Conic Finance Review

What is Conic Finance?

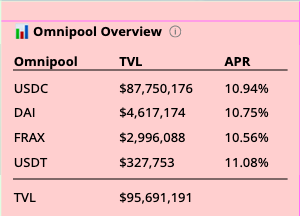

Conic Finance offers a user-friendly platform that allows liquidity providers to conveniently diversify their involvement in several Curve pools. Users can funnel liquidity into a Conic Omnipool, designed to distribute funds across Curve according to protocol-regulated pool weights.

The introduction of Conic Omnipools by Conic Finance means that liquidity can be dispersed across various Curve pools via a single asset, providing Conic liquidity providers (LPs) with access to numerous Curve pools through a solitary LP token. Curve LP tokens are automatically committed to Convex to accrue CVX and CRV rewards. Furthermore, Conic LPs are granted CNC, the token of the Conic DAO. The distribution of liquidity in an Omnipool towards Curve pools is determined by target allocation weights, which undergo routine updates through a liquidity allocation voting process conducted by the vote-locked CNC holders.

The Omnipools utilised by Conic serve as liquidity pools for a singular asset, facilitating the distribution of liquidity into multiple Curve pools. The Curve LP tokens are deposited on Convex and staked in the associated Convex pool rewards contracts, enabling an LP to attain exposure to a range of Curve pools via one LP token while earning CRV and CVX.

Additionally, each Curve pool is assigned a liquidity allocation weight by Conic Omnipools, which dictates the portion of an Omnipool’s liquidity that a Curve pool receives. Besides CRV and CVX, Conic LPs are awarded the CNC, the Conic Finance DAO token, which can be locked to obtain vlCNC, thus enabling involvement in protocol governance.

Biweekly, the liquidity allocation weights of each Omipool are refreshed through a DAO vote, allowing vlCNC holders to participate. While Curve and Convex provide mechanisms for using CRV and CVX to vote on gauge inflation weights to adjust CRV emissions across Curve pools, Conic supplies a mechanism for altering weights that directly transfer liquidity of one or more assets across Curve pools. Despite the complexities of managing slippage, gas costs, and flash loan attack risks associated with single-sided liquidity provision, Conic utilises a blend of oracles, LP token pricing mechanisms, and rebalancing incentives to guarantee secure execution of liquidity shifts.

What Makes Conic Unique?

Conic’s primary objective is to permit users to distribute their exposure over numerous Curve pools with a solitary asset, specifically facilitating users to allocate their asset (like ETH) to multiple Curve pools in a single transaction. The key targets of Conic encompass:

- Omnipools: Enabling users to deposit a singular asset into a Conic Omnipool that disperses liquidity among various Curve pools.

- Liquidity Distribution: Providing a remedy to the current liquidity contribution in the Curve ecosystem, which is primarily influenced by incentivized liquidity. This is accomplished by instituting Conic governance that allows vlCNC holders to directly manage which Curve pools gain liquidity.

- Governance: Establishing a protocol that is directed and governed by the Conic community through a self-regulating DAO.

- Ecosystem: Aiming to construct a protocol that encourages the development and durability of the Curve ecosystem.

Regarding platform fees, a Conic Omnipool may impose charges on CRV and CVX earnings, contingent on protocol governance. All collected fees will be paid to vlCNC holders.

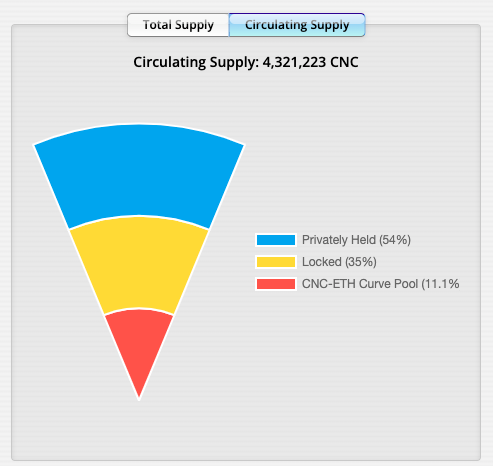

In terms of Tokenomics, the CNC token acts as the governance token for the Conic DAO and can be locked for vlCNC to participate in governance. The distribution of CNC is as follows:

- Liquidity Providers: Conic LPs obtain a proportion of minted CNC that corresponds to the share of liquidity they contribute.

- Incentivized Deposits and Withdrawals: When liquidity allocation weights in an Omnipool are modified, deposits and withdrawals that “rebalance” the Curve pools towards their target weights are incentivized with CNC.

- Stakers of the CNC/ETH AMM LP token: A total of 10% of the total CNC supply is awarded to stakers of the Curve factory pool CNC/ETH LP token to encourage adequate levels of liquidity for swaps.

How to Purchase $CNC Tokens

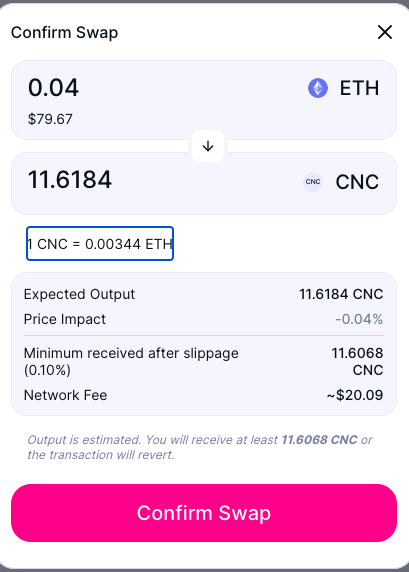

To purchase $CNC tokens, simply connect your web3 wallet to a decentralised exchange such as Uniswap. Alternaltivey, you can also purchase or trade $CNC on centralised exchanges such as MEXC.

In the Conic DAO, holders of CNC can lock their tokens for vlCNC. Analogous to other vote-locked tokens (like vlCVX or veCRV), vlCNC is non-transferable. CNC can be locked for a minimum of 4 months up to a maximum of 8 months. Users can relock all or some of their locks at any point.

For vlCNC, Conic employs a set of standard boosts for CNC lockers, which will determine their final vlCNC balance. There will also be two temporary boosts airdropped to v1 lockers and veCRV holders at launch. The vlCNC balance determines the voting power and fees a vlCNC holder receives. Note that not all boost factors apply to the vlCNC balance for fee distribution. All boost factors are multiplicative when calculating the total boost for a single lock.

Holders of vlCNC can engage in the Conic DAO and vote on proposals via Snapshot. This includes a bi-weekly liquidity allocation vote (LAV), during which the liquidity allocation weights of each Omnipool (the respective Curve pools) are refreshed. In addition to receiving a share of Conic’s platform fees, vlCNC holders may vote on other proposals, such as protocol parameter updates.

An essential vote will be the whitelisting of Curve pools. For a Curve pool to be eligible to be part of an Omnipool and receive a non-zero liquidity allocation weight, the Curve pool must first be whitelisted via a DAO vote.

Conclusion

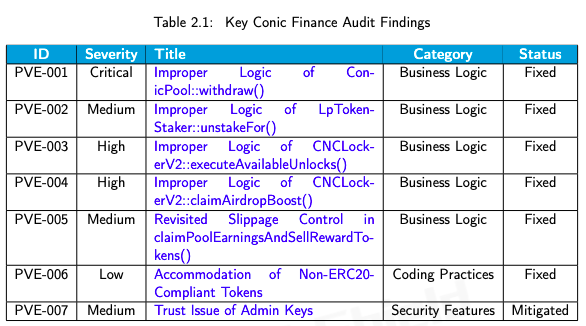

Platforms such as Conic Finance are demonstrating the power of DeFi. There are still risks associated with these early iterations of what will truly be a revolutionary space. It is therefore important that you do your known research and ensure the platforms you use have had their code audited as one of many precautionary measures for risk mitigation.