Top DeFi Trends to Watch in 2025

As DeFi (Decentralized Finance) continues to evolve at a rapid pace, 2024 is shaping up to be a year of revolutionary trends and game-changing innovations. From perpetual liquidity pools to prediction markets, DeFi offers an array of exciting developments that will reshape the financial landscape. Let’s break down the top DeFi trends for 2024 with insights drawn from key industry movements, making it easier for you to spot the opportunities ahead.

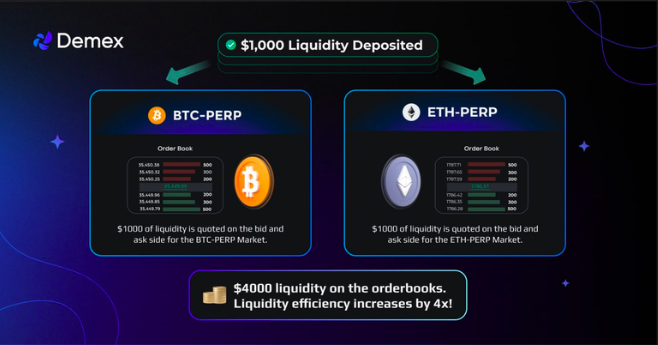

1. Perpetual Liquidity Pools: Real Yield for Consistent Returns

Perpetual Liquidity Pools (PLPs) are gaining serious traction in 2024, offering a reliable way for users to earn consistent returns through “real yield” mechanisms.

- What They Are: Liquidity pools are smart contracts that lock tokens to provide liquidity for decentralized exchanges (DEXs) and lending protocols. PLPs build on this by offering continuous liquidity, meaning less volatility and better price stability.

- Why It’s Hot: PLPs don’t just facilitate peer-to-peer trading. They allow for perpetual trading, meaning liquidity providers can “trade against the house,” pooling their funds to earn steady yields ranging from 30% to 100% APY.

- Key Players: Platforms like GMX (on Arbitrum and Avalanche) Demex on Carbon – a Cosmos SDK, and Jupiter (on Solana) are leading the way, offering substantial returns to liquidity providers.

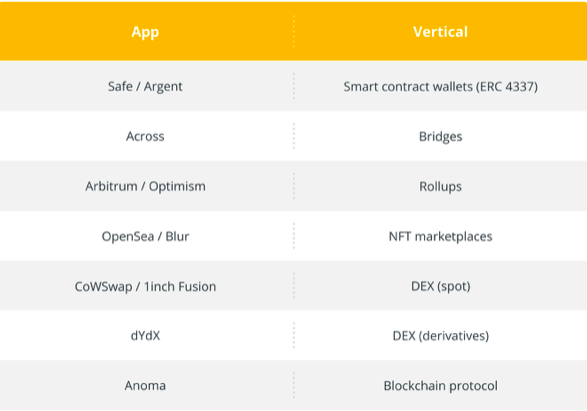

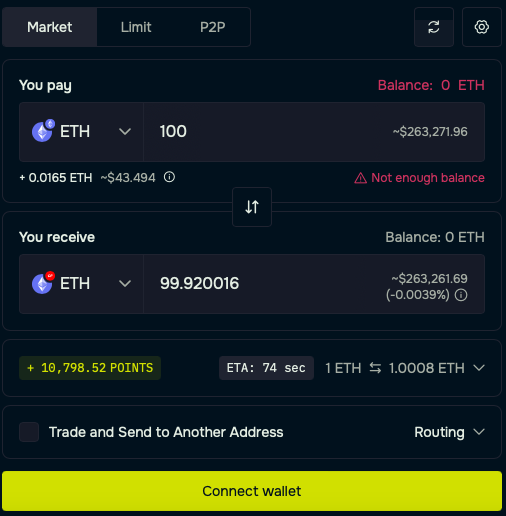

2. Intents-Based Architecture: Simplifying DeFi Interactions

2024 is all about making DeFi more user-friendly, and intent-based architecture is leading that charge by simplifying transactions.

- How It Works: Instead of specifying every detail of a transaction, users simply define their desired outcomes (e.g., “get the most USDC for 1 ETH”), and the protocol figures out the best way to achieve it.

- Why It Matters: This architecture eliminates the need for users to navigate complex parameters or platforms. It streamlines interactions, reduces errors, and ensures users get the best possible outcome without having to manage every step manually.

- Top Examples: UniswapX and Aperture Finance are pioneering this trend, leveraging AI and decentralized liquidity sources to make DeFi more accessible for everyone.

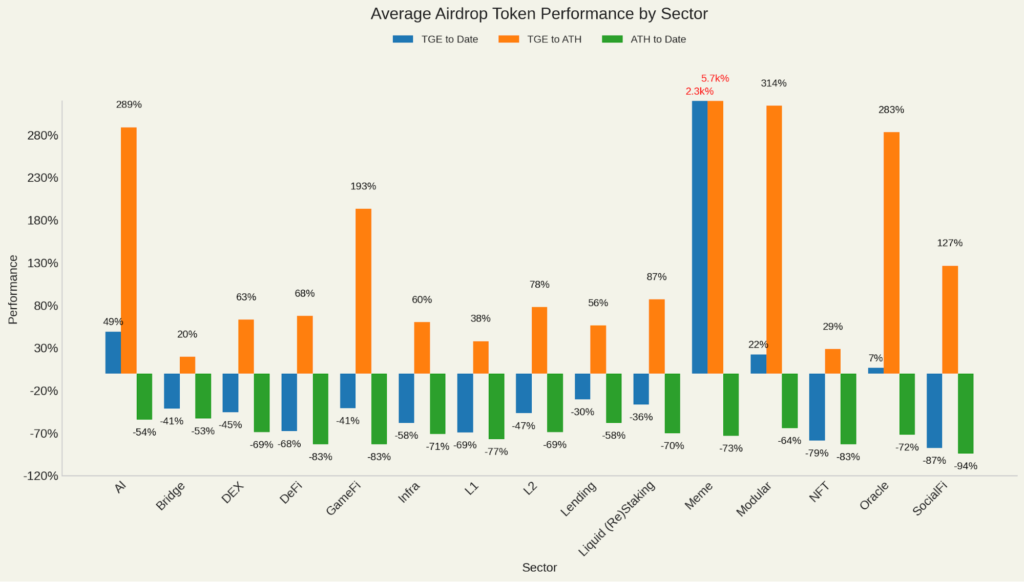

3. The Points and Airdrop Meta: Gamifying User Engagement

In the world of DeFi, airdrops and point-based systems are emerging as key tools to engage users and boost liquidity.

- What’s Happening: Airdrops distribute free tokens to users as a reward for their engagement with platforms. These incentives build communities, drive liquidity, and promote long-term participation in DeFi projects.

- 2024 Highlights: Blur’s $450 million airdrop, EigenLayer’s innovative points system, and Solana’s Saga smartphone airdrops are creating buzz, attracting new users and ramping up engagement on DeFi platforms.

- Why You Should Care: Airdrops aren’t just free money—they’re part of a broader strategy to build loyal user bases and ensure consistent liquidity, making DeFi projects more robust and sustainable.

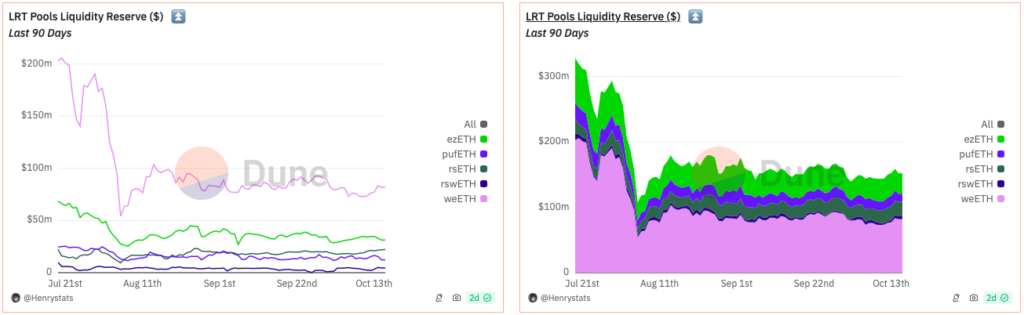

4. Liquid Staking and Restaking: Maximize Yield While Staying Liquid

Staking doesn’t have to mean locking your assets away. Liquid staking protocols are giving users the flexibility to earn rewards while maintaining liquidity—and restaking takes this one step further.

- How It Works: Users can stake their assets and receive liquid staking tokens (LSTs), which can then be used in other DeFi activities like yield farming or borrowing.

- Restaking in 2024: Protocols like EigenLayer offer Liquid Restaking Tokens (LRTs), allowing users to stake liquid tokens for even more yield, adding a new layer of utility to staking ecosystems.

- Why It’s Big: Liquid staking provides users with capital efficiency, allowing them to earn staking rewards while keeping their assets flexible. This makes staking more attractive and widely adopted.

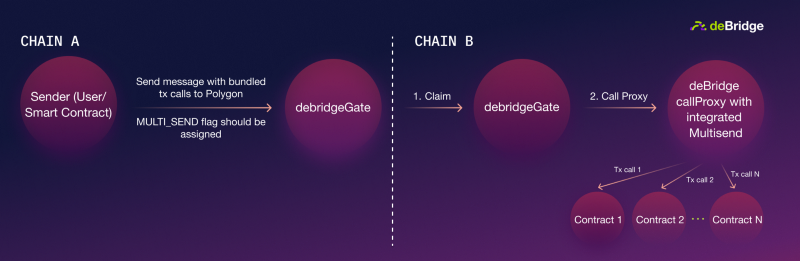

5. Cross-Chain Bridging: Seamless Interoperability Across Blockchains

Cross-chain bridges are transforming the DeFi ecosystem by enabling assets to move freely across different blockchain networks.

- Why It’s Crucial: Interoperability is the future of DeFi, allowing users to access a wider range of services across multiple blockchains. Whether you want to trade, lend, or yield farm, cross-chain protocols make it easier than ever.

- Notable Bridges: deBridge, Axelar and Hyperlane are leading the way in cross-chain connectivity, providing robust frameworks for seamless asset transfers. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is also enhancing liquidity pools and improving trade execution across chains.

- Security Focus: As bridge hacks have been a concern, protocols like Kima are doubling down on security measures to protect users and their assets.

6. Real-World Assets (RWAs): Bringing Tangible Assets to DeFi

Tokenizing real-world assets (RWAs) is making DeFi more stable and attractive to traditional investors, offering a safer haven amid crypto volatility.

- What It Is: RWAs are physical or financial assets (like real estate or commodities) that are tokenized and traded on blockchain networks. This brings stability and yield opportunities to the DeFi space.

- Why It Matters in 2024: With a 782% increase in tokenized treasuries in 2023, platforms like Ondo Finance and Realio are leading the charge in tokenizing RWAs, offering users stable yields and new investment opportunities.

- Big Players: Ondo Finance focuses on bringing institutional-grade assets into DeFi, while Swarm Markets enables trading of tokenized stocks and securities, bridging the gap between traditional finance and blockchain.

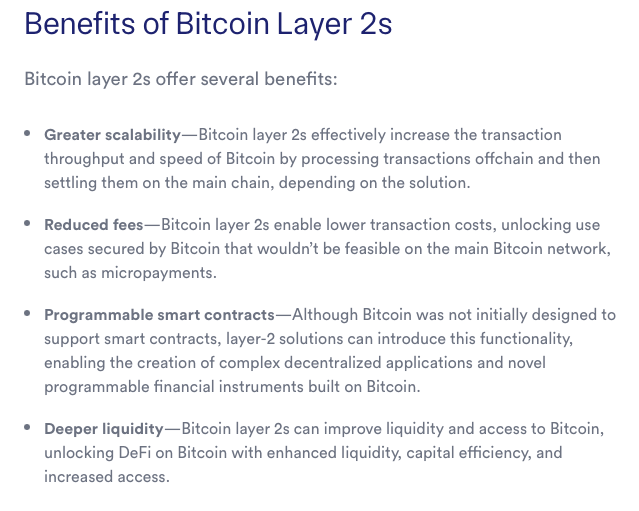

7. Bitcoin Layer 2: Unlocking DeFi on Bitcoin

While Bitcoin has long been viewed as a store of value, 2024 is the year it fully enters the DeFi ecosystem, thanks to Layer 2 solutions.

- What’s Happening: Technologies like the Lightning Network and Stacks are enabling decentralized applications (dApps) on the Bitcoin network, unlocking a whole new realm of DeFi opportunities.

- Why It’s Important: Bitcoin Layer 2 solutions provide scalability and reduced transaction fees, making it feasible to use Bitcoin in DeFi activities like lending and trading.

- Looking Forward: With the total value locked (TVL) in Bitcoin DeFi projects surpassing $1 billion, platforms like RSK and Liquid Network are pushing the boundaries of what Bitcoin can achieve in the decentralized space.

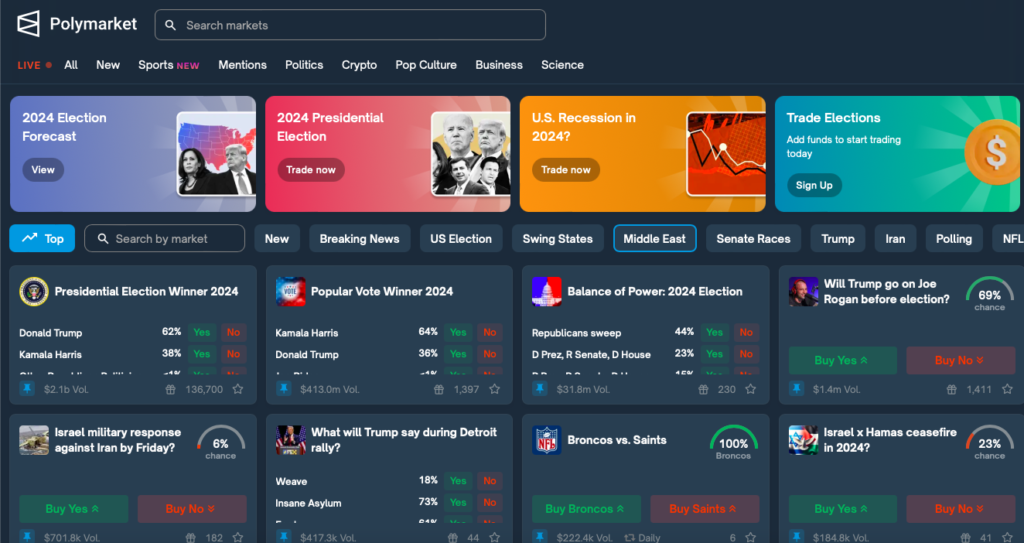

8. Prediction Markets: Bet on the Future

Prediction markets allow users to trade on the outcomes of future events—think elections, sports games, or economic indicators.

- Why They’re Growing: With major events like the 2024 U.S. Presidential election on the horizon, prediction markets are gaining popularity. Total value locked (TVL) in these markets has risen by 57.7% in early 2024, indicating growing demand.

- Key Platform: Polymarket, built on Polygon, stands out for its growing user base and trading volumes, offering a wide range of markets from politics to pop culture.

- Why It’s Exciting: Prediction markets leverage the wisdom of the crowd, providing valuable data and insights while allowing users to profit from accurately forecasting future events.

2024 – The Year DeFi Expands Its Reach

DeFi is on a path to becoming more than just a niche in the financial world. With perpetual liquidity pools, cross-chain bridges, and real-world asset tokenization, the DeFi landscape is maturing into a powerhouse of innovation and opportunity. Whether it’s the integration of Bitcoin into DeFi or the rise of user-friendly architectures like intent-based systems, 2024 promises to bring DeFi to new heights.

This is the year to get involved in DeFi’s evolution, as the space continues to break barriers, innovate, and offer more accessibility for both crypto-native users and traditional investors. Ready to explore the future of finance? Jump in and seize the opportunity!