The Complete Guide to Cryptocurrency Arbitrage Trading

The price of a particular cryptocurrency for example, Bitcoin, is not always the same across all the exchange platforms where people buy and sell digital assets. This is especially true in the case of such digital assets that are not stablecoins. For instance, the difference in price of Ethereum on Luno and Binance, or Bitcoin on Bitfinex and Kraken, or XRP on OKEx and Paxful can be significant. This also depends on the location because cryptocurrencies also work on supply and demand mechanics which are one of many factors that can also contribute to the price differences on different exchanges or in different markets.

As a result, traders buy the cryptocurrency on an exchange with a lower price and sell it on an exchange with a higher price.

The difference between the two prices minus the transaction cost is the trader’s profit. Here is an illustration:

Price of bitcoin at Kraken: $20 487

Price of bitcoin at Binance: $20 512

With this scenario, a trader buys a bitcoin at Kraken at $20 487 and sells it at Binance for $20 537.

The price difference is $50.

In order to get the profit, one subtracts the transaction cost, say $14, from $50, giving us $36.

This process of buying a certain cryptocurrency on one exchange and selling it on other in order to make a profit is called arbitrage trading.

Steps in arbitrage trading

With arbitrage trading, you have to follow these steps:

- Find out a cryptocurrency tradable at two exchanges.

- Use the order books from the two exchanges to calculate the interest.

- Purchase the cryptocurrency on the exchange with the lower price.

- Then sell it on the exchange with the higher price.

You will continue to buy and sell between these two exchanges until you meet your total profit target.

Do arbitrage opportunities exist today?

Yes, these opportunities exist. Search for the opportunities by comparing prices of your selected cryptocurrencies on various exchanges. Crypto University offers an arbitrage calculator that’s great tool to use.

For a start, compare the prices of your preferred cryptocurrencies on Binance, Bitfinex, Coinbase and Kraken. Usually, you find differences in their prices.

Arbitraging between Kraken and Binance

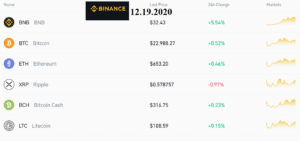

You can see, price differences of bitcoin between Kraken and Binance, as shown below.

More importantly, the price list for Binance and Kraken were collected at the same time.

Kraken Bitcoin price: $22 970.30

Binance Bitcoin price: $22 988.27

Price difference: $ 17.97

As you note, the difference is quite good. One can buy bitcoins from Kraken and sell at Binance to earn a profit. If this person keeps on buying and selling bitcoins within a day, they can make a substantial profit sum.

Incidentally, many arbitrage traders buy and sell different cryptocurrencies between Kraken and Binance.

The type of arbitrage we have discussed above is called simple or spatial arbitrage.

Cross border arbitrage

This is the second type of arbitrage. It is similar to spatial arbitrage except that the exchanges are in two different countries. However, the trading process is exactly the same. Learn more about this type of arbitrage trading here.

Triangular arbitrage

With triangular arbitrage, the trader takes advantage of different prices and transaction costs of three cryptocurrencies. Usually, the three cryptocurrencies exist on the same exchange. The individual trades the first cryptocurrency to the second one and then the second one to the third. At last he/she converts the third cryptocurrency to the first one.

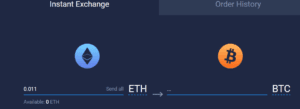

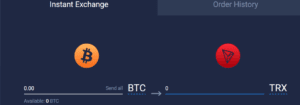

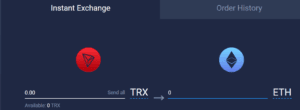

For example, the individual buys bitcoin and exchanges it for Ethereum. He then converts Ethereum to TRX. Finally, he/she converts TRX to Bitcoin.

![]()

Summary of the arbitrage trading process:

- The trader identifies three cryptocurrencies to arbitrage.

- He selects the cryptocurrency he will end up with.

- He trades the first cryptocurrency to the second.

- After that, he trades the second cryptocurrency to the third.

- At last, he trades the third cryptocurrency to the first one.

With that process, the triangular arbitrage round is complete.

The diagrams illustrate triangular arbitrage.

STEP 1: ETH to BITCOIN

STEP 2: BITCOIN to TRX

STEP 3: TRX to ETH

As you note, we end up with the first coin (ETH).

Assessment of arbitrage trading

Arbitrage trading has relatively low risk as compared to other forms of trading. However, it is important to consider transaction costs when calculating profits.

Also, you can get your profit within a short time. You do not take much time to complete the transactions.

Since there are many cryptocurrencies, you can select the three which give you the highest profit.

However one needs to constantly check the volatility of each cryptocurrency. This is because the price of a cryptocurrency can change within a minute.

Conclusion

Arbitrage trading has potential to earn you reasonable profit within a short period. This article has shown you how to leverage the price difference between cryptocurrencies on platforms such as Kraken, Binance, Coinbase and Bitfinex. However, you can search for other relevant exchanges.