Stader Multichain Liquid Staking Platform Review

What is Stader?

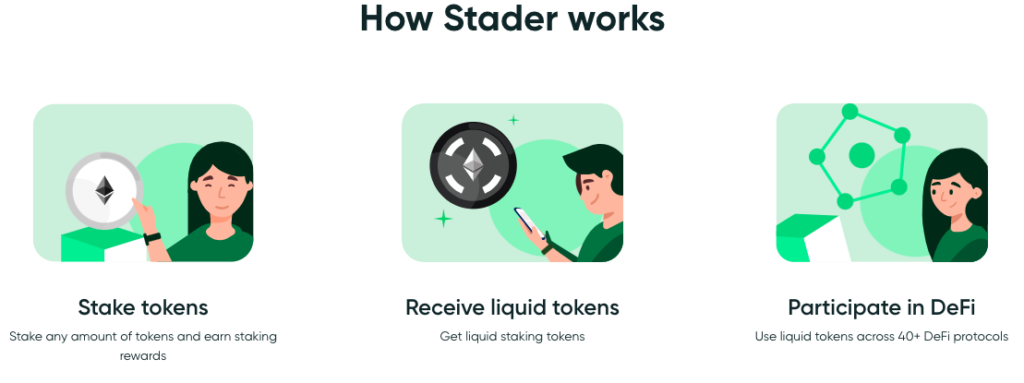

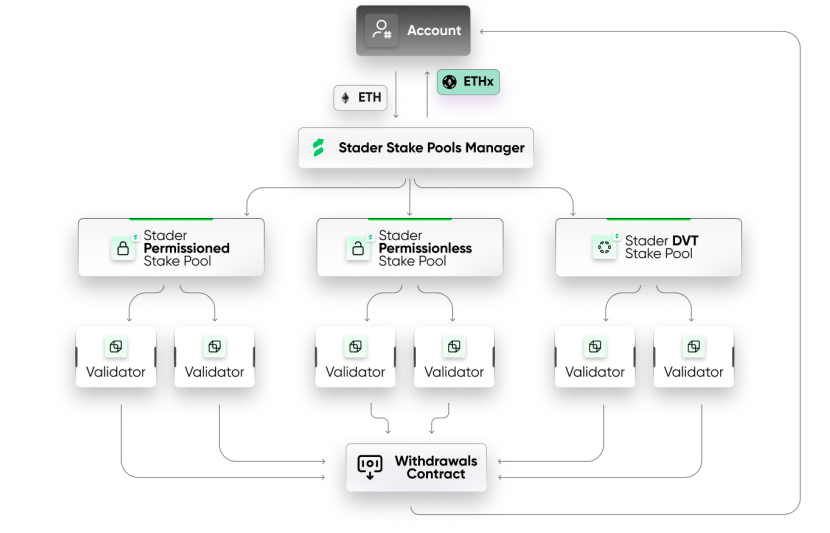

Stader is a smart contract-based, multichain and non-custodial liquid staking platform. Its primary objective is to assist users in earning staking rewards, all while providing an easy gateway to explore the opportunities within the DeFi ecosystem.

The team behind Stader is currently constructing essential staking middleware infrastructure for numerous Proof-of-Stake networks, catering to retail cryptocurrency users, exchanges, and custodians.

The concept of liquid staking revolves around the ability for users to create a token that encapsulates their staked assets. This token appreciates in value as the staking rewards pile up. Given the broad acceptance of these tokens in the DeFi space, users can concurrently secure the network through staking while participating in other activities.

The Stader (SD) Token

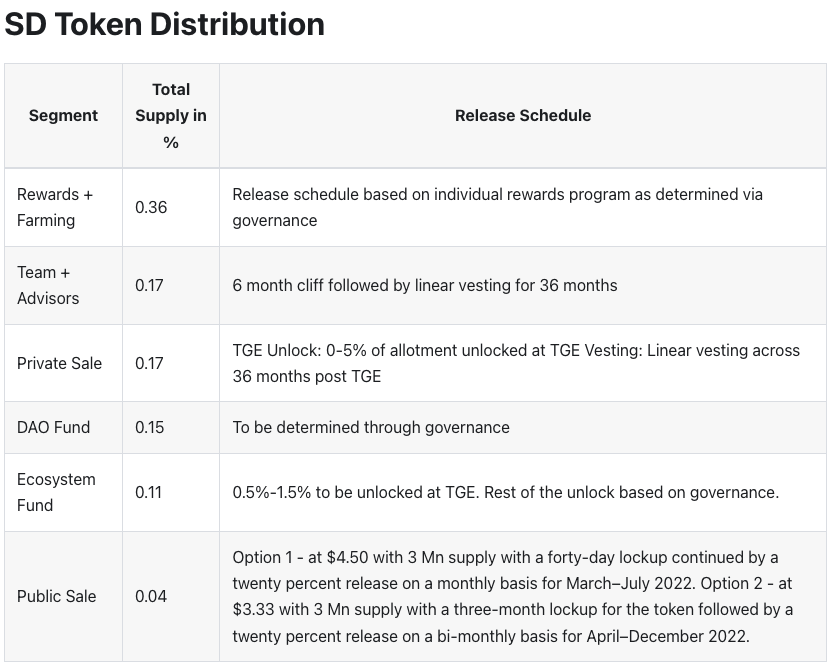

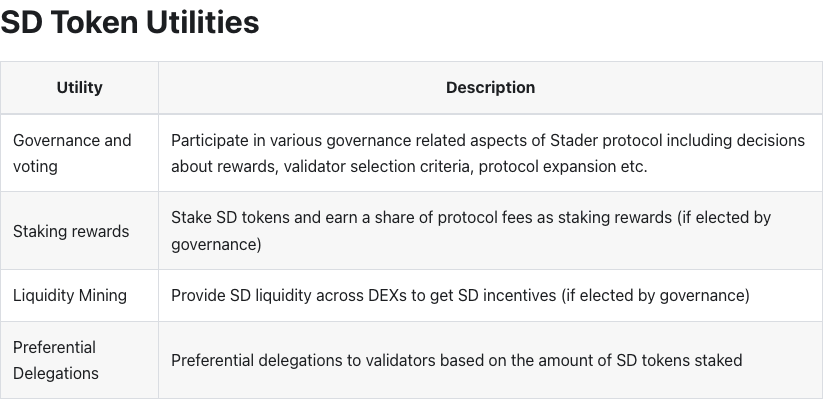

The native token for the Staker platform is the Stader (SD) token, which plays a critical role in governance and value accrual within the ecosystem. The SD token adheres to the ERC-20 standard and comes with a capped supply limit of 150 million tokens.

Stader strives to provide a robust and secure liquid staking solution. To ensure the highest level of security, the team carries out rigorous testing and review procedures on all codes. They assert that they routinely commission audits of their smart contracts by independent external auditors, with over ten successful audits across various chains. Furthermore, the team employs multi-signature administrative accounts for the modification of smart contract parameters.

Stader (SD) token is the native governance and value accrual token for Stader. It is an ERC-20 token in limited supply capped at 150Mn tokens. SD tokens can be purchased or traded on exchanges including KuCoin, Bybit, OKX, Huobi, Gateio, Uniswap and more.

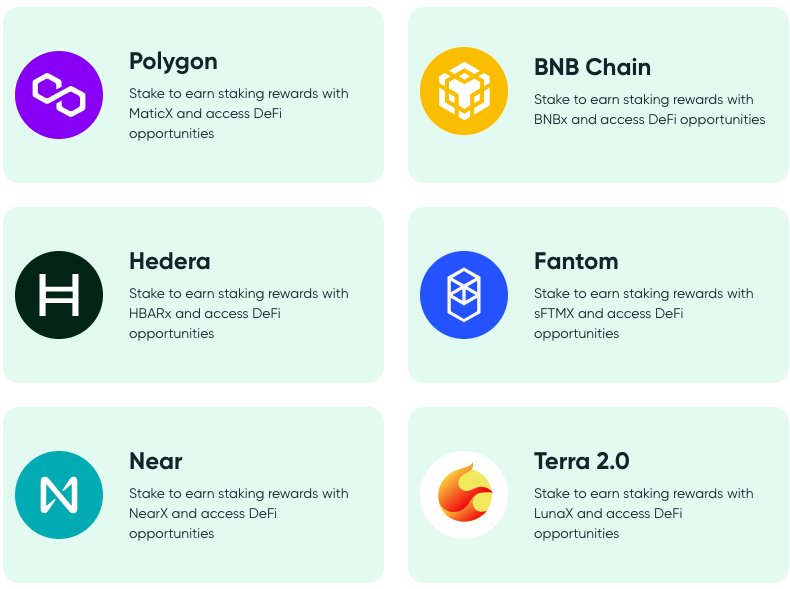

Stader is mutichain.

Stader on Fantom

What is sFTMX?

sFTMX serves as a liquid token that Stader users receive upon staking FTM. These tokens stand as a testament to their staked FTM and can be swapped at a future date for the staked FTM plus any rewards accumulated on the Stader platform. As the FTM rewards accumulate, the sFTMX tokens experience an increase in value.

Key Features of sFTMX?

sFTMX boasts an Annual Percentage Yield (APY) of over 4.7%. It offers the highest staking rewards, traditionally available to 365-day lock-ins, while also facilitating immediate liquidity on Decentralized Exchanges (DEXs).

sFTMX, with its cToken design, enhances DeFi interoperability by facilitating seamless integration with a variety of DeFi protocols. This ranges from DEXs to lending/borrowing protocols, and Yield Optimizers (including vaults, auto-compounders, and leveraged yield farming). This implies that the staking rewards are just the start of sFTMX’s potential.

By staking with Stader, user assets are distributed across a pre-selected set of validators, bolstering Fantom’s decentralization and reducing slashing risks.

How to Obtain sFTMX?

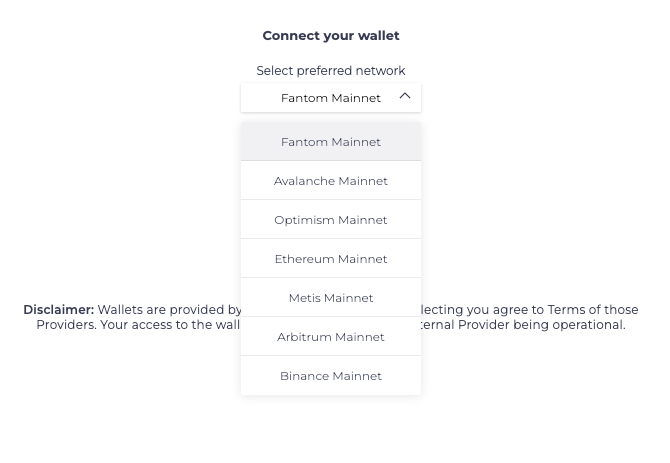

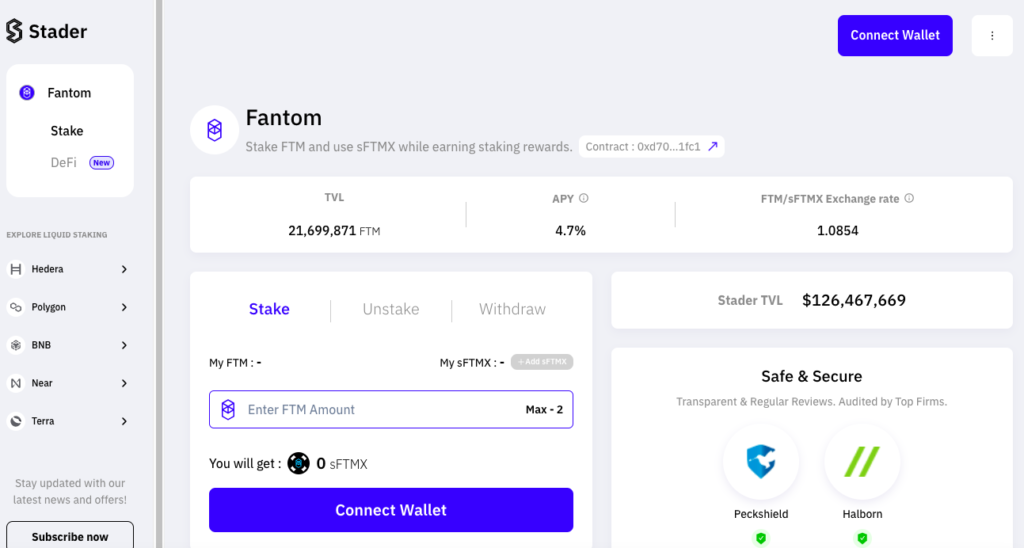

sFTMX can be minted directly through the Stader dapp, which is compatible with Metamask, Coinbase wallet, Wallet connect, and OKX wallet. Alternatively, users can acquire sFTMX by swapping at popular DEXs such as Spookyswap, Spiritswap, and Beethoven X. For instance, users can connect their MetaMask wallet to the Fantom network to perform this operation.

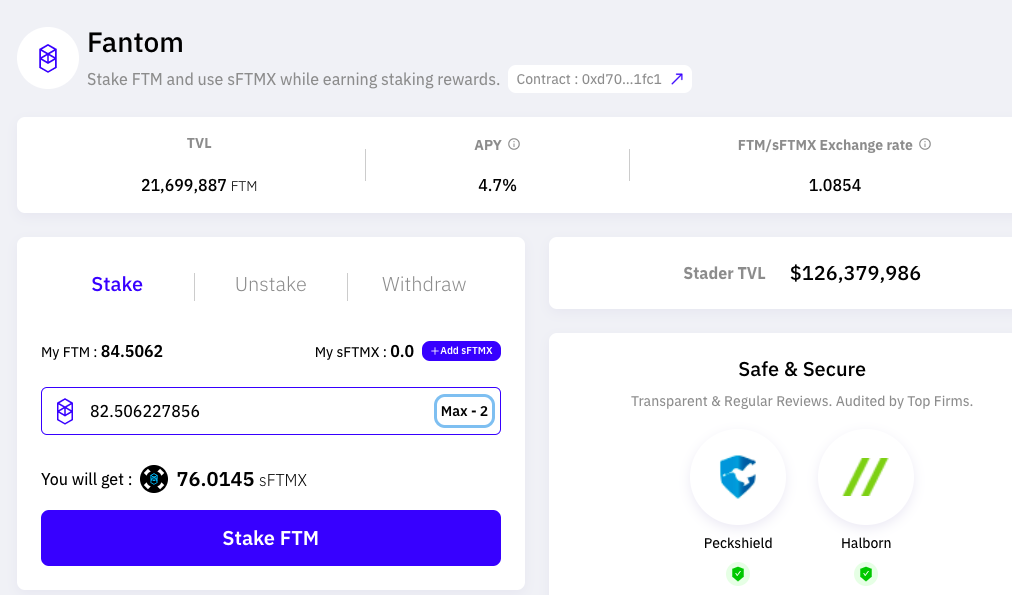

Once connected, you can choose how much FTM you want to stake in order to receive sFTMX.

As you can see in this example, we staked a bit of FTM and received our sFTMX.

Once you’ve received your tokens, you can also make sure you have added them to your web3 wallet i.e. MetaMask.

Where is sFTMX Accepted?

The Stader team has cultivated an extensive network of partnerships that recognize and accept sFTMX. This wide array of partners encompasses Decentralized Exchanges (DEXs), yield farming platforms, lending/borrowing services, and many more. The following partnerships are already in action:

- sFTMX liquidity pools on Spookyswap, Beethoven X, and Spiritswap

- sFTMX yield farming on Liquid Driver, Reaper Farm, Beefy Finance

- sFTMX lending/borrowing on Market.xyz and Tarot And this list is only set to grow!

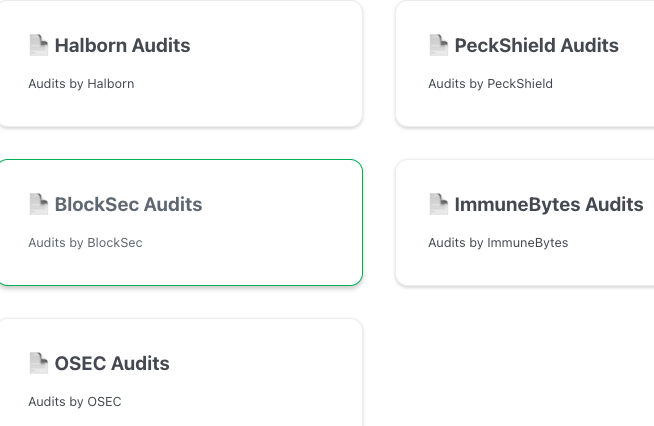

sFTMX Audit Status

The Stader team has developed FTM smart contracts that have undergone rigorous audits conducted by Peckshield and Halborn, earning them a clean slate.

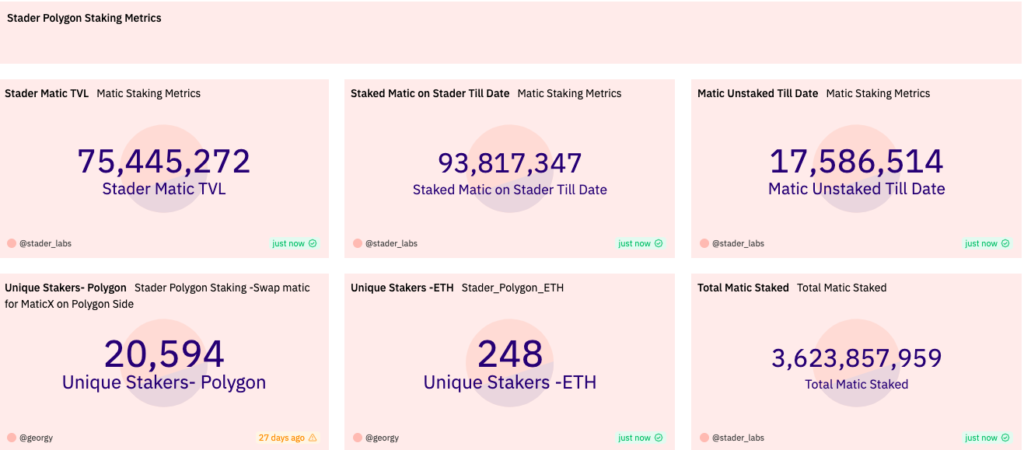

Stader on Polygon

Stader’s staking solution tailored for Polygon is MATICX. This liquid staking solution allows users to earn MATIC staking rewards while simultaneously participating in other DeFi protocols using MaticX and gaining additional rewards.

With Stader for Polygon, you benefit from:

- Liquidity via tokenization: The platform allows users to engage in DeFi activities using the liquid token.

- User-friendly staking: The design of the Dapp focuses on user experience, ensuring a smooth and straightforward staking process.

Stader on Hedera

What is HBARX?

HBARX is a token facilitated by the Hedera Token Service (HTS), representing your proportion of the total HBAR pool staked with Stader. Upon depositing HBAR into the Stader smart contract, you receive HBARX tokens, minted based on the exchange rate at the staking moment. As HBAR rewards accrue, the value of HBARX (relative to HBAR) increases.

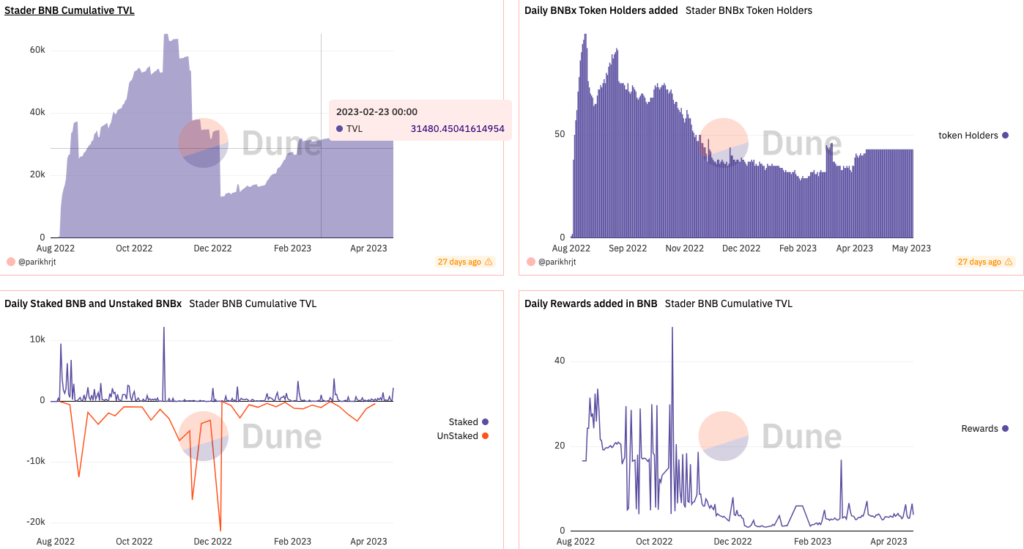

What is Stader for BNB Chain?

Stader’s service on the BNB chain offers a dependable liquid staking solution for BNB. It allows users to earn BNB staking rewards without having to maintain any infrastructure and permits users to engage in other DeFi strategies while accumulating rewards.

Stader’s solution for the BNB chain provides:

- Liquidity via tokenization: This enables users to participate in DeFi activities using the liquid token.

- User-friendly staking: The Dapp is designed with the user in mind, making staking effortless.

Stader’s Implementation on Near

Stader’s staking solution for Near is represented by NearX, a liquid staking solution for the Near platform. It allows users to earn Near staking rewards and simultaneously participate in other DeFi protocols using NearX, all while accumulating rewards.

The benefits of Stader for Near include:

- Liquidity via tokenization: Users can actively engage in DeFi using the liquid token.

- User-friendly staking: The Dapp’s design prioritizes the user experience, ensuring a seamless staking process.

The Process of Near Staking on Stader

A holder of Near tokens connects their wallet to the Stader Dapp and deposits tokens into the smart contract. They are immediately issued NearX tokens, representing their staked assets. As staking rewards are added, the value of NearX rises relative to Near.