Valr Crypto Trading Platform Review

VALR is a cryptocurrency exchange that has been operating since 2019 and is based in South Africa. VALR platform offers a good mobile experience and the app is available for download in Google Play Store and Apple’s App Store.

VALR has a partnership with Bittrex exchange and that enables the VALR platform to offer its customers a wide range of crypto assets. VALR also reportedly raised funds from 100X Group which is associated with BitMEX. The exchange supports more than 50 digital currencies giving it a competitive edge over other dominant exchanges such as Luno that are also operating within the South African market. VALR also offers an international arbitrage service. Arbitrage is simply taking advantage of crypto asset price differences locally and internationally.

VALR makes it possible for users to buy, sell, store, and transfer digital currencies with ease. Novice traders can get started by using VALR’s buy and sell feature where they’d simply need to choose an asset, enter the amount they wish to spend and then confirm their trades. Additionally, the platform offers decent features for advanced traders allowing them to market‑make and get paid to trade.

Incentives

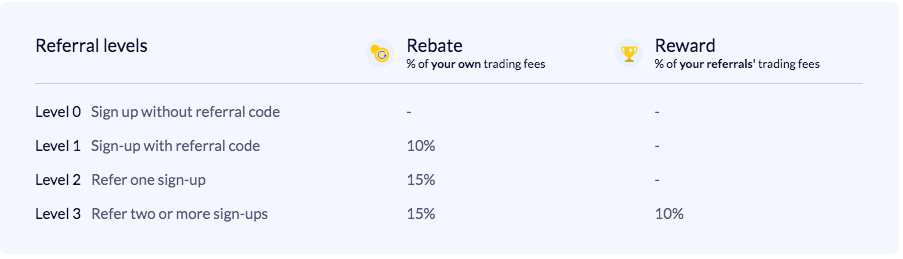

VALR users can save up to 15% on trading fees when they refer others and additional lifetime rewards when they refer more peers. Their referral program consists of rebates which are discounts on trading fees and also rewards which are commissions users are able to earn from their referral’s trading fees. Furthermore, VALR rewards market makers 0.01% of their trades for providing liquidity to their bitcoin-rand and bitcoin-ether order books.

Security

According to VALR, they store user’s funds on the exchange in both hot and cold wallets. They use multi-signature hot wallets for operational liquidity and apparently their cold storage is offline institutional vaults that they claim to be geographically-dispersed, video-monitored, and access-controlled. VALR requires multiple signatories in order to move crypto assets which means even the CEO cannot single-handedly move digital currencies.

VALR also enables 2FA and requires a user’s authorisation for all attempts to access account from new devices or locations. VALR also claims to be a full reserve digital asset exchange platform. This means that users are able to trade from pre-funded accounts. All customer fiat funds are kept in segregated accounts, which are separate from VALR’s operational accounts. All these measures don’t guarantee safety for your funds because there can always be internal collusion and racketeering. It’s always advisable to move your funds off exchanges after executing your trades and store them offline on a hardware wallet like Ledger or Trezor.

Fees

VALR exchange has no monthly or management fees. There are no fees charged for depositing or withdrawing crypto assets. Depositing fiat is also free. The standard fee for fiat withdrawals is about US$0.62 or ZAR8.50. The fee for withdrawing your digital assets varies. There’s a 0.75% fee per trade for simple buy and sell trades. For advanced traders executing exchange buy and sell orders, there’s a fee of 0.1% for takers and -0.01% for makers which means the exchange actually pays users for providing liquidity.

How to get started with VALR

All you need to do is create an account either via desktop or mobile. Simply follow the prompts after sign up e.g. verifying your email and phone number and setting up 2FA. You may need to also provide your personal information in order for your account to get verified so that there are no limits imposed on your account. Once you set up your account, ensure that you link your bank to VALR so that you can be able to deposit funds to the exchange.