Why Bitcoin’s Bull Market Has Just Begun

Markets don’t just move on numbers. They pulse with the rhythm of human lives – births, deaths, dreams, and disruptions. Since 1900, every major bull market top has echoed a demographic turning point. Now, in the midst of AI breakthroughs, geopolitical reshuffling, and institutional crypto adoption, the world is entering a new long wave. This isn’t the end. It’s a beginning. Bitcoin is not just a speculative asset – it’s an instrument of demographic destiny.

Demographics as the Invisible Hand of Markets

The 40-Year Rule: Births Predict Booms

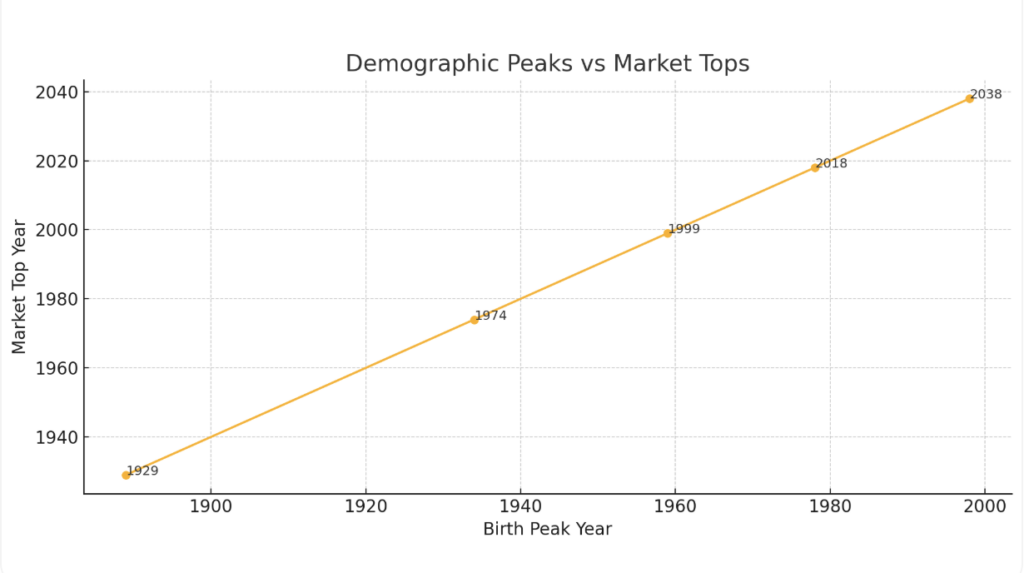

Every bull market top of the past century – from the roaring 1929 peak to the dot-com collapse in 2000 – has coincided with one strange but persistent trend: a 40-year lag from a peak in birth rates.

When a generation hits its economic prime – typically in their 40s – they buy homes, invest heavily, start businesses, and become the backbone of consumption. They drive markets upward.

This pattern held in 1929, when the market crashed 40 years after a demographic high in the late 1880s. It repeated in 1974, 1999, and again in 2018.

If that holds true again, the next demographic market peak isn’t due until 2038. That would suggest we’re in the early innings – not the twilight – of this current long-cycle bull market.

And while that might sound like financial astrology, it’s not. It’s demographics. And in markets, demographics are destiny.

According to analysis, every major market top over the past century – 1929, 1974, 1999, and 2018 – can be traced to a demographic crest, occurring 40 years after a birth peak.

📌 Key Insight: Peak economic output correlates with people hitting their 40s—a stage of maximum earnings, spending, and investing.

| Birth Peak | Economic Boom | Market Top |

|---|---|---|

| ~1889 | 1920s Roar | 1929 Crash |

| ~1934 | Post-WWII Boom | 1974 Stagflation |

| ~1959 | Dotcom Surge | 1999-2000 Crash |

| ~1978 | Tech + Credit Cycle | 2018 mini-bear |

Projected Next Peak? The birth surge of the late 1990s-early 2000s (Millennials/Gen Z) hits economic prime in the 2035–2040 window.

💡 This means: The current bull cycle could logically extend to 2038.

From Historical Cycles to Now

Kondratiev Waves & Long Cycles

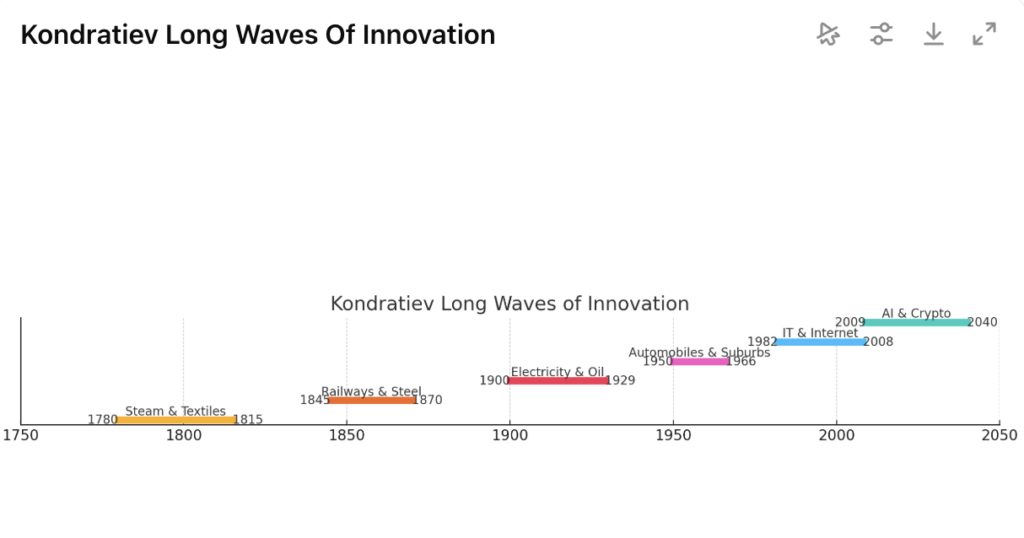

Russian economist Nikolai Kondratiev posited that economies move in 45-60 year “supercycles,” driven by technological revolutions. The previous waves:

| Cycle | Driving Innovation | Start | Peak | Collapse |

|---|---|---|---|---|

| 1 | Steam & Textiles | ~1780 | ~1815 | ~1840 |

| 2 | Railways & Steel | ~1845 | ~1870 | ~1890 |

| 3 | Electricity & Oil | ~1900 | ~1929 | ~1945 |

| 4 | Automobiles & Suburbs | ~1950 | ~1966 | ~1982 |

| 5 | IT & Internet | ~1982 | ~2000 | ~2008 |

| 6 | AI, Crypto | ~2009 | NOW | ??? |

⚡ We’re in the early innings of a sixth Kondratiev wave, led by AI, DeFi, and decentralized digital value.

Of course, try telling that to investors staring down red candles and volatile indexes.

Tensions with China are flaring again. Tariff threats are back. The Federal Reserve appears trapped – caught between stubborn inflation and signs of weakening employment. And consumer sentiment? Souring.

Yet underneath the fear, the structural forces driving long-term market value remain intact.

How Investors Think in Herds

Volatility, VIX, and Mass Psychology

Part of the current confusion stems from something less tangible: investor psychology.

Today, markets are more reflexive than ever. Push-button trading has collapsed time horizons. Fear and euphoria now swing in 24-hour cycles. Retail investors can dump portfolios with a swipe. Institutional desks follow momentum models. The “long term” often lasts a week.

So when sentiment indicators like the AAII survey hit record bearish levels – as they did in late 2024 – it can be a signal not of danger, but opportunity.

History is filled with examples where the crowd was wrong at the worst possible time.

In this environment, anchoring investment decisions to data – not doomscrolling – may be the only rational course.

The inversion of the VIX futures curve signals that short-term volatility is priced in, but beyond 3–6 months, the market expects calm.

This aligns with:

-

Recency Bias – Investors overweight recent downturns.

-

Availability Heuristic – Headlines of war, layoffs, and inflation dominate sentiment.

-

AI Investor Sentiment Surveys – Bearishness peaked in 2024 – historically a contrarian buy signal.

✅ Result: While the crowd fears collapse, structural investors are accumulating.

Global Dynamics Supporting the Case for Crypto

1. De-dollarization and Sovereign Hedging

-

BRICS+ nations diversifying away from the USD.

-

Central banks buying record levels of gold – a nod to hard assets.

-

Some (like El Salvador, Russia’s citizens, and parts of Asia) turning to Bitcoin as digital gold.

2. Geopolitical Tension = Flight to Neutral Assets

-

China–U.S. standoff.

-

Tariff wars and reshoring.

-

Bitcoin is borderless, censorship-resistant, and now a macro hedge in the same conversation as oil and gold.

3. Institutional Onboarding

-

BlackRock, Fidelity, and Goldman Sachs pushing Bitcoin ETFs.

-

Tokenization of assets: Real estate, debt, and equities being securitized on-chain.

-

TradFi embracing DeFi infrastructure.

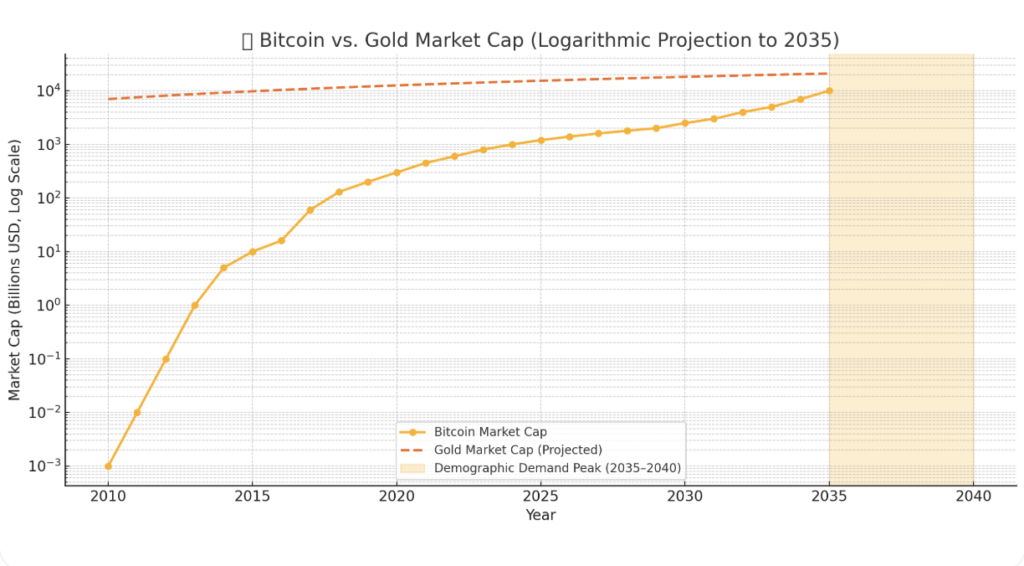

Bitcoin vs. Gold

| Asset | Market Cap |

|---|---|

| Gold | ~$21 Trillion |

| Bitcoin | ~$1.3 Trillion (as of 2025) |

If Bitcoin reaches 50% of gold’s market cap, price = $500,000+

If it reaches parity, price = $1,000,000+

Bitcoin’s Market Cap vs. Gold (Logarithmic Projection to 2035)

Why Crypto

Bitcoin is not alone.

-

Ethereum is becoming the programmable layer of value.

-

AI x Crypto (Autonomous agents, DeFi bots) is the new fintech.

-

Stablecoins are now doing $8 trillion+ in annual settlements, rivaling Visa.

📉 In a world where trust in institutions is declining, trust-minimized systems are rising.

The Predictive Outlook: 2025–2040

| Year | Trend | Market Driver |

|---|---|---|

| 2025–2027 | Recession scare → rate cuts | Crypto resilience, Bitcoin adoption wave 2 |

| 2027–2030 | Institutional integration | Tokenized assets go mainstream |

| 2030–2035 | Generational wealth shift | Millennials & Gen Z go risk-on, crypto-heavy portfolios |

| 2035–2040 | Peak demographic demand | Market climax, potential crypto maturity top |

This Is Not the End. It’s a Repricing of the Beginning.

History rhymes. And this verse is a techno-financial crescendo. While others panic over volatility, smart capital watches the long cycle. Just like the railroads, the internet, or the combustion engine, Bitcoin and crypto are infrastructural revolutions – not speculative bubbles.

If you can zoom out beyond the noise, you’ll realize:

This bull market is not only intact. It’s inevitable.