Zeta Markets – DeFi Derivatives Platform Review

What is Zeta Markets?

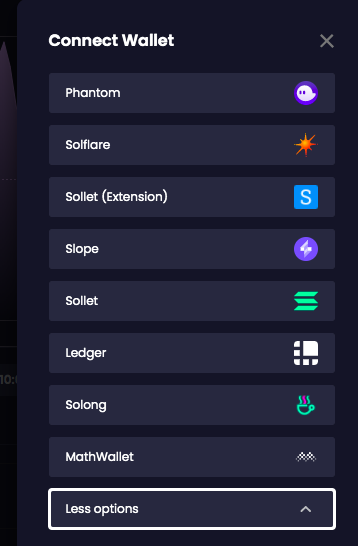

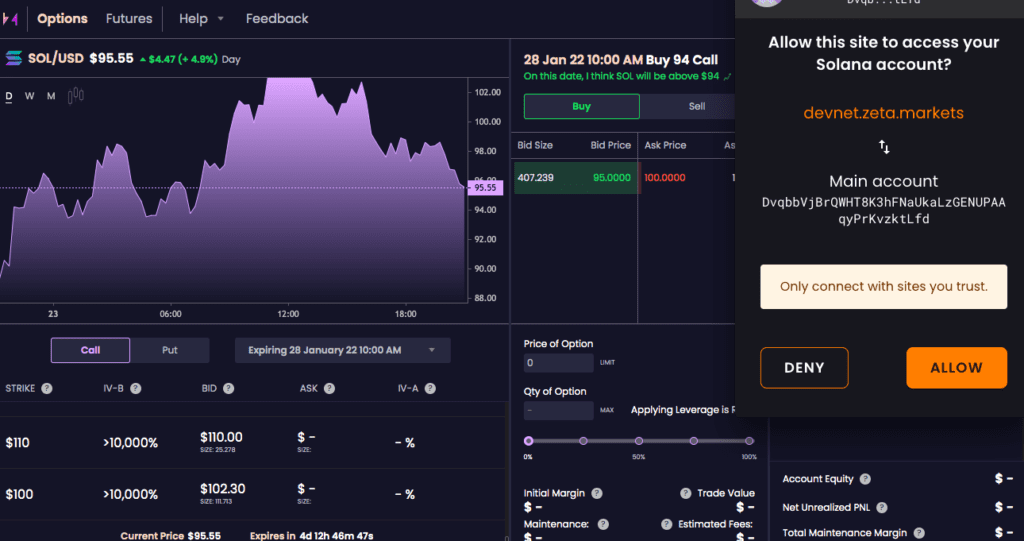

A decentralized platform that is built on Solana, Zeta Markets is a blockchain-based solution for facilitating non-custodial, liquid, and under-collateralized derivatives trading. The platform offers an intuitive front-end experience that is intended to cater to users from diverse trading backgrounds with differing degrees of trading experience. Zeta offers on-chain derivatives, futures and options. Users can currently access Zeta from both the devnet and mainnet. The platform can be accessed through web3 wallets such as Solflare.

In order to ensure users have accurate and reliable pricing updates and the capacity to execute trades and settle positions instantly with low gas fees of around US$0.01, Zeta makes use of Solana’s censorship-resistant infrastructure. Zeta has other protocol partners including Serum and Pyth.

Traders are able to post a fraction of the full price of the future or option, at the same time perform cross-margining in order that traders can be able to account for all holdings, all the while sharing profit and loss across all positions due to Zeta’s natively under-collateralized nature. The options market maker (OMM) is a function that prices and quotes all options and futures in real-time, on-chain, to ensure the platform guarantees liquid trading across all markets. Zeta’s goal is to provide the speed and deep liquidity of CeFi derivatives to DeFi and doing so while remaining permissionless and fully composable.

Zeta aims to offer a complete suite of derivatives with both options and futures for popular digital assets. The platform also offers features that are typically available on institutional-grade centralized exchanges such as:

- An orderbook and matching engine that is powered by Serum;

- Under-collateralized trading;

- Portfolio cross-margin;

- Sub-second mark-to-market updates; and

- Instant settlement.

How To Trade Futures On Zeta Markets

The Zeta project won the grand prize in the Solana Summer hackathon which had over 13,000 participants across the globe. From there the team managed to secure funding from some notable backers including Alameda Research, Solana Capital, LedgerPrime and others.

By leveraging Solana’s 400ms block time, Zeta is able to update prices and monitor positions multiple times per second. This also makes it possible to implement a margining system that enables an under-collateralized trading experience superior to that provided by centralized exchanges.

Key elements of the margin system on Zeta Markets

- Mark Pricing: it’s important to know the worth of a user’s position when it comes to under-collateralized trading because absent that data, their PnL and their risk is impossible to ascertain. With Zeta’s internal pricing engine, the Mark Price of all tradable assets is easy to calculate. This data is also useful for informing the system of margin and collateralisation. Zeta makes use of the Nobel prize winning Black-Scholes-Merton model called the Black-76 model for options pricing. The model factors in future price, volatility, interest rate, strike and time to expiry.

- Collateral Framework: since under-collateralized trading is essentially reliant on efficient capital utilization, this framework is crucial for capital management within the system. It is still important to note that when trading more than you have, there are inherently higher risks involved. The collateral framework is effectively there to maintain a balance in order for the exchange to function properly.

- Liquidation Mechanism: this mechanism is in place in order to keep the platform from losing funds. With it, liquidators can intervene when a user’s trading account is too risky to continue trading. In essence, when this occurs the user gets liquidated to ensure that the losses don’t extend beyond that particular user.

How To Trade Options On Zeta Markets

Margin Accounts on Zeta Markets

On Zeta Markets, when a user deposits USDC to the platform, an account is atomically created. At present, Zeta only accepts USDC as collateral. This means that users are only able to deposit and withdraw USDC from the system. All trades are settled and margined in USDC. Zeta supports around 46 markets currently and charges approx 0.044 SOL as rent exemption on the margin account. Margin accounts essentially keep track of a user’s state across a particular underlying asset. It stores all the important data for the user state bookkeeping such as the balance, trading fees, open orders, positions, cost of trades, etc.