Camelot Decentralized Exchange Review

What is Camelot?

Camelot epitomizes an ecosystem-centric, community-led DEX engineered on the foundation of Arbitrum. It is designed as an adaptable, highly effective protocol, empowering builders and users to utilize custom infrastructure for enduring, flexible, and comprehensive liquidity. It pioneers a shift from the conventional DEX structure, emphasizing a bespoke approach that values composability.

What Makes Camelot Unique?

- Camelot aims to equip the Arbitrum ecosystem with an array of pioneering features, granting them an unprecedented level of flexibility and control over their individual liquidity.

- It intends to back emerging protocols debuting on Arbitrum, supplying tools that aid in launching, liquidity bootstrapping, and maintaining their expansion.

- It aspires to democratize access to permissionless tools, enabling projects of diverse sizes to utilize the protocol to meet their unique needs.

- Its objective is to provide top-notch functionality that is easily integrable, buildable, and can be utilized by other protocols within the ecosystem.

- Camelot is keen on integrating the real yield narrative into a DEX and liquidity provision, formulating inventive emission strategies that take advantage of more enduring tokenomics, harmonizing incentives with builders, users, and the protocol.

- It is committed to maximum decentralization, allowing the community to guide the protocol’s evolution as a DAO, while facilitating the core team to build the protocol sustainably.

Key Features

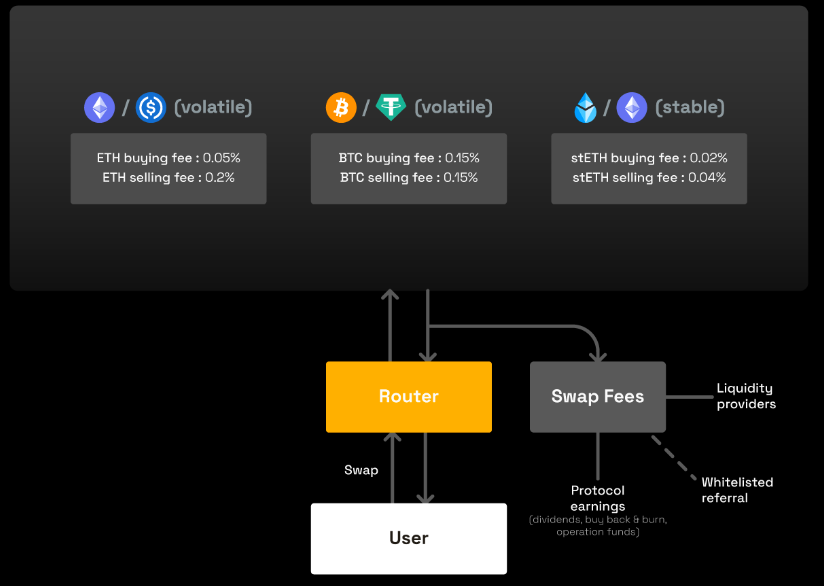

Camelot operates on the principle of a dual AMM, capable of supporting both volatile (UniV2) and stable (Curve-like) swaps.

In addition they’re implementing dynamic directional fees for the trading pairs: this facilitates setting distinct fees for each pool, and having varying fees based on the direction of the swap (purchase/sale).

These advanced AMM characteristics enable us to present pool configurations that are more personalized and catered to the specific trading pairs.

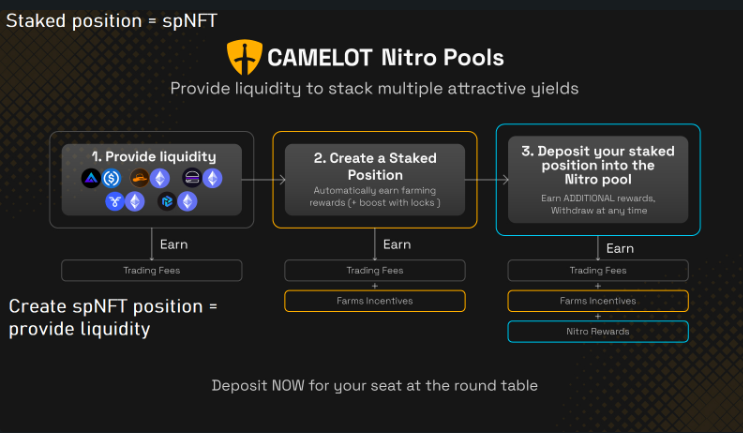

Cutting-edge yield & incentives

A pivotal attribute of Camelot is the incorporation of an innovative liquidity strategy rooted in non-fungible staked positions.

These yield-generating positions serve as an extra layer over the traditional LP tokens, introducing new features advantageous to both users and protocols:

- Management of locks on staked positions and their associated yield enhancements.

- Considerable augmentation of capital efficiency via the introduction of diverse custom staking strategies.

- A unique reusability, either through the protocol, as in the Nitro Pools, or via the infinite potential of external implementations.

Permissionless

The team are staunch proponents of offering protocols the prerogative to interact directly with Camelot without any approval or intervention from the team, considering this the gold standard for a modern AMM.

Through the permissionless Nitro Pools, projects retain complete control over their incentives and possess extensive flexibility to construct the precise type of liquidity required for their success. While protocols maintain total control to incentivize and manage their liquidity as they wish, Camelot will also offer a custom strategy to aid in achieving their objectives.

The custom launchpads will likewise be entirely permissionless, providing all projects an equal chance to bootstrap their token launch and liquidity, with various models available to meet every unique requirement. Camelot itself will debut through the launchpad, and they view it as a feasible option enabling teams to raise funds and liquidity in a completely decentralized, community-led manner.

Long-lasting sustainability

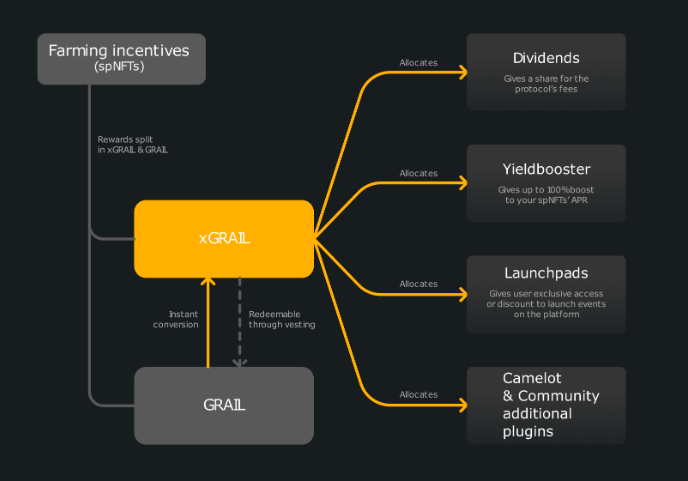

Camelot is rooted in a dual token system, composed of the native liquid GRAIL and its escrowed version xGRAIL, a non-transferable governance token, both employed as farming rewards.

Most emissions are distributed in xGRAIL, offering a high degree of control on the supply flow in the market. This empowers us to strike a healthy equilibrium between enticing incentives to augment initial liquidity, while preparing for the long-term wellbeing of the protocol.

The establishment of a supply hard cap, meticulously designed emissions and supplementary deflationary mechanisms, will be another vital component to ensure Camelot’s tokenomics’ long-term sustainability.

Protocol earnings, initially sourced primarily from swap fees, will be partially redistributed to xGRAIL users as real yield, and used for buy back & burns to maintain constant buying pressure on GRAIL.

How to Use Camelot DEX

Trading

What You Can Do:

Exchanging (swapping)

- Execute token swaps

Liquidity Provisioning

What You Can Do:

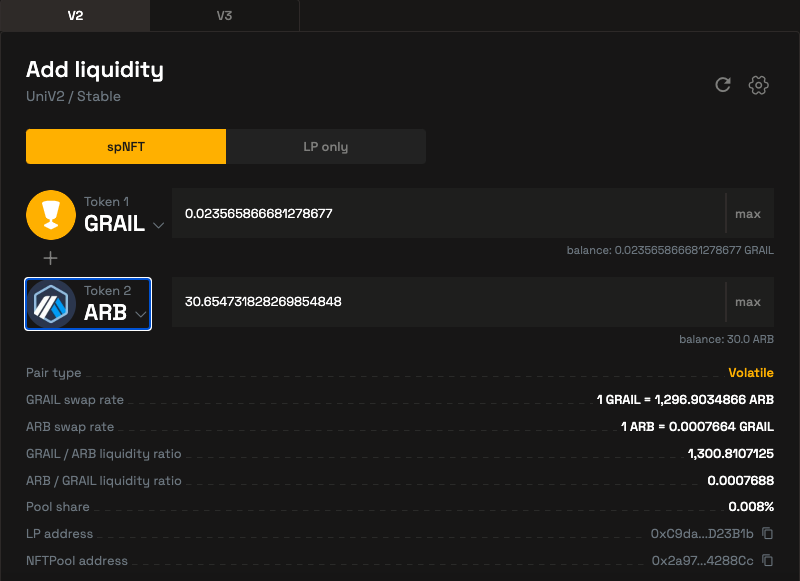

- Establish a staked position (spNFT)

- Supply liquidity V2 / V3

- Formulate new staked positions (spNFTs)

Earning

Staking (positions) – Positions & Pools

What You Can Do:

- Unbind the LP

- Wrap LPs or individual assets into fresh staked positions (spNFTs)

- Inspect your staked positions

- Observe yield-generating pairs (those incentivized by Camelot)

- Collect earned rewards from the operational farm

- Modify locks on staked positions

- Increase and decrease staked positions

- Transfer your position to a different wallet address

- Divide staked position

- Consolidate staked positions

- Retract from nitro/genesis pool

$GRAIL Token

Name: Camelot Token

Ticker: GRAIL

Chain: Arbitrum

Max supply: 100,000 GRAIL

Contract: 0x3d9907F9a368ad0a51Be60f7Da3b97cf940982D8

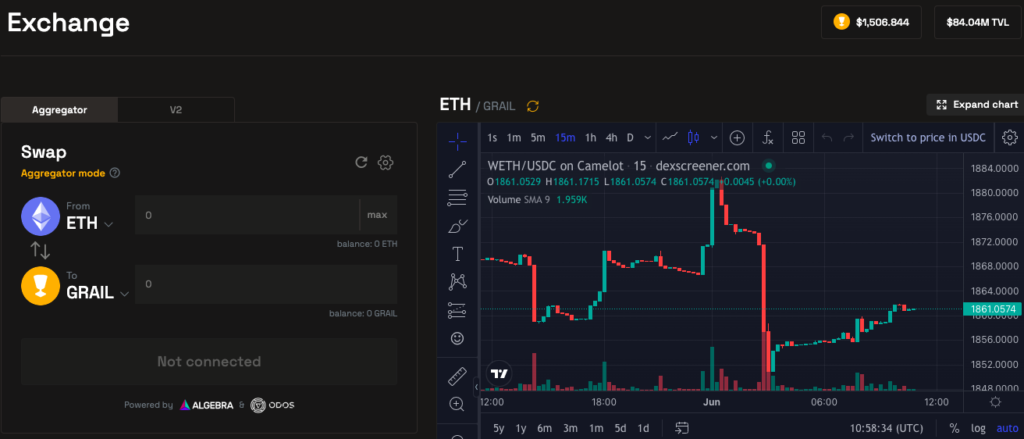

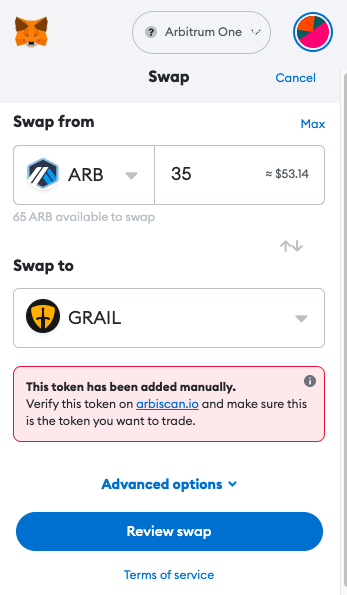

$GRAIL is Camelot’s native token. It can be earned as yield rewards on incentivized staking positions.

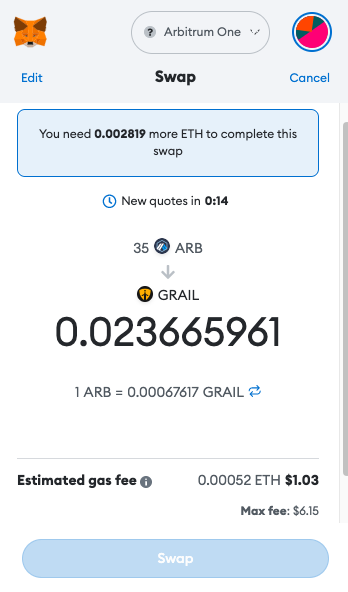

To purchase $GRAIL is easy using decentralised exchanges. Alternatively, you can swap it with another asset by simply using a web3 wallet e.g. MetaMask. Firstly, add the above token contract address to your wallet.

You can then proceed to do test transaction. This is recommended if you’re going to make a large purchase to just check that everything works perfectly. And since Arbitrum makes it possible to pay very low fees, taking the precaution is a small price to pay for peace of mind. In this example, we swap a small amount of Arbitrum network’s native ecosystem token $ARB for $GRAIL.

$XGRAIL Token

xGRAIL Using the dashboard, users can:

- Transform GRAIL into xGRAIL

- Exchange xGRAIL for GRAIL via the vesting process

- Assign xGRAIL to dividends to earn a portion of the protocol’s earnings

- Distribute xGRAIL to enhance your spNFT positions’ APR obtained from farming emissions

- Assign xGRAIL to the launchpad plugin to avail benefits

Currently, there are three native xGRAIL plugins available for users to designate their xGRAIL holdings:

- Dividends: to accommodate dividends sourced from protocol revenue

- YieldBooster: to augment the yield of existing staking positions

- Launchpad plugin: to gain access to launchpad-related benefits

Learn about other decentralised exchanges on Arbitrum and beyond e.g. Kromatika, gTrade, MUX, SynFutures and ApeX.

Learn about other decentralised exchanges on Arbitrum and beyond e.g. Kromatika, gTrade, MUX, SynFutures and ApeX.