SmartCredit.io Decentralized P2P Marketplace Review

What is SmartCredit?

SmartCredit.io is an AI-powered self-custodial neobank that provides fixed-term, fixed-rate loans to borrowers and fixed income funds to lenders, along with fiat on/off ramp capabilities, without the risk of bank runs.

This decentralized global P2P lending marketplace facilitates direct connections between lenders and borrowers, eliminating the need for intermediaries. Lenders supply their funds, while borrowers access these funds on the worldwide platform.

Decentral Autonomous Blatform Ltd, a BVI company, operates the platform. The leadership team includes co-founders Martin Ploom and Tarmo Ploom, both CFAs (Chartered Financial Analysts), each have ten years of experience as vice presidents at Credit Suisse in Zurich, Switzerland.

Platform features include:

- Fixed-term, fixed-interest-rate collateralized loans for borrowers

- Personal Fixed Income Funds for lenders

- Efficient collateral utilization through the Positions Monitoring System

- AI-driven predictive Crypto Fraud Score, accessible for free at https://smarttrust.io

- AI-driven Crypto Trust Score for crypto lenders, available at https://smarttrust.io

- AI-driven Continuous Transaction Monitoring for wallets, exchanges, and payment processors, suitable for all crypto service providers (accessible via https://smarttrust.io)

- Fiat on-ramp/off-ramp

- AI API and Borrow/Lend SDK integrations for other wallets and platforms

- Staking and rewards for users

SmartCredit.io emphasizes offering self-custodial solutions that are compliant with regulations. More information can be found in the Regulations section.

Unlike Aave, Compound, and other money-market-based lending systems, SmartCredit.io does not face bank run risks.

The vision of SmartCredit.io is to provide all the financial services that traditional banks offer while maintaining a self-custodial approach.

To get started on the platform is straightforward. Simply launch the app.

Credit Lines and Fixed Income Funds

On SmartCredit.io, lenders establish their personal DeFi Fixed-Income Funds by specifying their desired investment types and setting their investment rules. Lenders can opt for short-term lending strategies (yielding lower interest) or long-term lending strategies (yielding higher interest). They can allocate portions of their portfolio to short-term and/or long-term investments as they see fit.

Borrowers, on the other hand, outline their collateralized loan requirements within Credit Lines. The specific collateral ratio is influenced by the collateral asset’s volatility, the loan term, and the borrower’s trust score. Predefined interest rate curves are in place, with the exact interest rate depending on the underlying asset, loan term, and trust score.

SmartCredit.io automatically matches borrowers’ loan requests with lenders’ fixed-income funds in the background.

Credit Lines

SmartCredit.io Credit Lines resemble traditional finance (TradFi) Lines of Credit. Borrowers collateralize their Credit Lines and can repeatedly borrow against their collateral. For each loan, the borrower specifies:

- The borrowing asset, which is one of the Fixed-Income Fund’s assets available for borrowing

- The collateral asset for the loan

- The loan term

- The specific collateral ratio for the loan, determined by the loan term, borrowed asset, collateral asset, and borrower’s trust score

- The precise interest rate for the loan, influenced by the loan term, borrowed asset, and borrower’s trust score (calculated automatically)

During the first loan, the system creates a credit line in the background. For subsequent loans, the existing credit line is utilized. A borrower can have various collateral types within a single credit line and multiple loans via their credit line. If a loan is liquidated, the remaining funds are transferred to the borrower’s credit line.

Borrowers can:

- Repeatedly borrow against unallocated collateral in the credit line

- Withdraw unallocated collateral (i.e., collateral not used for active loans) at any time

- Enhance the collateral ratios of active loans

- Add more collateral assets to their credit line

Borrowers must pay gas (ETH) for the following transactions:

- The first loan, which creates a credit line

- Depositing collateral

Repaying the loan

- If a borrower already has collateral in the credit line, they can create new loan requests without paying gas. In this case, gas is only paid when repaying the loan, resulting in significant gas savings for the borrower.

SmartCredit.io does not rehypothecate collateral. The collateral remains locked in credit lines and is considered “out of circulation.”

There are four credit line types:

- ERC20-ERC20: Borrowing ERC20 assets against ERC20 collateral

- ERC20-ETH: Borrowing ERC20 assets against ETH collateral

- ETH-ERC20: Borrowing ETH against ERC20 collateral

- ETH-ETH: Borrowing ETH against ETH (for those who wish to do so)

A credit line is always established with the initial borrowing transaction and is used in subsequent borrowing transactions. The assets within the credit line can be reused continuously, similar to a collateralized line of credit in traditional finance.

Fixed-term and fixed-interest-rate

Unlike most DeFi borrowing/lending platforms that offer variable-rate, variable-term loans, SmartCredit.io caters to the real economy by providing borrowers with fixed interest rates and fixed loan terms.

Why are fixed interest rates important for borrowers?

- Predictability is crucial in the actual economy, as it allows borrowers to know their capital costs and liability values in advance.

Why are fixed loan terms necessary for borrowers?

- Borrowers can anticipate their financial obligations beforehand.

- Efficient use of collateral is facilitated.

Fixed-Income Funds

Lenders create their personal Fixed Income Funds (FIF) and deposit assets into them. The platform then matches the FIFs with borrowers’ credit lines.

Lenders lend through their FIFs, deciding on the maturity ratios for their asset investments. This enables lenders to combine various loan maturities and generate their desired loan portfolio.

An FIF is divided into four buckets:

- “Bucket 0” invests in Compound’s variable-rate money-market fund.

- “Bucket 1” invests in 11–30-day loans.

- “Bucket 2” invests in 31–90-day loans.

- “Bucket 3” invests in 91–180-day loans.

Investors can also establish multiple FIFs, such as:

- A first FIF for short-term lending strategies.

- A second FIF for long-term lending strategies.

Alternatively, investors can select a single bucket for their investments:

- Only bucket 1 for 11–30-day loans OR

- Only bucket 2 for 31–90-day loans

This flexibility allows lenders to adopt strategies that best align with their expectations. Lenders can allocate more funds to “bucket 2” or “bucket 3” to earn higher interest, or they can allocate more funds to “bucket 0” or “bucket 1” for greater flexibility but lower interest.

Efficient Collateral Utilization and Positions Monitoring System

SmartCredit.io features a Positions Monitoring System, which allows borrowers to receive Telegram notifications if the liquidation probability increases. This automated function is accessible to all users.

The Position Monitoring System promotes efficient collateral usage.

Liquidations

SmartCredit.io oversees loans and initiates liquidation if a borrower fails to pay or if their collateral value drops too far. Borrower’s collateral assets in the smart contracts are safeguarded by oracles, ensuring that the liquidation process commences only after oracle verification.

Unlike its competitors (Aave, Compound, and Maker), SmartCredit.io does not profit from liquidations. Any remaining collateral post-liquidation is returned to the borrower. Competing platforms generate revenue by liquidating under-collateralized borrowers, selling their collateral at a discount. The residual collateral value becomes profit for liquidator bots, often hosted by the respective platforms. In some instances, liquidation revenues account for up to 50% of a platform’s total earnings.

If collateral is insufficient to cover a borrower’s obligations, the Loss-Provision Fund compensates the lender for the difference.

No Bank Run Risk like Aave or Compound

Many DeFi platforms face bank run risks due to unmatched maturities. In contrast, SmartCredit.io matches borrower/lender maturities, functioning like a traditional bank without custodial concerns or bank run risks.

Regulations

From a regulatory perspective:

- SmartCredit.io operates as a purely peer-to-peer platform, without pooling client assets. As a result, it does not need to register as a security.

- Competitors that have implemented peer-to-pool-to-peer business models must register as securities, which they may never achieve.

- SmartCredit.io has implemented Transactions Monitoring.

How are loan requests matched?

SmartCredit.io pairs borrowers’ loan requests with lenders’ fixed-income funds through a three-component system:

- Borrowers establish their collateralized loan requests using credit lines.

- Lenders create their fixed-income funds (FIF) and deposit assets.

- SmartCredit.io serves as a matching engine, connecting borrowers’ loan requests with lenders’ fixed-income funds.

Interest payments accumulate in the FIFs and are continuously matched with new loan requests.

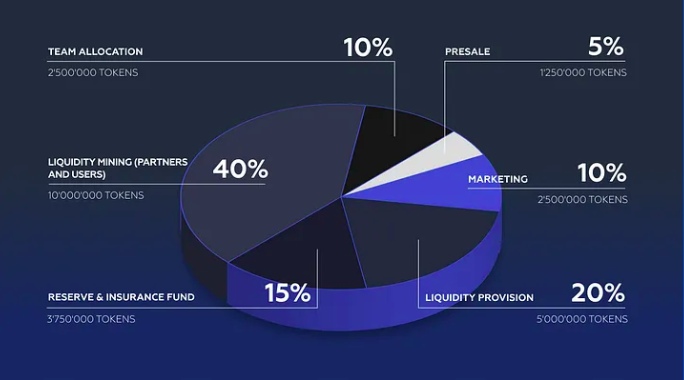

SMARTCREDIT Token Utility

SMARTCREDIT utility is defined as follows:

- SMARTCREDIT as collateral for borrowing

- SMARTCREDIT for staking

- SMARTCREDIT for improving the borrower’s credit score

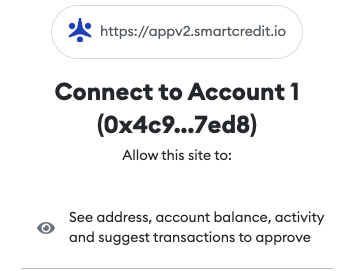

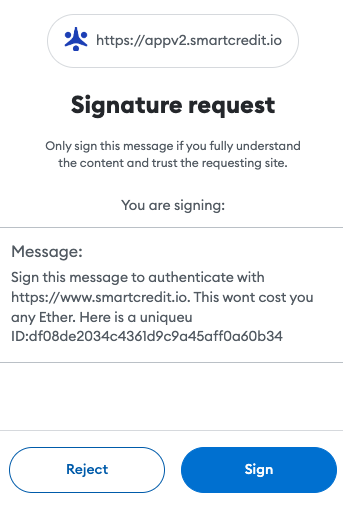

To purchase SMARTCREDIT tokens is quite easy using a web3 wallet such as MetaMask to purchase tokens via decentralised exchanges. Connect your wallet.

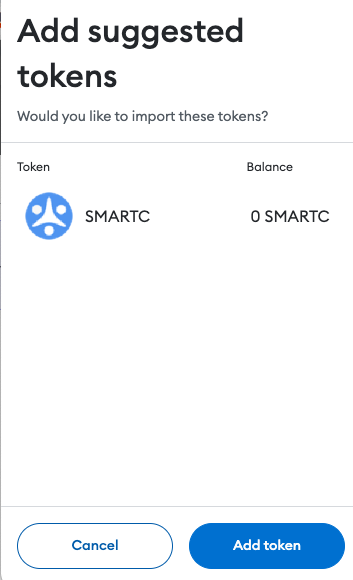

Make sure you add the contract address and import the token to your MetaMask.

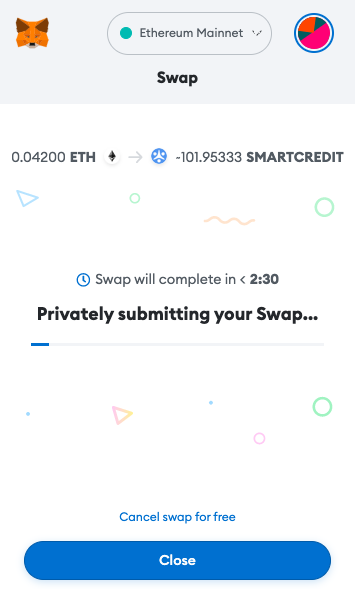

Once your wallet is connect to the SmartCredit.io smart contracts, you can proceed to swap from another asset e.g. ETH to SMARTCREDIT.

Rewards Program

SmartCredit.io will offer the following rewards:

Staking rewards for the holders

- 15% annualized inflation

- 225,000 tokens annually for staking rewards

- 4,327 tokens weekly for staking rewards

Bonus rewards for the borrowers and lenders

- 10% annualized inflation

- 150,000 tokens annually for bonus rewards

- 2,885 tokens weekly for bonus rewards

Affiliates/Marketing rewards

- 6% annualized inflation

- 90,000 tokens annually

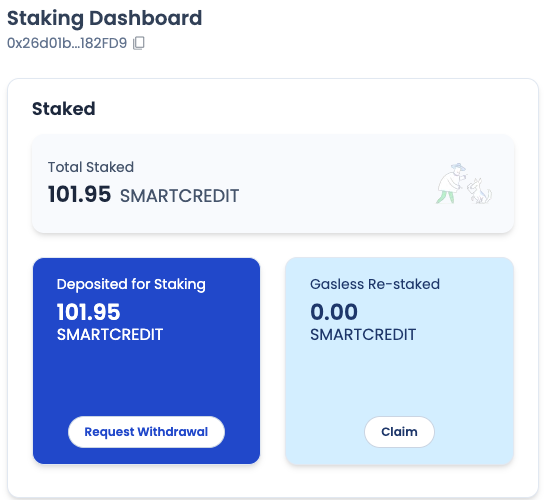

Staking

Staking rewards are provided to SMARTCREDIT holders who lend SMARTCREDIT via staking FIFs, earning rewards in return. SmartCredit.io distributes 2,415 SMARTCREDIT tokens weekly to stakers through https://appv2.smartcredit.io/.

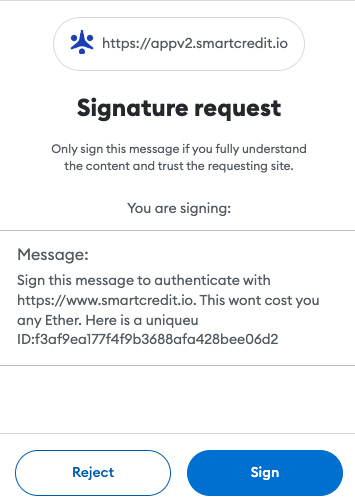

Launch the app to begin staking. You’ll need to give the app permission to interact with your wallet.

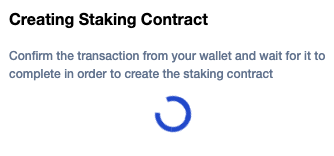

You can then proceed to create the staking contract.

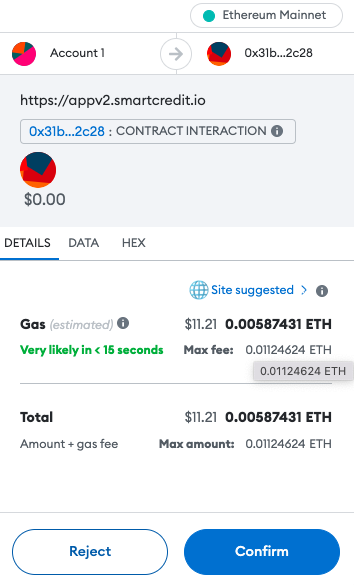

You’ll be required to pay the gas fee for this set up / initial contract interaction.

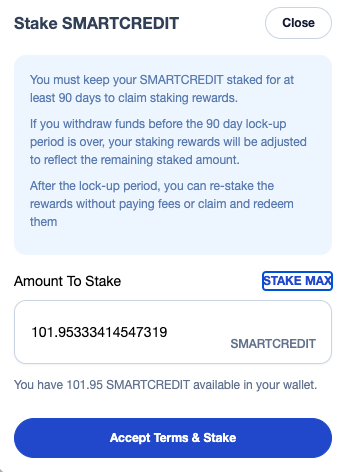

Choose the amount of SMARTCREDIT tokens you wish to stake for example.

Pay the transaction gas fee.

Once that processed, your tokens will be staked.

Staking rules include:

- Staking is executed via SmartCredit.io fixed-income funds, with each staker required to create a unique staking FIF.

- To receive rewards, stakers must deposit for a minimum of 90 days. They can increase their staking position at any time by depositing additional SMARTCREDIT.

- Staking for less than 90 days results in forfeiture of rewards.

- Stakers can initiate a “Request Withdraw” transaction to cancel staking, triggering a five-day cool-down period. They can withdraw any amount within five days of the cool-down commencement. Remaining tokens are still eligible for staking rewards if deposited for at least 90 days.

- Users can either claim rewards or utilize gasless re-staking to re-stake their staking rewards.

- Gasless re-staking enables re-staking of rewards without incurring gas fees. Staking rewards are distributed every Sunday at 12:00 UTC, allowing stakers to re-stake their rewards weekly.

- Gasless re-staking is a distinctive feature, allowing users to claim rewards and deposit them without paying gas fees.

The “My Rewards” section updates every Sunday at 12:00 UTC, displaying rewards for staking positions held for a minimum of seven days. Weekly staking rewards for users may vary depending on the number of other stakers. Staking rewards are divided pro week, pro rata, and pro volume among all stakers:

- If 50% of holders stake, a 20% staking APY is calculated.

- If 25% of holders stake, a 40% staking APY is calculated.

Staking is implemented via FIFs. While standard FIFs have four buckets (0-10 days, 11-30 days, 31-90 days, 91-180 days), staking FIFs have a single bucket (91-180 days). The staking FIF buckets are not displayed on-screen, with only one bucket visible.