Ether.Fi Liquid Staking Protocol Review

What is Ether.Fi?

Ether.fi stands as a decentralized, non-custodial delegated staking protocol, offering a Liquid Staking Derivative (LSD) token.

One key feature of ether.fi is the stakers’ control over their keys. It also supports a node services marketplace where stakers and node operators can register nodes for infrastructure services provision.

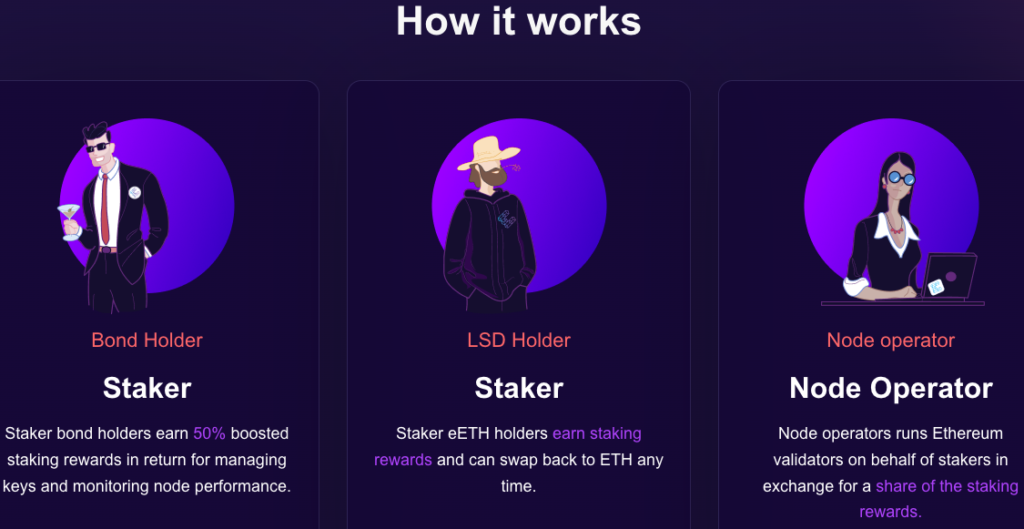

The user and stakeholder types on ether.fi encompass:

- Bond-holding stakers

- Stakers solely holding ether.fi’s LSD, eETH

- Node operators

- Node services consumers

Ether.fi has laid out three phases in its roadmap:

- Delegated staking

- Liquidity pool

- Node services

In each phase, the mentioned roles evolve.

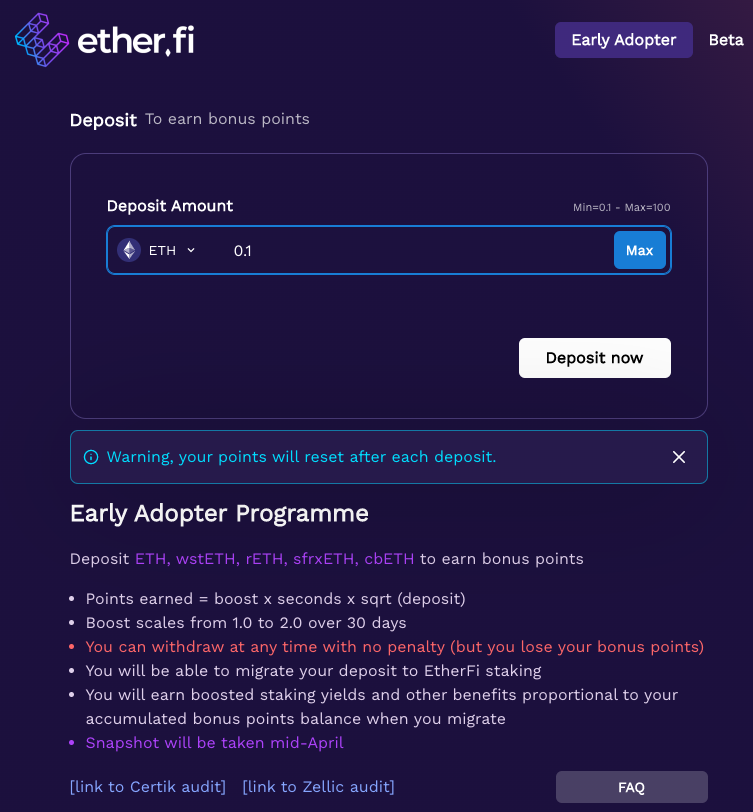

Getting started on the platform is simple. Just connect your web3 wallet e.g. MetaMask.

To start staking, you need a minimum of 0.1 ETH which we staked for the purposes of demonstrating here.

Once you’ve staked, you can check your reward points, claim those rewards and make withdrawals if you wish to.

Delegated Staking

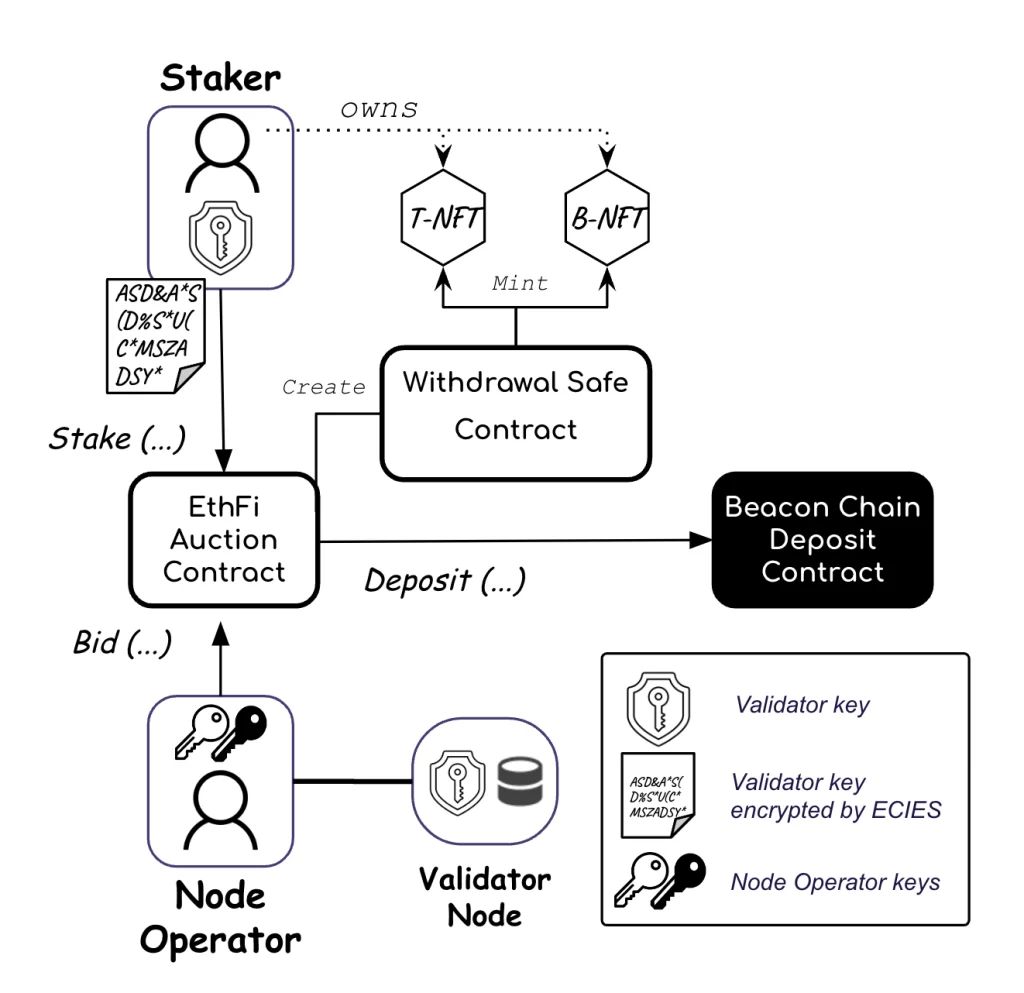

For stakers intending to stake in multiples of 32 ETH, the following procedure is adopted: A node operator presents a bid to become a possible validator node assignee. Trusted node operators may offer a nominal bid for availability marking, while trustless ones partake in the auction system, getting assigned validators based on their successful bids.

The staker then deposits their 32 ETH into the ether.fi deposit contract. This action ignites the auction system, assigns a node operator for validator running, mints a withdrawal safe, and two NFTs (T-NFT, B-NFT) that give ownership over the withdrawal safe. The T-NFT represents 30 ETH and is transferable, while the B-NFT signifies 2 ETH and is soulbound, only recoverable when the validator is exited or completely withdrawn.

The staker then encodes the validator key using the winning node operator’s public key, submitting it in an on-chain transaction. This transaction triggers an event to which the node operator responds. Later versions will replace this step with a sharded key DVT solution. The node operator then initiates the validator using the decrypted validator key.

The staker (or node operator) can issue the exit command to exit the validator and retrieve the staked ETH into the withdrawal safe. The staker can then destroy the NFTs to reclaim their ETH minus fees.

The B-NFT serves to supply the deductible for slashing insurance (in case of a slashing event), representing a responsibility to supervise the validator node’s performance. Due to the added risk and responsibility, it yields a higher return than the T-NFT. Ether.fi makes validator performance monitoring easy through notifications and alerts.

Liquidity Pool and eETH

Stakers with less than 32 ETH, or those not wishing to shoulder the responsibility of monitoring validator nodes, can partake in ether.fi staking by minting eETH in the NFT liquidity pool. This pool contract holds a combination of assets comprising ETH and T-NFTs. At any given moment, ETH constitutes a minor percentage of the pool assets.

Minting and Burning eETH

Upon depositing ETH into the pool, it mints eETH tokens and transfers them to the depositor. Stakers holding T-NFTs can deposit them into the liquidity pool and mint eETH equivalent to the T-NFT’s value (determined by an oracle.)

A staker holding eETH can exchange it for ETH in the liquidity pool on a 1:1 basis, given sufficient liquidity. If there is inadequate liquidity, the swap prompts a validator exit.

Bond-holders and Minting new T-NFTs and B-NFTs.

Stakers wishing to stake specifically with B-NFTs (due to their higher yield) deposit their ETH into the pool and join a queue to be allocated a B-NFT. These stakers, known as bond-holders, perform a role similar to full-node stakers who have sold their T-NFT.

When the amount of ETH in the liquidity pool exceeds a threshold, the next bond-holder staker in the queue is assigned. They generate private keys and trigger the staking process where 32 ETH gets staked, minting the T-NFT into the pool and the B-NFT to the bond-holder

Exiting Validators

When the amount of ETH in the liquidity pool falls below a threshold, an exit request is initiated on the oldest T-NFT. This triggers an event to which the bond-holder corresponding to that T-NFT must respond (ether.fi offers a free notification service to bond-holders to facilitate this).

The exit request notes a timestamp and starts a timer. If the timer runs out and the validator hasn’t exited, the B-NFT holder faces progressive slashing. The node operator receives a reward upon exit of an expired validator, motivating them to exit the validator if the bond-holder fails to do so.

Upon validator exit, the T-NFT and B-NFT are burned, and the ETH (less fees) is deposited into the liquidity pool.

Node Services

This phase of the protocol is speculative, with many technical decisions pending.

The NFTs, signifying the economic value of the staked ETH, allow for a programmable layer on staking infrastructure by creating economic incentives for node operators and stakers.

Enrolling Nodes into Services

NFTs can be registered to offer node services by setting metadata parameters part of the NFT contract.

In the initial implementation, the node operator must run the ether.fi client bundle and be registered to provide node services.

All 3 parties – the node operator, B-NFT holder, and ether.fi – must agree to enroll a given node for additional services.

Ether.fi Node Client

The node client bundle is a user-friendly CLI that facilitates launching, monitoring, and registering clients on ether.fi.

Billing

Billing for node services is done via a billing contract. Services tracking and attribution are performed via a centralized service run by ether.fi. This arrangement will evolve over time.

Ether.fan NFTs

Ether.fan presents a delightful method to stake your ETH and mint a fan NFT, which aids in earning membership points and enhancing staking rewards. Moreover, your fan NFT facilitates participation in exclusive events and displays your dedication to Ethereum’s decentralization.

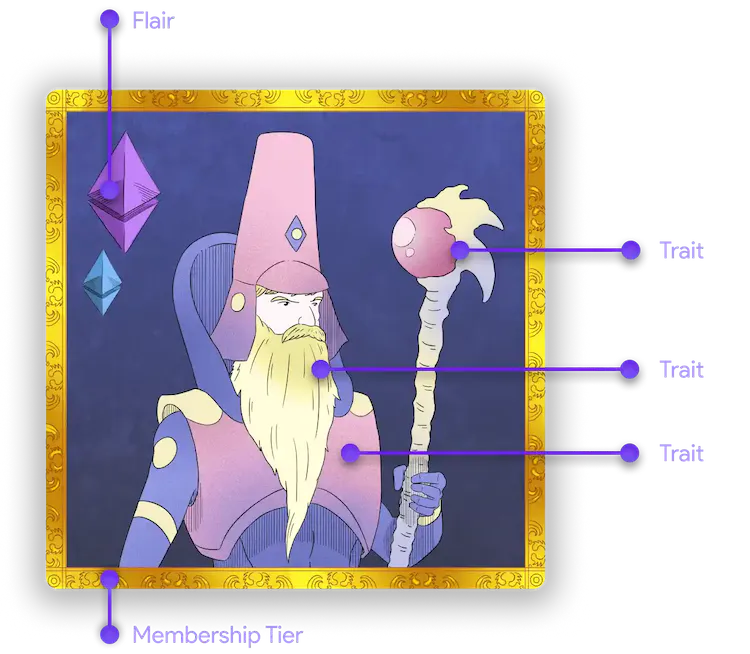

Staking ETH through ether.fan enables you to mint a fan NFT. The attributes of the fan consist of:

- Traits: provably scarce and randomly assigned during minting

- Flair: deterministic and proportional to the staked ETH quantity

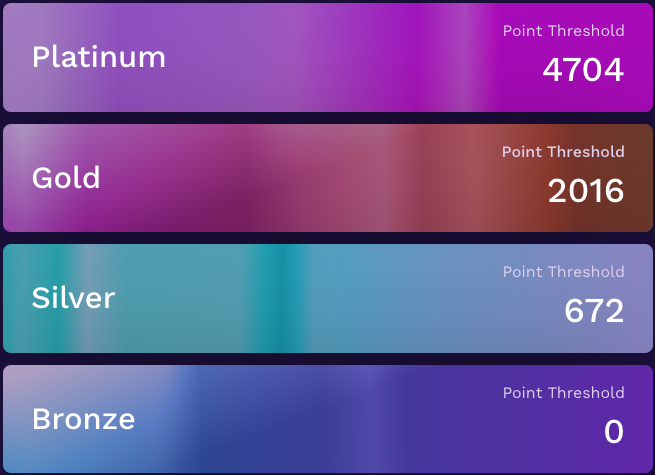

- Membership tier: commencing at Bronze, it escalates over time resulting in amplified staking rewards.

The fan NFT embodies your staked ETH and accumulates staking rewards automatically. You’re free to augment your stake or retrieve your ETH whenever you wish.

All ETH staked via ether.fan is assigned to individual node operators employing DVT and operating physical nodes across varied geographical regions.

The fan NFT partakes in a membership loyalty rewards scheme that boosts your portion of staking rewards and protocol revenue the longer you stake.

Staking is executed through the ether.fi non-custodial staking protocol, and all revenue from the protocol is returned to stakers and individual node operators to subsidize staking hardware costs, with a minor share allocated to sustain the ether.fi interns.

Creating a Fan

When you invest ETH (at least 0.1 ETH) through ether.fan, the ETH is staked via ether.fi and designated to individual node operators across multiple geographic locations. As part of your investment, you generate a fan NFT representing your staked ETH. The fan consistently gathers staking rewards over time.

Each fresh deposit creates a new fan, and there’s no limit to how many fans you can store in your wallet. Consider them similar to trading cards, and in the future, you will be able to engage in various games and activities with your fan collection.

You can utilize your fan NFT as a Profile Picture (PFP) to demonstrate your endorsement for Ethereum and decentralization. The fan NFT’s attributes comprise three components: traits, flair, and membership tier.

Find out about Ethereum Staking and other Liquid Staking Protocols e.g. SharedStake or EigenLayer. For the basic on staking in general, check out our guide.

Learn more about Decentralised Finance by downloading a FREE copy of DeFi Millionaire.