Handle.Fi global defi FX protocol review

What is Handle.fi? An Overview

Handle.fi stands as a decentralized protocol specializing in multi-currency stablecoins. In the world of digital currencies, stablecoins aim for consistent market value by anchoring their worth to external assets. Within Handle.fi, these collateral-backed stablecoins, known as fxTokens, mimic and are loosely pegged to a variety of global currencies.

Built on the Arbitrum network, Handle.fi serves as a comprehensive solution in decentralized finance (DeFi). The protocol enables users to engage in leverage trading, currency conversion, borrowing, and earning through its primary building blocks – fxTokens.

The global forex market sees an average daily trading volume of $7.5 trillion, and in 2022, it reached a staggering $2.74 quadrillion. While the USD serves as a global financial backbone, the rapid growth of DeFi has resulted in a surfeit of USD-pegged stablecoins, some of which see daily trading volumes above $30 billion. Handle.fi expands the options by offering multi-currency fxTokens, which empower users to engage in various financial activities in their chosen currency.

Your Assets, Your Control

Being non-custodial in nature, Handle.fi ensures you have full control over your assets, eliminating the need for third-party mediation. The fxTokens currently available include:

- Australian Dollar (fxAUD)

- British Pound (fxGBP)

- Canadian Dollar (fxCAD)

- Chinese Renminbi (fxCNY)

- Euro (fxEUR)

- Japanese Yen (fxJPY)

- Philippine Peso (fxPHP)

- Singapore Dollar (fxSGD)

- Swiss Franc (fxCHF)

- US Dollar (fxUSD)

How to Trade Forex on Handle.fi Decentralized Exchange

To get started simply go to https://app.handle.fi/

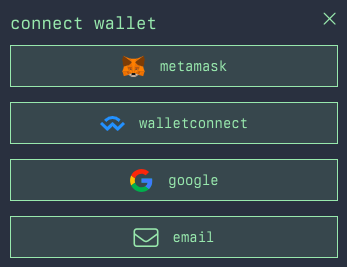

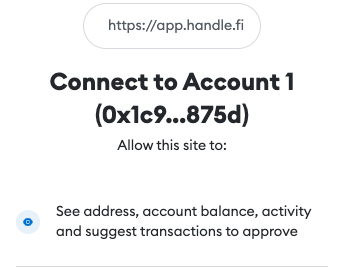

Connect your web3 wallet e.g. MetaMask.

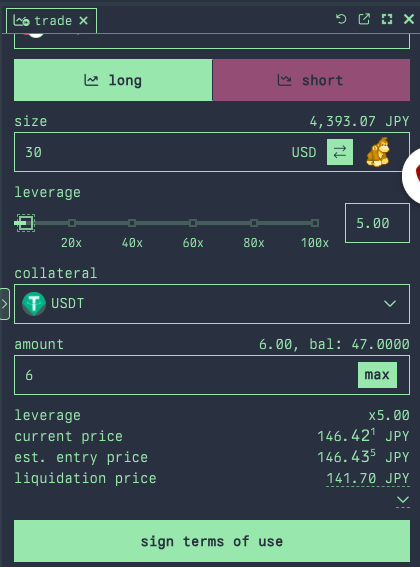

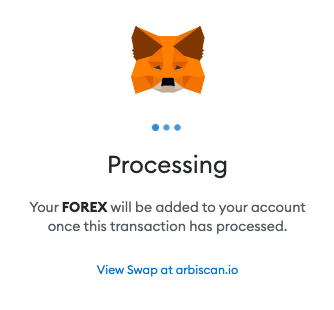

Once your wallet is connected, you can proceed to set up your trades i.e. take a long or short position on the currency pair of choice.

In this demonstration, we take a $30 long market position on the USD/fxJPY pair using 5x leverage.

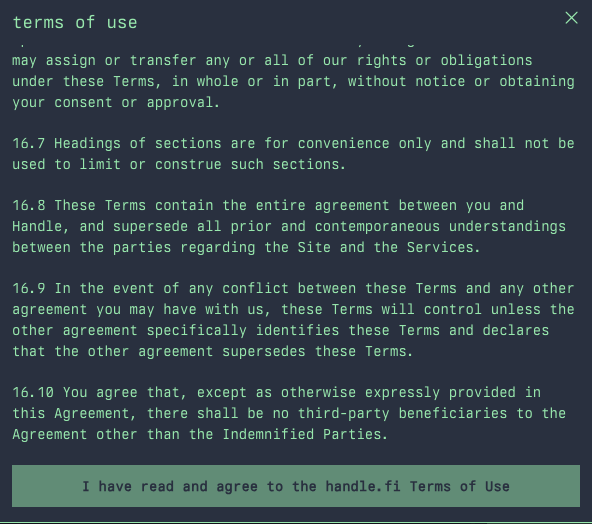

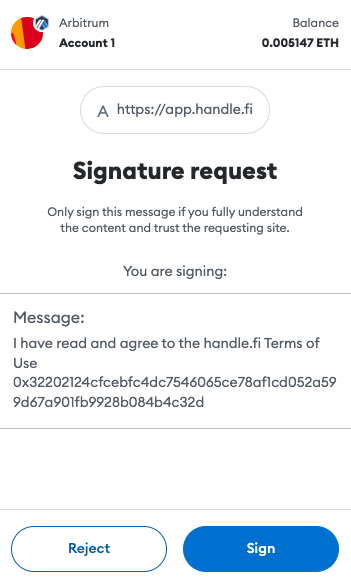

To proceed you need to read and agree to the terms of use.

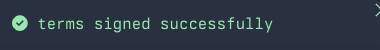

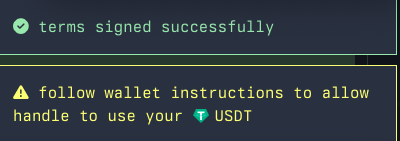

You may be required to sign a transaction signature to allow the smart contracts to interact with your wallet.

Once everything is all set , you can confirm your buys indifferent.

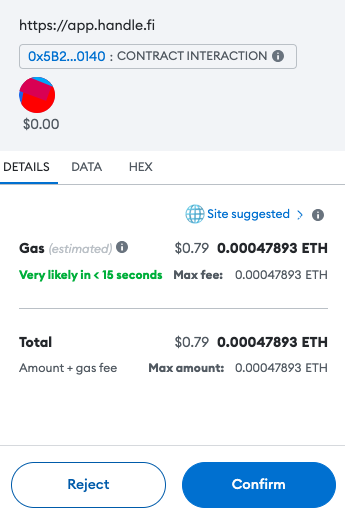

Confirm the transaction fee.

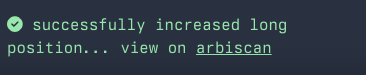

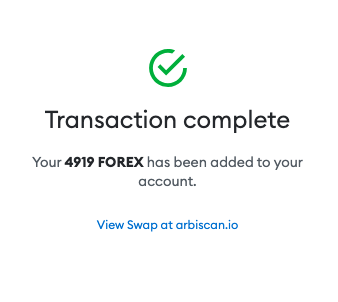

Every transaction can be tracked using ArbiScan – the Arbitrum block explorer.

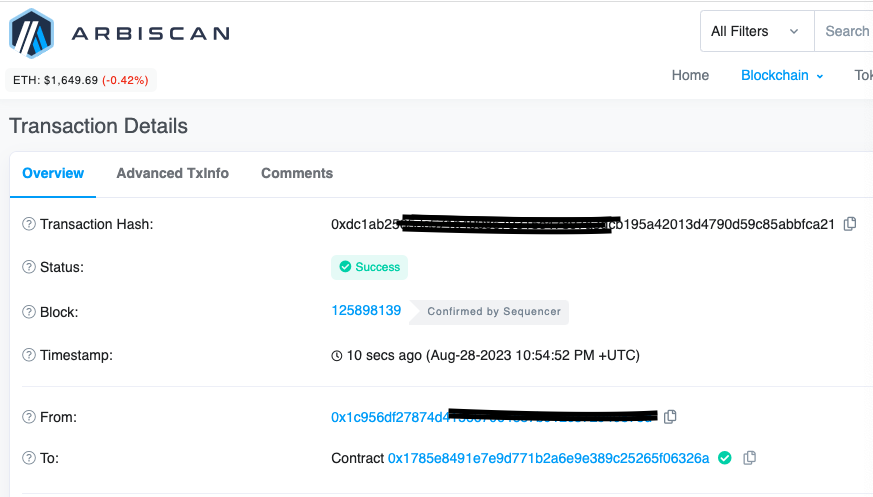

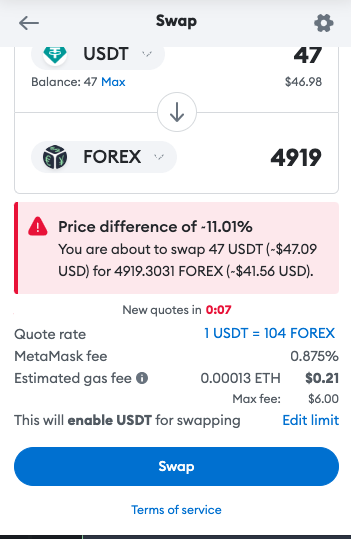

How to Purchase $FOREX tokens

Simply add the correct contract address to your Metamask e.g

Arbitrum: 0xdb298285fe4c5410b05390ca80e8fbe9de1f259b

The $FOREX Token Ecosystem

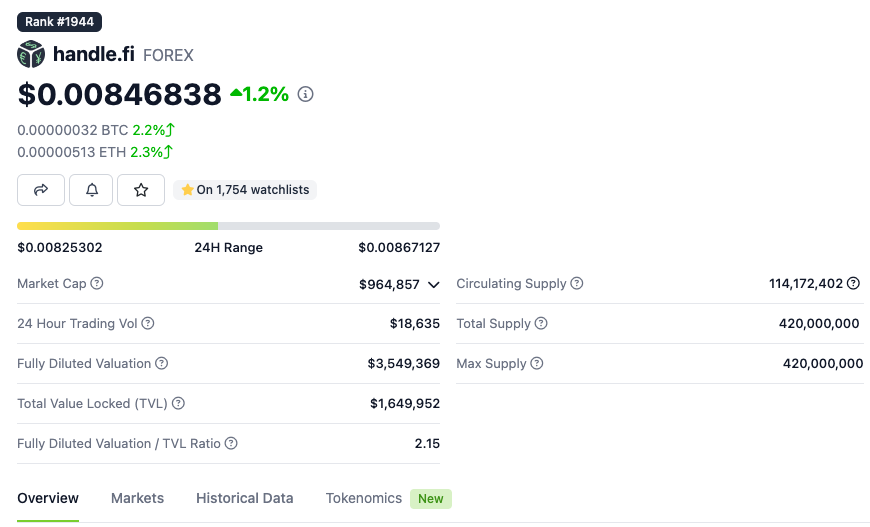

The protocol’s native token, $FOREX, rewards users for actions that benefit the platform and allows participation in governance. To be a part of Handle.fi governance, users must first acquire veFOREX.

veFOREX holders can:

- Take part in governance.

- Earn up to 2.5x boosted rewards for various protocol activities.

- Receive a share of the protocol’s earnings through $FOREX liquidity provision.

Tokenomics and Distribution

A total of 420,000,000 FOREX tokens will be minted over an initial 182-week timeframe, followed by a terminal inflation rate of 2.1% per year. The token allocation is varied and designed for long-term ecosystem health.

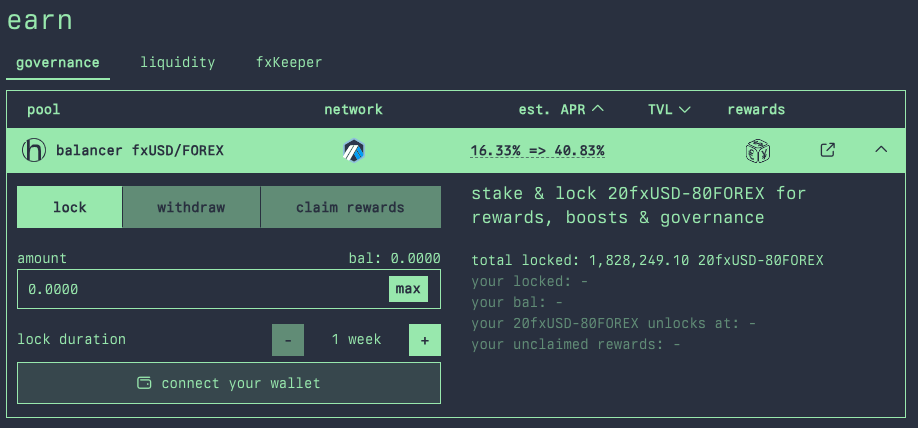

Governance Staking: veFOREX

Users can lock their FOREX/fxUSD (80/20) Balancer Pool Tokens (BPT) into the governance pool to receive ‘vote escrowed FOREX‘ or veFOREX. This allows them to participate in governance, receive enhanced rewards, and a share of protocol fees. The longer you lock your tokens, the more veFOREX you receive, thereby increasing your influence and rewards within the ecosystem.

The minimum lock-in period is one week, and the maximum extends to one year. The weight of a user’s veFOREX diminishes linearly as the locked tokens near their expiration.

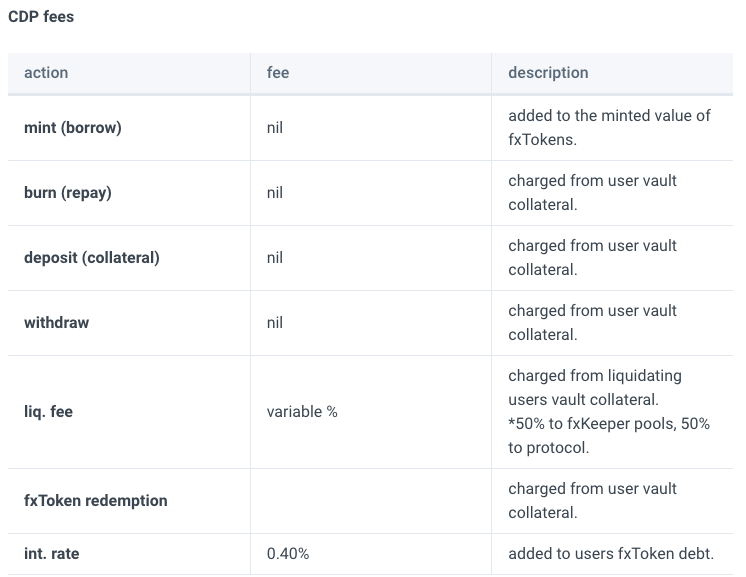

Fees on Handle.Fi

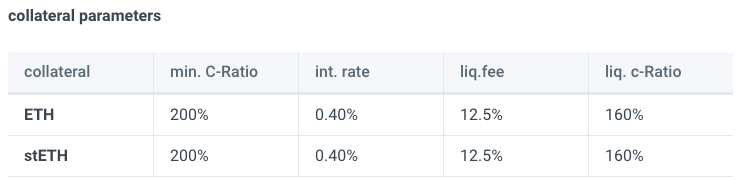

Vaults and Collateral in CDP: What You Need to Know

Initiating a vault to obtain credit comes with both upfront and ongoing fees. Additionally, it’s crucial to stay aware of the minimum collateral-to-debt ratio (min c-Ratio) to steer clear of any potential liquidations. Be informed that the lowest debt you can incur at any given time is 100. This is particularly relevant if you’re planning to pay down some of your outstanding debt and the remaining balance falls below 100.

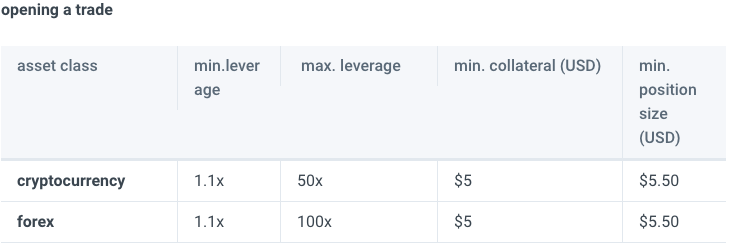

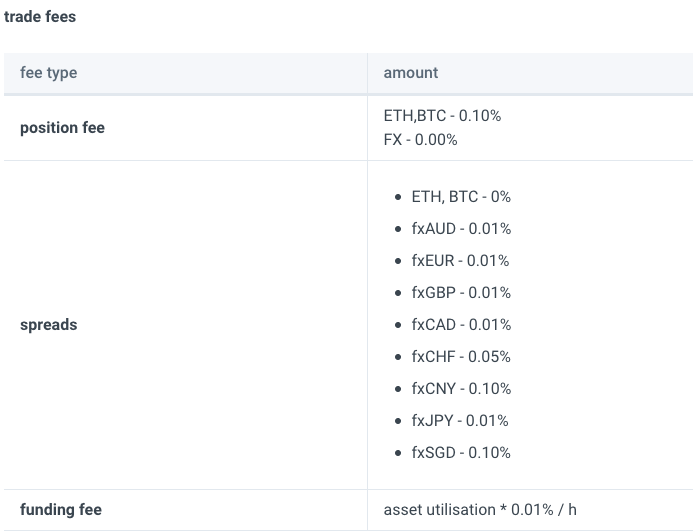

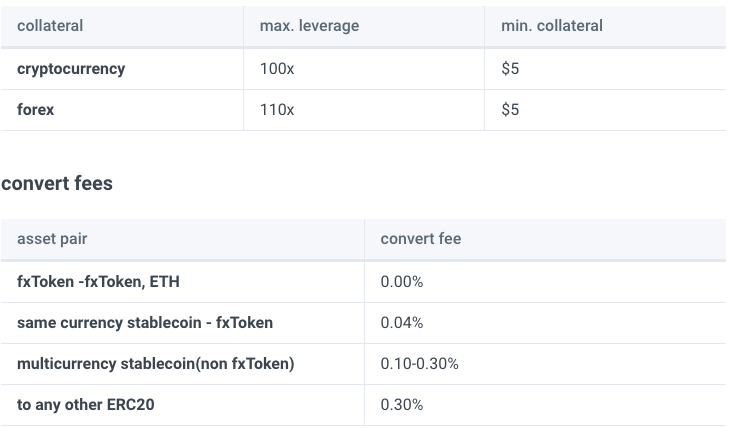

Fee Structure for Trading and Liquidations

Trading Fees: Industry Standard Practices

When it comes to leveraged trading, it’s typical in the sector to calculate fees based on the entire value of your position, which is determined by multiplying your leverage with the collateral.

Liquidation Charges: Understanding the Triggers

On Handle.fi, any trading position is subject to liquidation if specific criteria, known as liquidation triggers, are met. Your position will cross the liquidation threshold if its leverage exceeds the maximum allowed or if it falls below the minimum collateral required.

Continuous Collateral Calculation

It’s important to note that the value of your collateral is not static; it’s computed in real-time. Your ongoing collateral value is essentially your initial collateral, adjusted for any losses and fees you’ve incurred.

At the outset, Handle.fi DAO governance will be responsible for determining all fees and system parameters.

The protocol has future plans to transition toward algorithmically-driven mechanisms for fee and parameter adjustments in subsequent upgrades.