AVNU Decentralised Exchange Review

What is AVNU?

AVNU is a decentralized exchange aggregator, aiming to deliver optimal execution in DeFi on Layer 2. DEX aggregators pull together liquidity from various decentralized exchanges (DEXs). AVNU focuses on providing enhanced pricing, no slippage, protection against MEV, and trading without gas fees, to facilitate highly efficient and smooth DeFi operations.

Automated Market Makers (AMMs) have significantly contributed to DeFi’s expansion, presenting multiple advantages for users. Nonetheless, sole dependence on AMMs can introduce drawbacks like inefficiency in capital use, suboptimal price discovery, and several risks (such as impermanent loss, vulnerabilities, and MEV assaults). DeFi‘s scaling is hindered by relying only on AMMs.

How AVNU Works

AVNU advocates for a blend of diverse liquidity sources for superior execution. Hence, AlphaRoad’s evolution into AVNU introduced Starknet’s first Request-for-Quote (RFQ) system and a DEX aggregator, synergizing to enhance the trading experience for users:

What Makes AVNU Unique?

RFQ System

Utilizing professional market makers and off-chain price algorithms, the RFQ system offers improved pricing and more precise quotes. This method refines the price discovery mechanism and reduces concealed costs. Cryptographic signatures in this system provide MEV protection, averting front-running and ensuring safe trading.

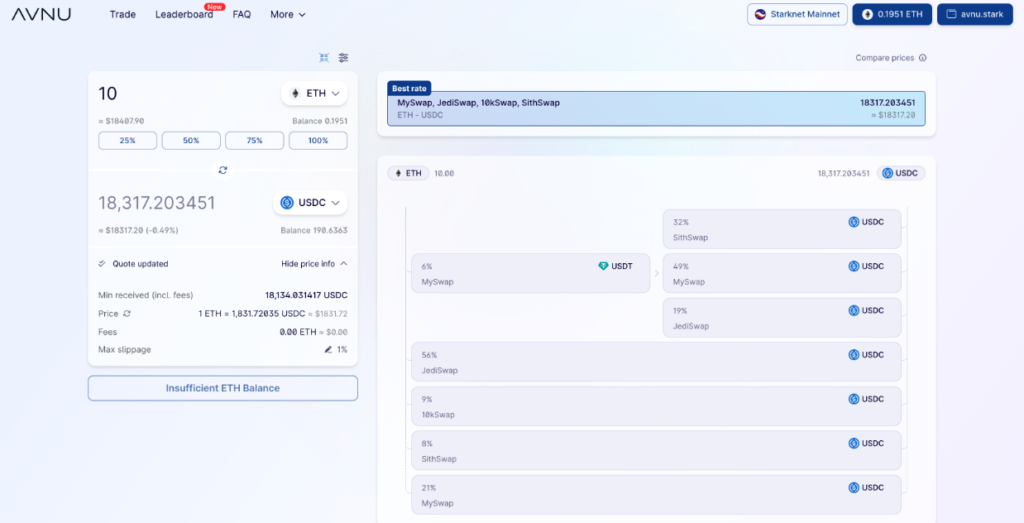

DEX Aggregator

This component searches and amalgamates liquidity from various AMMs, identifying optimal trade routes to reduce slippage and enhance execution. AVNU’s aggregation of multiple liquidity sources guarantees access to the most competitive market prices.

AVNU’s mission is straightforward: to facilitate the finest execution possible.

What tokens can be traded on AVNU?

AVNU currently supports the following tokens for swapping on Mainnet:

- ETH

- DAI

- USDC

- USDT

- WBTC

Additionally, any valid ERC20 token can be imported for trading.

AVNU operates as a decentralized exchange, giving users complete control over their tokens during trades. Contrasting with centralized exchanges like Binance and Coinbase, AVNU does not hold users’ tokens. All transactions occur directly from the user’s Starknet wallet. While using Starknet and smart contracts through AVNU is generally secure, some inherent risks exist.

Service Fees on AVNU

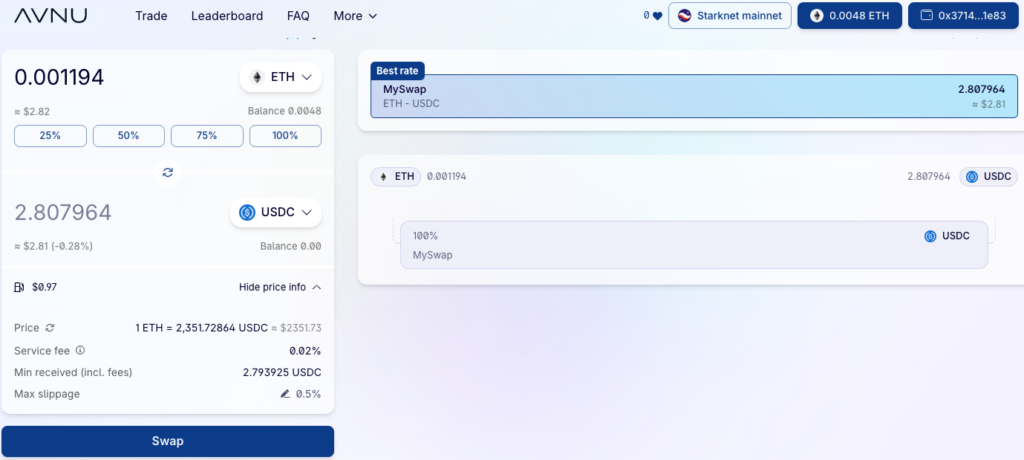

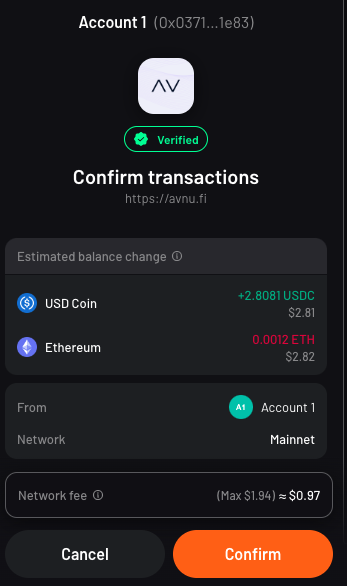

A nominal fee of 0.02% applies for direct routes, while 0.15% is charged for more complex routing.

These reasonable fees contribute to AVNU’s ongoing viability, with a strong commitment to providing an unmatched trading experience in the DeFi sector.

How to Trade on AVNU

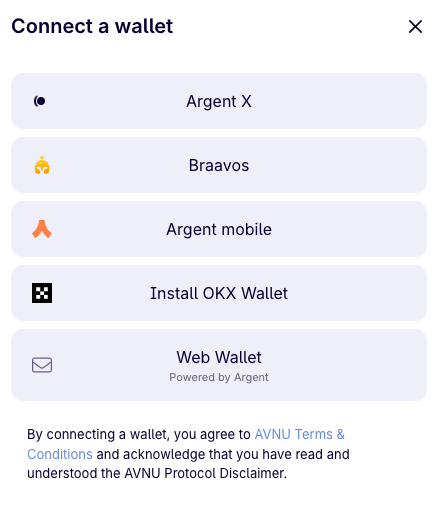

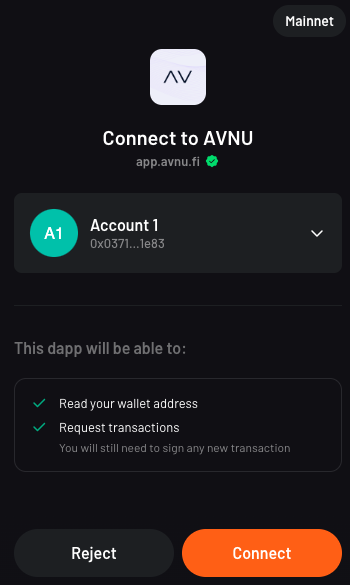

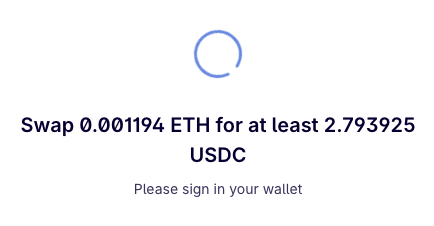

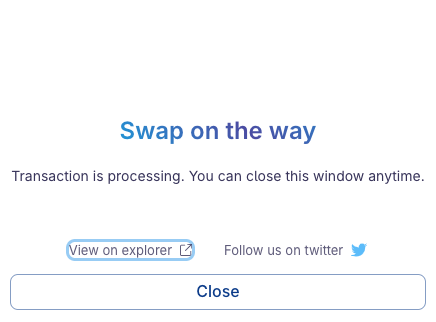

To begin using the AVNU platform, simply connect your web3 wallet.

Since AVNU is deployed on StarkNet which makes transactions very cheap. Users are able to do micro transaction digital asset swaps that would be impossible on most layer 1 blockchain networks such as Ethereum.

Pay the small network fee.

Pay the small network fee.

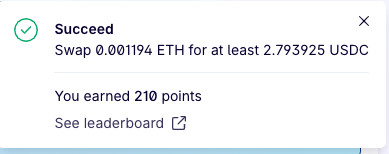

You earn point for making transactions. Perhaps this may help you also meet some of the eligibility criteria for the long-awaited StarkNet airdrop

You earn point for making transactions. Perhaps this may help you also meet some of the eligibility criteria for the long-awaited StarkNet airdrop

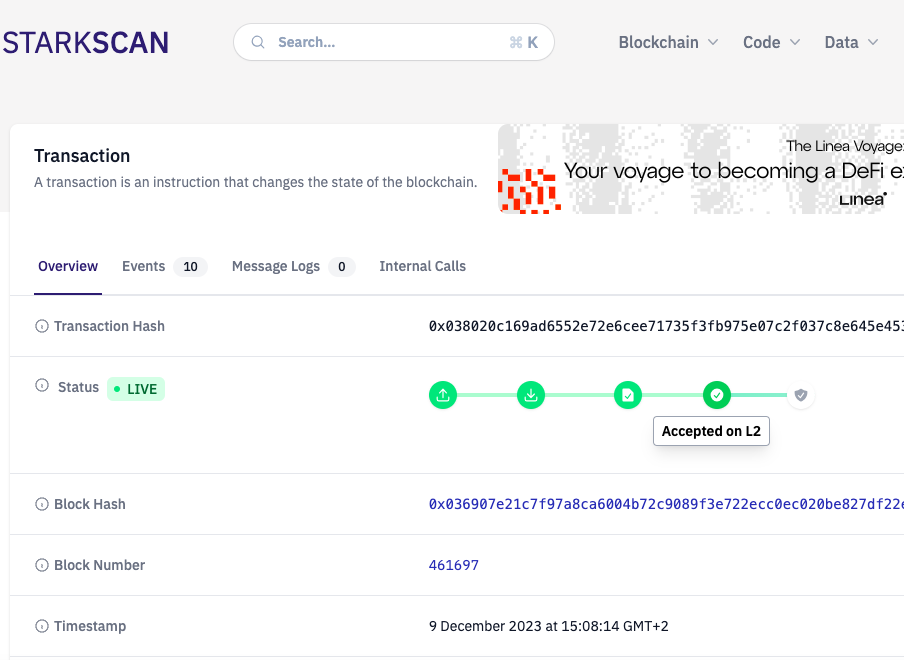

You can verify your transactions on StarkScan.

Conclusion

AVNU is a neat and simple to use DEX on StarkNet. It’s yet another platform demonstrating the power of decentralised finance and give us a look into what is possible with DeFi capital market infrastructure. Although users can’t yet trade sophisticated products such as derivatives and perpetual markets, AVNU is a gateway into the StarkNet ecosystem and how users can trade liquid markets with very low fees.