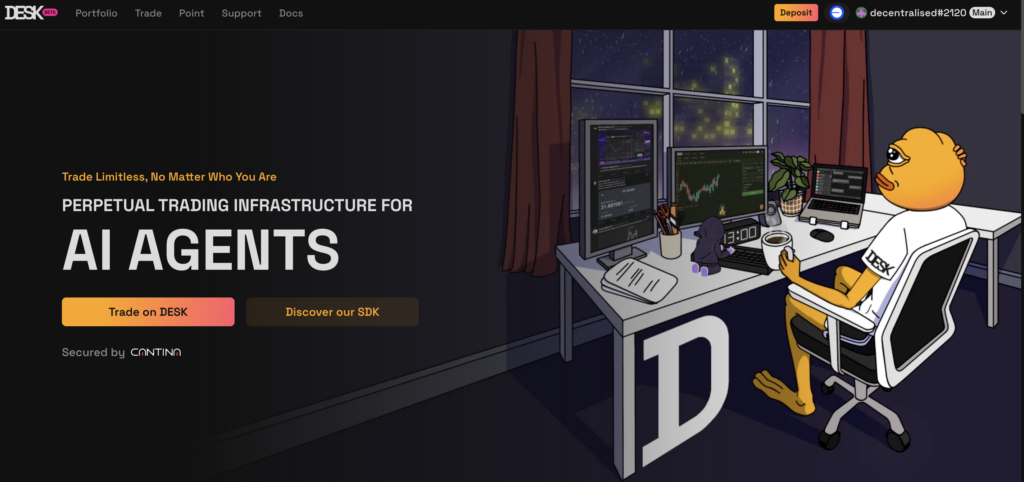

3️⃣ DESK Exchange: Institutional-Grade Perpetuals and Order Books

🔹 Best For: High-frequency traders looking for on-chain settlement and perpetual futures

DESK brings the Central Limit Order Book (CLOB) model to DeFi, offering fast, transparent, and fully on-chain trade execution.

Key Features:

- 10,000+ Transactions Per Second: High-speed order execution with low latency.

- Flexible Trade Settlement & Borrowing Fees: Allows traders to settle negative balances later.

- Insurance Fund Protection: Covers liquidation losses to prevent cascading liquidations.

Why DESK?

🏆 A hybrid model combining centralized exchange (CEX)-level speed with DeFi transparency, perfect for serious traders who want institutional-grade execution.

4️⃣ HMX: 1,000x Leverage Trading on Arbitrum

🔹 Best For: Perpetual trading with cross-margin support and leveraged market-making

HMX is a next-generation decentralized perpetual protocol that offers up to 1,000x leverage, allowing users to trade crypto, forex, and commodities.

Key Features:

- Cross-Margin & Multi-Collateral Support: Traders can use multiple assets as collateral.

- Leveraged Market Making (HLP Vault): Earn passive yield while market-making for both HMX and GMX.

- Trader Incentives: Earn rewards for keeping positions open.

Why HMX?

🔹 One of the highest APRs for LPs in DeFi, with multiple revenue streams including platform fees, GMX yields, and staking incentives.

5️⃣ gTrade (Gains Network): AI-Enhanced On-Chain Trading

🔹 Best For: AI-powered decentralized trading with partial liquidations and cross-margin

gTrade has evolved into a multi-chain DeFi powerhouse, offering deep liquidity for perpetuals while integrating AI-driven trading mechanics.

Key Features:

- $85 Billion+ in Lifetime Trading Volume

- GNS Utility Expansion: Staking, buybacks, and reward incentives.

- Multi-Collateral Trading & Partial Liquidations

- Gamified Trading & Social Layer: Integrates leaderboards and social features.

Why gTrade?

🚀 gTrade is combining AI, DeFi, and derivatives into a next-gen trading platform, offering high leverage and user-friendly on-chain execution.

6️⃣ MUX Protocol: The First Perpetual Trading Aggregator

🔹 Best For: Aggregating deep liquidity from multiple sources for optimal execution

MUX introduces the world’s first decentralized perpetual trading aggregator, integrating top liquidity sources such as GMX, gTrade, and SynFutures.

Key Features:

- 100x Leverage with Optimized Liquidation Prices

- Smart Position Routing: Selects the most cost-efficient liquidity route.

- Yield-Bearing Liquidity Pools: LPs earn optimized returns from multiple sources.

Why MUX?

🔹 Instead of competing with individual DEXs, MUX connects them, offering traders the best prices, lowest slippage, and highest leverage.

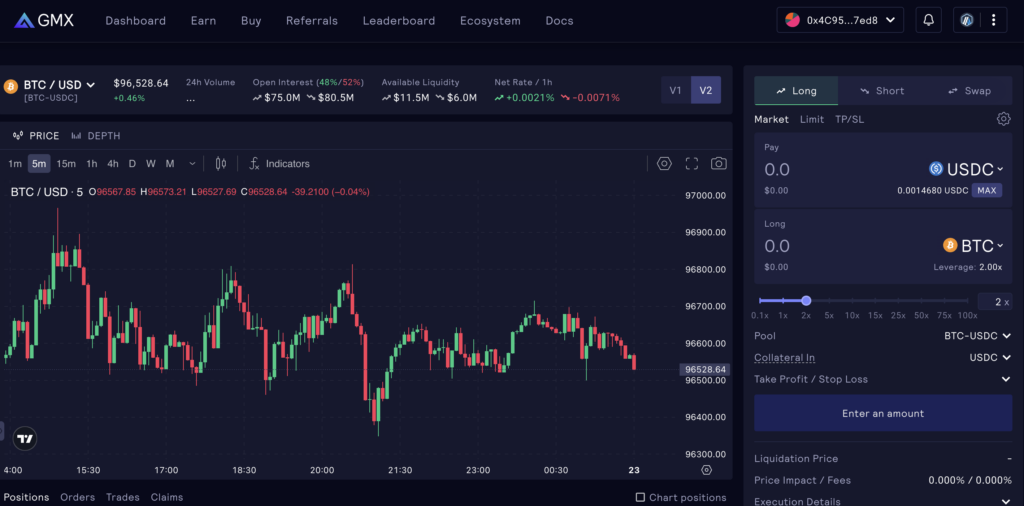

7️⃣ GMX: The DeFi Perpetual Exchange Standard

🔹 Best For: Low-fee perpetual trading with deep liquidity pools

GMX remains a dominant force in the DeFi trading ecosystem, providing a secure, non-custodial alternative to centralized futures trading.

Key Features:

- Multi-Asset Liquidity Pools: Earn from swaps, market making, and leverage trading.

- Chainlink Oracles for Dynamic Pricing

- Low Slippage & Low Trading Fees

Why GMX?

🔹 The leading perpetuals DEX on Arbitrum and Avalanche, maintaining deep liquidity and a strong community.

Conclusion: Which DEX Is Best for You?

The best decentralized exchange for you depends on your trading needs:

✅ Want to trade FX in DeFi? → Use Handle.fi

✅ Looking for an order book experience? → Try DESK

✅ Prefer leverage trading? → HMX, GMX, or SynFutures

✅ Need a liquidity aggregator? → MUX Protocol

✅ Want AI-powered trading? → gTrade

2025 is shaping up to be the biggest year for decentralized trading yet—and these platforms are leading the way! 🚀🔥