Top 10 Non-KYC Crypto Exchanges 2025

The demand for no-KYC crypto exchanges continues to rise as cryptocurrency traders seek privacy and convenience. These platforms offer an alternative to traditional exchanges, allowing users to trade without undergoing identity verification. Despite increased regulatory scrutiny, several no-KYC platforms remain available, combining privacy, security, and functionality.

Here’s a list of the 10 best no-KYC crypto exchanges in 2024, including their unique features, benefits, and limitations.

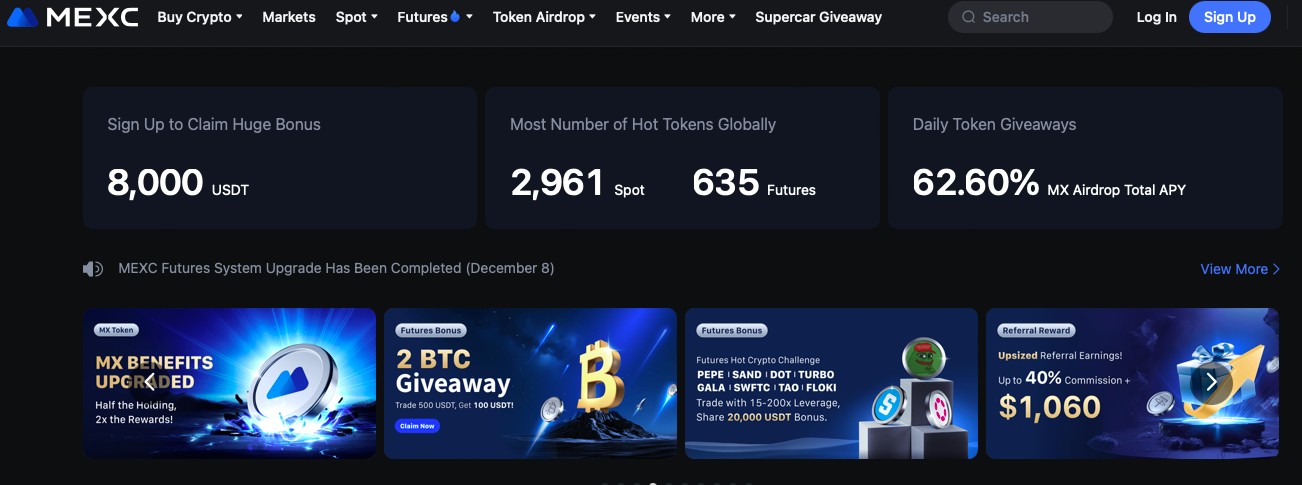

1. MEXC: Leading Exchange for Diverse Markets

- No-KYC Features: Spot, margin, and futures trading available without KYC; withdraw up to 5 BTC daily.

- Fees: 0% maker and 0.02% taker for spot trading.

- Regional Restrictions: Restricted in the US, Canada, and China.

- Pros:

- Supports over 2,300 cryptocurrencies.

- Low trading fees.

- High liquidity for diverse trading pairs.

- Cons:

- Limited availability in major markets.

- Higher withdrawal limits require verification.

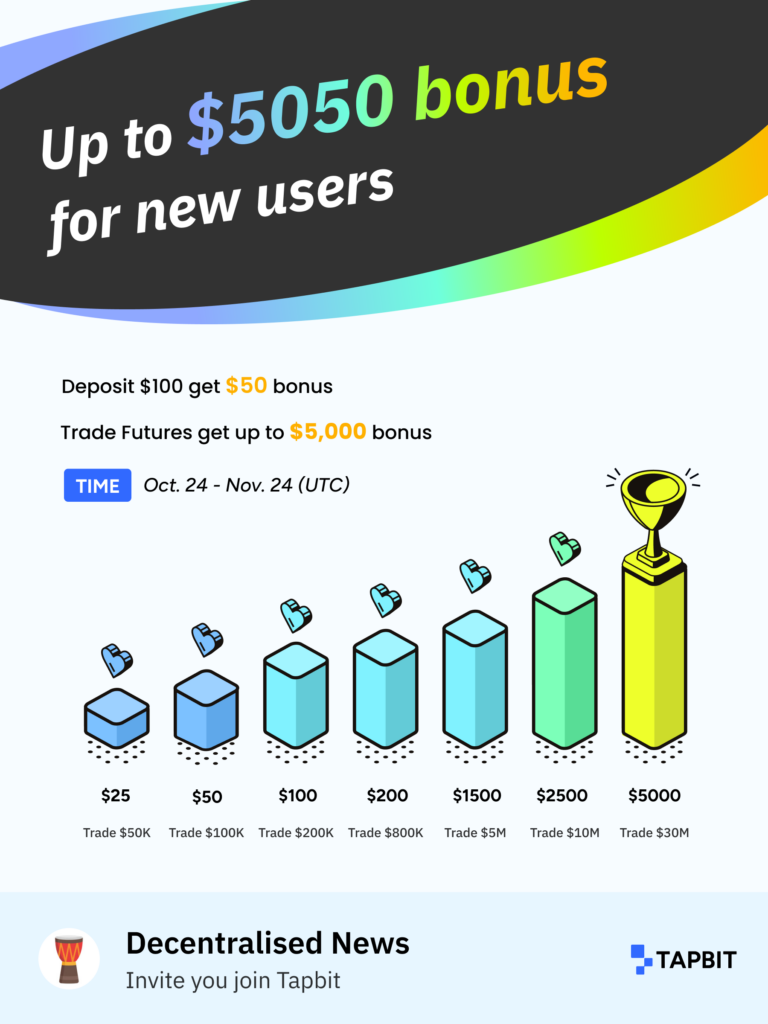

2. Tapbit: User-Friendly and Secure

- No-KYC Features: Spot and futures trading available without verification; non-KYC users can withdraw up to $20,000 daily.

- Fees: 0.02% maker and 0.04% taker.

- Regional Restrictions: Not available in the US and a few other regions.

- Pros:

- Offers 100x leverage for futures trading.

- Modern and intuitive interface.

- Advanced trading tools, including copy trading.

- Cons:

- Limited withdrawal for non-verified users.

- Fewer supported cryptocurrencies compared to competitors.

3. Bitunix: Rising Star in Crypto Derivatives

- No-KYC Features: Trade with up to 50x leverage and withdraw up to $10,000 daily without KYC.

- Fees: 0.06%–0.1%.

- Regional Restrictions: Restricted in the US and a few other countries.

- Pros:

- Competitive trading fees.

- Advanced analytics and trading tools.

- High liquidity for derivatives markets.

- Cons:

- Limited fiat on-ramp options.

- Smaller asset selection compared to larger platforms.

4. dYdX: Best Decentralized Exchange for Perpetuals

- No-KYC Features: Permissionless perpetual trading with no deposit or withdrawal limits.

- Fees: 0.02%–0.05%.

- Regional Restrictions: US and China restricted.

- Pros:

- Non-custodial trading for added security.

- DAO governance and token rewards.

- Seamless integration with wallets.

- Cons:

- Limited to Ethereum-based assets.

- Complex for beginners.

5. Uniswap: Best DEX for DeFi Enthusiasts

- No-KYC Features: Unlimited swaps and liquidity provision without KYC.

- Fees: 0.3% per transaction.

- Regional Restrictions: Restricted in Iran, Cuba, and Belarus.

- Pros:

- Permissionless trading across multiple chains.

- Access to a vast array of DeFi tokens.

- Highly liquid pools.

- Cons:

- High gas fees on Ethereum.

- Limited features compared to centralized exchanges.

6. PrimeXBT: Best for High-Leverage Trading

- No-KYC Features: Trade crypto, Forex, and commodities without verification; $20,000 daily withdrawal cap.

- Fees: 0.05%.

- Regional Restrictions: Not available in the US, Canada, and Algeria.

- Pros:

- Supports up to 200x leverage for crypto futures.

- Comprehensive market offerings beyond crypto.

- Robust copy trading platform.

- Cons:

- Limited access for non-verified users.

- Restricted in major regions.

7. CoinEX: Solid Option for Spot and Futures

- No-KYC Features: Trade and withdraw up to $10,000 daily without KYC.

- Fees: 0.08%–0.16%.

- Regional Restrictions: Not available in the US and China.

- Pros:

- Over 1,000 trading pairs.

- Beginner-friendly interface.

- Decent liquidity for day trading.

- Cons:

- Withdrawal limits for non-KYC users.

- High fees for non-VIP users.

8. LBank: Best for Spot Trading with Low Fees

- No-KYC Features: Non-verified users can withdraw up to 10 BTC daily.

- Fees: 0.02%–0.1%.

- Regional Restrictions: Restricted in the US, North Korea, and others.

- Pros:

- Offers 125x leverage on derivatives.

- Over 600 cryptocurrencies supported.

- 24/7 customer support.

- Cons:

- Limited access in several regions.

- Withdrawal restrictions for non-verified users.

9. Changelly PRO: Best for Instant Swaps

- No-KYC Features: Crypto-to-crypto swaps with 1 BTC daily withdrawal limit.

- Fees: 0.1%.

- Regional Restrictions: Not available in the US, Cuba, and North Korea.

- Pros:

- Supports over 500 cryptocurrencies.

- Seamless wallet integrations.

- Simple, user-friendly interface.

- Cons:

- Limited services for non-verified users.

- Higher fees for fiat transactions.

10. Phemex: Versatile Platform for Spot and Futures

- No-KYC Features: Up to $50,000 daily withdrawals for non-verified users.

- Fees: 0.01%–0.1%.

- Regional Restrictions: Restricted in the US, UK, and Canada.

- Pros:

- Low fees on futures trading.

- Wide range of supported assets.

- Mobile-friendly platform.

- Cons:

- No fiat trading pairs.

- Regional restrictions limit accessibility.

Why Use a No-KYC Exchange?

- Privacy: Avoid sharing personal information.

- Speed: Bypass lengthy verification processes.

- Global Access: Use platforms even in restricted regions.

Key Considerations When Choosing a No-KYC Exchange

- Limits: Many no-KYC exchanges cap withdrawals and services for non-verified users.

- Security: Ensure the platform has robust security measures.

- Fees: Look for competitive rates to maximize profits.

- Liquidity: High liquidity minimizes slippage during trades.

Conclusion

Whether you’re a seasoned trader or a privacy-conscious beginner, no-KYC exchanges provide valuable options for crypto trading. Platforms like MEXC, Tapbit, and Bitunix offer robust features and competitive fees, while Uniswap and dYdX cater to those in the DeFi space.

While no-KYC exchanges emphasize privacy, they require users to exercise caution. Always research platform security and transfer funds to personal wallets for safekeeping. Balancing privacy with security ensures a seamless trading experience in 2024 and beyond.