Is it too late to buy bitcoin? Cost averaging with South African (Rand) case study

During the first quarter of 2021, Bitcoin and other cryptocurrencies grew and made new all-time highs. Even though the market has had some notable corrections recently, it still appears the interest in cryptocurrencies is not waning.

Many people, especially those who are still new to the crypto markets wonder whether it is too late to buy bitcoin now and also where the bitcoin price might be in a few years. If the past sets a precedent to base predictions on, then the likely answer would be that the price could potentially be higher. The price is expected to take a dip when the market cycle and sentiment goes from bullish to bearish which could see the price of bitcoin come significantly down from the highs we’ve witnessed recently. That doesn’t however spell trouble for the relatively new asset class. In fact, the opposite could be true. Cryptocurrencies are still an unfamiliar phenomenon to the majority of the world but as they gain wider adoption, it is feasible that even higher highs could be seen if the demand rises, especially when it comes to cryptos with a limited supply such as bitcoin.

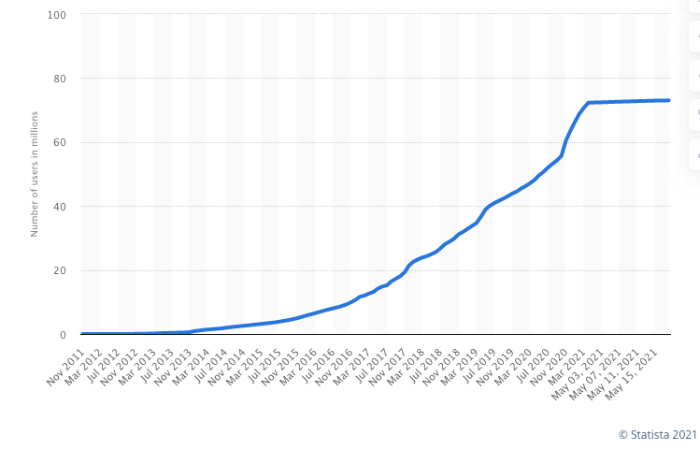

According to the Bloomberg Crypto Outlook report, the technical outlook for Bitcoin in 2021 remains strongly upward, if past patterns repeat. In addition, when you consider that the number of blockchain wallet users has been steadily rising, it’s not out of the realm of possibilities that further price appreciation can still be realised.

If you are looking to buy Bitcoin as a long term investment in South Africa, then utilizing the Rand cost averaging method could be an effective strategy.

What is Rand Cost Average?

Rand Cost Average simply involves investing a fixed amount of Rand into buying Bitcoin over a specific time period.

Suppose you decide to buy BTC worth 100 rands every week, this process is what is referred to as Rand cost averaging.

Rand Cost Averaging (RCA) – How it Works

Buying BTC without RCA

Let’s say around January 2018, when BTC was around $13,800 per BTC, you decided to buy 14567.670 ZAR ($1000) worth of Bitcoin. This simply means you owned about 0.0724 BTC.

Buying BTC with RCA

If Rand cost averaging, what you’d essentially do is that instead of using your entire budget of 14567.670 ZAR ($1000) in one go for instance, you opt to spread out your purchases across ten months – let’s say buying 1456.767 ZAR ($100) on a P2P exchange on a monthly basis.

Within that 10 month period, you would have accumulated about 0.122 BTC, which is almost 2 times more than if you had bought without Rand cost averaging even though the same amount was invested. This is because you’d be buying at different price points which would work out cheaper on average. By regularly purchasing at intervals regardless of the asset’s price, you do not try to time the market – which is one of the hardest feats to achieve in the world of investing. By using a constant rand plan, you are able to neutralize short-term volatility.

This system is best for those who want to invest a fixed amount of Rand into accumulating bitcoin long term, but do not want to put all their capital in at once to avoid price peaks.

Rand cost averaging like every other method of investment, has its advantages and disadvantages. Let’s look at a few of the pros and the cons and then you can decide if using RCA is the best method for you if you decide to buy BTC.

Positives

- Takes emotions out of the equation

One of the most significant advantages of the Rand cost averaging method is that it takes away the emotions associated with trying to identify perfect market entry points. It also encourages capital deployment that is systematic or calculated and not random or sporadic. With RCA you can be more conservative in your investment approach by investing small sums over a longer period.

By taking the emotional component out of your decision making, you’re also inclined to worry less about the day-to-day price volatility since your focus will be playing the long game. Investors who use the Rand cost averaging method typically aren’t reluctant to buy when the market dips which puts them in a better position to confidently continue to buy even when the market sentiment is fearful, meaning a higher probability to buy bitcoin at opportune prices.

- Helps avoid bad market timing

Markets are cyclical with upward and downward trends or sideway market movements. Using all your funds to buy bitcoin in one go at a specific time can pose significant risks and even result in losses. This could be because of unforeseen circumstances that unfavourably shift the market, or simply other factors beyond your scope of understanding prior to your decision to buy at the time.

Rand cost averaging is useful at reducing some of that risk since your purchases are made to schedule with the price factor largely inconsequential as far as factoring it into the decision making when taking that investment approach.

Furthermore, since crypto markets are highly volatile and prices of cryptocurrencies can drop as much as over 30% in just a few hours, if you use the RCA strategy it means instead of having all your capital invested at once, you can instead have funds to buy at bottom prices should the market trend turn bearish.

- Doesn’t require large amounts of capital

RCA strategy often means that you invest small amounts of money on a regular basis for a fixed period. Hence, it doesn’t require a lot of funds to be invested all at once. It means you could allocate just a small portion of your monthly earnings toward it. It is an ideal strategy for those who fear losing their life savings.

- Buys you time to learn the market without being over invested

With the RCA strategy, you don’t have to feel like you’re missing out since you’ll be actively participating in the market but without putting all your capital at risk. This could buy you time to research the market and learn more about the crypto space while conservatively and steadily building your portfolio.

Negatives

- Doesn’t allow large volume buying at bottom prices

Although RCA prevents you from buying a lot of Bitcoin at market top prices, it also makes it difficult to reserve a lot of your capital in order to buy at the market bottom prices should such an opportunity arise.

- Potential low ROI in bullish market

Since the primary purpose of using the Rand cost averaging method is to help investors mitigate their risk, it could also result in a low ROI. The theory of risk and return dynamic states that the higher the risk, the higher the return, the lower the risk, the lower the return.

Put another way, if you had budgeted $100 monthly investment and suppose bitcoin rose by 10%, your return on investment is $10 but if you had put, let’s say $1000 and Bitcoin rose by 10% your return on investment is $100.

- Higher transactional fees

With RCA, you are accumulating some percentage of Bitcoin over a specific period of time. As a result, you could incur higher transactional fees in the process which could potentially affect your portfolio’s overall profit. Since you have to execute multiple buy orders instead of a one-off fee in the case of bulk buying, you may end up paying more on transaction fees.

Find out the 20 best and secure platforms to buy BTC in South Africa.