Umami Finance – DeFi Platform Review

What is Umami Finance?

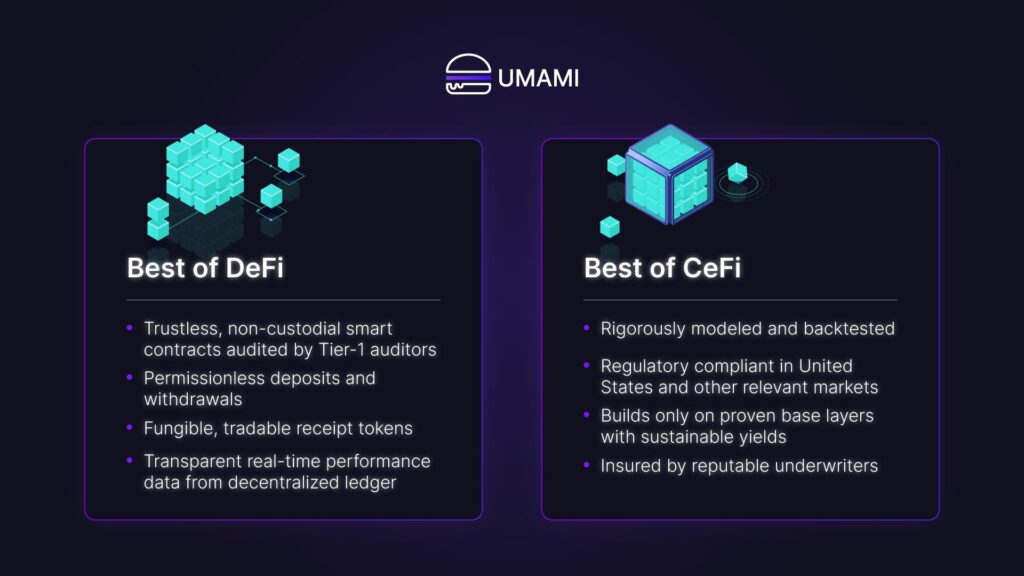

Umami Finance provides DeFi yield products that are tailored to institutional investors. Its non-custodial vaults make use of trustless smart contracts which ensure that depositors retain control of their assets at all times. This feature is becoming more desirable as more centralised platforms face criticism for misusing customer funds. Due to the network’s decentralised ledger, Umami’s users are not only able to deposit or withdraw assets at any time; they can also track vault performance in real-time.

The Umami protocol is built on Arbitrum, Ethereum’s leading Layer 2 scaling chain. The Arbitrum ecosystem is fast-becoming one of the widely used networks in crypto and is backed by some noteworthy players in the digital asset space.

Umami is described as aiming to bridge the gap between DeFi and TradFi through the creation of DeFi products that are distributed to financial institutions through Umami Advisors – its in-house Registered Investment Advisor (RIA), alongside its partnership network of crypto asset custodians.

Umami has a simple but sophisticated structure that is meant to give it maximum operational efficiency. First, there’s the Umami Decentralized Autonomous Organization (DAO) which consists of $UMAMI token holders who are responsible for the direction of the protocol’s development and also for controlling the protocol’s assets and smart contracts. The protocol governance token, $UMAMI, is a Cayman registered Virtual Asset.

The DAO is represented off-chain by a Cayman Islands-based legal entity Umami DAO Foundation. This structure gives the DAO off-chain legal representation and the ability to enter into legally valid contracts. Another arm of Umami is Umami Labs LLC which contracts the Umami DAO Foundation. The legal structure that Umami has settled on allows it to distribute DeFi products to institutional investors while also remaining fully compliant with regulators.

Umami Finance’s key smart contracts have been certified ‘low risk’ and have been audited by Zokyo. Umami’s full audit report can be viewed here.

What Makes Umami Finance Unique?

Umami is setting the industry standard with its on-chain DeFi protocol and DeFi Yield Vaults. Through the U.S.-regulated crypto custodian, Umami Advisors, Umami is on-ramping institutions into its DeFi products in a compliant way. According to research by JP Morgan and others, institutional DeFi is viewed as the application of DeFi protocols to tokenized real-world assets with appropriate safeguards in place so that regulatory compliance and customer protections are observed and best-in-class standards that promote financial integrity are promoted.

Umami’s vaults make use of a capital efficient hedging strategy which is designed to mitigate depositors’ exposure to unwanted market delta in GLP while continuing to pass on nearly all of its highly-competitive APR.

Umami’s hedging strategy is popular for its internal netting since each of its vaults effectively acts as a hedging counterparty to the others. This means that instead of costly external hedges, Umami’s vaults swap delta among themselves while keeping the vast majority of their TVL deployed to GLP to generate yield. What’s smart is that if necessary Umami’s vaults take external long or short hedging positions on GMX or similar exchanges.

In addition, Umami’s modeling also reflects the fact that GMX’s leveraged perpetuals are an exceedingly cost effective tool for hedging out unwanted delta for its vaults. Umami’s vaults make use of a proprietary algorithm that systematically adjusts hedges in order to maintain a target delta exposure. Umami Finance is said to have backtested its algorithmic hedging model against all available historical data for GLP. Since Umami’s vaults are non-custodial, its team will never actively manage its asset allocations.

It is expected that Umami’s GLP vaults will deliver some of the most competitive risk-adjusted returns on USDC, BTC or ETH in the institutional crypto market. By enabling institutional clients to easily deposit into its DeFi yield products through its in-house RIA, Umami should be able to scale TVL quite quickly by leveraging its CeFi partners’ robust compliance frameworks, highly secure digital asset custodial platforms and extensive client networks.

Umami is said to have the longer term vision of onboarding institutional TVL through Umami Advisors which is also pursuing Money Services Business licenses in all U.S. states. Umami already has access to an enterprise-grade fiat <> crypto onramp from Circle.

Umami Tokenomics Explained Simply

$UMAMI is the protocol’s governance token. The token is also used for fee-generation. Umami’s supply dynamics are fascinating, with a fixed Max Supply of 1,000,000. The tokens can be staked for a share of Umami’s protocol revenues.

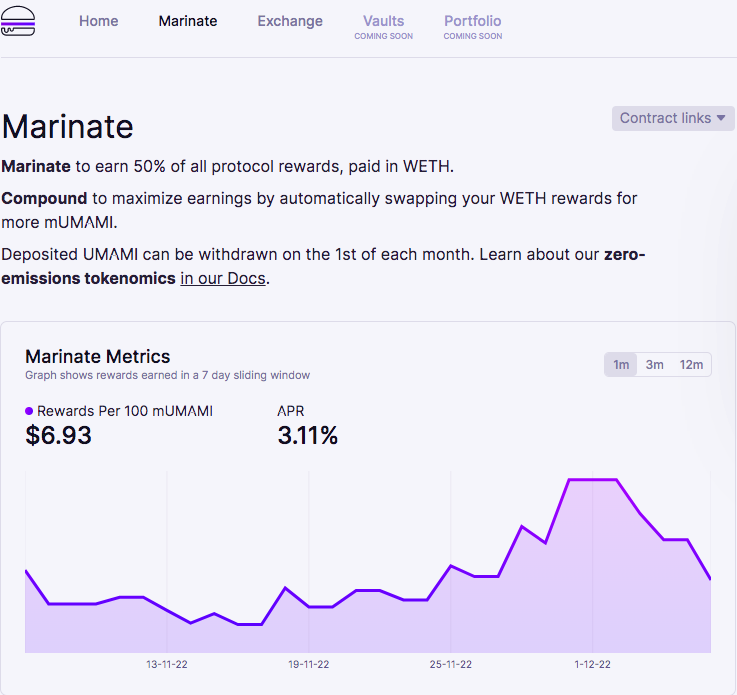

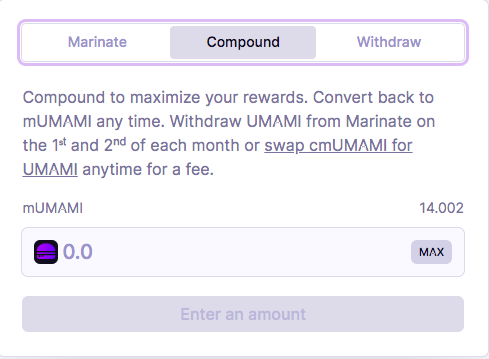

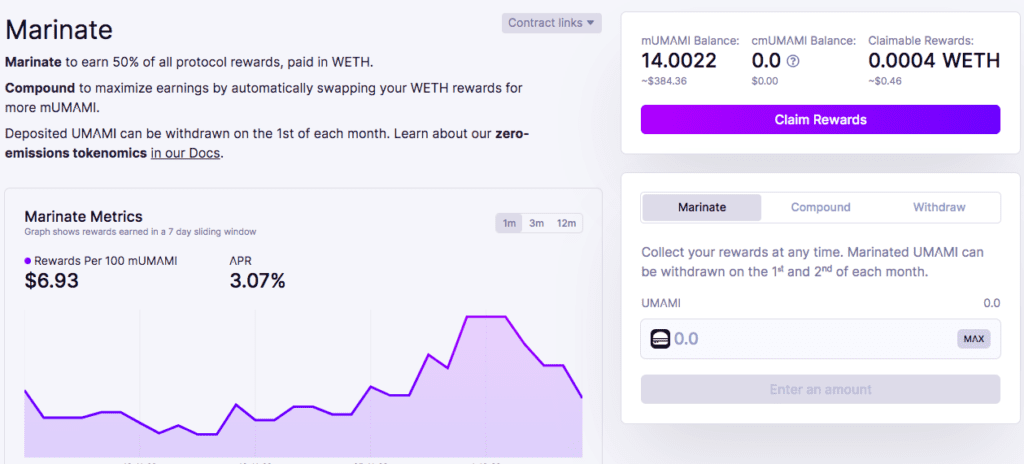

Holders of $UMAMI tokens have a couple of staking options. They can choose to Marinate – this rewards stakers with a share of protocol revenues in $wETH. Alternatively, they can also Compound – this allows users to automatically reinvest $wETH to market-buy and stake more $UMAMI.

The $UMAMI token is not an emissions token so no new $UMAMI tokens can be minted beyond the maximum supply of 1 million tokens. Approximately 650K $UMAMI tokens are already in circulation. Around 125K are non-circulating $UMAMI tokens that are permanently locked in defunct staking contracts and effectively “burned.” The remaining tokens are held in Umami’s treasury and reserved for DEX liquidity, OTC capital raises (albeit very limited) and future team compensation.

Token holders of $UMAMI governance token also have the opportunity to participate in the strategic direction of the Umami protocol via on-chain Snapshot votes.

Umami’s protocol revenues are derived from a transparent fee structure that is built into its vaults’ smart contracts. The vaults collect a 2% of total value locked as a management fee. A performance fee of 20% of yield from depositors is also chargeable. The annual fees are charged linearly.

Deposits & Withdrawals on Umami Finance

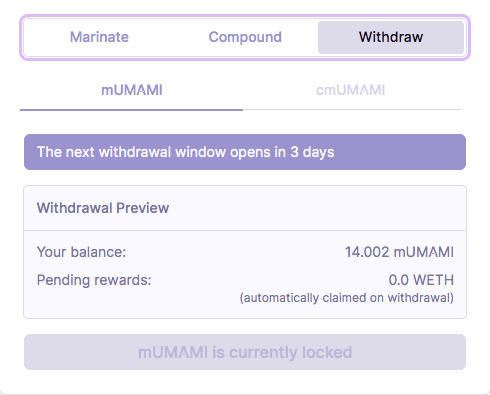

Those users who choose to Marinate are able to deposit $UMAMI in exchange for $mUMAMI at any time throughout the month. They also get an option to withdraw $UMAMI on the 1st of each month. As a user, you can simply choose to deposit $UMAMI into Marinate as regularly as you wish, even if you’ve already deposited tokens.

Rewards & Incentives on Umami Finance

Users who choose to Marinate are able to claim $wETH rewards as soon as they are made available. Only the user holding $mUMAMI at the time of a reward issuance is eligible for that reward. The $wETH rewards Marinate at mostly on a daily basis. To collect rewards, users simply need to click”Collect Rewards” under the “Withdraw” tab.

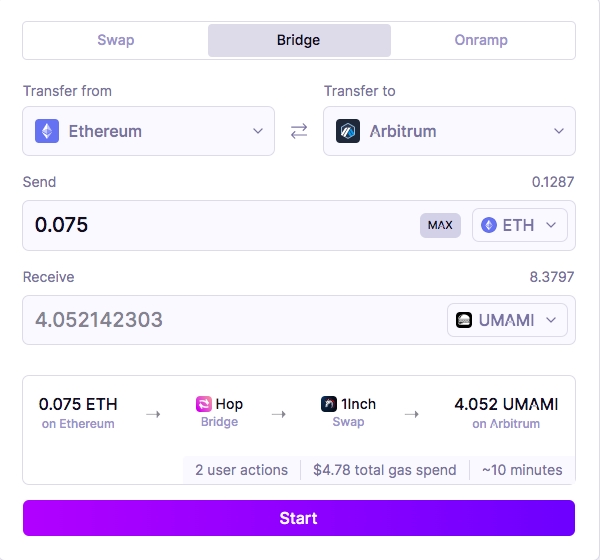

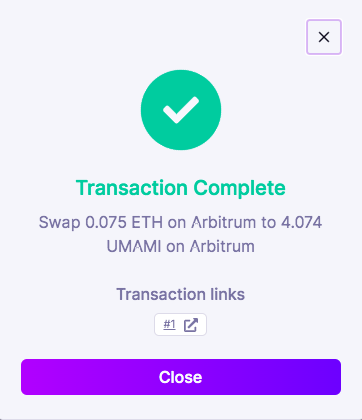

$UMAMI tokens can also be traded on secondary markets so users can procure them and then deposit to earn yield via the platform. If you already have some ETH on the Arbitrum network then you can simply make an exchange.

You have to accept the gas fee in order to proceed with executing your swap.

Once you confirm the swap will be processed.

Should you need to verify your transactions, you’ll be able to do so using the Arbitrum block explorer, Arbiscan.

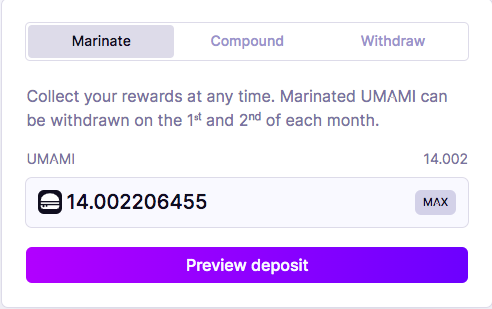

Once you have some $UMAMI tokens, you can Marinate to earn yield.

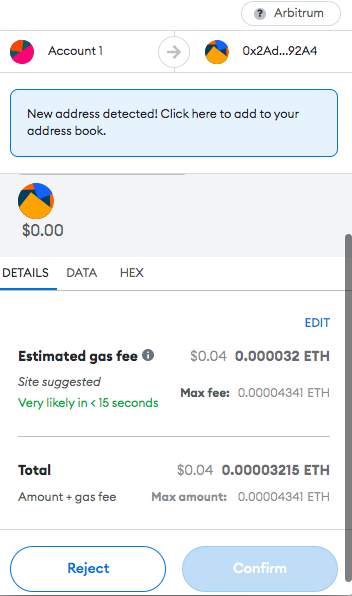

You have to give the smart contract permission to interact with your wallet.

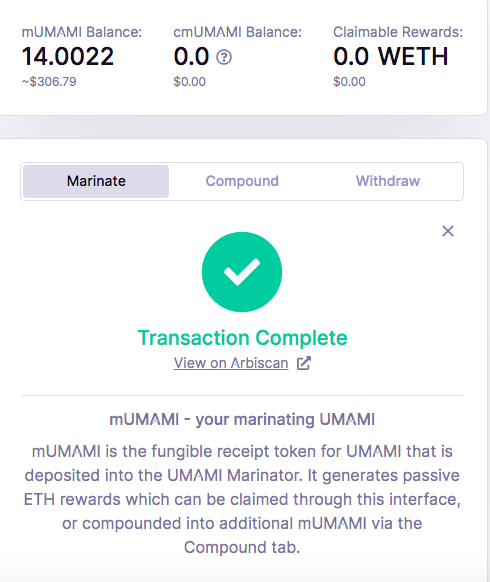

Once you’ve confirmed. The transaction can be confirmed on the block explorer.

From there you can proceed to Marinate your $UMAMI tokens.

You can see the preview before confirming your deposit.

There’ll be a small gas fee to process the deposit.

Once that’s done, your tokens will be Marinated. and you’ll be able to start earning your wETH rewards.

Now you can start earning your wETH rewards. You can also choose to Compound.

You’re also able to withdraw your $UMAMI tokens if you wish to.

Once you’ve accumulated your rewards you’ll be able to claim them.

Conclusion

Umami Finance’s vision of pushing mass adoption of DeFi through different DeFi yield products tailored to institutional investors is worth pursuing since it can open doors to capital inflows that will help legitimise and grow the decentralised finance ecosystem. Although Umami seems promising and ticks many of the boxes in terms of what you look for in a sustainable project, it is always advisable that any user wishing to interact with web3 platforms take time to familiarise themselves with the risks and benefits of using smart contract platforms.