WOO Network Review

WOO Network is a multi-strategy trading firm with a focus on market making, arbitrage and high-frequency trading. It reportedly averages $5-10 billion of daily trading volume on global digital asset exchanges. Incubated by Kronos Research, WOO Network has evolved to become a global quantitative trading powerhouse with a deep liquidity network that connects traders, exchanges, institutions and DeFi platforms, providing cost-effective access to liquidity, trading execution, and yield generation strategies.

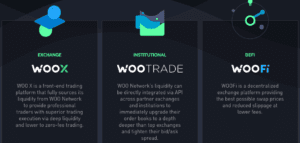

WOO Network has three main flagship products:

- WOO X – a zero-fee trading platform that provides professional and institutional traders with liquidity, execution, and features fully customizable modules for workspace customization.

- WOOtrade – a gateway for institutional clients such as exchanges to access WOO Network’s liquidity to upgrade their order books to a depth deeper than top exchanges and tighten their bid/ask spread.

- WOOFi – a suite of DeFi products that aims to expand WOO Network’s liquidity network to DeFi and helps DeFi users get the best pricing, tightest bid-ask spreads, and yielding opportunities when trading.

Overview

- WOO X trading platform is currently available on the App Store and is soon to be launched on Google Play.

- WOO X is essentially a spot market exchange that allows users to purchase or sell cryptos, however, margin can be extended to users in order to facilitate their ability to enter into spot purchases and sales of crypto assets on the spot market exchange using leverage.

It’s important to note that when a user utilises WOO X’s spot exchange for spot transactions on margin, they ought to hold sufficient collateral assets in their wallet. Users are able to buy or sell crypto through any of the available order books, even if they don’t actually hold any balance in the specific asset they wish to trade. The maximum margin ratio displayed on WOO X is set at 1,000% currently. This effectively represents (equity or exposure)x 100% which means users incur corresponding obligations and would need to comply with certain conditions until those obligations are satisfied if they decide to use an extension of margin from WOO X.

- Opening an account is simple and straightforward. When you register as a user on WOO X, you simply provide your name, email address and password, and accept the Terms to get started.

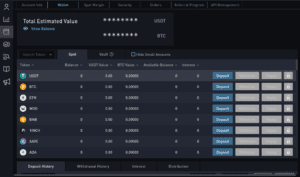

- In order for a user to fund their account and begin trading, they can deposit digital assets including stablecoins.

- The app features an intuitive trading interface which allows users to view real-time portfolio value, crypto prices, and charts while offering market data and advanced trading tools.

- Offers spot and margin integrated order forms and a central collateral wallet for unified margin and risk management.

- WOO Network has ecosystem partners that it assists with trading execution while also benefiting from higher network volumes through order flows.

- WOO X offers its staking program to all users that complete KYC checks. Users can stake WOO tokens and unlock fee discounts, earn bonus yields, or gain access to zero-fee trading and higher referral commissions.

- WOO does not offer services to people in some countries such as the USA, China, Iran, Iraq, Malaysia, Qatar, Afghanistan, Democratic Republic of Congo, Egypt, Liberia, and many others.

Fees

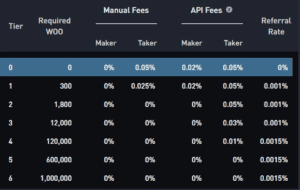

- WOO offers 0 maker and 0.05% taker fees for all trading. Users can stake 1800+ of WOO tokens to reach the 0 maker and taker fee threshold.

- The fees charged by WOO for spot or margin trades are effectively deducted in the currency a user receives. For example, a buying order on the BTC/USDT market will have the fees charged in BTC and the selling order will have the fees charged in USDT.

- There’s a limit for Fee Discounts which is set at 50,000 orders during a 24-hour period.

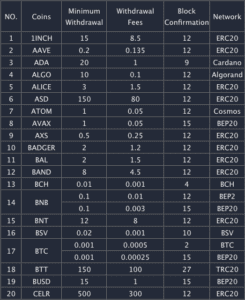

Withdrawals

- With Level 1 verification a user can withdraw up to 2 BTC for every 24 hours at 00:00 AM (UTC).

- Level 2 allows for unlimited withdrawals per day and requires KYC verification.

WOOFi Swap

WOOFi is a DEX that uses an on-chain market making algorithm called Synthetic Proactive Market Making (sPMM) which provides the most effective way to simulate a CEX order book in a DEX liquidity pool. Through it WOOFi Swap allows users to enjoy deep liquidity on-chain that can even be better than that provided by centralized exchanges, all without needing to pay high fees.