Singapore, Singapore, 13th August, 2022, Chainwire

TUSD has been endorsed by CryptoQuant, a data analysis firm for cryptocurrencies, ranking in the top eight in the stablecoin efficacy report published July 21.

The efficacy report offered an in-depth analysis of eight significant stablecoins in the market (USDT, USDC, BUSD, DAI, FRAX, TUSD, USDP, and GUSD) from four dimensions: peg robustness, price premium, velocity, and accessibility.

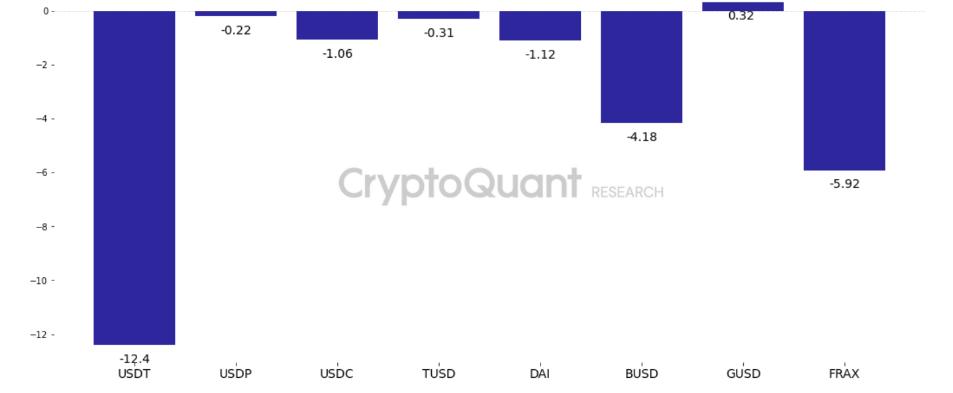

In terms of peg robustness, TUSD ranks among the top stablecoins. This dimension shows how reliable a stablecoin is during an increase in supply, which occurs when users are redeeming their stablecoins. This is known as a redemption run or better known as a “bank-run.”

Robustness is crucial for financial products as it represents stability. Stablecoins with high peg robustness allow users to redeem their assets securely, without fear of a price shock.

Measuring a stablecoin’s peg requires two metrics: price deviation and redeemed supply flow. Stablecoins with lower price deviation and higher redeemed supply, have a higher chance of maintaining their stability. Results show that TUSD has one of the lowest levels of price deviation, marking higher peg robustness scores.

TUSD’s high robustness score is well-deserved. Available sources reveal that it is one of the most transparent stablecoins, fully collateralized by U.S. dollars and attested live on-chain. Also, TUSD is audited in real-time by Armanino, a leading U.S.-based accounting firm, to ensure a 100% collateral ratio.

(Different stablecoins’ peg robustness scores)

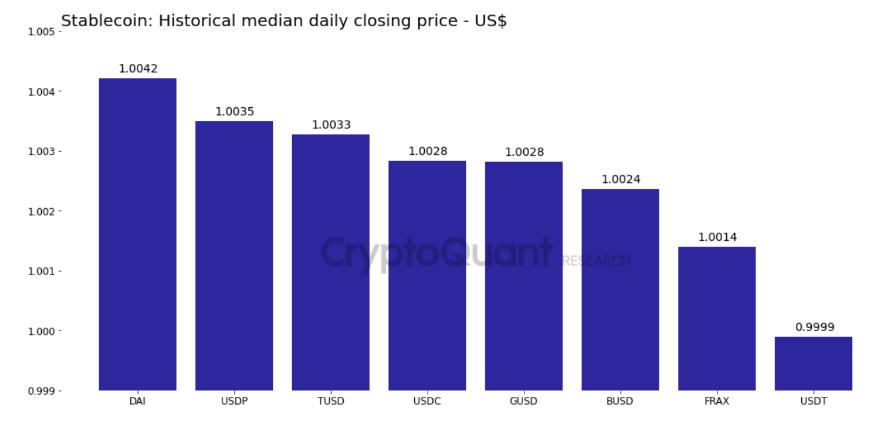

The price premium is used to analyze the historical prices of stablecoins to identify if a token has traded at a premium or a discount. The report indicates that TUSD ranks somewhere in the middle. A price premium allows stablecoin holders to profit from selling at a premium in the short term, as opposed to losses from trading at a discount.

Velocity and accessibility are the other two dimensions examined in the report. TUSD scores low in velocity and medium in accessibility. Moreover, the report also points out that stablecoins’ availability on public chains is equally important to their accessibility on exchanges. While many stablecoins operate on Ethereum, TUSD is one of the major stablecoins on TRON, while BUSD runs on BNB Chain.

(TUSD’s scores in the four dimensions)

TUSD ranking in the top eight for stablecoins, as shown in the TUSD blog article and CryptoQuant efficacy report mentioned earlier, reveals its all-around effectiveness in the four dimensions. The report expects TUSD to see further growth in the coming months.

About TUSD

TrueUSD is the first digital asset with live on-chain attestations by independent third-party institutions and is backed 1:1 with the U.S. dollar. So far, it has been listed on more than 100 trading platforms such as Binance and Huobi, and is live on 11 mainstream public chains including Ethereum, TRON, Avalanche, BSC, Fantom, and Polygon. TrueUSD is attested to in real-time by Armanino, one of the largest U.S.-based accounting firms, to ensure the 1:1 ratio of its USD reserve to the circulating token supply and the 100% collateral rate. Users can access the publicly available audit results via the official website tusd.io at any time.

Website | Twitter | Twitter(Truly) | Medium | Discord | Telegram | Telegram(Truly)

Contacts

- Annabel Gan

- pr@trueusd.com