Pendle Finance Review

Described as a protocol that liberates future yield, Pendle Finance is also said to make it possible to tokenize and trade future yield on a novel automated market maker (AMM) that is especially designed to support assets with time decay.

The team behind Pendle envision that as decentralized finance (DeFi) markets mature, yield trading of financial instruments including bond coupons and interest rate swaps will become more prominent. With that vision Pendle is now dubbed somewhat the first protocol to make the trading of tokenized future yield on an AMM system possible. Pendle will essentially be made up of three key components i.e. yield tokenization, AMM, and governance.

Their goal is to provide an opportunity to crypto ecosystem users who hold yield-generating assets that make it possible for them to generate additional yield and also be able to lock in future yield upfront. Furthermore, Pendle also wants to offer traders direct exposure to future yield streams. All this without need for underlying collateral. Currently, Pendle supports DeFi platforms such as Compound and Aave.

How Pendle Works

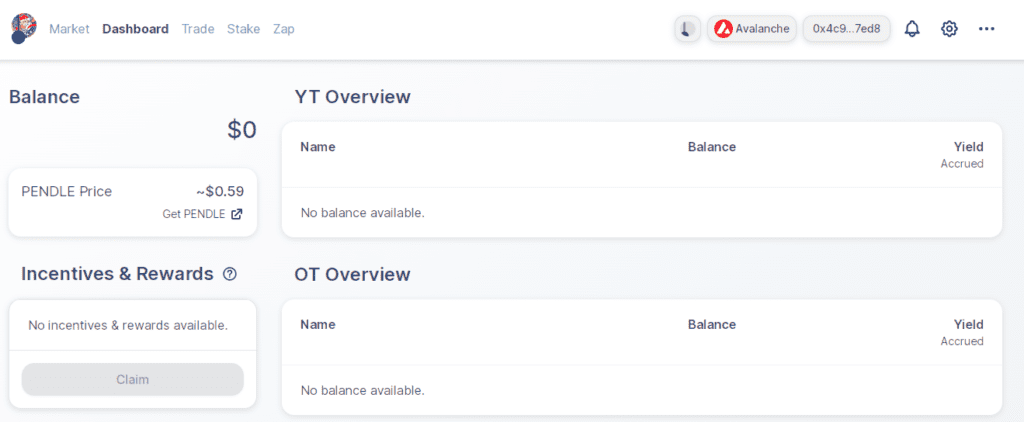

Users of Pendle who hold yield-generating assets are able to deposit these tokens into Pendle. This enables them to mint an Ownership Token (OT) which effectively represents the underlying principle, and then a Yield Token (YT) which represents the holder’s right to receive the yield.

As a user, you’d be able to utilise the yield token in a couple of ways 1) you can deposit your YT into Pendle’s AMMs in order to provide liquidity to Pendle. Fees and other incentives are made available to you in return for being a liquidity provider. 2) You can simply sell your YT for cash upfront which allows you to fix the interest rates and lock in returns instantly. All this means that traders are then able to buy the yield tokens directly and without needing to first lock up their underlying assets. Pendle sees this as a more effective and capital-efficient way for traders to gain exposure to future yield.

On SushiSwap, users can also provide liquidity with their ownership tokens. Alternatively they can also sell the ownership tokens in order to retain exposure to yield via the yield tokens. Pendle offers different types of liquidity incentives including liquidity provision to the yield token or base token pools; liquidity provision to the PENDLE / ETH pool on SushiSwap and auto-compounding PENDLE token staking.

How to Use Pendle

Pendle makes it possible for users to lock in yield at the current interest rate and makes it possible for the user to receive cash upfront. If a user thinks that interest rates will drop in the future, they can certainly make use of this function. This means that by the user deciding to lock in the yield, they are effectively making a bet that interest rates could drop in the future therefore it’s better for them to secure the interest rate currently offered.

For instance, if a user decides to lend USDC on Aave and receive aUSDC but they are of the opinion that the lending rate on Aave is high and unsustainable long term, they may think it wise to capitalize on the opportunity to lock in the current lending rate on Pendle. In order to do so, the user then goes on to use Pendle to mint ownership token and yield token. Following that they sell the yield token on the Pendle automated market maker in order to lock in the yield.

The rest of the ownership token can then be redeemed for an equal amount of USDC upon expiry. All the user would need to do is go on to the Pendle minting interface and then proceed to select the underlying token and the date of expiry. (Note that yield token cannot accrue interest and upon expiry, its value will be zero. Holders of expired ownership token can redeem the underlying, or they also have the option to roll the contract forward and receive ownership token and yield token with the new expiry.) From there a user can input and also approve the underlying token and the minting amount. They can then mint and receive the ownership token and yield token on the chosen date. A user is then free to go to the swap interface and select the yield token as the input before proceeding to input and approve the yield token to be swapped into USDC.

Another way to use Pendle is to leverage on yield exposure since buyers can pretty much increase their leverage by simply purchasing yield tokens on Pendle with the intention to speculate on yield. For example, say a user decides to speculate that the aUSDC rate will steadily increase over a certain period as a result of demand coming from yield farms for USDC. In the case that the user has some capital and intends on maximising potential gains, they can choose to exercise a couple of options including using Aave to gain lending rate exposure via holding aUSDC or use Pendle to purchase exposure to interest rates. The second option creates better leverage in the trade since the user can have exposure to the yield of the underlying token without needing to actually own the token. All they’d need to do is simply use Pendle’s swap interface to swap USDC for yield token and then holding it and swapping back to USDC at their convenience.

Fees on Pendle

Pendle charges mainly two types of fees:

- Forge Fees – at least 3% of the interest that is accrued from yield token is allocated to the Pendle Treasury

- Swap Fees – the automated market maker charges a 1% swap fee on trades. 0.85% is then distributed to liquidity providers and 0.15% is sent to the treasury.

- Governance of the Pendle protocol through PENDLE token can influence fee structure changes in the future.

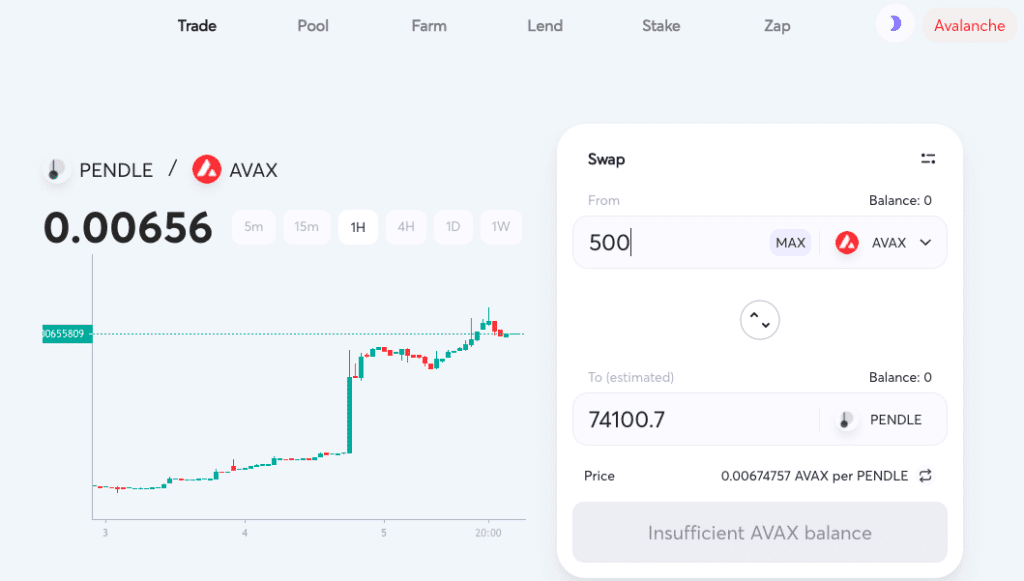

Where to trade PENDLE tokens

Pendle is currently traded on exchanges such as Crypto.com and Gate.io.