Beethoven X Decentralized Investment Platform Review

What is Beethoven X?

Beethoven X is a project spearheaded by an anonymous group dedicated to bringing DeFi to Fantom Opera. Beethoven X is built on Balancer V2, Beethoven X is the first next-generation AMM protocol on Fantom Opera.

Beethoven X Platform Features

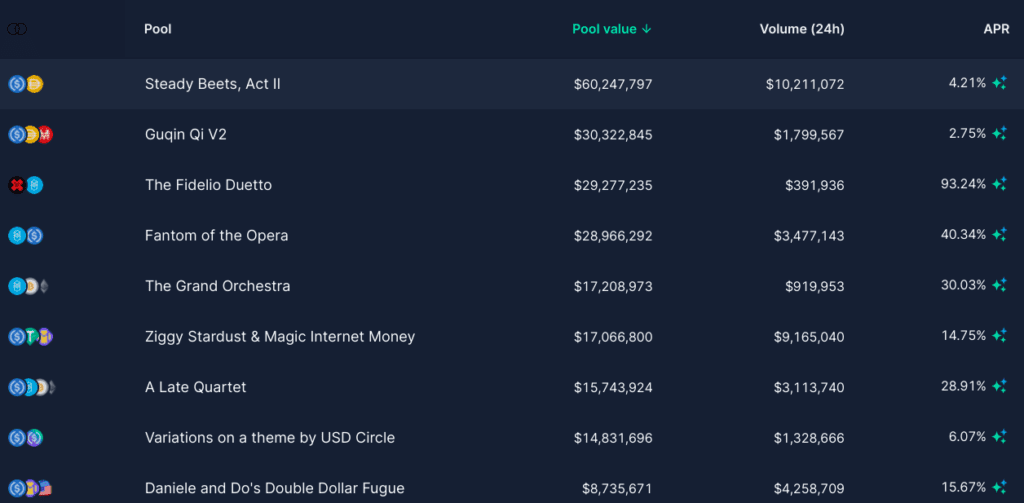

Beethoven X offers different types of pools. Some are Beethoven X’s own pools and some are community run pools. What’s unique about their offering are the Weighted Investment Pools which essentially have a unique take on the way index funds work. Instead of having fees paid out to portfolio managers in order for them to rebalance a user’s portfolio, the user can in fact collect fees from the traders, who will be tasked with rebalancing the portfolio through exploiting arbitrage opportunities.

These weighted investment pools each contain up to eight different digital assets and each of those tokens gets assigned a weight that defines what fraction of the pool is made up by each asset.

Beethoven X also offers Stable Pools. These are for assets that are meant to trade at near parity consistently for example, different stablecoin types or synthetic assets. To make this possible, Beethoven X utilizes the Curve popularized StableSwap automated market market maker (AMM). Such pools enable larger trades of those types of stable assets to take place before any significant price impact can be felt.

Trading on Beethoven X

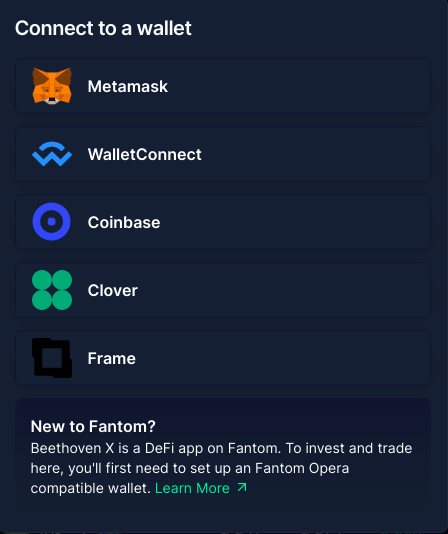

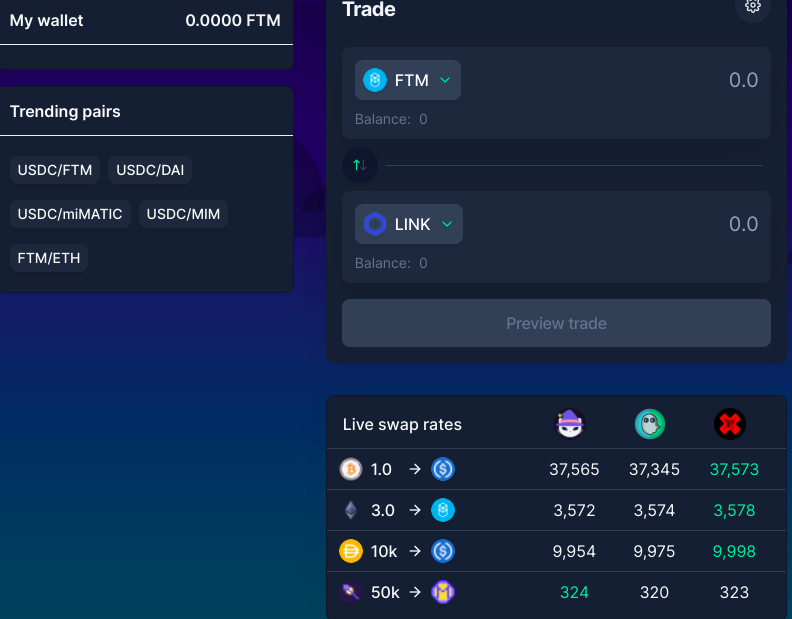

The platform’s trading experience is akin to that offered by other decentralised exchanges such as Uniswap. In order to swap between different crypto assets, a user simply needs to connect their Web3 wallet e.g. MetaMask.

Once a user’s wallet is connected they can swap different assets including FTM, LUNA, BAL, SOL, LINK, etc.

Beethoven X has a Smart Order Router (SOR) that effectively sources liquidity from multiple pools in order to figure out the best available price from all available pools in an automated fashion.

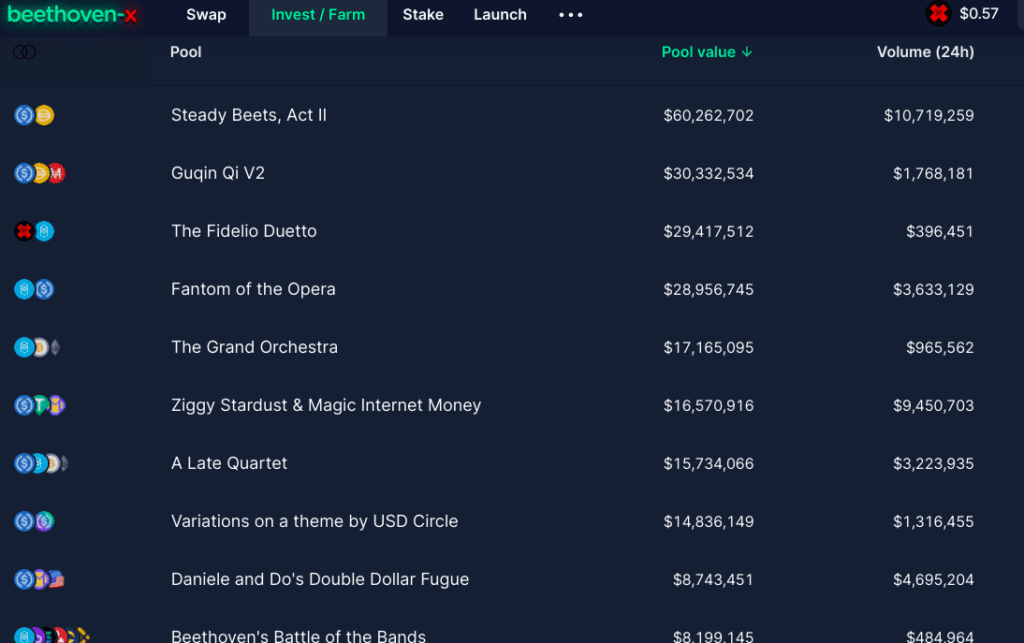

Beethoven X Farms

Users can stake their liquidity provider tokens and earn BEETS, the native token of the Beethoven X ecosystem. Users can also earn protocol fees that are distributed to liquidity

Stakers if they choose to provide liquidity in one of the 80/20 BEETS weighted pools. For doing so, a user can receive a portion of the 30% of the protocol fees that are distributed to stakers. Beethoven X uses 30% of the fees it makes on the platform to buy BEETS on the open market and redistribute them to liquidity stakers.

Beethoven X Protocol Fees

Beethoven X makes fees from traders using the protocol. Traders pay fees to liquidity providers and in return their swaps are enabled. When executing a trade, Protocol fees are typically denominated in the input token. The protocol fees for trades are generally collected as a percentage of the trade fees which means from a trader’s perspective, there’s really no noticeable price increase since the fees are simply a fraction of a fraction of the fees already being collected by the protocol. Interest on flash loans is also another source of protocol fees.

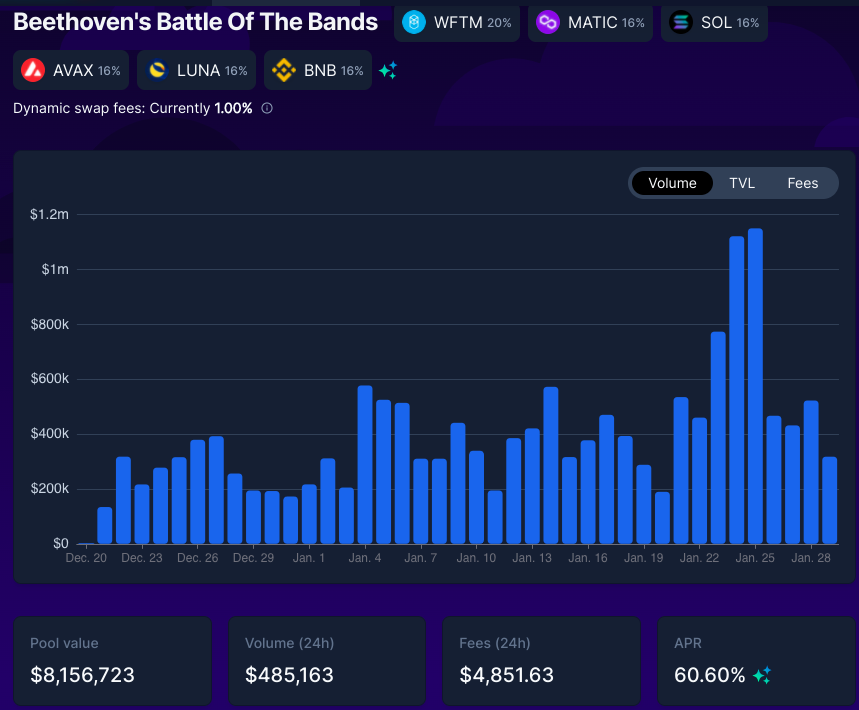

Beethoven uses 50% of protocol fees to build a diversified decentralised autonomous organisation controlled treasury. Users can provide liquidity to diverse pools offering different annual percentage rates as yield. Beethoven’s Battle Of The Bands pool for example is offering nearly 60% APR at the time of writing.