UMA – A Protocol for Building Synthetic Assets on Ethereum

Ever since Bitcoin’s creation, people have speculated when cryptocurrency will finally start to achieve mainstream adoption. Of the many recent developments which have hinted that this adoption is near, the release of UMA may just be the most significant indicator. Short for Universal Market Access, UMA makes it possible to create synthetic cryptocurrencies representing virtually any asset you can think of. Not only that, but the financial market UMA is targeting is worth over a quadrillion US dollars according to some estimates (you read that correctly).

Who created UMA?

UMA was created by a team of former Goldman Sachs traders and investors. This team includes Allison Lu, former vice president of Goldman Sachs. While the UMA project is quite new, it has seen unbelievable success. The value of the UMA token increased in value nearly 100x since its initial release (though the price has come down a bit since then). This is not all that surprising given that the team may have the best connections of any cryptocurrency project currently in existence. Its value proposition is likewise priceless: allow anyone to trade anything.

How does UMA work?

Like most of DeFi, UMA is built on the Ethereum blockchain. In case you are unfamiliar, Ethereum is not just a tradeable cryptocurrency but a sort of network which allows you to create applications which are stored on all of the computers connected to the Ethereum network (hence the terms decentralized applications and decentralized finance). UMA makes it possible to create Ethereum-based tokens which can represent virtually any asset.

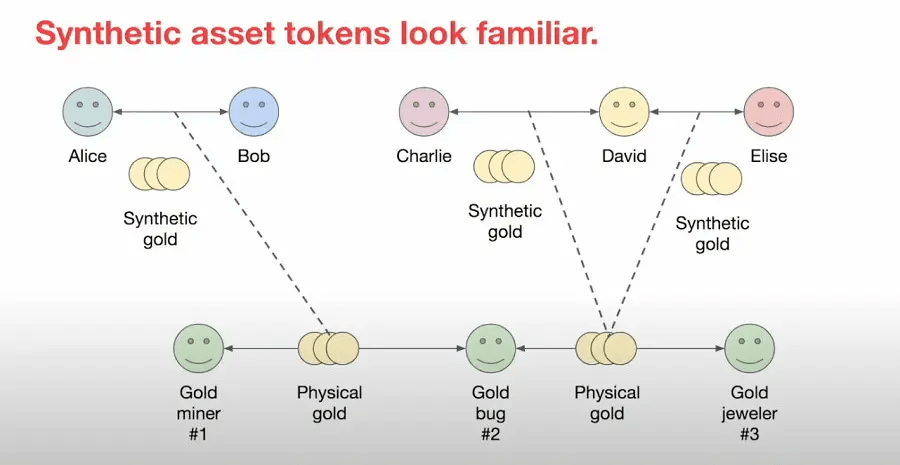

The way this works is devilishly simple and is best understood using an example. Suppose you wanted to issue cryptocurrency tokens which represent the price of gold. You would have to lock up some cryptocurrency as collateral to issue the tokens. These tokens cannot actually be redeemed for gold, but instead mirror the price of the asset they are meant to represent. UMA makes it possible not only to create cryptocurrencies which represent real world assets, but tokens which represent real-world anything (the number of likes on a specific Twitter post, for example).

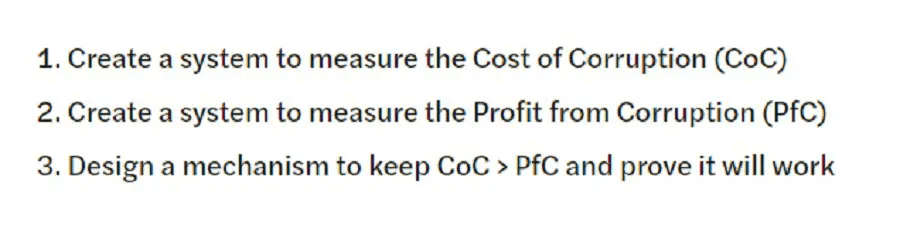

The UMA platform is governed by the UMA token. What is fascinating about UMA is that it is designed to ensure that nobody can manipulate the platform. This is done by constantly measuring how much UMA it would cost to corrupt the system and then automatically buy or burn (destroy) UMA tokens to make sure that no single individual could afford to gain enough voting power to change it to their liking.

Part of this involves making sure that UMA’s market cap (the amount of tokens in circulation x their price) is always greater than the value of the assets issued by the platform. This means that as it becomes more popular, the UMA token will automatically appreciate in value. Given that UMA is targeting a market worth anywhere between 500 trillion to over a quadrillion US dollars, the platform still has a lot of room to grow compared to other crypto projects.

Why is UMA important?

Until the release of UMA, most of decentralized finance revolved around lending, borrowing, staking/saving, and other fairly basic financial services. UMA opened the door to the meat of traditional markets by making it possible to create cryptocurrencies which represent virtually anything. With UMA, it is now possible for anyone with an internet connection to get exposure to Tesla stock or the S&P 500 index. While not owning those stocks directly, it gives anyone the possibility to trade the dollar value of these assets. The possibilities with UMA seem endless, and the project has raised the bar for the entire decentralized finance space.