Vesper DeFi Platform Review

What is Vesper?

At its core, Vesper makes decentralised finance (DeFi) much easier to use. Products such as its interest-yielding ‘Grow Pools’ attract users who may want to passively increase their digital asset holdings through different strategies.

Some strategies can be conservative and others more aggressive but always appropriate to the asset they hold. Vesper’s modular and multi-pool design software architecture is developed in such a way that enables smart contract administrators to also adapt and transition strategies.

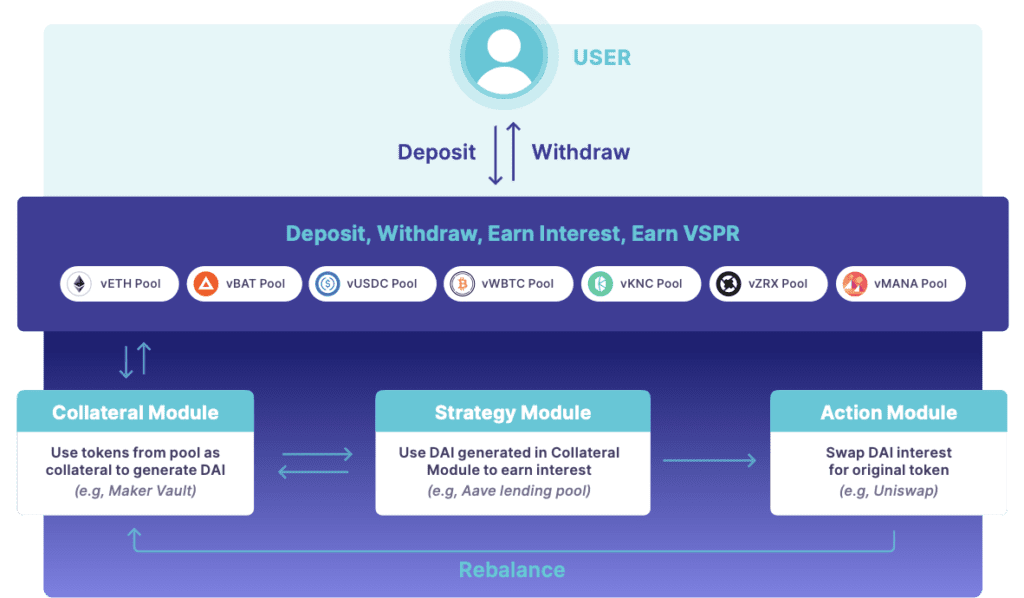

For instance, with Vesper, a user can easily choose to deposit a token and potentially earn more of it. In addition, they have the ability to route deposits through a variety of yield sources via the Grow Pools. Each Vesper pool is typically composed of a couple or several components i.e. the frontend which is responsible for handling deposits and withdrawals, and the backend strategy or strategies that are designed to direct the deposits and also to aggregate yield.

The approach Vesper utilises makes it possible for developers to create different yield-earning strategies and combine those strategies with others or even replace existing strategies in an effort to capture high-yield opportunities as they become available. Some of these strategies could include different elements of DeFi e.g. lending, yield farming, liquidity provisioning and synthetic asset trading.

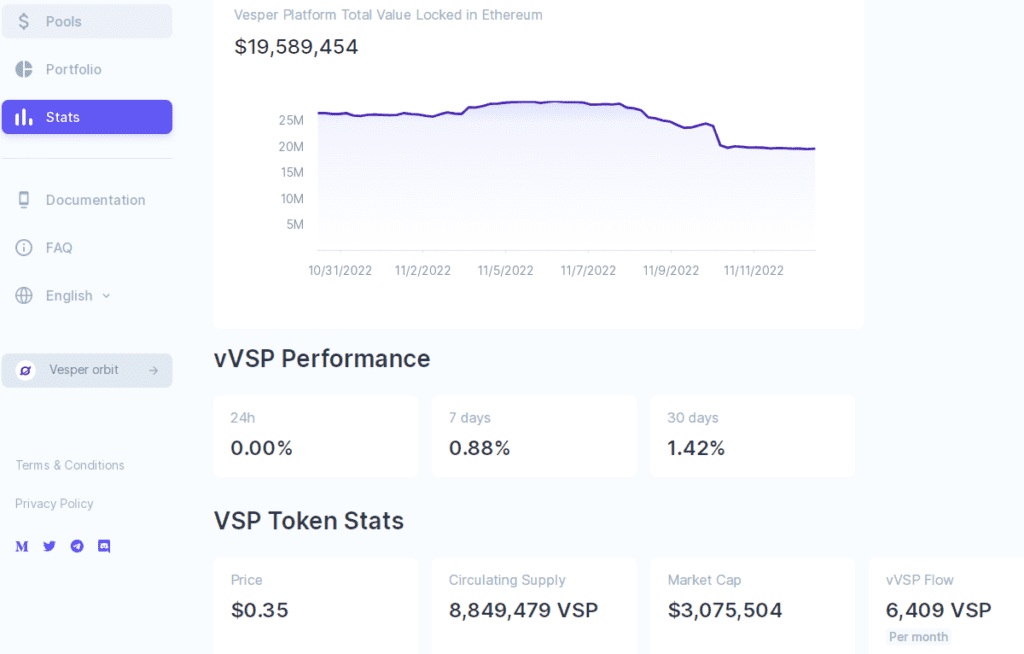

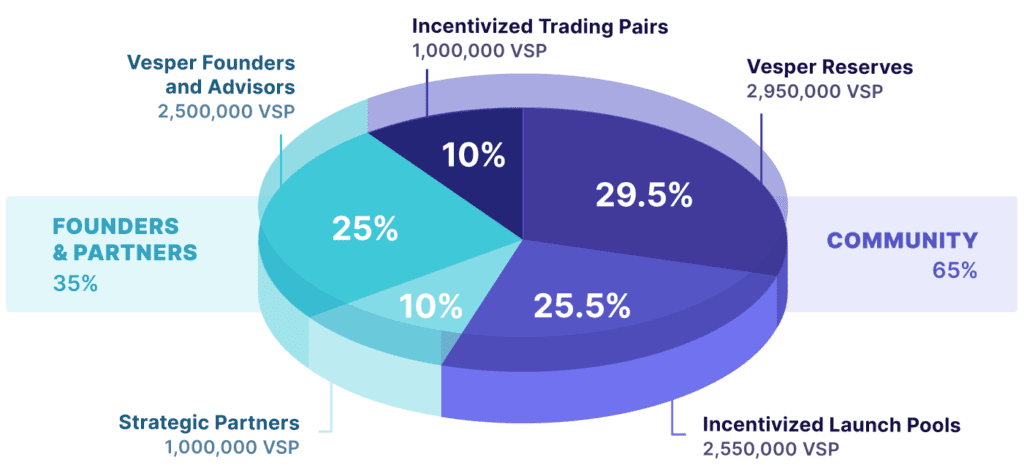

The Vesper Grow Pools are the core products offered by Vesper, with more products in development. Vesper Token, which has the ticker $VSP, is the platform’s native token that is meant to incentivize ecosystem participation and user contribution, as well as facilitate governance. Users have the opportunity to earn VSP through pool participation.

What Makes Vesper Unique?

Vesper is non-custodial. This means that users have control over the assets that they deposit on the platform, which are deployed automatically via smart contracts through a trustless architecture that allows contracts to be algorithmically deployed according to the specifications laid out by the Vesper pool strategy. Users do not have to worry about deciding which strategy specifications to choose since that is the responsibility of the architects of each pool strategy. Vesper pool smart contracts generally contain a few privileged addresses including a ‘governor’ and one or more ‘keepers’ who are tasked with implementing updates to the pools & strategies. Vesper’s code has undergone two independent audits by Coinspect and Certik.

As a permissionless protocol, Vesper doesn’t require users to sign up. There’s no whitelisting or account verification required in order to participate in the Vesper ecosystem.

In addition, Vesper gives users the ability to interact with smart contracts directly and since the project is open source, pretty much any developer is able to start building with Vesper.

Vesper’s user interface is conveniently designed to be easy to use. Users can simply use a one-click deposit and withdrawal function, as well as mechanisms for portfolio tracking and other metrics.

Vesper is deployed on the Ethereum blockchain, which allows the protocol to interact with existing DeFi protocols for yield farming. Vesper has also deployed the VSP token and Grow pools on the Polygon and Avalanche networks. The pools can route through protocols such as Aave and Curve in order to earn the best yield offered through those platforms. It is important to understand there are always risks associated, for instance, if a ‘black swan’ event occurs, Vesper pools can be affected e.g. if a pool’s underlying asset flash crashes.

VSP is the governance token that VSP holders can use to vote on proposals, in addition to depositing the tokens in order to passively accumulate more VSP. There are three core ways VSP can be earned through ecosystem participation in:

- Vesper pools – an amount of VSP tokens is assigned to each pool and distributed to use in proportion to the size of their stake.

- Liquidity provisioning – liquidity providers are incentivized with VSP.

- Staking – VSP are awarded to pool depositors.

The vVSP pool is a revenue-sharing mechanism that rewards VSP token holders with additional VSP when they deposit their tokens in it.

As a user you can also acquire VSP through secondary marketplaces, for example, you can swap other crypto assets for VSP.

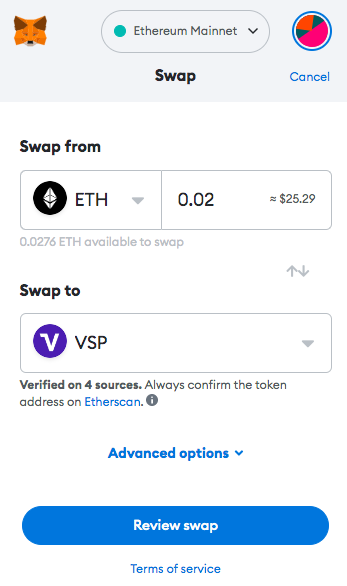

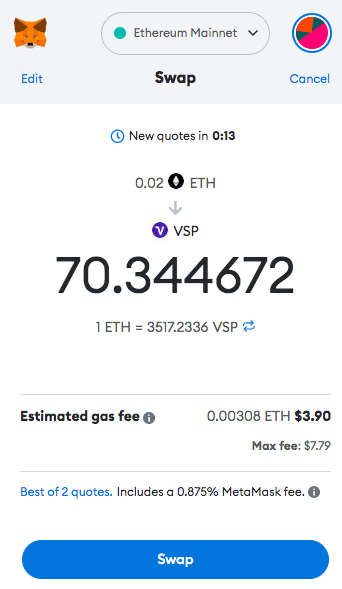

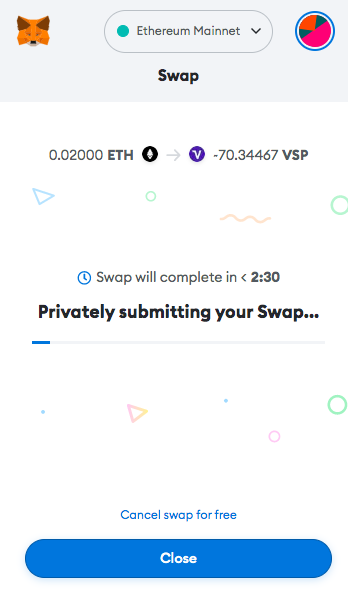

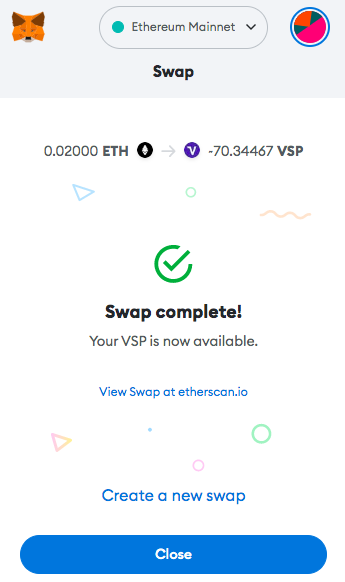

For the purposes of demonstrating, we swapped some Ethereum for VSP using MetaMask wallet which connects to several DeFi marketplaces and makes it easier to swap and custody assets.

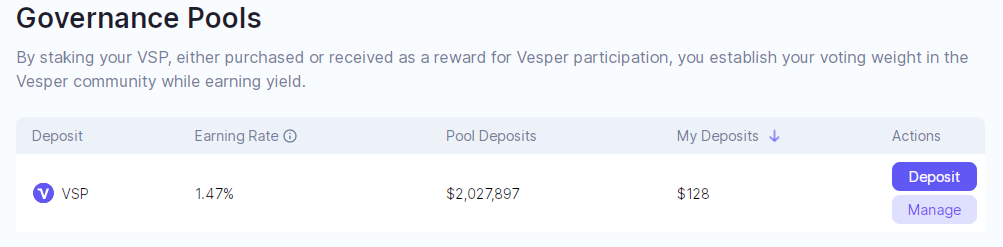

How to Stake $VSP Token in the Vesper Governance Pool

Staking $VSP tokens establishes your voting weight in the Vesper community. What’s also great is that you can do so while earning a yield on your deposited funds.

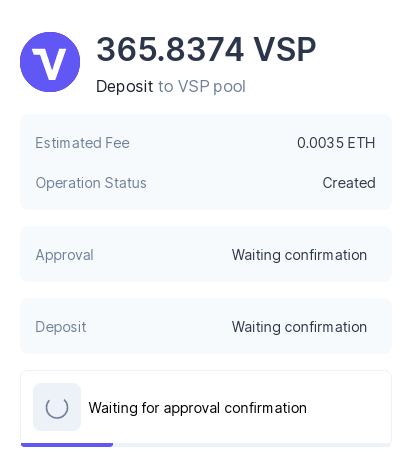

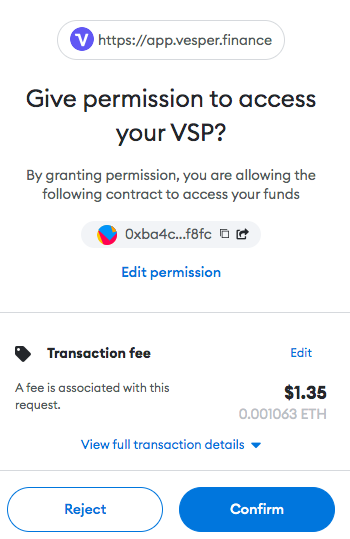

Once you choose how much you want to deposit and if you agree with the transaction fee for interacting with Vesper smart contracts.

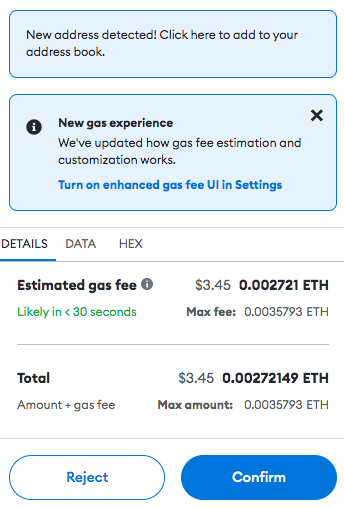

There’s a gas fee charged for processing the transaction.

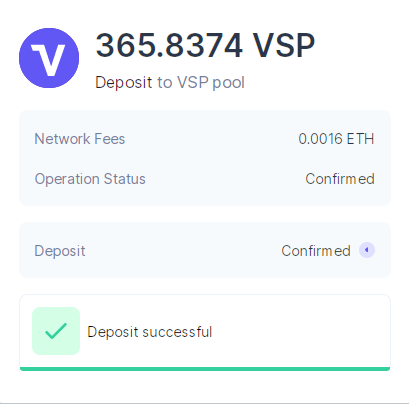

And just like that your VSP will be staked and ready to earn yield.

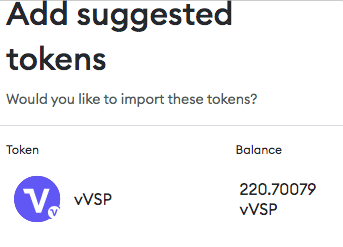

First, you’ll be prompted to add vVSP staking pool token.

Following that you’ll be able to view your staked balance.

What are the fees on Vesper?

Vesper charges two fee types i.e withdrawal and platform fees. A 0.6% fee is chargeable on withdrawal from Vesper Grow pools. There’s also a 15% platform fee charged on yield generated by assets deposited by a user. Both fee types are taken in the form of pool shares, and then delivered to the Treasury where they continue to earn yield until converted to VSP tokens which can be achieved by selling them on the open market via an automated market maker such as Uniswap or SushiSwap. These VSP go to the vVSP pool to be distributed to vVSP holders.