SyncSwap Protocol on zkSync Review

What is SyncSwap?

SyncSwap stands as a cutting-edge decentralized exchange (DEX) running on zkSync Era. Harnessing the power of zero-knowledge proofs, SyncSwap offers an accessible, cost-efficient DeFi experience, all while maintaining the robust security of Ethereum.

The SyncSwap protocol acts as both the transactional layer and a liquidity solution within the zkSync Era network. It has an open-source and modular design, easing the integration process with the zkSync ecosystem.

SyncSwap Exchange Features

SyncSwap users benefit from the scalability advantages of zkSync, experiencing up to 1000x scaling enhancements, reduced costs, and dynamic gas reimbursements. Its architecture, designed for gas efficiency, offers competitive gas costs relative to other exchanges.

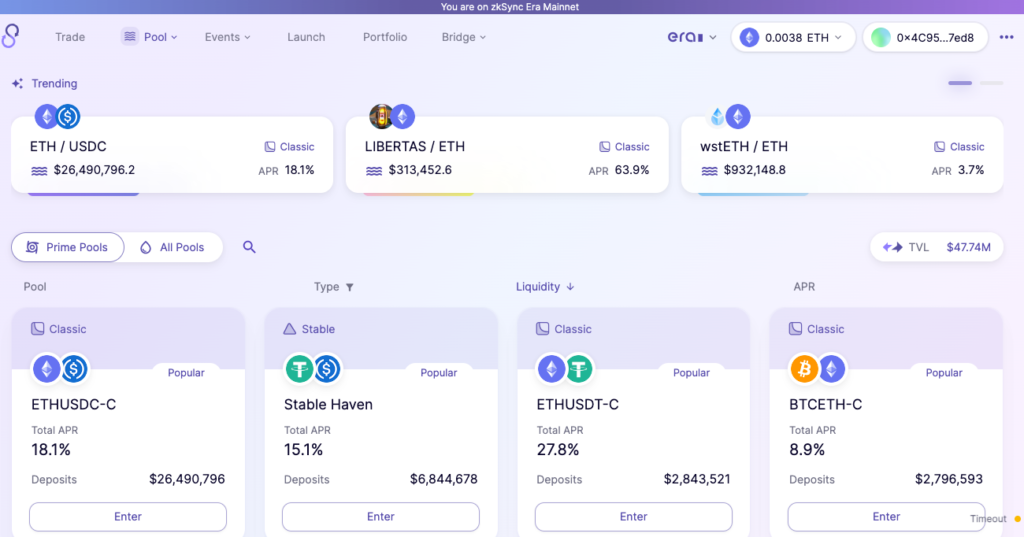

At the heart of SyncSwap’s protocol is its DEX, showcasing a dynamic multi-pool design.

The exchange’s design is adaptable and the innovative Multi-Pool approach allows SyncSwap’s DEX to support diverse pool models, each tailored for specific needs.

It accommodates various AMM algorithms, improving capital efficiency and offers liquidity providers a range of options.

At the core of the liquidity model are the Auto Market Makers (AMMs), which set prices algorithmically rather than relying on external price feeds.

SyncSwap’s DEX design is highly adaptable, consisting of several independent modules for easy future enhancements.

In the realm of smart contracts, immutability is a core principle, usually preventing direct upgrades.

Through proxy patterns, developers can update contract functionalities, a method that, while powerful, poses risks in trustless environments due to potential malicious code insertion.

SyncSwap utilizes this pattern to facilitate safe future updates without sacrificing its trustless integrity.

The protocol is crafted to serve as both an exchange layer and a liquidity solution at the zkSync Era network’s foundational level.

SyncSwap’s DEX is designed for full composability, ensuring easy integration with other protocols.

How to Use SyncSwap

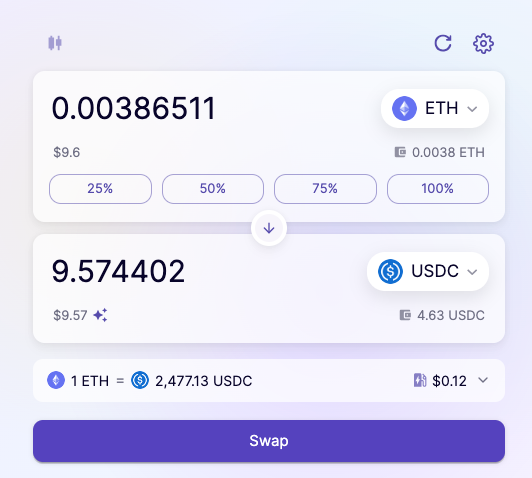

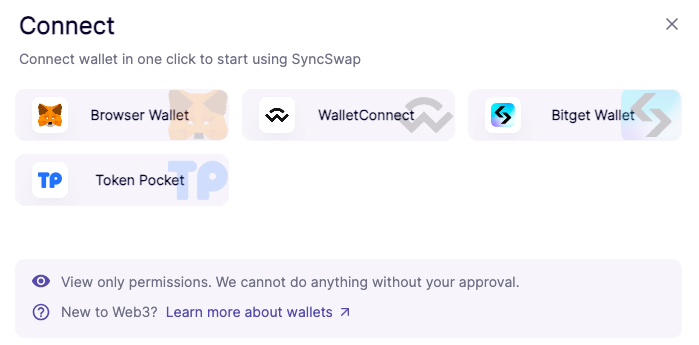

Connect your web3 wallet e.g. MetaMask.

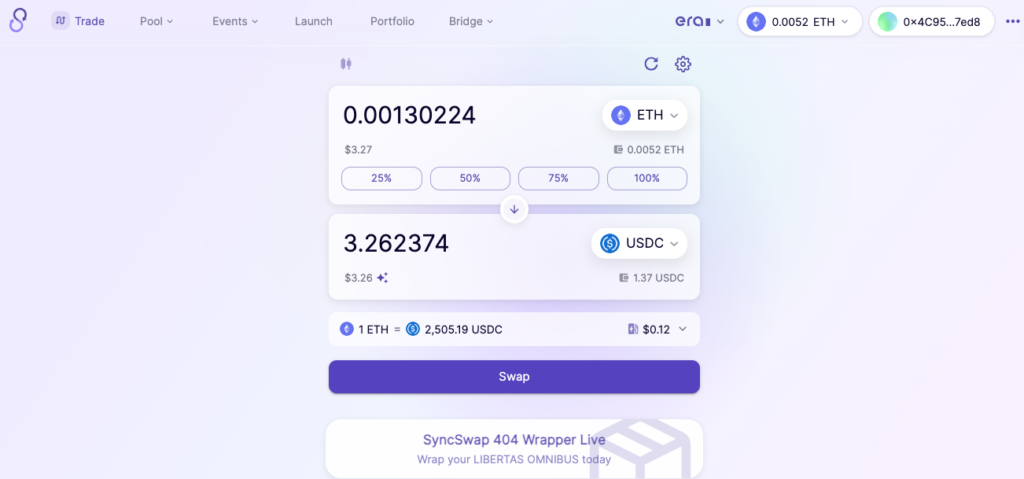

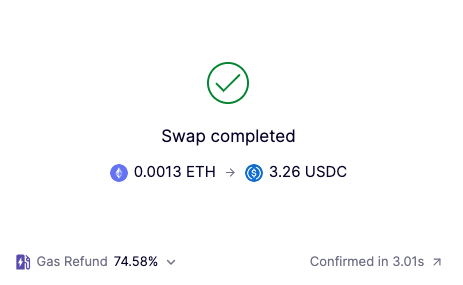

Choose the assets you wish to swap. For this demonstration, we’ll perform a micro-transaction swap from ETH for USDC to show how easy it is to use layer 2 solutions like zkSync for small transactions with small transaction fees.

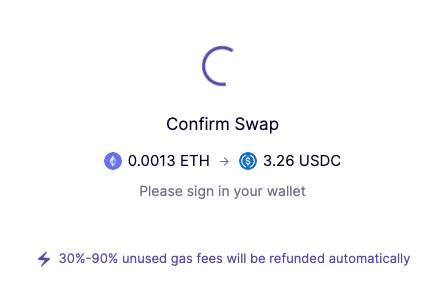

Sign the transaction.

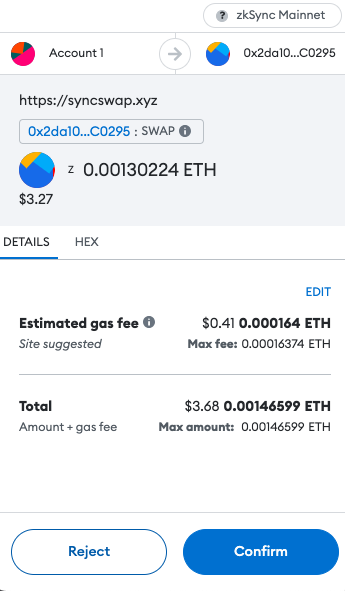

Pay the gas fee.

Your transaction will be processed.

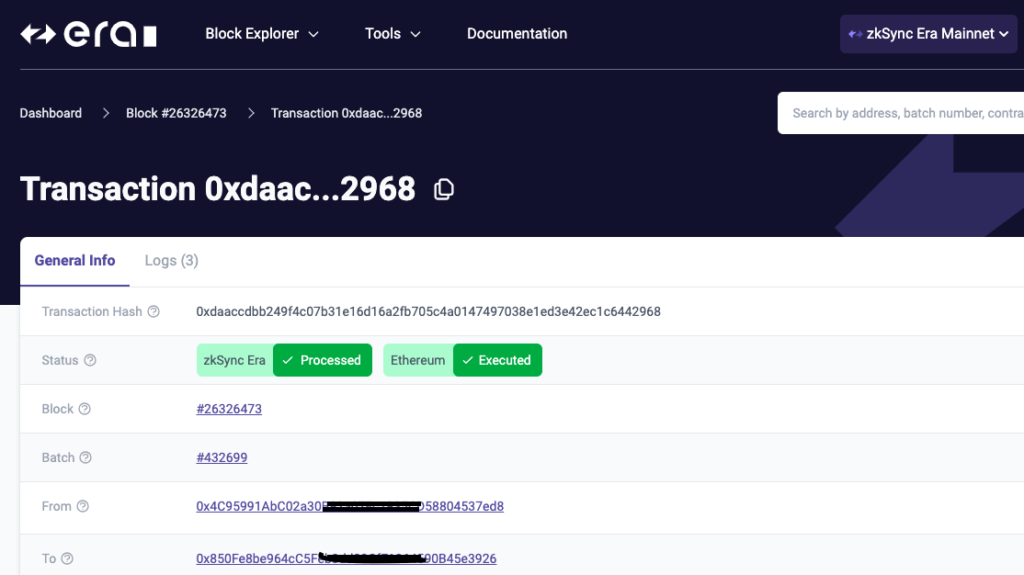

You can verify your transaction on the block explorer.

Fees on SyncSwap

SyncSwap’s trading fees are dynamically adjustable, ensuring competitive rates and minimal spreads for traders, while optimizing revenue opportunities for liquidity providers and stakeholders across varying market conditions.

The platform’s dynamic fee structure is a highlight, offering customizable trading fees that can adapt to market trends or community preferences.

Thanks to zkSync’s state-diff technology, SyncSwap offers reduced gas expenses. Transaction gas fees on SyncSwap are dynamic, with unused portions refunded after each transaction is confirmed. Typically, between 20%-90% of transaction gas fees are refunded, including for transactions that fail or are reverted.

Fee Types

- Variable Fees: These basic dynamic pricing features allow for individual adjustments across different pool models and specific liquidity pools, with a default fee for each model.

- Directional Fees: This feature enables custom trading fee tiers for liquidity pools, depending on the transaction type (buying or selling tokens).

- Fee Discounts: Similar to centralized exchanges (CEXs), SyncSwap will offer fee discounts for token stakers, with varying discount levels based on the amount staked.

- Fee Delegation: A groundbreaking feature allowing for the dynamic delegation of trading fees to partner ecosystem projects, enabling a democratic approach to fee setting.

The maximum fee tier is set at 10%, offering extensive customization possibilities.

TIP: Use SyncSwap as that may qualify you for a zkSYNC airdrop.