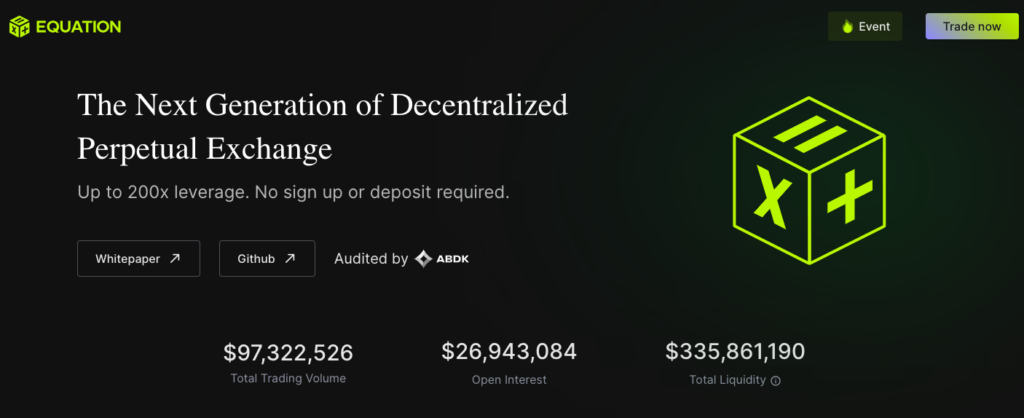

Equation Decentralized Perpetual Exchange Review

What is Equation?

Equation is a perpetual contract protocol on the Arbitrum network, providing traders with up to 200x leverage and an expansive liquidity pool via the novel BRMM approach.

Equation enables boundless liquidity without capping trade sizes, along with a notably low maintenance margin of 0.25%, minimizing the risk of liquidation. Unlike traditional services, Equation steers clear of direct brokering between opposing trades and LP schemes.

- Equation utilizes a funding rate system to equilibrate long and short positions.

- It boasts reduced trading expenses.

- Equation champions higher decentralization.

- It contributes to more tangible profits.

Equation pioneers a new perpetual contract price determination process through equilibrium rates from liquidity pools, derived from the groundbreaking Balanced Rate Market Maker (BRMM) framework.

It provides features like market and limit orders, alongside the option of leveraging up to 200x, offering traders enhanced strategic flexibility.

Equation enables substantial, unrestricted position sizes with an exceptionally low maintenance margin rate of 0.25%, markedly lowering liquidation dangers, which sets it apart from its competitors such as GMX (v1) and dYdX.

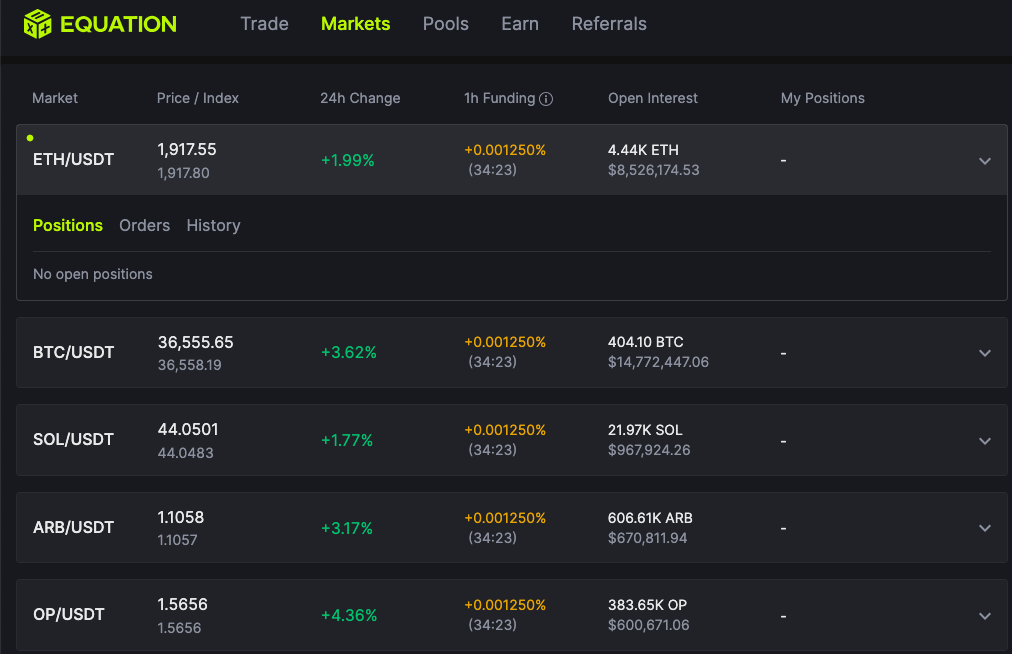

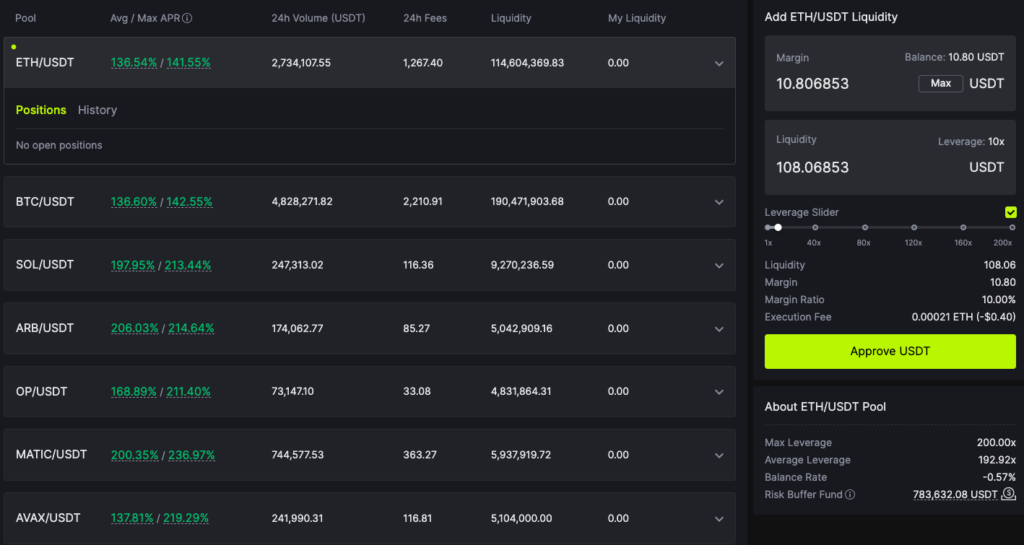

With the mainnet launch, Equation will facilitate perpetual contract trading across various digital currencies, including ETH, BTC, SOL, ARB, OP, MATIC, AVAX, and LINK.

What Makes Equation Unique?

In similarity to GMX, Equation operates as an AMM-style DEX protocol, aiming to amass LPs to perpetuate liquidity supply, with LPs earning genuine returns from transaction fees and market fluctuations induced by the protocol.

Contrary to the standard CFMM (Constant Function Market Maker) mechanism used by Uniswap-representative DEXs, Equation’s protocol allows LPs to assume only transient position risks via BRMM (Balanced Rate Market Maker), and the system’s established funding rate directives mitigate net exposure risks from the current liquidity pool.

Thanks to BRMM, Equation not only empowers on-chain perpetual contract trading with up to 200x leverage but also enables LPs to tailor their leverage multiplier to their risk preference when supplying liquidity (up to 200x), optimizing capital use and returns.

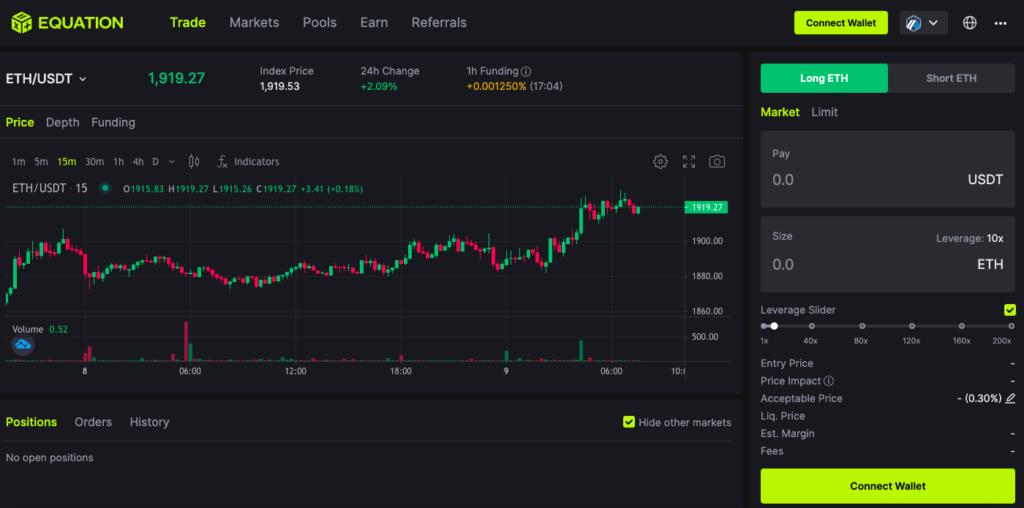

How to Trade on Equation DEX

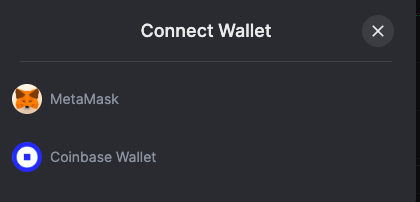

To get started, simply connect your web3 wallet to the platform.

Once you’ve connected your wallet, make sure you are connected to the Arbitrum network and have the base asset USDT, which you can bridge from another network or swap for another token on Arbitrum.

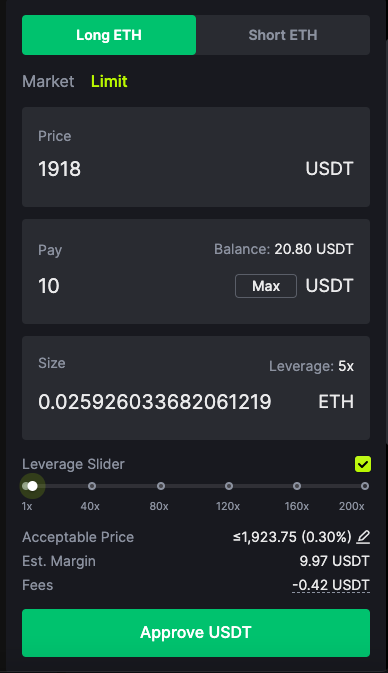

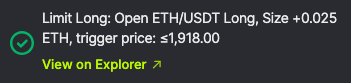

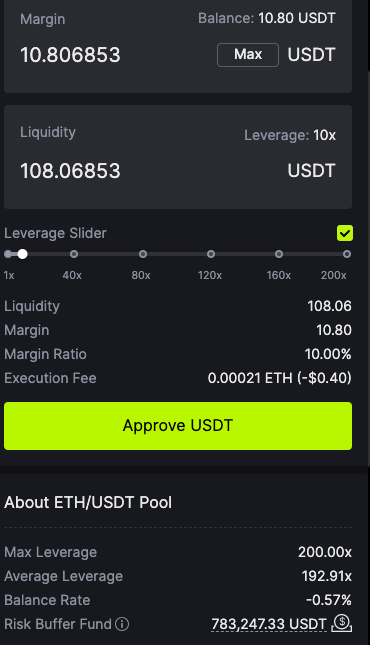

You can now proceed to trade perpetuals. In this example, we are going to place our test trade position of an ETH LONG LIMIT ORDER with $10. Once we are comfortable with how the platform works, we will then take a more sizeable position.

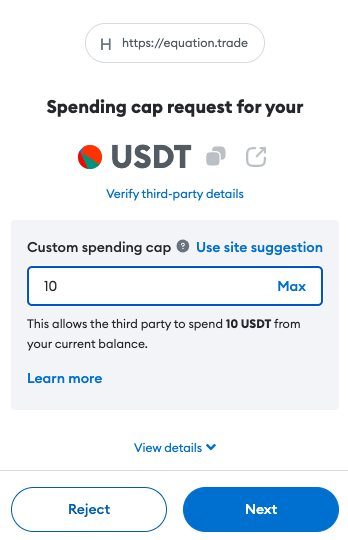

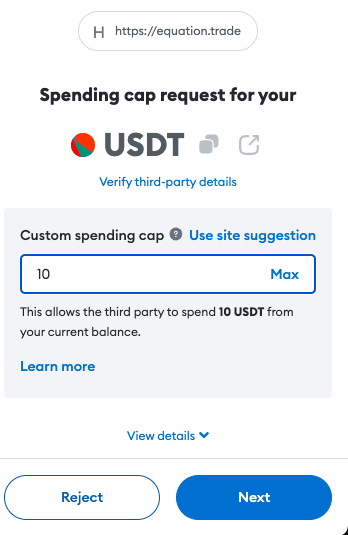

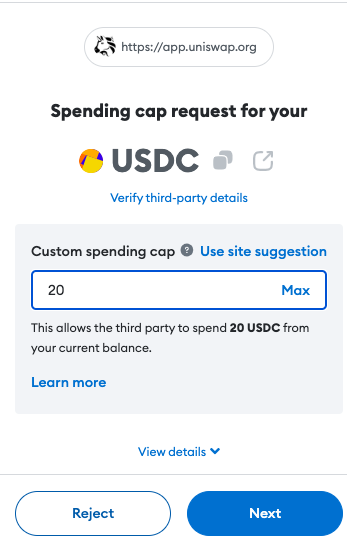

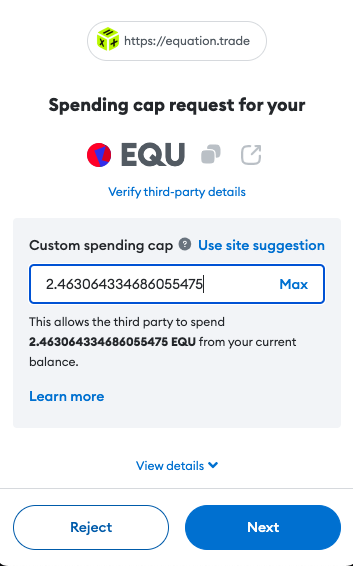

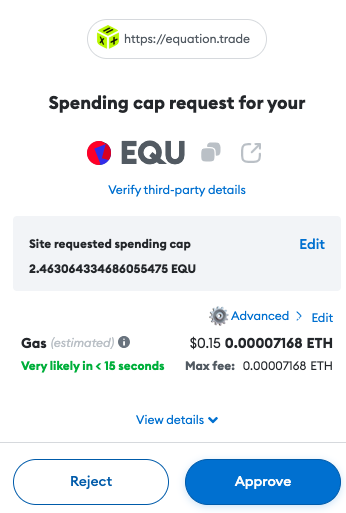

If using a wallet such as MetaMask, you can even set your spending cap to ensure you only what what you intend to on any given trade.

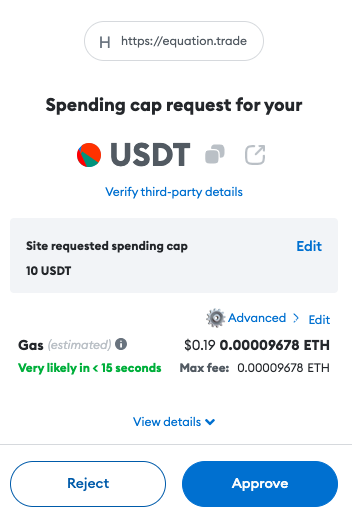

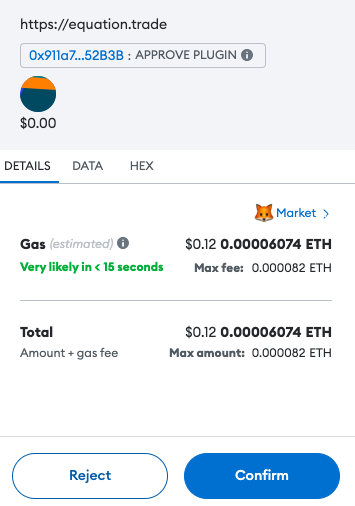

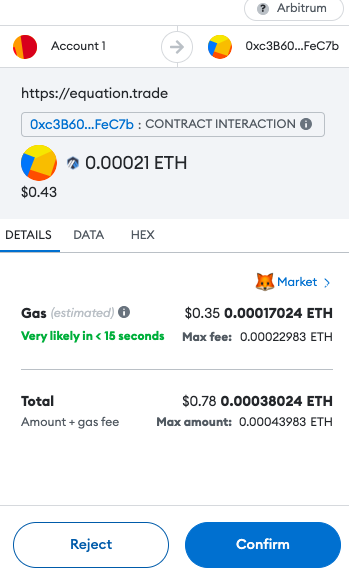

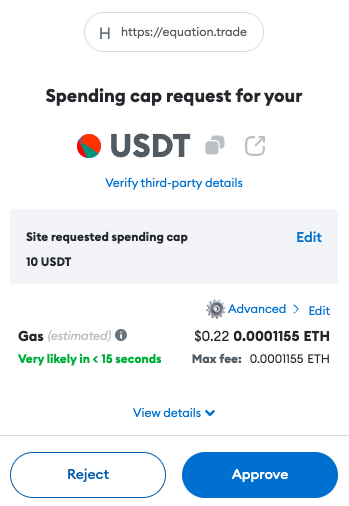

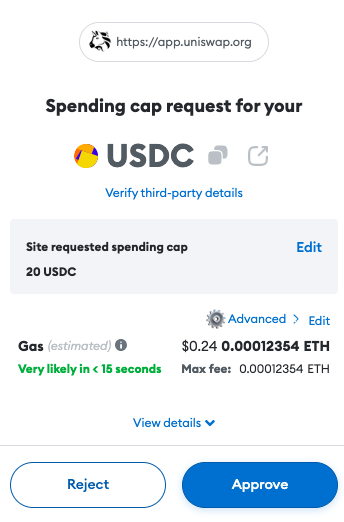

Pay the gas fee to approve the contract.

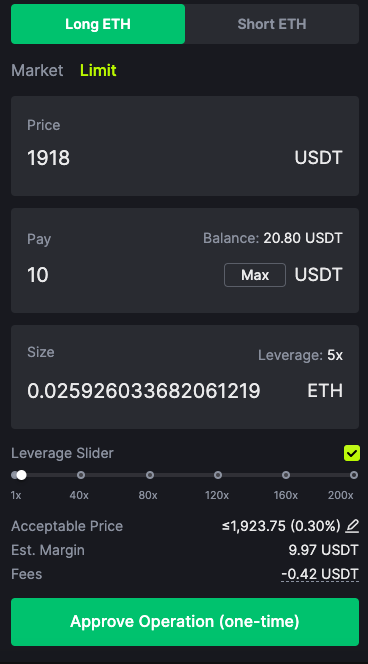

You can now proceed to approve your non-custodial wallet interaction with the Equation smart contracts.

Pay the small gas fee.

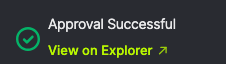

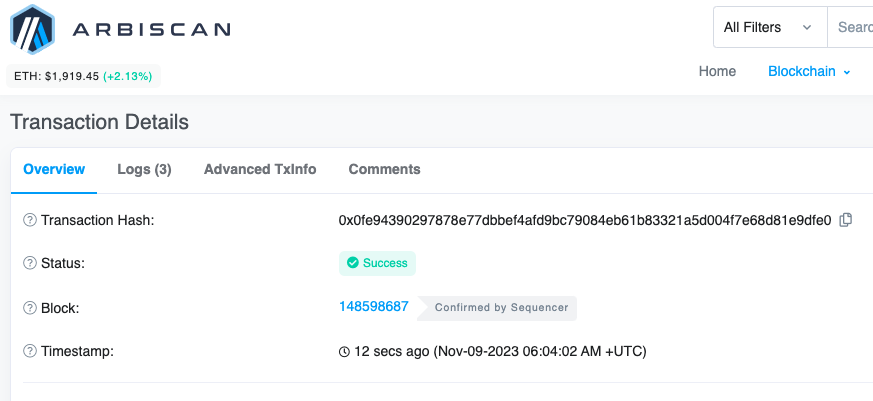

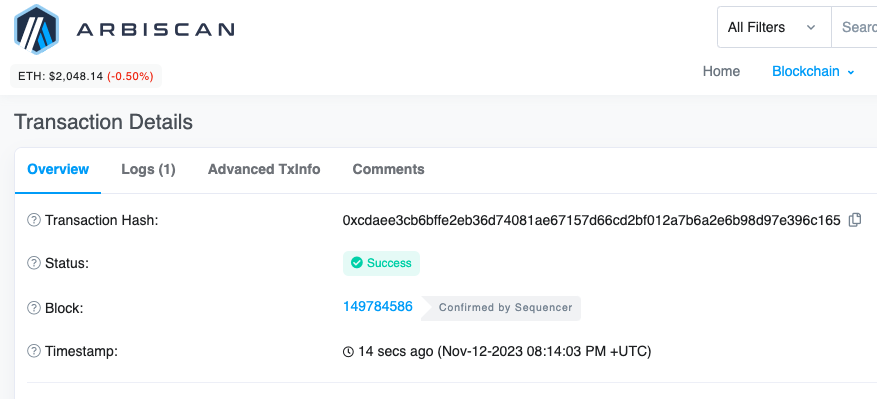

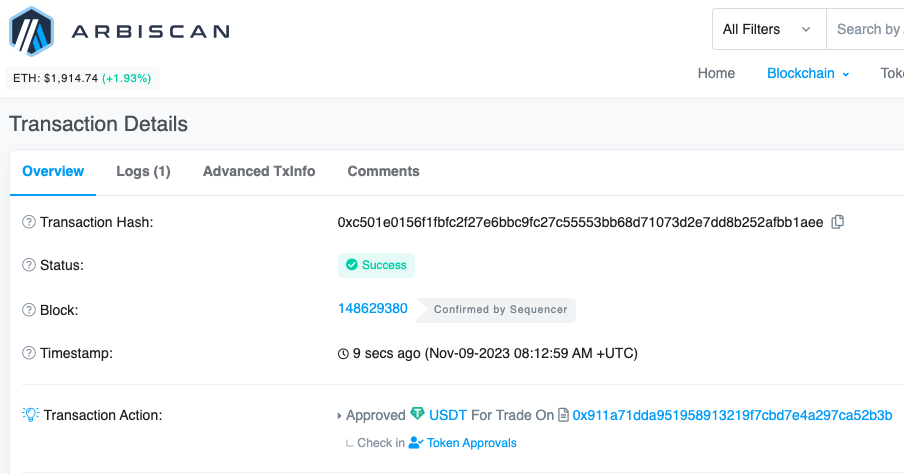

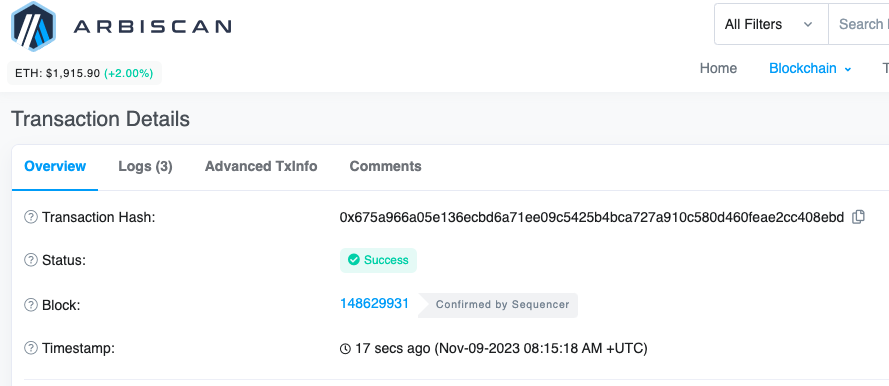

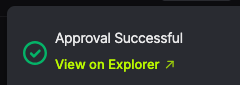

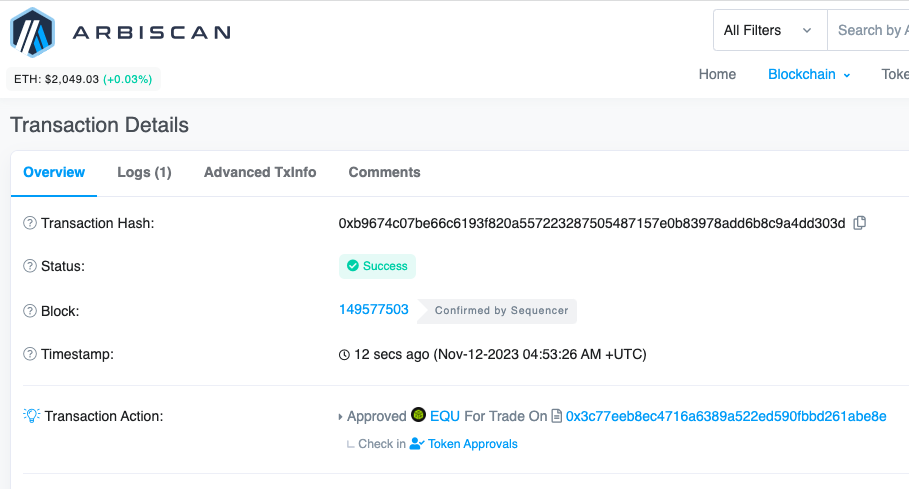

You will see an approval notification on your dashboard which you can also verify on Arbiscan – the Arbitrum network block explorer.

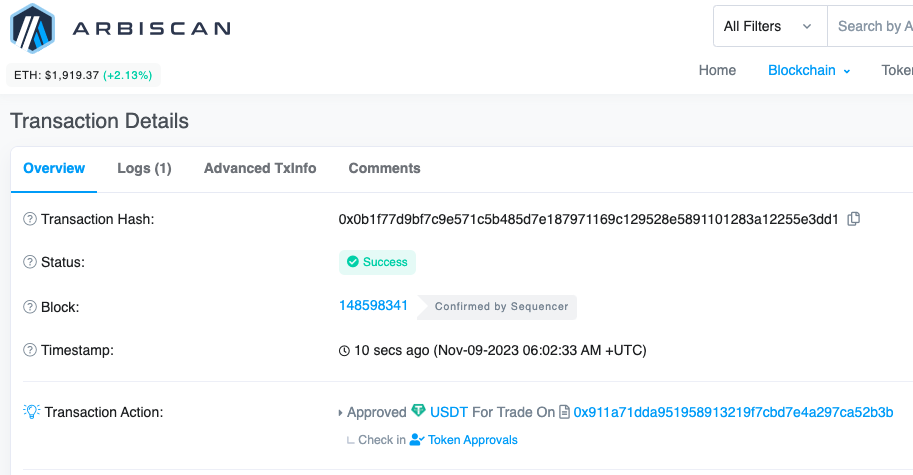

Once that’s all set, you can simply proceed to pay the small gas fee to execute your LONG position LIMIT or MARKET ORDER.

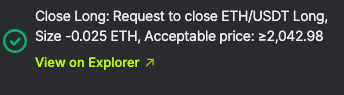

You’ll see a notification pop up on your screen to confirm and as always you can also verify via Arbiscan to ensure your order has been placed.

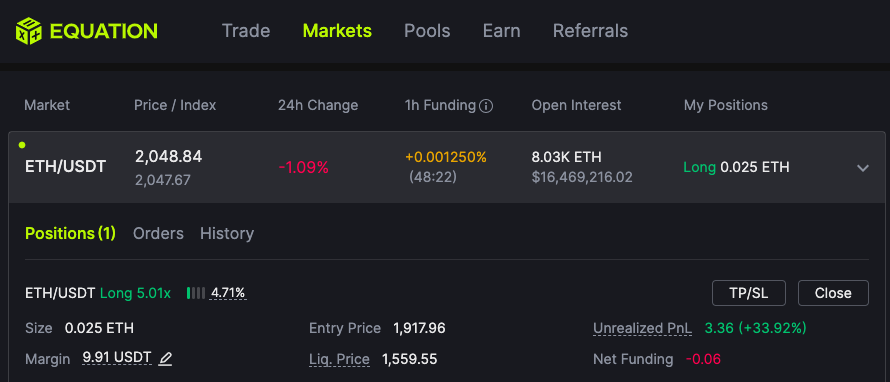

Alternative, check your dashboard to see your open positions, order, etc.

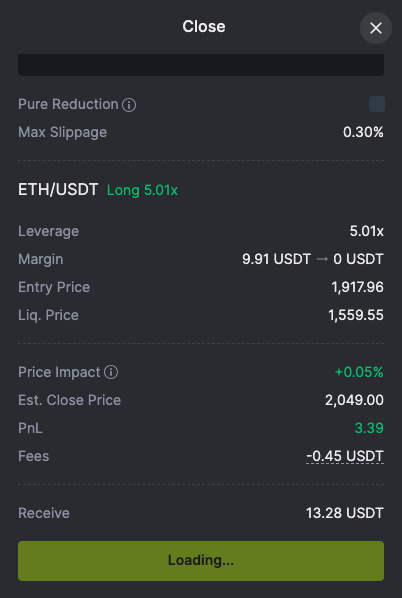

To close your position is also simple.

Pay the gas fee.

In addition to the notification you see onscreen, you can also verify on Arbiscan.

How to Add Liquidity on Equation

Within the BRMM framework, Liquidity Providers (LPs) act as provisional counterparts to traders. LPs can be subject to net open position risk when there’s an imbalance in long and short positions among users. Nevertheless, due to the stabilizing influence of the funding rate, the Benchmark Rate (BR) value tends to oscillate around zero, avoiding extreme deviations. As a result, the LPs’ position value is generally much lower than the total pool liquidity, which in turn, confines the risk for LPs.

Take, for instance, a scenario where user-held long positions substantially surpass short positions, creating a marked imbalance in the liquidity pool. In such cases, long position holders would encounter additional funding rate pressure. Concurrently, these conditions present arbitrageurs with ongoing chances for spread and funding rate arbitrage. With this dynamic in play, it’s improbable for tokens with robust liquidity to sustain a significant imbalance over a long duration. Hence, we describe the loss stemming from LPs’ temporary net open positions as “Temporary Loss”.

Given that LPs face constrained risk, the Equation protocol permits them to offer liquidity at elevated leverage levels. LPs have the discretion to set their leverage in alignment with their risk tolerance when supplying liquidity. The introduction of leverage markedly elevates the capital efficiency for LPs.

LPs derive their earnings from two principal sources:

- Liquidity mining incentives.

- A share of the transaction fees.

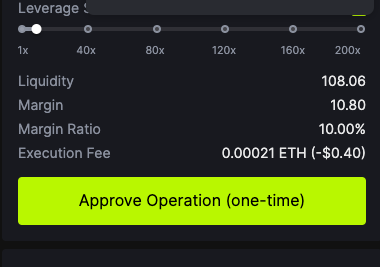

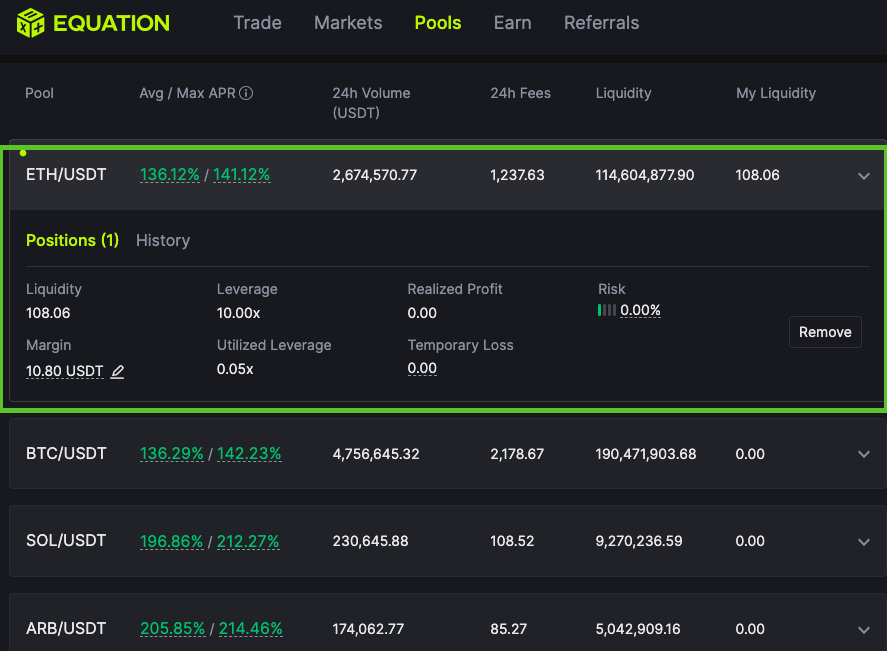

In order to add liquidity, choose the liquidity tokens and pools you wish to add to.

You may be asked to again set your spending cap.

Pay the gas fee.

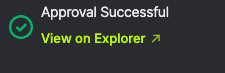

You’ll be notified that your approval has been successful.

You can also verify this on Arbiscan.

You can now proceed to approve the assets you wish to provide as liquidity.

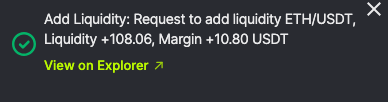

You’ll be notified when the liquidity provisioning has been approved.

You can also verify this on the block explorer.

You can also view on your dashboard the status of your liquidity provisions.

In conventional spot AMM frameworks like CFMM (e.g., Uniswap), LPs encounter what is known as impermanent loss. However, this term can be quite misleading due to several factors:

- Regardless of whether market prices increase or decrease from the point at which LPs provided liquidity, they are subject to impermanent loss, a consistent form of loss, signifying the absence of an “impermanent profit” concept.

- The “impermanent” loss experienced by LPs can readily become a “permanent” loss. To elaborate further, the rationale behind labelling the loss as “impermanent” is based on the notion that should market prices ever revert to the initial level at which liquidity was added by LPs, the impermanent loss would nullify. Yet, for most token pairs, apart from some pegged ones (like stablecoin pairs), it is unrealistic to expect that token prices will oscillate around a certain “mid-price” (for instance, we cannot presuppose that the price of BTC or ETH will swing around any particular value relative to the dollar). The prices may not return to their original levels, possibly ever, which means that the “impermanent” loss for LPs could indeed become “permanent”.

In contrast, within the BRMM model, LPs actually face what can be called a “temporary loss”: The Benchmark Rate (BR) typically varies around zero, swayed by the funding rate’s anchoring effect. Maintaining a certain position by LPs does not inherently lead to a loss (indeed, reflecting on some derivative DEXs that operate on the “wagers between LPs and users,” the likelihood of LPs making profits from their positions over time is higher).

The Risk Buffer Fund absorbs all temporary losses initially (by the same token, profits from LP positions are also funneled into the Risk Buffer Fund, which has additional ongoing revenue streams. This further diminishes the chances of LPs incurring temporary losses.

The Risk Buffer Fund (RBF) is designed to absorb the temporary losses of Liquidity Providers (LPs) first, when they serve as interim counterparties to users and sustain losses, up to the limit of the fund’s balance. The existence of the RBF markedly lowers the likelihood of LPs suffering from temporary losses. When the RBF accumulates to a substantial amount, it enables LPs to employ higher leverage more safely, without a high risk of liquidation.

The RBF’s revenue streams are threefold:

- A share of the transaction fees incurred by users when they initiate or close positions, or during their liquidation.

- Gains accrued by LPs in their role as temporary counterparties to traders.

- The assets from LPs when they undergo liquidation, which are directly funneled into the RBF.

Should the RBF’s volume eventually surpass the necessary threshold for risk mitigation, any excess funds could be reassigned through a DAO governance vote.

Token economy model

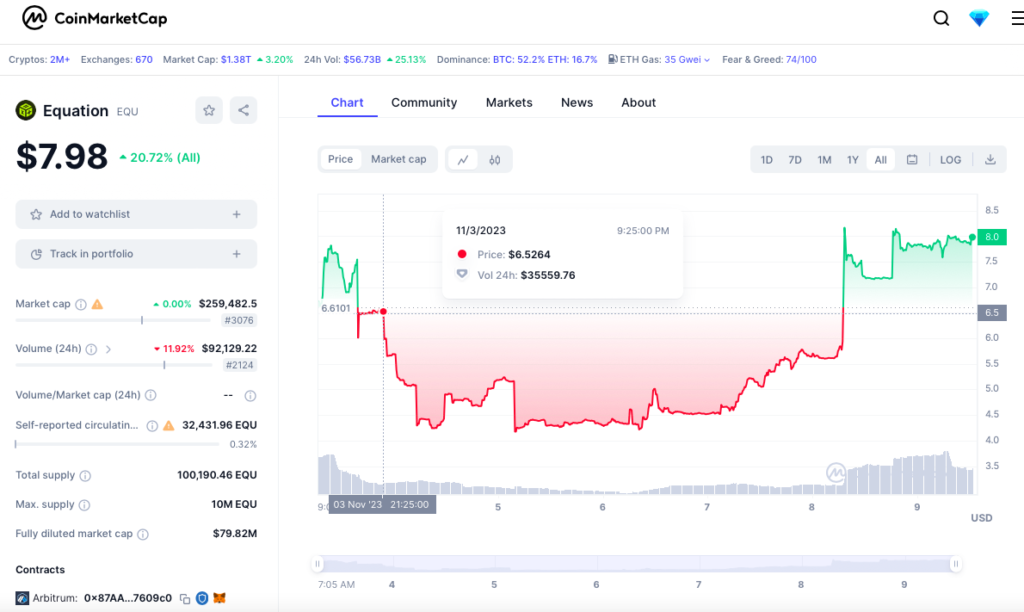

Addressing the issue of misaligned interests in traditional token economies, Equation introduces an innovative hybrid token economy model that merges FT (EQU) and NFT (EFC) to co-govern the ecosystem. $EQU — Equation’s native token, utilized for ecosystem governance, fee reductions, and rewarding LPs, has a capped supply of 10 million, with an initial daily release of 10,000 for EQU, entirely allocated through liquidity and referrer mining to community members. (EQU’s daily release rate is adjustable by DAO but will not surpass 10,000).

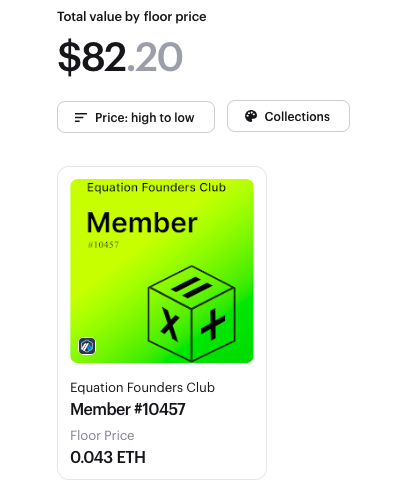

$EQU — Equation’s native token, utilized for ecosystem governance, fee reductions, and rewarding LPs, has a capped supply of 10 million, with an initial daily release of 10,000 for EQU, entirely allocated through liquidity and referrer mining to community members. (EQU’s daily release rate is adjustable by DAO but will not surpass 10,000). EFC (Equation Founders Club) -EFC, Equation’s native NFT, is categorized into Member, Connector, and Architect tiers, allocated to influencers, the core promotional team, and the core research and development team, respectively.

EFC (Equation Founders Club) -EFC, Equation’s native NFT, is categorized into Member, Connector, and Architect tiers, allocated to influencers, the core promotional team, and the core research and development team, respectively.

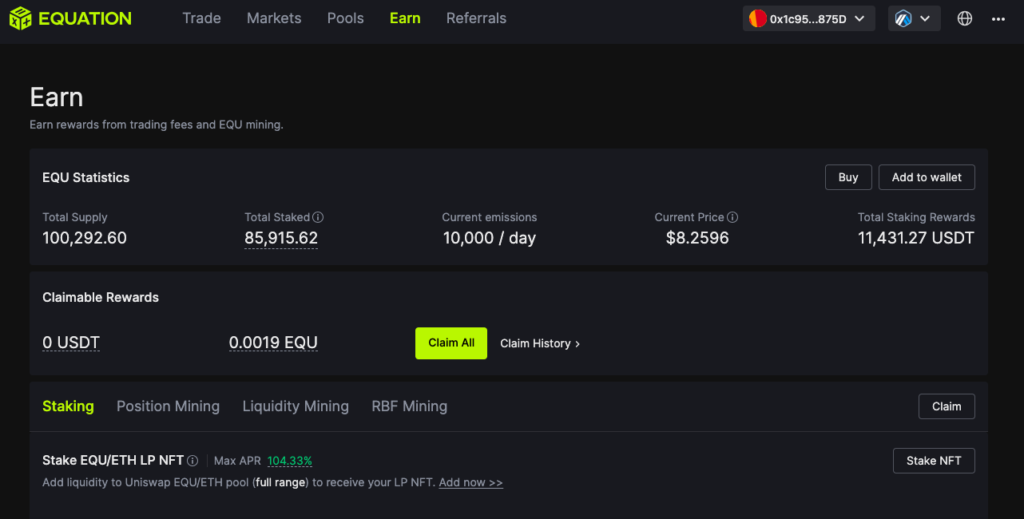

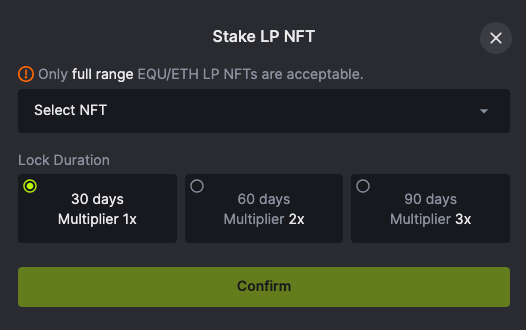

veEQU — By staking EQU-ETH LP NFT in the Uniswap EQU-ETH pool, one can acquire veEQU, which entitles holders to a 25% share of the protocol’s transaction fees, along with a stake in its governance. The accumulation of veEQU depends on the quantity and duration of locked tokens.

Equation allocates 100% of protocol-generated revenue to its community, with $EQU entirely produced via liquidity and referrer mining. Users can secure real earnings by staking EQU, possessing veEQU, engaging in referral mining, and participating in RBF liquidity mining.

Equation’s creator, 0xfermat (pseudonym), ensures freedom from constraints like KYC, regulation, and geography. Additionally, its token distribution follows a FAIR LAUNCH principle, with no pre-allocations for teams or early investors. It has successfully undergone ABDK Consulting’s smart contract audit.

The total EQU supply is 10 million, fully distributed through liquidity and referral mining to community participants. The initial daily EQU distribution is 10,000, a figure DAO can adjust without exceeding the cap.

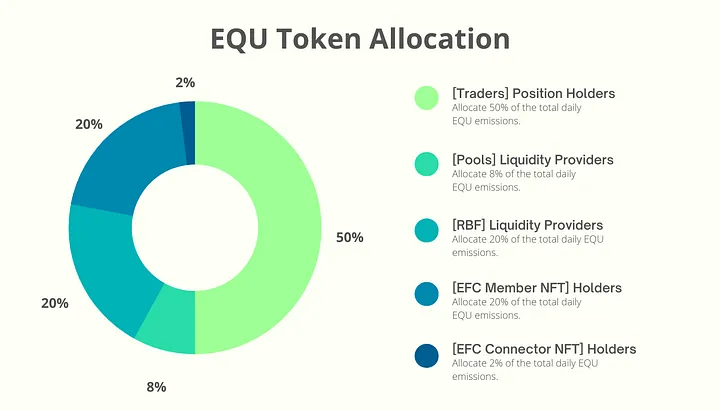

There are five ways to accrue EQU:

- Maintain contract positions, receiving 50% of daily EQU distributions.

- Supply liquidity to pools, obtaining 8% of daily EQU distributions.

- Contribute to Risk Buffer Funds (RBFs), garnering 20% of daily EQU distributions.

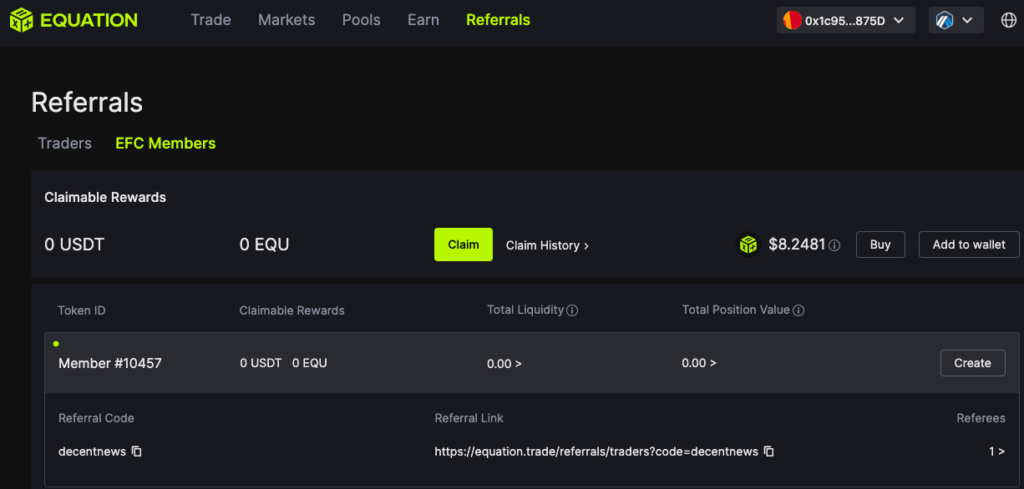

- EFC Member NFT holders can generate referral codes, earning from referred users’ open interests or LP positions, allotted 20% of daily EQU distributions.

- EFC Connector NFT holders can produce Member NFTs, earning 10% of their EQU rewards, allocated 2% of daily EQU distributions.

EQU stakeholders can gain income through staking, entitled to 25% of the protocol’s transaction fees and governance rights.

Two avenues to earn from trading fees include:

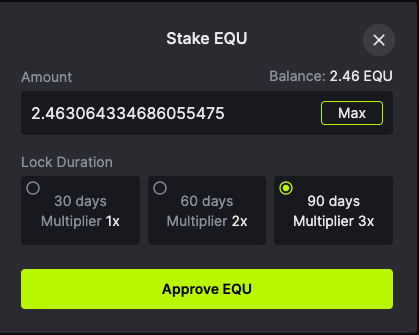

- Direct EQU locking. Staking EQU-ETH LP NFT (via Uniswap EQU/ETH pool contributions).

- The lock-up duration impacts the multiplier for earnings, with longer commitments (30, 60, 90 days) enhancing the multiplier (1x, 2x, 3x respectively).

How to Purchase $EQU Tokens on Uniswap

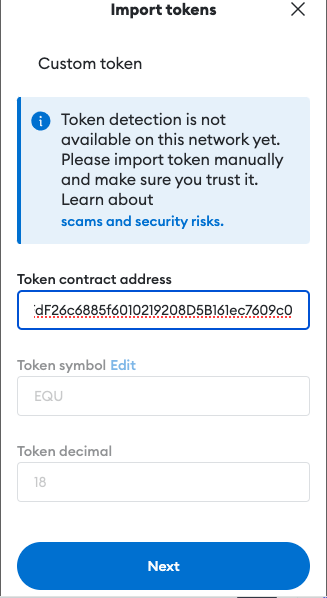

Add the token contract address to your MetaMask: 0x87AAfFdF26c6885f6010219208D5B161ec7609c0

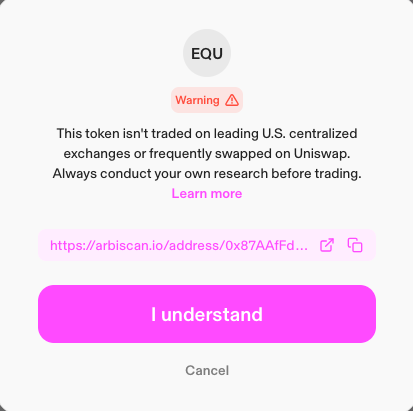

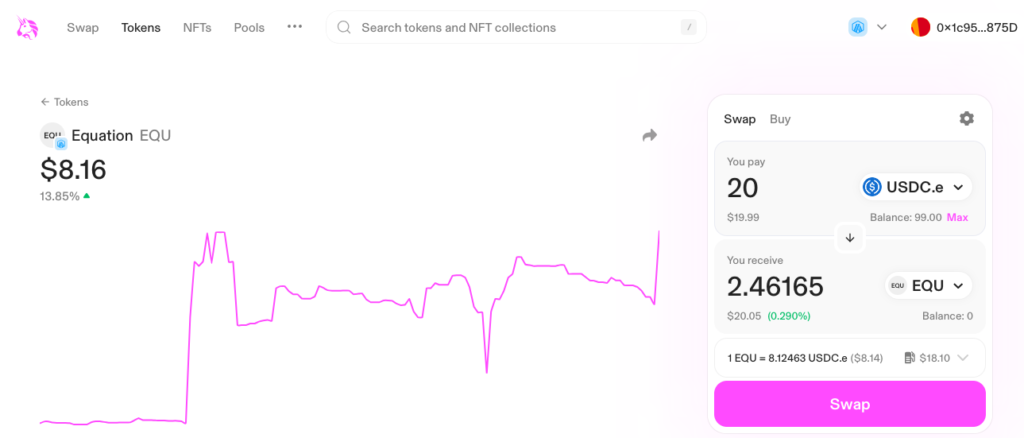

Go to the Uniswap v3 dashboard and also add the contract address there.

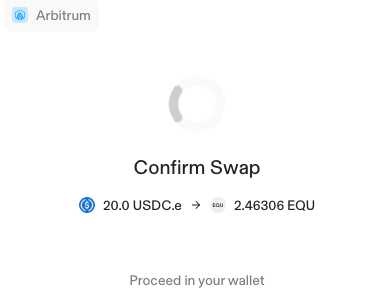

Now you can proceed to swap.

Enable swap.

Set the spending cap.

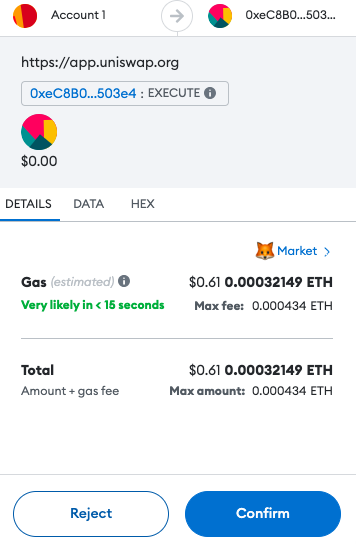

Pay the the gas fee.

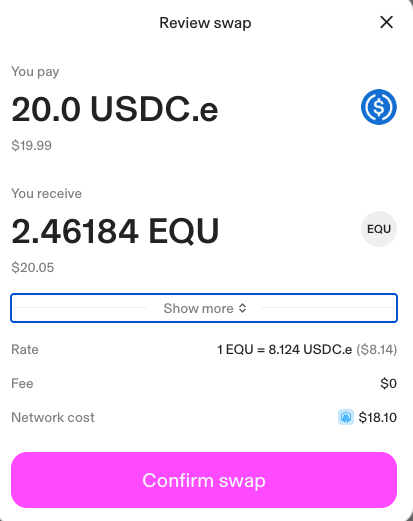

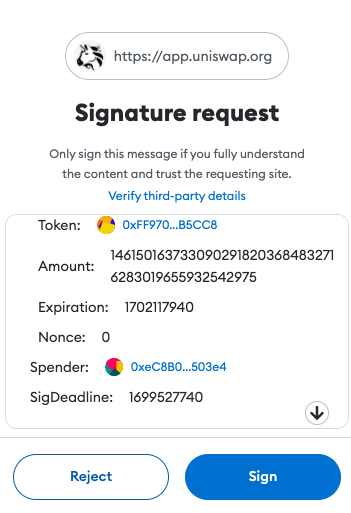

Proceed to sign the transaction to process the swap.

Pay the gas fee.

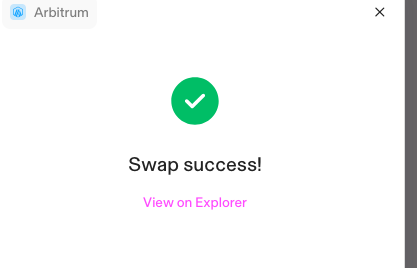

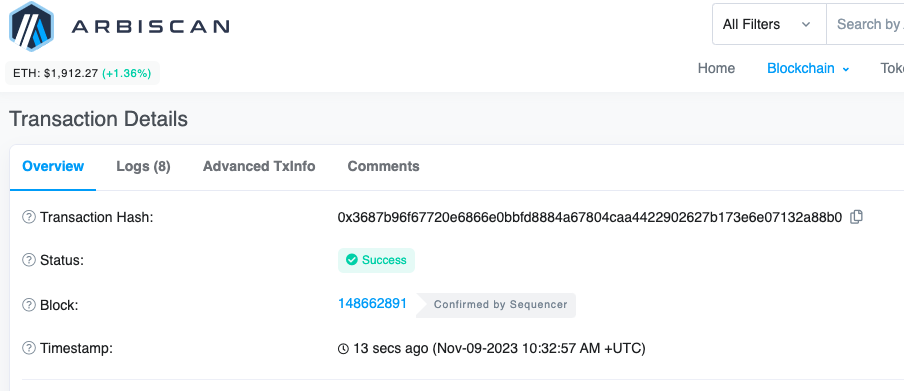

You’ll get confirmation once your swap has been processed.

You can then confirm the transaction on the block explorer and check your wallet balance.

Equation is also introducing an earn program and you can stake your ETH LP NFT or $EQU to earn rewards.

To stake $EQU, simply choose the amount and duration.

Set your spending cap.

Pay the gas fee.

You’ll be notified once staking is completed.

You can also verify transaction on Arbiscan.

Equation Referral Program

Equation Referral Program  You can also participate in the referral program and earn extra incentives.

You can also participate in the referral program and earn extra incentives. Users can also participate in the Position Mining Program where all users who hold a contractual position in Equation will be able to receive a certain number of Equation eco tokens, $EQU, as a reward, depending on the amount of the position and the time of day it is held. Currently, $EQU is released daily for 10,000, of which 50% will be allocated to position mining, with an APR up to 12,462%!

Users can also participate in the Position Mining Program where all users who hold a contractual position in Equation will be able to receive a certain number of Equation eco tokens, $EQU, as a reward, depending on the amount of the position and the time of day it is held. Currently, $EQU is released daily for 10,000, of which 50% will be allocated to position mining, with an APR up to 12,462%!

Conclusion

Equation is one of the most uniquely designed dexes for traders who want to use non-custodial decentralised exchanges that offer a complete suite of DeFi offerings. The future is certainly bright for this promising DEX. Become an early user and benefit from the incentives available to ecosystem participants.